Environmental activist and entrepreneur Daniel Batten has spent the last few months investigating Bitcoin's new ESG narrative and backing it up with facts. He has already published some aspects of this on the 𝕏 platform - Blocktrainer.de reported. He has now completed his comprehensive report. Batten believes that if Bitcoin were no longer seen as a problem but as a solution due to a solid factual basis, enormous sums of money that are currently deposited in ESG funds could flow into the Bitcoin mining industry and thus attract more investors.

Bitcoin and the ESG funds

Batten puts the money currently deposited in ESG funds at 23 trillion US dollars, which cannot be invested in Bitcoin due to incorrect information. He assumes that only a small portion of these funds could consolidate Bitcoin's market capitalization above the one trillion dollar mark and make it more visible to institutional investors when choosing between the major assets. Currently, the real estate market is the most valuable asset at USD 328 trillion, followed by fiat currencies (USD 156 trillion) and equities (USD 109 trillion). Even the gold market with USD 12.7 trillion is currently more than 18 times more valuable than Bitcoin with USD 0.7 trillion. The higher the market capitalization, the more comfortable large investors feel about investing their money there.

With the help of Willy Woo 's analyses, Batten finds that just one percent of the financial resources deposited in ESG funds would already increase Bitcoin's market capitalization to 1.68 trillion US dollars. At 2.5%, it would even be 3.3 trillion US dollars. This would draw the attention of institutional investors to Bitcoin. Their additional investments would create a positive feedback loop and further increase Bitcoin's value - catalyzed by the ESG funds.

The report also emphasizes that almost a third of ESG investors are currently struggling to find attractive ESG investment opportunities. Demand is outstripping supply. Batten sees Bitcoin "as the fastest-acting and most widely measurable cleantech technology" that could meet this demand. However, this would require meaningful data and facts to be available and action to be taken.

The flawed Cambridge study

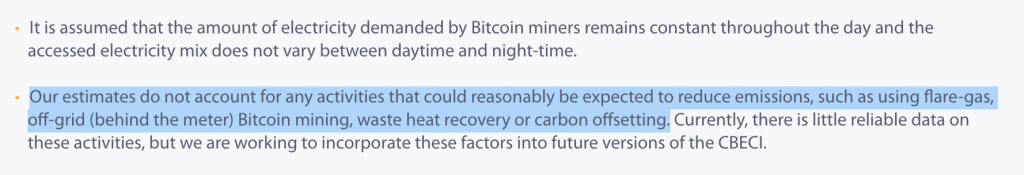

Batten notes that many ESG arguments that have been made against Bitcoin and could affect institutional adoption are based on a study by the Cambridge Centre for Alternative Finance based on a study by the Cambridge Centre for Alternative Finance.

Bitcoin would primarily use fossil fuels and promote their use, with coal as the largest energy source. Emissions and emissions intensity would therefore be very high and continue to rise. Critics in Germany also rely on this study - Blocktrainer.de reported.

Upon closer examination of the study, Batten quickly realizes that the results differ greatly from the results of the Bitcoin Mining Council and that the mining data cited by Cambridge is outdated or not up to date. Given the dynamic nature of Bitcoin mining, however, updated data is necessary. This also applies to certain charts on Bitcoin mining. The emissions intensity chart has not been updated since January 2022, meaning that no current data is available.

This would distort many statements, such as in the case of Kazakhstan, which relies predominantly on fossil energy sources. While Kazakhstan's share of the global hashrate was still 13.2% at the beginning of 2022, the country currently contributes less than one percent of global hashrate (15,000 MW) with a capacity of 100 megawatts (MW).

BEEST model from Batten

Daniel Batten has developed his own model for off-grid facilities called BEEST (Bitcoin Energy & Emissions Sustainability Tracker). This involves data from 52 off-grid mining companies that were not included by Cambridge. Five use fossil fuels, six use mixed energy sources and 41 use sustainable energy sources.

