The Canadian Bitcoin mining company Bitfarms announced yesterday that it had reached an agreement to purchase its US competitor Stronghold Digital Mining after three years of negotiations.

Bitfarms

Founded in 2017, Bitfarms currently operates twelve data centers in North and South America (USA, Canada; Paraguay, Argentina) with more than 65,000 mining devices and a hash rate of 11.1 exahash per second (EH/s). It also has a proprietary data analytics system that continuously drives the optimization of operations and the improvement of energy efficiency and hash rate.

Bitfarms is committed to the use of sustainable and underutilized energy infrastructure and has already mined over 25,000 BTC using sustainable energy sources.

The systems run mainly on environmentally friendly hydropower and long-term electricity contracts. The public limited company contributes the computing power to mining pools and receives the corresponding Bitcoin payments.

The US mining company Riot Platforms is the largest shareholder with an 18.9 percent stake in the company or 85.3 million Bitfarms shares. Riot itself is aiming to take over Bitfarms. After initial takeover attempts failed, Riot recently increased its stake in Bitfarms and demanded more influence on the Bitfarms board - Blocktrainer.de reported. Bitfarms' purchase of Stronghold Digital Mining is ultimately also important for Riot Platforms.

Stronghold Digital Mining

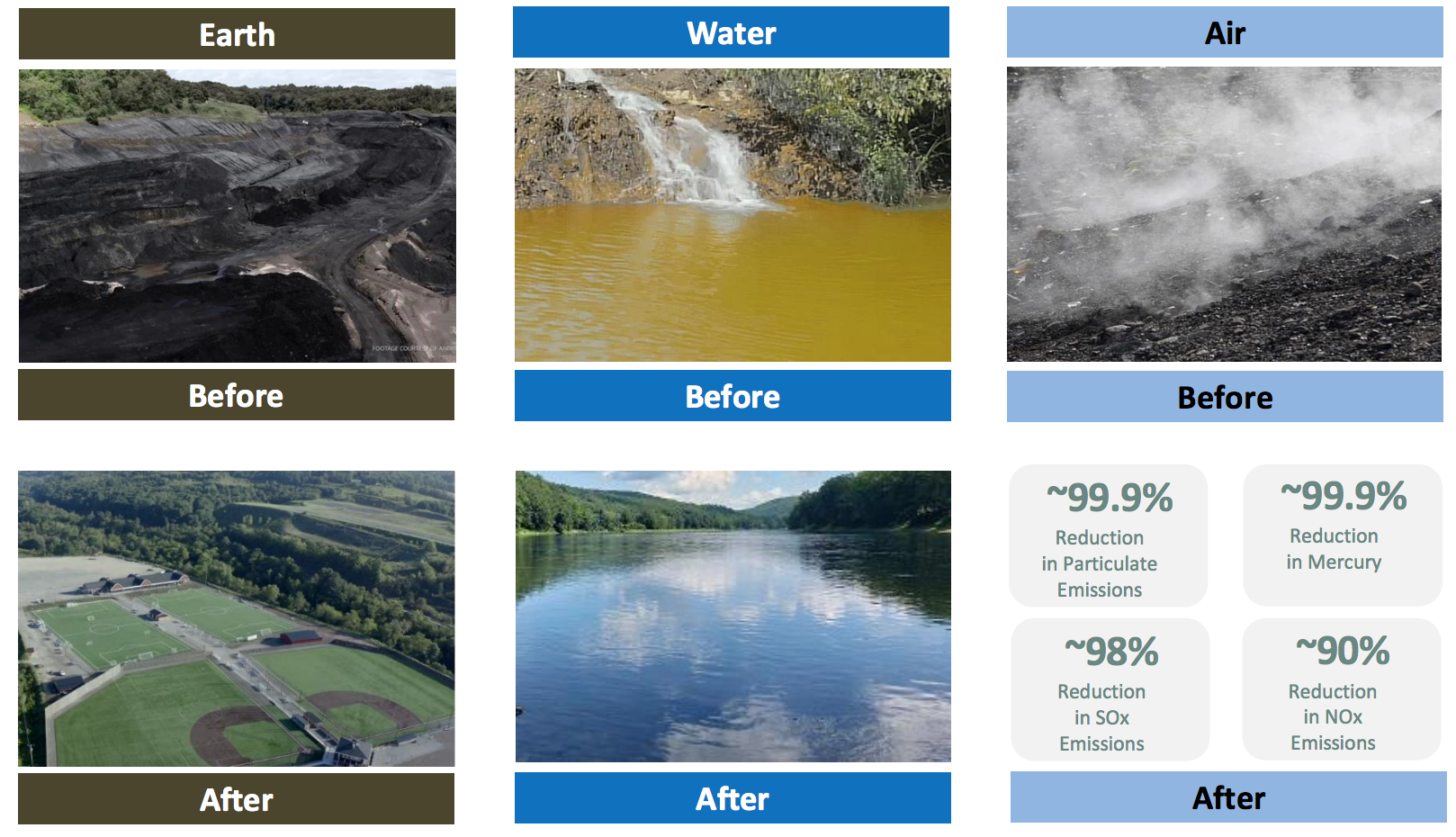

The US company Stronghold Digital Mining focuses on Bitcoin mining and environmental remediation services. The public company generates electricity from 19th and 20th century mining waste in two environmentally friendly power plants in the US state of Pennsylvania.

