Abolition of the Federal Reserve

Congressman presents bill

Republican Congressman Thomas Massie has presented a bill to abolish the US central bank. The bill is called the "Federal Reserve Board Abolition Act", which means "Act to Abolish the Federal Reserve Board".

Abolition of the Federal Reserve

Thomas Massie, who has represented the fourth district of Kentucky in the US House of Representatives since 2012, first asked the general public on the social media platform 𝕏 whether there was general support for the idea of abolishing the US central bank.

Should I introduce a bill to abolish the Federal Reserve?

- Thomas Massie (@RepThomasMassie) May 15, 2024

The result was clear: at over 86%, the vast majority of the more than 115,000 respondents voted in favor of dissolving the Federal Reserve, while not even 3% of respondents were in favor of the US central bank.

Although such a 𝕏-survey is not representative of the entire US population, it nevertheless shows that there is great resentment towards the Federal Reserve System, at least among certain groups.

The Federal Reserve Board Abolition Act

One day after the survey, on May 16, 2024, Massie then submitted the bill aimed at getting rid of the US Federal Reserve System altogether. The bill calls for the abolition of the Board of Governors of the Federal Reserve and the Federal Reserve Banks. It also calls for the repeal of the Federal Reserve Act of 1913, which created the Federal Reserve System.

The exact plan for the wind-down involves selling the assets of the Federal Reserve and transferring the proceeds to the Treasury Department, which would also assume the liabilities. According to the bill, Federal Reserve employees will continue to be paid during the wind-down and will be allowed to keep their pension entitlements.

Criticism of central banking

Massie himself is a major critic of the central banking system. According to him, the US would be better off without it.

I just introduced "End the Fed"

Thomas Massie (@RepThomasMassie) May 16, 2024

Title: Federal Reserve Board Abolition Act, HR 8421

Americans would be better off if the Federal Reserve did not exist. The Fed devalues our currency by monetizing the debt, causing inflation.https://t.co/JWSaCssAJB pic.twitter.com/z8IDQ139Yc-

In the press release on the bill, Massie elaborates on his criticism of the Federal Reserve:

Americans are suffering from crippling inflation and the Federal Reserve is to blame. During COVID, the Federal Reserve created trillions of dollars out of thin air and loaned it to the Treasury Department to enable unprecedented deficit spending. By monetizing the debt, the Federal Reserve devalued the dollar and enabled a free-money policy that led to the high inflation we are experiencing today.

Monetizing the debt is a closely coordinated effort between the White House, the Federal Reserve, the Treasury Department, Congress, the big banks and Wall Street. Through this process, retirees are seeing their savings evaporate through the actions of a central bank pursuing inflationary policies that benefit the wealthy and connected. If we really want to curb inflation, the most effective policy is to abolish the Federal Reserve.

Thomas Massie

Massie's criticism centers on the process of the Federal Reserve buying the government's debt securities with new money on the secondary market. Even if the Federal Reserve does not directly lend freshly created money to the government, it has more or less the same effect. The authorized banks buy the bonds on the primary market because they know that they can sell them directly to the central bank at a small profit in the next step. Ultimately, this process creates new money that ends up in the economy through government spending and can therefore fuel inflation.

Prospects of success

In the past, there have already been several efforts to abolish the Federal Reserve. Former Congressman Ron Paul has repeatedly introduced corresponding bills since 1999. Paul ran for US president in 2008 and 2012 and called for a return to the gold standard, among other things. Neither his candidacy nor the "Federal Reserve Board Abolition Act" he introduced were successful. Since 2013, there have been no further attempts to abolish the Federal Reserve by means of a bill,

As the USA is increasingly reliant on its own central bank to finance its escalating government spending, it is unlikely that the proposal will meet with great approval in US politics. Although Thomas Massie's bill already has the support of at least 20 Republican members of Congress, there is still a long way to go to win the majority of the House of Representatives for the idea.

Government or central bank triggering inflation?

In response to the draft law, a debate broke out among supporters of free markets. The subject of this was the question of whether the central bank is solely to blame for inflation and whether the abolition of the central bank alone would lead to the desired goals. Some opponents of interventionism see the state itself as the bigger problem, but this does not mean that they are not in favor of dissolving the Federal Reserve.

We cannot blame the Federal Reserve alone for this inflation. [...] Because that distracts from the real villain - which is the government.

George Gammon, renowned analyst

Gammon argues that the government, with its stimulus checks and lockdown measures, has been the bigger driver of inflation since the coronavirus pandemic than the Federal Reserve. While he also acknowledges that the Federal Reserve directly increased the money supply in circulation with its monetary policy measures, he is certain that this increase in consumer goods prices would not have occurred without the aforementioned government measures.

