Australia: Bitcoin spot ETF admitted to largest stock exchange

Following the recent launch of a new Bitcoin spot ETF on the Cboe Australia, a Bitcoin spot ETF has now also been given the green light by the larger Australian Securities Exchange (ASX).

The VanEck Bitcoin ETF with the ticket VBTC will be tradable on the ASX on Thursday of this week. This was announced in a press release by asset manager VanEck, which has also launched a Bitcoin spot ETF in the USA.

The VanEck Bitcoin ETF (ASX: VBTC), which will list on Thursday, June 20, 2024, will be the first Bitcoin ETF on the ASX and the lowest cost Bitcoin fund exposure in Australia.

From the press release

Bitcoin spot ETFs in Australia

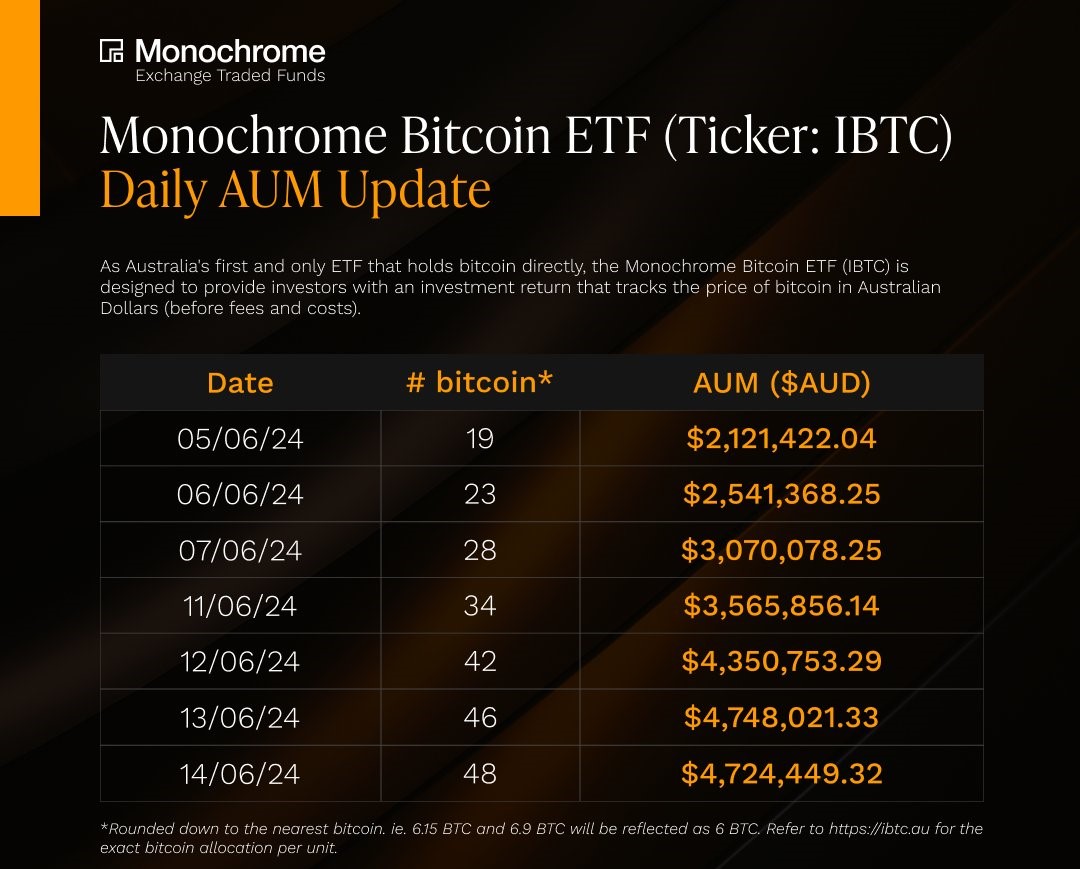

On June 4, the Bitcoin spot ETF IBTC from Monochrome Asset Management was launched on Cboe Australia - Blocktrainer.de reported. The asset manager marketed the product as "Australia's first Bitcoin spot ETF to hold Bitcoin directly". However, Bloomberg ETF expert Eric Balchunas clarified that a Bitcoin spot ETF had already been tradable on Cboe Australia for two years at the time - namely EBTC from Global X Management and 21 Shares, which offers holders a stake in physical Bitcoin held in custody by Coinbase. In addition, EBTC shares are exchangeable for Bitcoin, as is common with spot ETFs.

Here it is and yes it directly hold bitcoin. I don't blame the other issuer for trying to drum up interest but they are #2 in that country. pic.twitter.com/AIhTKMmsir-

Eric Balchunas (@EricBalchunas) June 3, 2024

IBTC from Monochrome nevertheless has its raison d'être. With annual costs of 0.98 percent, it is cheaper than EBTC, which charges an administration fee of 1.25 percent. Nevertheless, IBTC's trading start was subdued. Last Friday, the spot ETF held just 48 Bitcoin with an equivalent value of around 4.7 million Australian dollars, or just over three million US dollars.

First Bitcoin spot ETF on the ASX

With the approval of the Australian Securities Exchange (ASX), the much larger ASX will now also list a Bitcoin spot ETF alongside the "junior exchange" Cboe Australia. Asset manager VanEck has been working for around three years to finally get the green light.

We are delighted to list Bitcoin on the Australian market as a regulated financial product on the country's main exchange, the ASX.

Arian Neiron, CEO of VanEck in the Asia-Pacific region

The financial product will be available for purchase by institutional and retail investors. Specifications such as the annual costs or the custodian of the Bitcoin are not yet known. However, the promise that VBTC will be "the lowest cost Bitcoin fund exposure in Australia" suggests a relatively low fee.

Arian Neiron, the CEO of VanEck in the Asia-Pacific region, emphasizes that the demand for exchange-traded Bitcoin funds is high.

Despite the fact that crypto investing is a polarizing topic, we have recognized that Bitcoin is an emerging asset class that many advisors and investors want to access. We have developed a robust offering that we believe provides an opportunity for Bitcoin exposure via a regulated, transparent and trusted investment vehicle.

VBTC also makes Bitcoin more accessible by managing all the back-end complexity. It is no longer necessary to understand the technical aspects of acquiring, storing and securing digital assets.

Arian Neiron, CEO of VanEck in the Asia-Pacific region

Other asset managers are still awaiting approval from Australia's largest exchange for their own Bitcoin spot ETFs. The Australian Securities and Investments Commission (ASIC), which must give the green light to investment products in Australia before the respective exchange can do so, has again warned of the volatility of the asset class in the face of approval.

The ASIC has repeatedly warned investors that cryptocurrencies are risky, inherently volatile and complex. Investing in cryptocurrencies is a highly speculative activity.

An ASIC spokesperson

Bitcoin adoption is progressing

It remains to be seen whether demand for the VanEck Bitcoin ETF (VBTC) will exceed the rather subdued demand for Bitcoin spot ETFs on the Cboe Australia due to the size of the ASX. However, as the ASX is even smaller than the Hong Kong or even the German stock exchange, the start of trading is unlikely to be market-moving.

In Hong Kong, the Bitcoin spot ETFs approved at the end of April only absorbed a few hundred million US dollars. To put this into perspective: Bitcoin ETFs from the US have recorded cumulative net inflows of over USD 15 billion since the start of trading in January.

The US capital market is and remains by far the most relevant in the world - also for the Bitcoin price. Nevertheless, the fact that Bitcoin-backed investment products are becoming tradable on more and more exchanges around the world is certainly a positive development, meaning that Bitcoin adoption can continue to progress worldwide.