A new study deals with the integration of Bitcoin mining in biorefineries as an additional source of income and cost compensation. Above all, this should increase the profitability of refineries and the use of bioproducts. The study is entitled "The potential relationship between biomass, biorefineries and Bitcoin" and was prepared by the four authors Georgeio Semaan, Guizhou Wang, Quoc Si Vo and Gopalakrishnan Kumar for the University of Stavanger in Norway.

Biomass as a raw material and energy

The basis of non-fossil chemical products, such as biofuels, biofertilizers, bio-solvents or bioplastics, is the carbon-neutral renewable resource biomass. There are various types of biomass that differ in terms of source or properties. These organic materials, such as biowaste, animal manure, algae or agricultural and forestry residues, contain chemical substances that are extracted or converted in biorefineries.

Biorefineries are industrial plants that are comparable to oil refineries. [...] A biorefinery is defined as a system with multiple biomass inputs and simultaneous production of multiple outputs through a variety of processes.

Excerpt from the study

The products obtained can be, for example, food and animal feed, materials and chemicals as well as fuels and represent a more environmentally friendly alternative to their fossil counterparts.

In addition to being used as a raw material in the pharmaceutical industry, agriculture or the processing industry, biomass is also used in the energy sector and improves sustainability, for example in the form of biomethane, biohydrogen, bioethanol, biodiesel or biogas. Biofuels can be easily integrated into existing systems and - despite the release of CO₂ during combustion - are considered carbon neutral due to the binding of CO₂ as the biomass grows. They are therefore an attractive and accessible option for reducing CO₂ emissions.

The energy and heat released during the combustion of the fuels or as a by-product in the production of the bio-products can be used to generate electricity, for example. It is expected that this bioenergy production, in conjunction with efficient combined heat and power processes, will play an important role in meeting future global energy needs. The company Mercer Rosenthal GmbH is a good example of this aspect. It processes softwood biomass and other forestry waste in Germany, producing pulp, tall oil and large quantities of green electricity, which is used in the biorefinery and to supply 50,000 households.

The challenges for biorefineries

Although the product yield is diverse and the demand for biochemicals is increasing, many biorefineries still have problems with profitability and commercialization. There are various reasons for these problems, depending on the different types of biomass: These include, for example, the lack of effective methods in processing or separating certain substances (lignocellulose from agriculture/forestry), the need for precisely controlled conditions and energy-intensive processes (algae) as well as purification processes of the fuels or the lack of proper separation of organic waste. Additional processes mean that costs often exceed revenues. Therefore, the traditional models of a biorefinery focus on maximum production output and minimum costs. However, the authors of the study propose a new approach.

Bitcoin mining as an innovative solution

In order to increase the profitability of biorefineries, the low-cost or surplus bioenergy can be used as electricity for Bitcoin mining plants, which can be used almost anywhere, or converted into a digital asset. This increases income, the incentive for continuous operation and ultimately the efficiency of the biorefineries.

In addition, the high costs of manufacturing the products could be offset, which in turn could reduce their selling prices and make the market for bio-based products more attractive. Ultimately, this would also promote sustainability and the energy transition.

Optimization of energy use and economic efficiency

In addition to the additional income, the integration of Bitcoin mining in biorefineries also optimizes energy use. However, this also depends on various factors that differ from case to case.

The relationship between mining and energy use is complex and includes several interrelated factors such as the cost of the biomass, the biofuel used, the size of the biorefinery, the process technology used, the efficiency of the biofuel conversion, the cost of purifying the biofuel, the power generation system used and the cost of electricity.

Excerpt from the study

In addition, there is the volume of production of bio-products and their selling prices as well as miner-specific factors such as the price, availability and efficiency of the mining hardware, the Bitcoin price and the difficulty of the BTC network.

A robust power distribution system is fundamentally necessary. If the waste heat from the miners is not used for heating processes for rooms in the biorefinery or greenhouses, cooling technologies must also be installed. These aspects could entail enormous investments in infrastructure and thus increase the overall costs and must therefore not be neglected when determining the actual cost basis for mining operations.

