After a strong trading week last week, Bitcoin has once again made significant gains at the start of the week. Yesterday alone, Bitcoin rose by almost 8% and has since been trading at around USD 71,000, just a few percent away from its all-time high. According to Coinglass, over 84 million US dollars in short positions on Bitcoin were flushed out of the market as part of yesterday's strong price increase.

New all-time high for ETF inflows

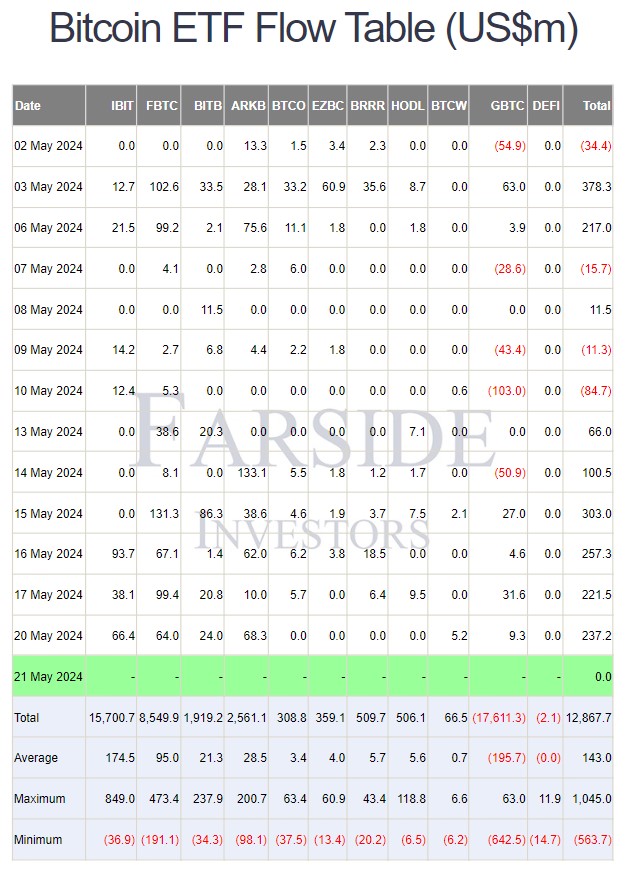

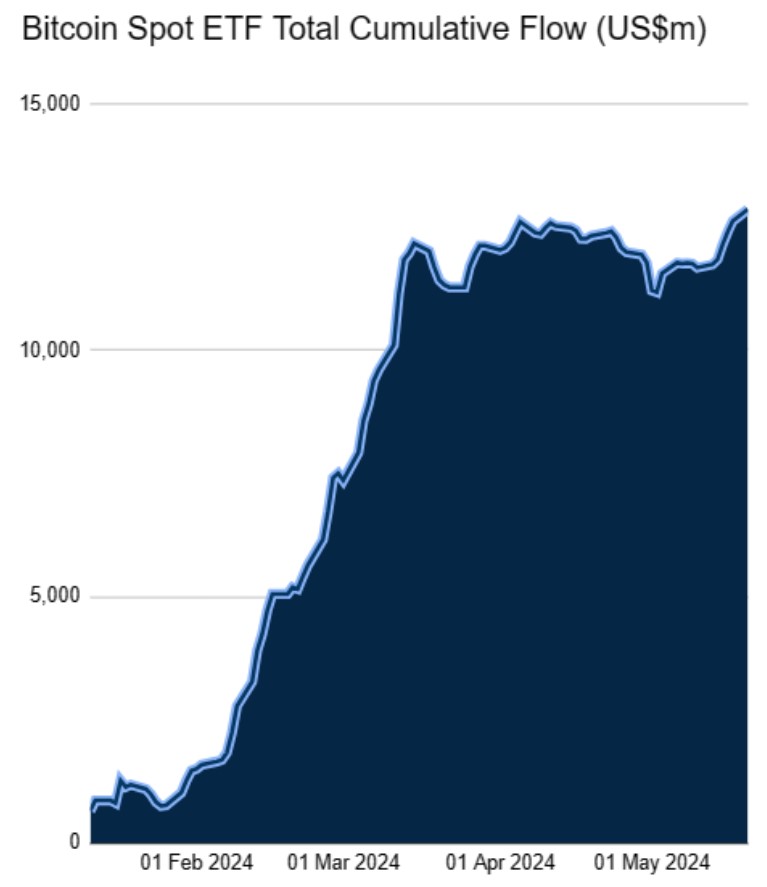

Since mid-March, there has been a slight dip in the Bitcoin spot ETFs approved in the US in January, which had exceeded all expectations with their successful launch. However, demand for the investment products has increased significantly again since the beginning of May - presumably also due to the prospect of interest rate cuts by the US Federal Reserve in the near future. In the past trading week alone, ETFs received an inflow of almost one billion US dollars.

As Whit Monday is not a public holiday in the US, the US stock exchanges were open yesterday. Bitcoin ETFs recorded inflows of USD 237 million on the first day of trading this week. This catapulted the cumulative net inflows into the investment products to a new high of more than USD 12.8 billion.

Another interesting aspect of the ETF data is that outflows from the largest ETF have slowed. GBTC was allowed to convert from a closed-end trust to a Bitcoin spot ETF as part of the ETF approval process. Since then, more than half of Bitcoin has flowed out of the investment product, which at the time managed just under 620,000 BTC. This selling pressure, which was primarily due to the comparatively very high management fee, now appears to be largely over.

Bitcoin price scratches all-time high

With the strong increase in ETF inflows, the Bitcoin price has also recovered considerably since the interim low on May 1. In just three weeks, BTC has risen by over 25%, from below USD 57,000 to over USD 71,000.

With yesterday's strong price increase, the asset is now trading just over 3% away from its previous all-time high of around USD 73,800 set on March 14.

Since the start of the year, Bitcoin has gained almost 70 percent, while the US technology index Nasdaq, for example, has risen by around 12 percent and the precious metal gold by almost 18 percent.

New all-time highs ahead?

When slightly lower-than-expected US inflation figures for April were reported last week, the market again assumed an increased probability that the US Federal Reserve could soon cut interest rates. As things stand, a first rate cut in September and another by the end of the year have been priced in.

The positive development in this respect has catapulted the US stock markets to new highs. As Bitcoin as an asset generally benefits even more from a loose monetary policy or a rising money supply, it cannot be ruled out that the largest cryptocurrency will soon follow the stock markets. This is also supported by the significant increase in inflows into Bitcoin ETFs, which have been the main driver of the Bitcoin price in recent months.

It remains to be seen how exactly the 1.4 trillion US dollar asset will fare in the coming weeks and months and whether the news situation will remain so positive.