This means that 79.2% of off-grid systems are operated with completely sustainable energy sources. By neglecting these plants, the Cambridge study is not meaningful, according to the report.

At the end of August this year, Cambridge itself admitted that the energy consumption and emissions were overestimated in its model, whereupon Bloomberg dropped this model and finally used BEEST, as it is said to be "more accurate". This reassessment could also influence some ESG investors.

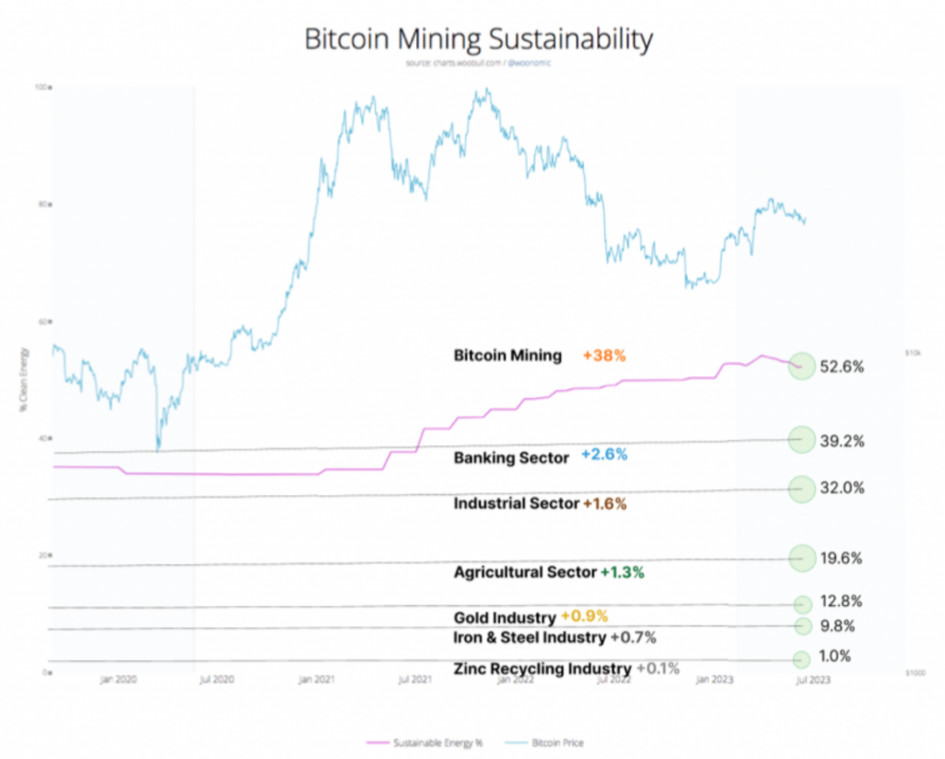

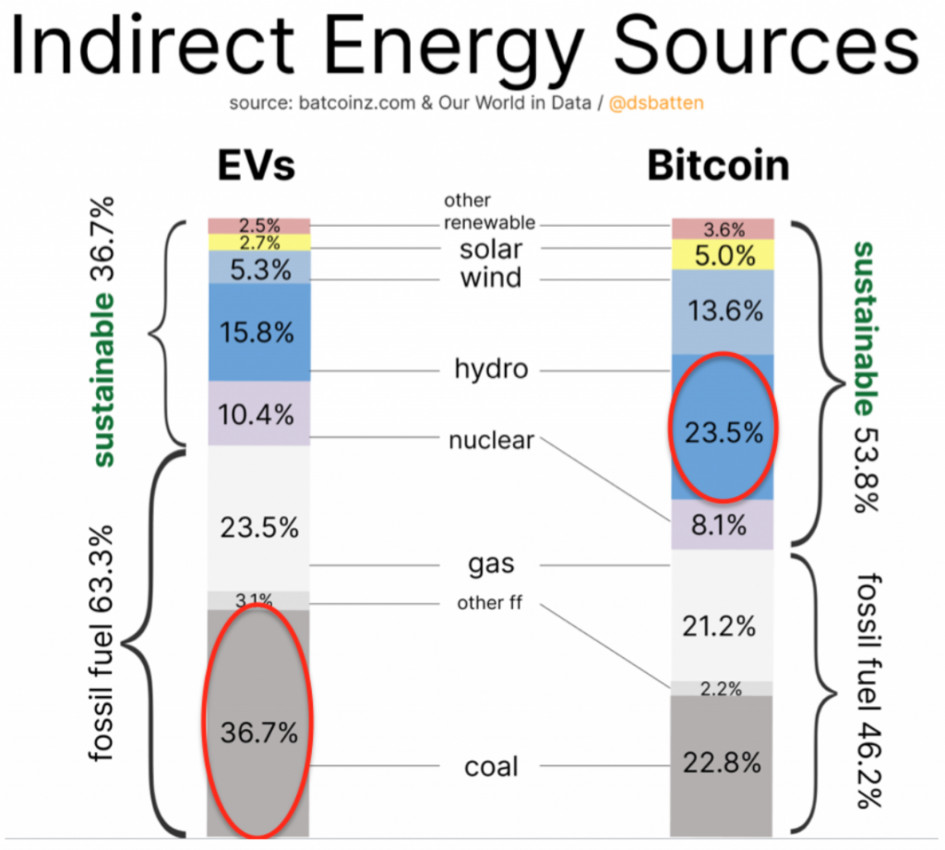

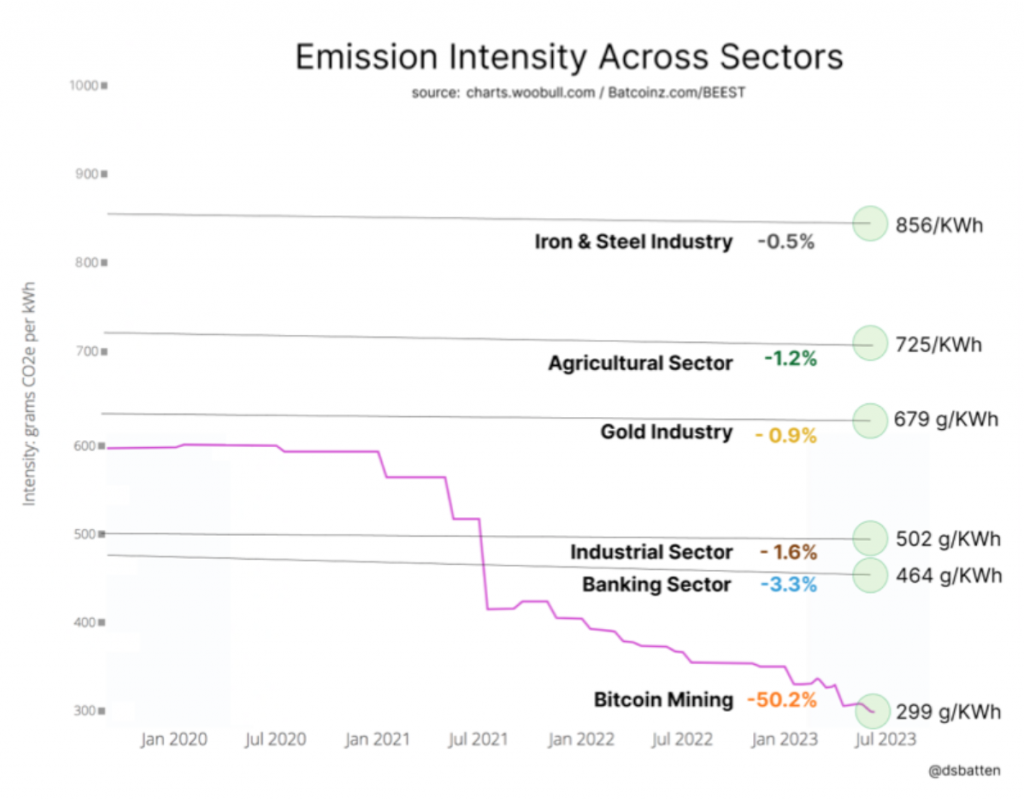

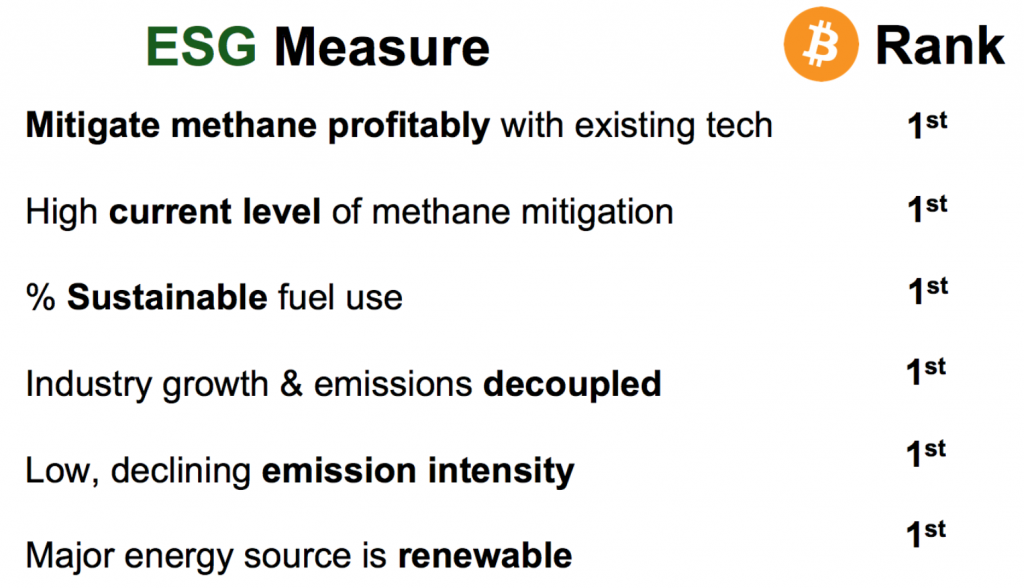

Batten has merged the two models, updating the overall data and making it more meaningful. Based on the results, it can be said that the Bitcoin network currently uses 53.8% (52.6% in July) sustainable energy sources, more than any other global industry. No other industry uses a non-fossil energy source as its main source, while Bitcoin uses 23.5% hydropower. In the flawed Cambridge model, coal was in first place, but is actually in second place with 22.8%.