Investigation of the yield potential

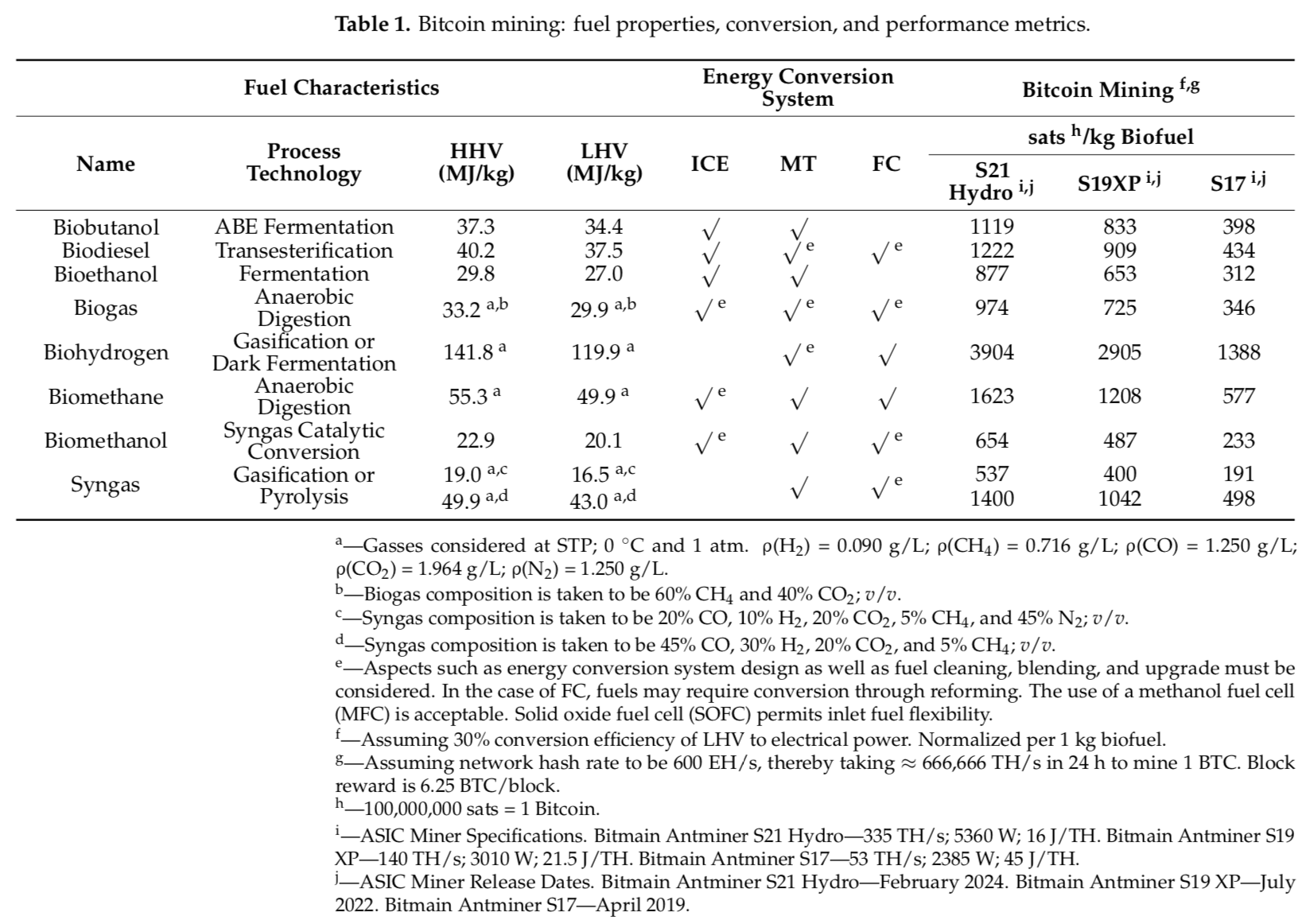

In the study, the authors strive to analyze the yield potential of using different biofuels and their compatibility with different systems and mining hardware. In a graph of the study, they show a comparison of the energy content of different biofuels and their BTC mining yield with three ASIC models.