This point was also made by a 𝕏-user in response to a post by Thomas Massie on the "Federal Reserve Board Abolition Act". Massie responded that the stimulus checks and the aid to businesses under the Paycheck Protection Program (PPP) were a trap that the population fell into.

Yes, without a doubt. The stimmy checks and PPP were the cheese 🧀 in the trap. 🪤-

Thomas Massie (@RepThomasMassie) May 19, 2024

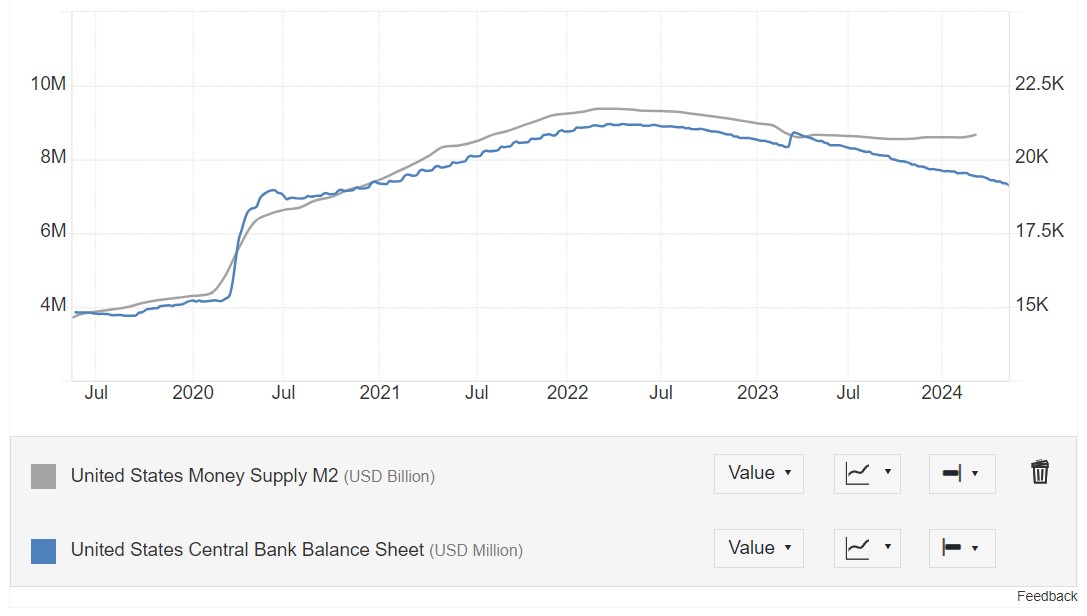

The main subject of discussion is whether a state would have been able to implement such measures without central banks, simply by borrowing on the market and through taxes. During the coronavirus pandemic, the Federal Reserve supported rampant government spending in the US with a record-breaking expansionary monetary policy. By purchasing US government bonds, among other things, the Federal Reserve doubled its balance sheet from just over USD 4 trillion to almost USD 9 trillion during the pandemic. This contributed to an increase in the amount of US dollars in circulation of around 30%.

Accordingly, it is probably the case that without the efforts of the Federal Reserve, which is probably only independent on paper, such a sprawling state apparatus would not be possible.

Where the two camps of opponents of interventionism do agree, however, is that the Federal Reserve leads to inefficiencies in the markets by controlling the key interest rate, among other things, which sometimes also leads to the recurring boom-and-bust cycles.

Bitcoin as a central bank alternative

Bitcoin is a free money that, unlike fiat currencies such as the US dollar or the euro, is limited in its maximum amount and is not subject to the control of central actors. Money, as the foundation of society, is a huge honeypot that is always being manipulated by interest groups who want to enrich themselves. Accordingly, many opponents of interventionism see Bitcoin as the solution to the many problems that arise from the existence of central banks and their interaction with governments.

In a free money market, Bitcoin would probably sooner or later establish itself as the money of mankind due to its superior characteristics such as decentralization and guaranteed scarcity. With Bitcoin as money, no central bank could manipulate interest rates or create new money to indirectly provide it to the government by buying bonds on the secondary market.

In the long term, Bitcoin could be the best alternative to a fiat money system controlled by a small number of people thanks to its maximally transparent monetary policy, i.e. the fact that the number of new units per block is anchored in the code. Whether more and more people will recognize this in the future remains to be seen. In any case, it is positive that draft legislation such as the Federal Reserve Board Abolition Act is once again bringing the problems of the prevailing monetary system into focus.

Even if it is extremely unlikely that the US central bank will be abolished in the foreseeable future, it will be interesting to see how many people will continue to campaign for this idea.