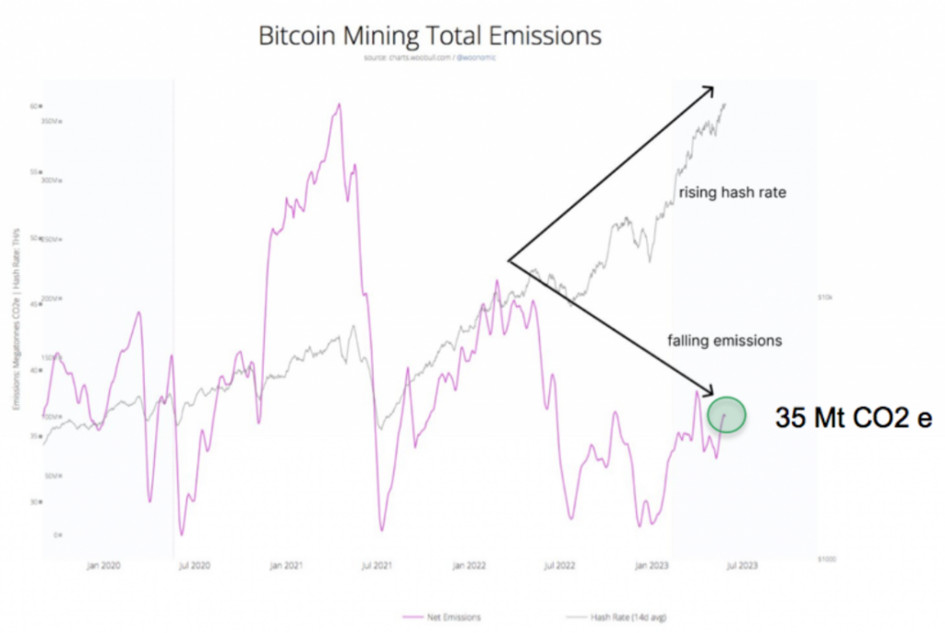

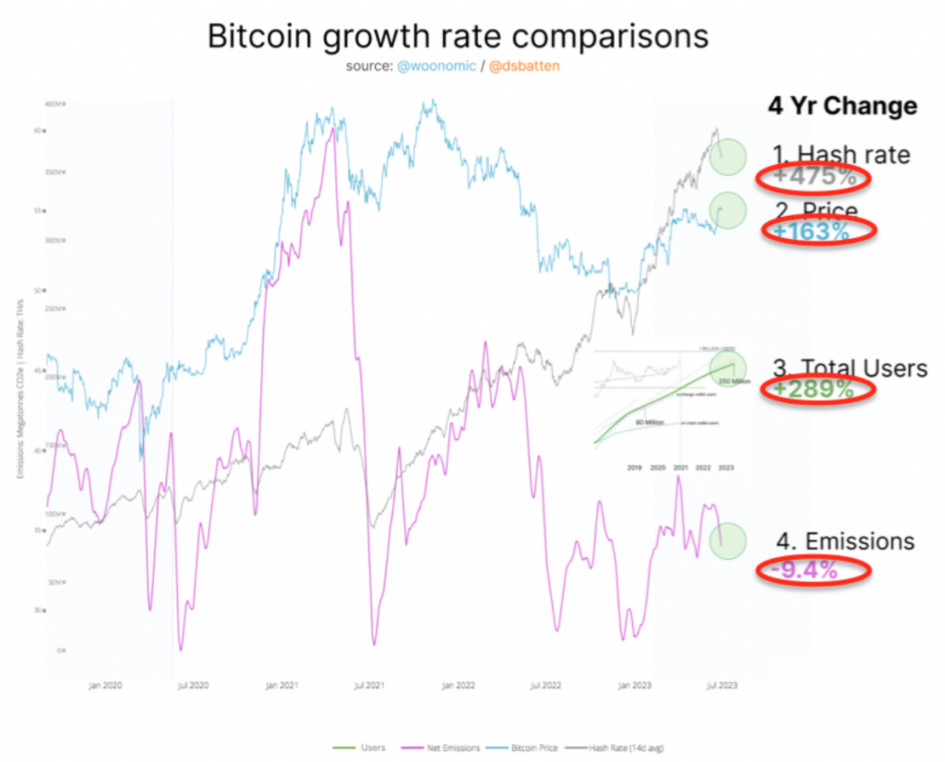

This makes Bitcoin the only industry in the world where the growth of the industry has not led to an increase in emissions.

Daniel Batten, excerpt from the report

The ESG criticisms leveled against Bitcoin are therefore false and even misleading. Bitcoin is better than any other global industry in terms of various ESG criteria! If the bias against Bitcoin is set aside, the proven sustainability should therefore not only have a positive impact on media coverage, institutional investors or companies such as Tesla but could also influence politicians who need such facts to deal with the mining industry. According to Batten, the only thing left to do is to overcome the bias and take action.

Methane reduction

Good data and models can defend Bitcoin against falsehoods and show that Bitcoin is a good ESG investment. But methane reduction can make Bitcoin the best ESG asset in the world forever.

