The Austrian Bitcoin broker Coinfinity has published a report entitled "Bitcoin - A paradigm shift in asset protection". Based on brief explanations of selected aspects of Bitcoin - such as its monetary properties, ESG aspects and increasing recognition as an asset - the authors explain why this relatively young asset has been so successful to date and why its success story is probably far from over. Ultimately, they recommend Bitcoin as an investment for sensible asset protection.

More than just asset protection

As the authors Jan Wüstenfeld (Melanion GreenTech) and Fabio (Coinfinity; Aprycot-Media) initially note, Bitcoin is not just another payment system or object of speculation, but encompasses many aspects that require just as much background knowledge to understand in detail. The asset, which has only been in existence for around 16 years, is the result of more than 40 years of development by activists who want to preserve civil rights using computer software. However, other areas such as game theory, monetary history, economics, philosophy and energy management also play an important role.

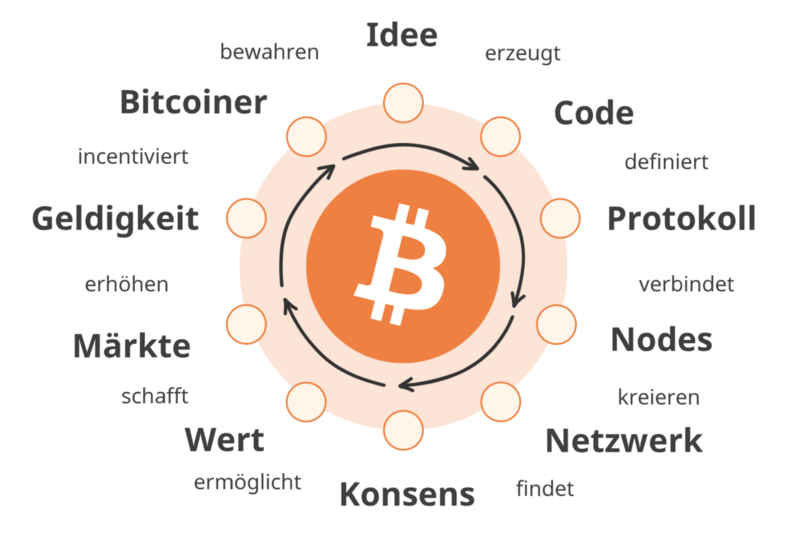

To justify the investment recommendation, the authors discuss in particular the advantages of Bitcoin over other types of money and assets. In particular, the promise of digital scarcity - meaning that there are approximately 21 million Bitcoin in total with a fixed decreasing issuance rate - stands out among Bitcoin's unique features. The consensus mechanism, economic incentives and network effects have also led to Bitcoin becoming both a store of value and an asset as well as a decentralized, free, organically and uniquely grown computer network with an increasing number of participants. Bitcoin does not require a central authority, which affects not only the network but also the identity of its discoverer Satoshi Nakamoto. It is tamper-proof, censorship-resistant and secured by large amounts of energy.

Monetary evolution

Based on the history of the development of money, the authors illustrate the differences between the various types of money that have naturally prevailed throughout history and today's imposed state debt money system, which has dominated the global economy since the abandonment of the gold standard in 1971.

Distorted economic incentives, debt and depreciation of money define the phase of government unbacked fiat money and drive investors into other assets such as stocks and real estate. Those closest to the money source (government, banks) benefit the most from this system, but also influence the free market through the wayward distribution of funds and prevent the development of a healthy economy.

In today's economic landscape, it is clear that capital does not necessarily flow to where it could have the greatest productive impact.