In addition, they point out some results from the graph in the text, such as the finding that bio-hydrogen can produce almost 8 times more bitcoin than syngas under the same conditions.

When using bio-H2, a total of 3904 sats/kg of fuel can be obtained, compared to 537 sats/kg of fuel when using syngas.

Excerpt from the study

It is also emphasized that 1 kg of biohydrogen produces twice as much satoshis compared to biomethane due to its higher energy content. With an Antminer S19 XP, you would earn more than twice the amount of satoshis with hydrogen than with an S17, and more than a third more with an S21 Hydro.

Finally, the authors also conclude that mining yields increase with increased biofuel capacity and improved ASIC efficiency, and that biofuels with higher energy content (such as biohydrogen) are more efficient for Bitcoin mining.

Indirect subsidization of organic products

The authors also evaluate various scenarios that include the positive and negative effects of Bitcoin mining on the production costs of bioproducts and ultimately the profitability of biorefineries. In this way, they aim to provide guidance on whether Bitcoin mining is worthwhile or not for a particular biorefinery and facilitate an informed decision. They also offer a calculation model for the minimum price of the products through the integration of Bitcoin mining.

In the "best case scenario", the production and thus the price of biochemicals and biomaterials becomes more favorable as the rising Bitcoin price offsets the production costs and thus increases the profitability of the refinery. In the "words case scenario", the revenue from Bitcoin mining is not significant, so the additional energy consumption increases production costs and thus product prices, resulting in losses for the refinery.

It is therefore very crucial to investigate the potential of integrating Bitcoin mining in a specific biorefinery and to conduct a more in-depth risk assessment.

Not suitable for all refineries

The various scenarios make it clear that the integration of Bitcoin mining facilities is not suitable for every refinery. Due to the food situation in the world, the authors generally rule out biomass from food or animal feed for the production of Bitcoin.

Since electricity costs are an important factor for the profitability of mining, the integration of Bitcoin mining into a refinery that has access to low-cost energy and ideally also uses the waste heat from the ASICs is suitable.

If a biorefinery has access to reliable, cheap energy that is either purchased or generated on-site through biofuels, then Bitcoin mining can be a highly profitable endeavor. Mining Bitcoin in a biorefinery and then using it as a store of value should enable a reduction in production costs and prices for other co-produced VAPs [value-added products].

Excerpt from the study

In addition to the technological limitations and economic feasibility, the lack of a standardized legal framework also represents a significant hurdle for the integration of Bitcoin mining.

The creation of a standardized legal framework that clarifies the legal and tax obligations for biorefineries mining Bitcoin would facilitate smoother integration and compliance. With careful management and continued innovation, this approach could lead to greater adoption and lower costs in both sectors and make a compelling case for the triple use of biomass for bioproducts, bioenergy and Bitcoin.

Excerpt from the study

Conclusion

The integration of bitcoin mining facilities can help make a biorefinery economically viable, commercially successful and improve its environmental profile.

In addition to converting organic biomass into valuable bioproducts, bitcoin mining offers a biorefinery an additional source of revenue that can offset production costs, significantly reduce the price of biobased products and increase the overall efficiency of the refinery. The energy source, the region and the choice of biofuel are important aspects here.

At the same time, the use of biofuels from biomass, alongside the increasing use of renewable energy sources such as solar, wind, hydropower or geothermal energy, is another way to reduce the carbon footprint of bitcoin mining.

This study has once again made it clear that the integration of Bitcoin mining can have positive ecological and economic effects for all sides and is therefore an attractive option for many industries.