Daniel Batten, excerpt from the report

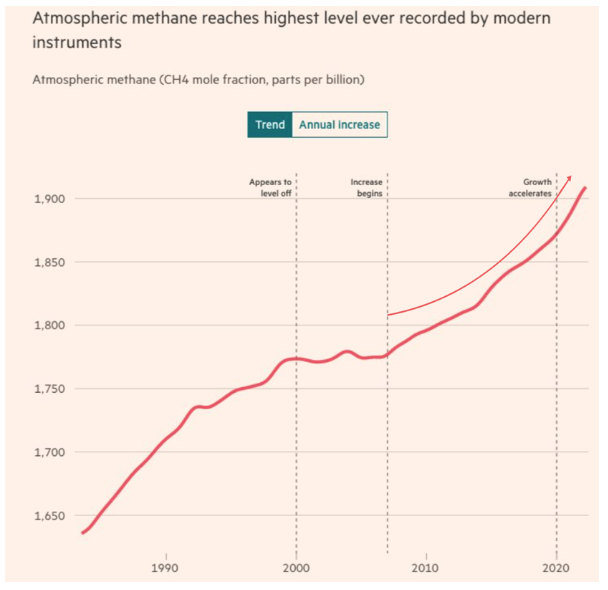

ESG funds, the US government and the International Monetary Fund (IMF) agree that Bitcoin would be a good option if it could be measurably proven that Bitcoin mining can reduce methane emissions. These pollute the environment 84 times more than carbon dioxide emissions and are increasing at an ever faster rate. Although combating methane emissions is the most powerful weapon against climate change according to the UN, little has been done so far. According to Batten, this is primarily due to the lack of profitability.

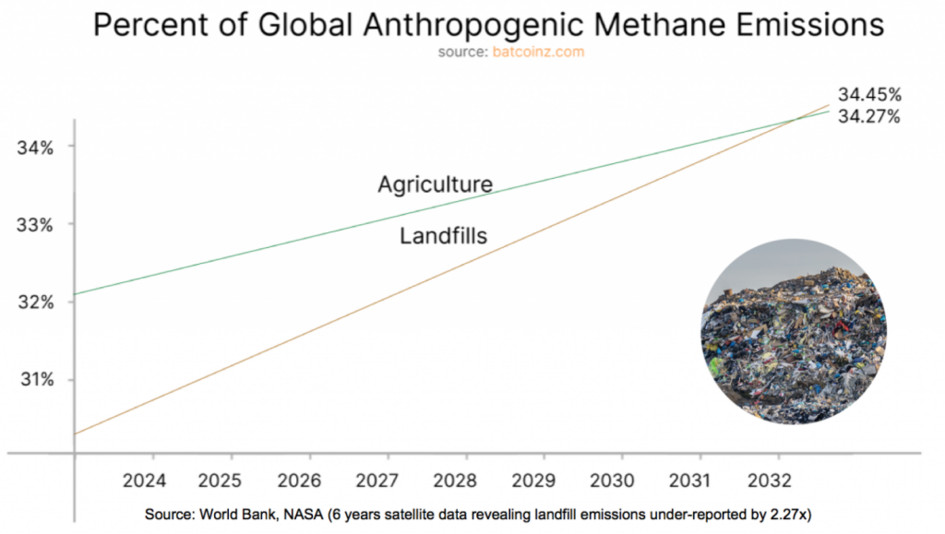

According to the World Bank and NASA, landfills will replace agriculture as the largest methane-producing industry by 2032. Bitcoin mining offers the opportunity to profitably reduce these methane emissions by almost 100%. The landfill gas must first be purified and compressed to be fed into a generator to produce electricity. It is estimated that selling to an electricity grid operator is not an option for landfill operators in 50% of cases due to the lack of infrastructure, which is too expensive. But Bitcoin miners are the solution for these landfills. The energy-hungry bitcoin mining companies can set up their mobile data centers almost anywhere and want to do so in order to obtain low-cost energy. It would be economically viable for them to run their operations directly on landfills and even invest millions of dollars in additional GCCS (gas collection and control systems) and generators. Batten explains that there are no other customers for this, but forgets high-performance computing (HPC) or artificial intelligence, which are also based on temporary calculations that can be carried out in mobile and modular data centers.