In doing so, the company transforms centuries-old contaminated sites in the USA into usable land, removes acidic drainage, restoring former waterways and eliminating emissions.

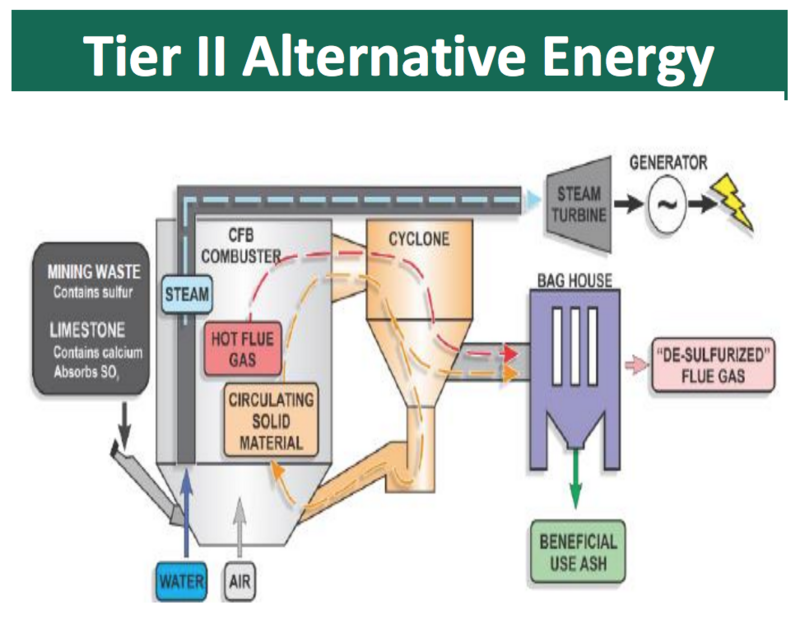

The Scrubgrass and Panther Creek power plants are located near major metropolitan areas and fiber optic lines. A highly specialized combustion process (Circulating Fluidized Bed) destroys countless tons of toxic mining waste or transforms it into electricity. A usable ash remains as a by-product.

The technology has been proven to have significant benefits for the environment and the community, which is why the power plants are recognized as a Level 2 alternative energy source (i.e. like hydroelectric power plants).

We are using 21st century crypto-mining techniques to address the impacts of 19th and 20th century mining in some of the most environmentally neglected regions of the United States.

Excerpt from the Stronghold website

In addition to the two power plants, Stronghold owns over 300 acres of land (with an option for 445 additional acres) and Bitcoin mining facilities with a hashrate of 4.0 EH/s and a capacity of 165 megawatts (MW). The company is focusing on environmentally friendly operations. With efficiency improvements through equipment upgrades, there is potential to increase capacity to around 10 EH/s in 2025.

Stronghold also has access to the largest wholesale power market in the US, the PJM grid (Pennsylvania-New Jersey-Maryland), from which it can purchase over 142 MW of power (with an option to purchase up to 790 MW). The grid offers flexible load management and demand response programs and is rapidly expanding renewable capacity, helping to decarbonize the national grid.

Details of the agreement

The boards of directors of both companies have unanimously approved the deal. Provided the Stronghold shareholders give their approval, the authorities give the green light and other customary conditions are met, the acquisition could be completed in the first quarter of 2025.

The transaction is worth around USD 125 million in equity and the assumption of around USD 50 million in debt. Under the terms of the agreement, Stronghold shareholders will receive 2.52 Bitfarms shares for each Stronghold share, which equates to a price of USD 6.02 per share and is expected to result in a stake of just under 10 percent in the merged company.

Upon completion of the transaction, Stronghold's current CEO, President and Chairman of the Board, Gregory Beard, will be available in an advisory capacity.

Conclusion

The purchase of Stronghold provides Bitfarms with new opportunities to generate and utilize low-cost, flexible grid power. Bitfarms gains access to the strategically valuable PJM power grid as well as two environmentally friendly power plants in Pennsylvania - a business-friendly state with Democrat Governor Joshua Shapiro who has a positive attitude towards Bitcoin and energy projects.

