Before the Bitcoin halving: last chance for low transaction fees?

There is only one week left on the countdown to the long-awaited Bitcoin halving, which is now almost certain to take place on the morning of April 20. However, the 840,000th Bitcoin block will not only halve the block subsidy, i.e. the number of new Bitcoin per block from 6.25 BTC to 3.125 BTC. In the past, halving has always attracted increased attention around the Bitcoin network, which sooner or later was also reflected in the transaction fees. This effect could accelerate with the fourth Bitcoin halving next week due to the launch of the Bitcoin Runes protocol and other "gimmicks" based on Bitcoin.

So is now a good time to dry up your Bitcoin and avoid potentially high fees in the future with a UTXO consolidation or two?

The start of the Runes

From version 0.17.0 of Ordinals, the more or less controversial Runes, which were also invented by Ordinals inventor Casey Rodarmor, have now also been implemented. Similar to BRC-20 tokens, these are arbitrary tokens that are completely mapped on the Bitcoin blockchain. Rodarmor himself spoke of a "terrible idea" at the time, but at least the minting process, i.e. the creation of the runes or tokens, should require less storage space on the Bitcoin blockchain. With various BRC-20 tokens, the network was previously flooded with thousands of such mint transactions, which drove up the fees accordingly.

ord 0.17.0, which includes the final implementation of runes, has been released!

Casey (@rodarmor) March 31, 2024

It includes the hard-coded genesis rune, UNCOMMON-GOODS.

🧵https://t.co/bMYCZKHdOe-

ord version 0.17.0, which contains the final implementation of Runes, has been released!

It contains the fixed "genesis rune" UNCOMMONGOODS.

@rodarmour on 𝕏

Rodarmor deliberately set the block height of the next Bitcoin halving as "Genesis" in order to attract more attention and probably also to provoke something. After all, there is no real technical justification for this start date. This is one of the reasons why some fear a demand shock for storage space on the Bitcoin blockchain - i.e. sharply rising transaction fees.

UTXO consol... What?

Bitcoin's transaction model works very differently than one would intuitively imagine. Strictly speaking, Bitcoin addresses do not have an "account balance", as there is no such thing as an account in the Bitcoin network. Instead, only transactions and their inputs and outputs are used to track who is currently allowed to spend which Bitcoin shares. This concept gives rise to the concept of an Unspent Transaction Output (UTXO), i.e. an output of a transaction that has not yet been spent.

As with a wallet full of small change, the more such UTXOs are used, the more cumbersome and therefore expensive it is to carry out a transaction on the Bitcoin network. For this reason, it can make sense to "change change" from time to time, especially when regularly executing a savings plan, in order to avoid falling into a fee trap in the future should the fees rise extremely and persistently.

No more empty blocks?

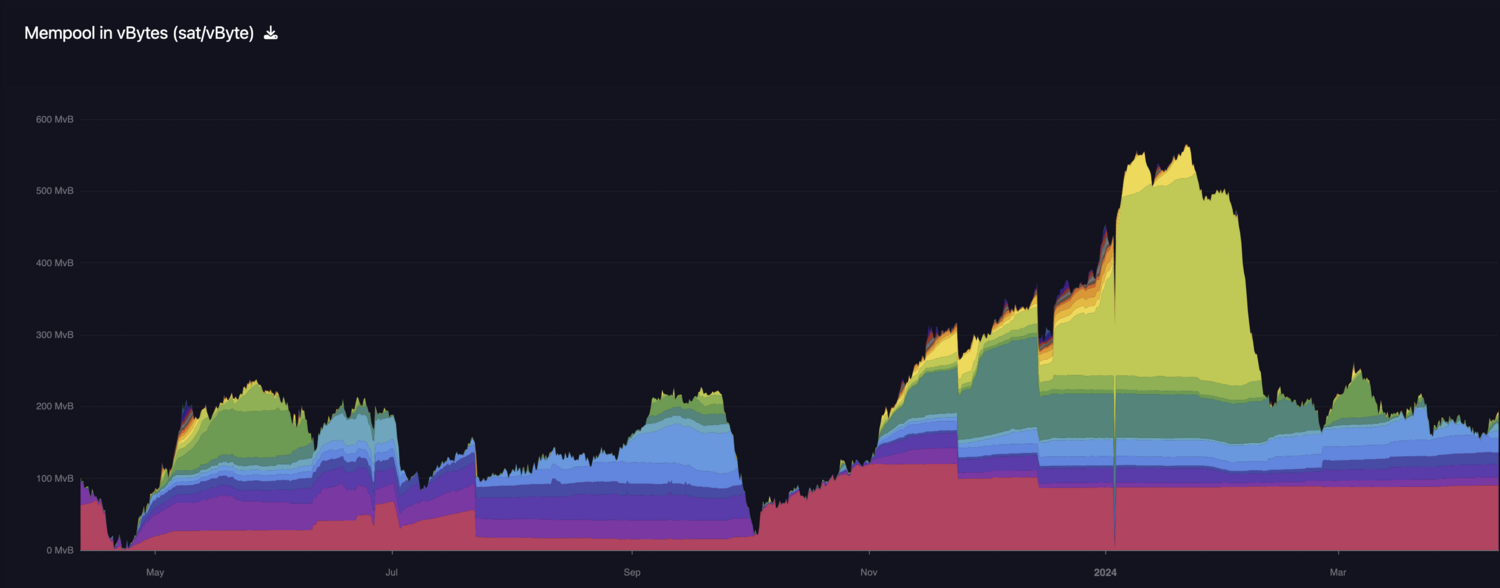

Anyone who has come across Bitcoin in the last year has most likely never experienced an empty Bitcoin block, or more precisely a Bitcoin block that has not been completely filled - completely empty blocks can occur by chance. With the Ordinals protocol and the BRC-20 tokens based on it, 2023 was characterized by comparatively high transaction fees, which even broke records when measured in US dollars.

Whether the year 2024 will be similar, especially after the halving, is of course written in the stars. Basically, statements about future fees, i.e. the future demand for transactions in the Bitcoin network, are pure speculation. But once fees have risen, it will always be said: "The best time to consolidate UTXO was yesterday!"