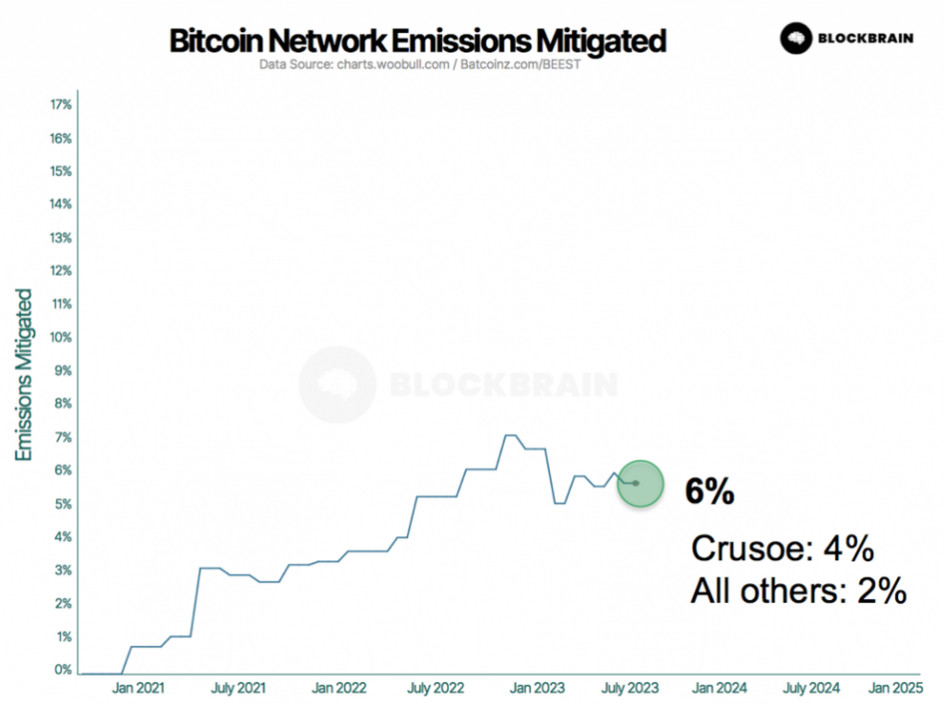

Such data centers could therefore be used to profitably manage 50% of the world's landfills. Some companies have positioned themselves accordingly (Nodal Power, Vespene Energy, DC Two, Crusoe Energy) and cooperate with Bitcoin mining or energy companies, such as Marathon or Exxon. Crusoe Energy takes a slightly different approach by operating data centers on oil fields with flared methane. This alone already reduces around four percent of the emissions of the entire Bitcoin network every year. If this concept were applied to four medium-sized landfills, the reduction in emissions could almost triple, estimates Batten. With the appropriate technology, this could be achieved within a year.