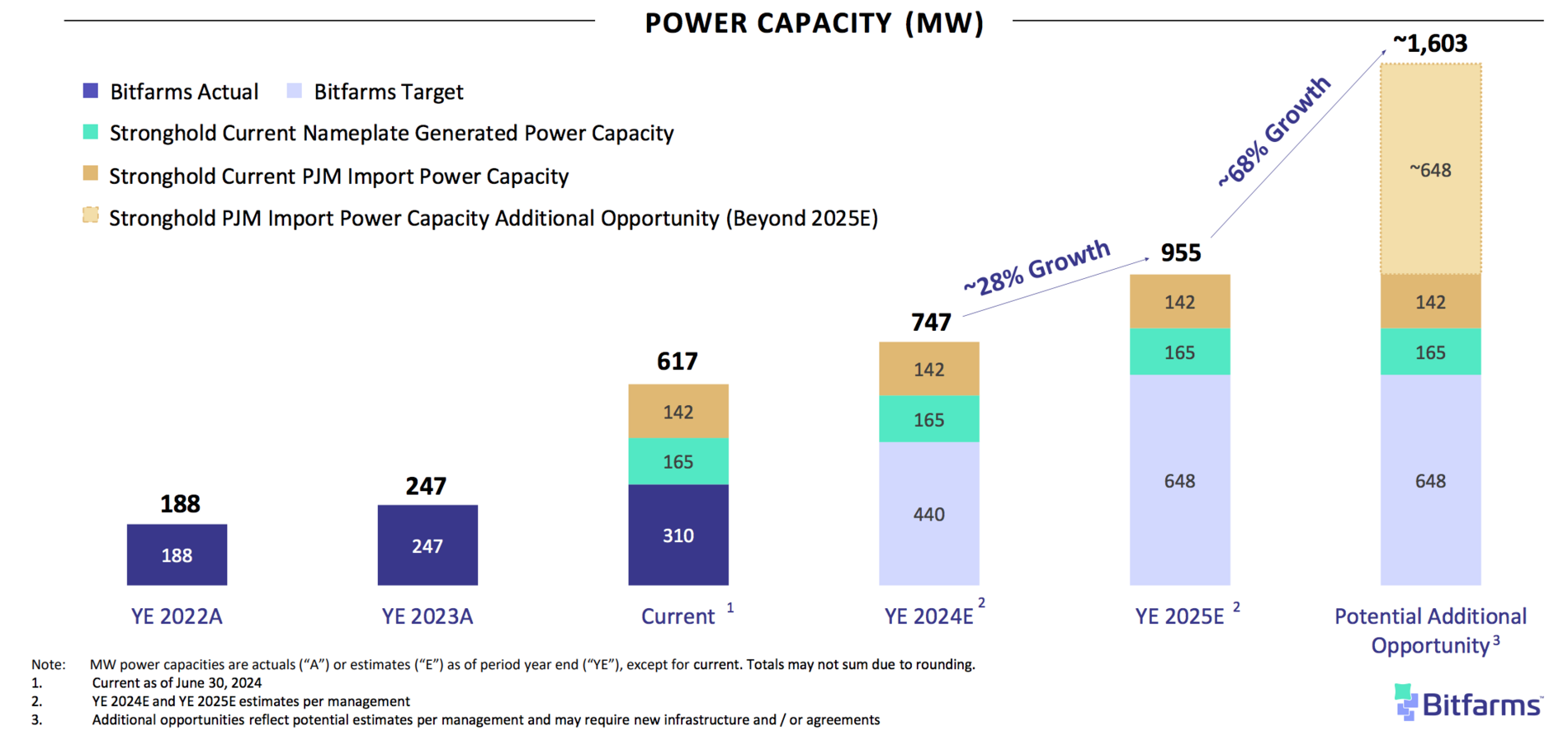

With increased hashrate (4 to 10 EH/s) and capacity (165 to 307 MW), Bitfarms is well on track to increase its total capacity to over 950 MW by the end of 2025. The share in the USA will increase to around 48 percent.

Ben Gagnon, CEO of Bitfarms, estimates the further expansion potential after 2025 at up to 1.6 gigawatts, which could also drive strategic diversification beyond Bitcoin mining - for example by combining it with high-performance computing (HPC) and artificial intelligence (AI). The location and infrastructure of the power plants in Pennsylvania are also suitable for HPC/AI projects.

Ultimately, the company also gains access to tax credits and thus additional revenue. According to the Director of Sustainability at Bitfarms, Arnold Lee, this would make the Bitcoin mining company "one of the largest potential carbon capture projects in the world".