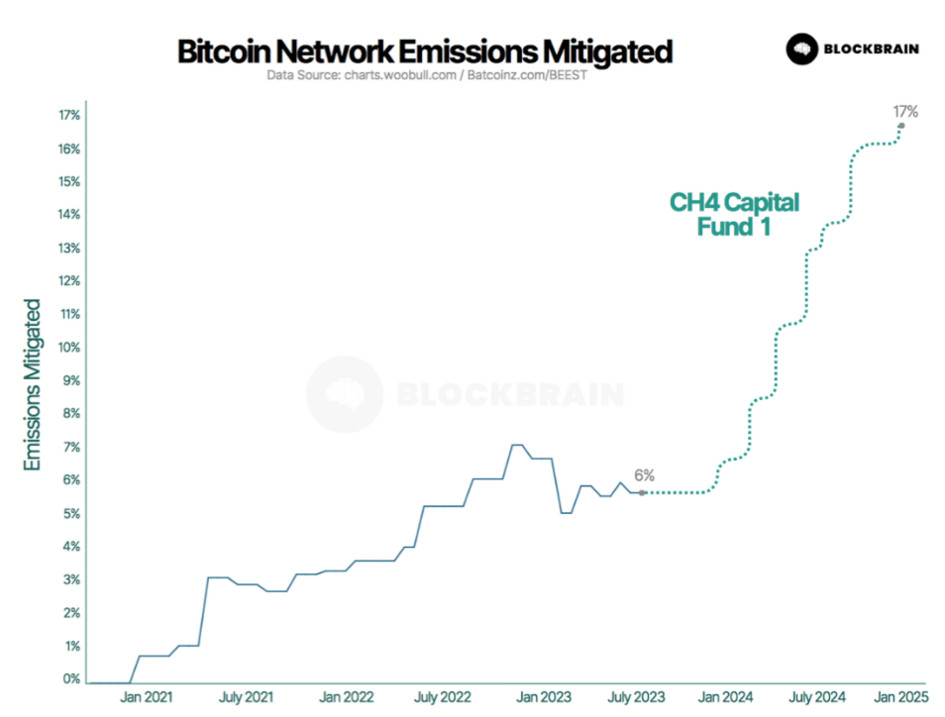

However, companies and landfill operators lack financial resources, so Batten wants to help with his company CH4-Kapital by financing the infrastructure with Climatech funds. To do this, Batten makes some calculations: To achieve negative emissions using Crusoe Energy 's approach (which invested $505 million to reduce four percent), you'd need to raise $12.1 billion. However, if flaring were to be avoided, only 421 million US dollars of investment capital would be required, as ten times more emissions would be reduced without flaring.

Batten has provided a concrete calculation for mining companies in a thread on 𝕏. They would have to bear the entire investment costs and also pay around one cent per kWh of electricity to the landfill operator (if they had no other customers). If some basic requirements are met - such as well-maintained vertical wells with good capping mechanisms to retain the methane, no passive flaring at the landfill and good conditions for the generators - a capacity of four megawatts would be required for optimal implementation. For the four MW, the company would need to raise around ten million US dollars for GSSC equipment ($1.1 million), generators ($4 million) and ASICs (including accommodation and network, $4.9 million). The generators with low financing rates are easier to finance through loans than the ASICs and GCCS, as these are high-risk assets that quickly lose value. For this reason, the financing company will largely receive the income from carbon credits during the term of the loan. In addition, around 25 % equity would have to be raised, as not everything can be covered by loans. After the loan has been paid off, the mining company receives cheap electricity and additional income from carbon credits. The landfill operator receives 0.01 $/kWh or around 30,000 US dollars per month, which it would otherwise not have earned. In addition, profit sharing or risk sharing can be agreed in line with the price performance of Bitcoin.

Batten thus not only provides models that make the environmental impact of Bitcoin more meaningful, he also presents concrete financing models, whereby he himself wants to finance GCCS and ASICS (everything except electricity generators) with his capital company.

The big picture

At the end of the report, Batten makes it clear that they have only focused on one aspect of all the environmental benefits of Bitcoin. There are many other environmental aspects where Bitcoin can be beneficial rather than harmful. In addition, the ESG components "social", such as access to electricity or the ability to save, or "governance", which Anita Posch, for example, deals with in detail, were not addressed. In connection with methane reduction at landfills, however, attention is briefly drawn to a social aspect.

According to the UN, methane is responsible for more than one million premature deaths per year. This particularly affects waste pickers who spend their entire lives on landfill sites, such as in Haiti.

The methane reduction projects can provide waste pickers with a living wage for sorting waste with appropriate tools and protective clothing. As these projects impact the health and financial well-being of entire communities, the carbon credits generated by the project can be traded for a higher premium, sufficient to offset the additional cost of this work.

Daniel Batten, excerpt from the report