Excerpt from the report

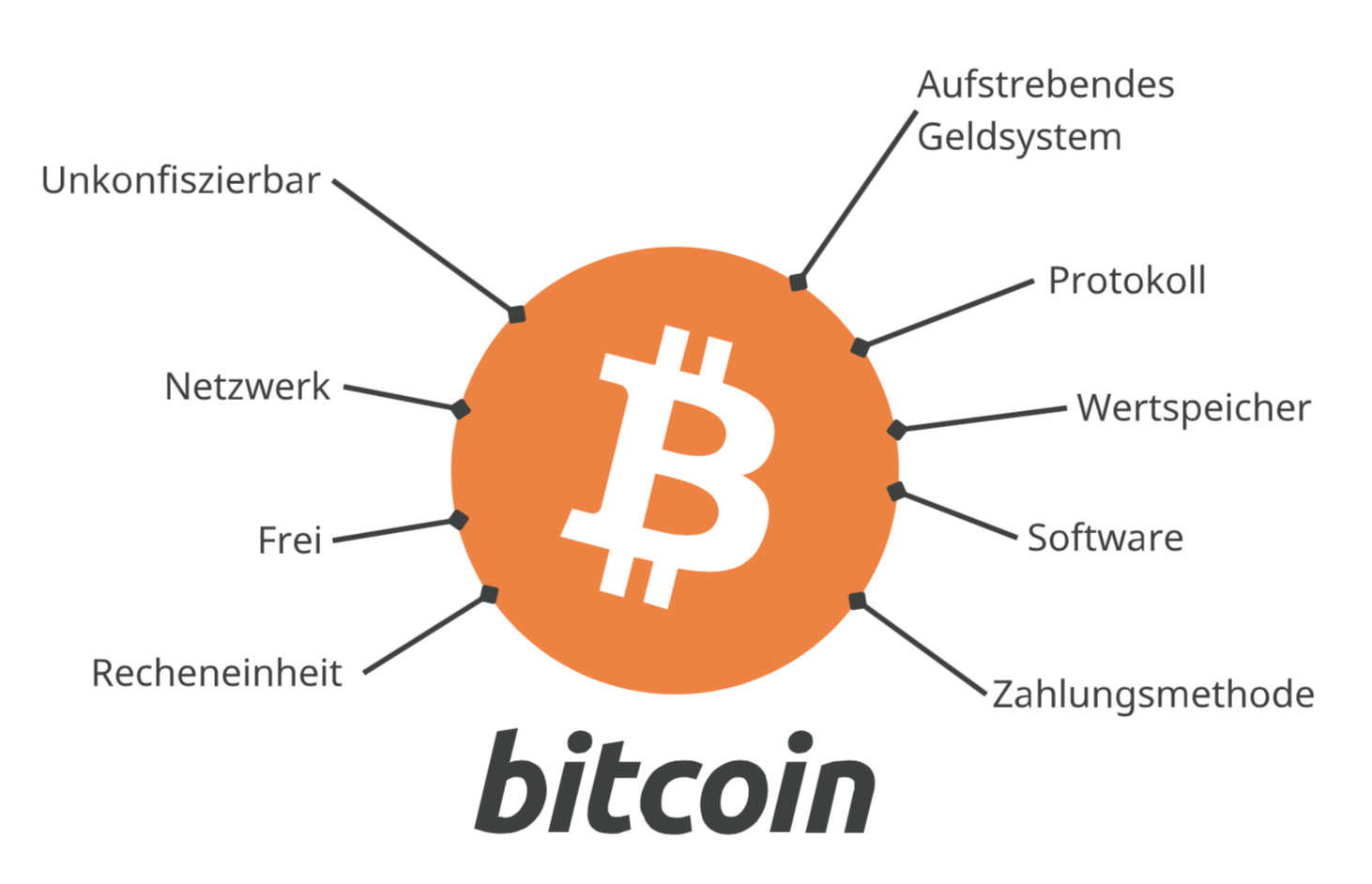

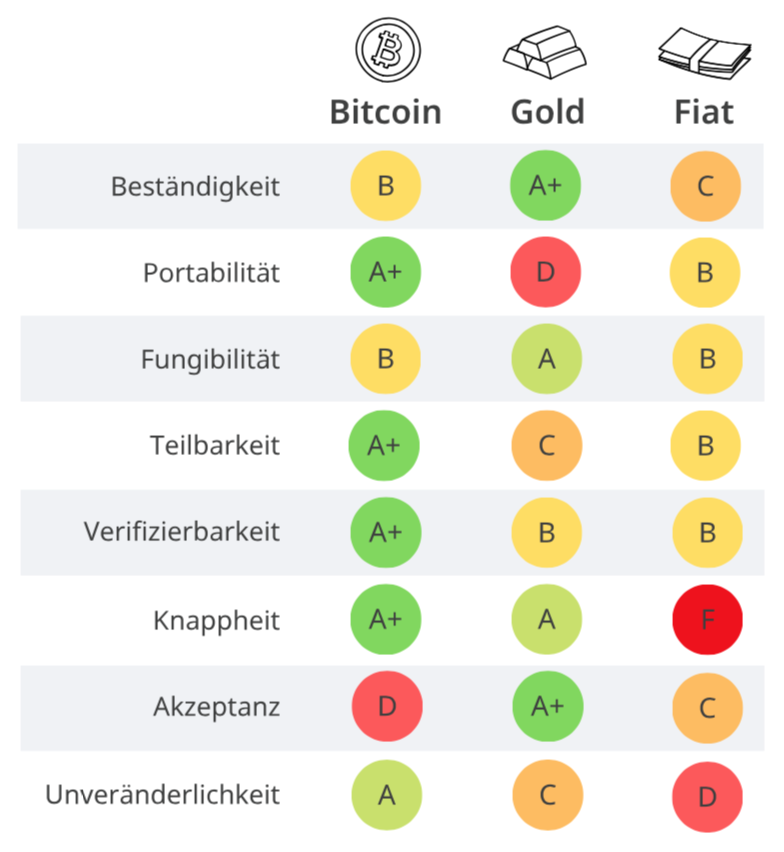

The authors also explain the advantages of Bitcoin's monetary properties compared to fiat money, gold and traditional forms of money. As the next stage of monetary evolution, Bitcoin combines the long-term value storage of gold with the transferability (divisibility, transportability) of fiat money.

Due to the fixed total quantity and the decreasing issue rate, Bitcoin is the hardest money that has ever existed, while the inflationary fiat money supply continues to grow unpredictably and continuously. Bitcoin is therefore in many ways an alternative that goes beyond censorship-resistant inflation protection.

Bitcoin not only serves as a hedge against the expansion of the fiat debt money system and its potential collapse, but also offers a viable alternative. Through its unique properties, Bitcoin could usher in a paradigm shift in the monetary system, where value is extracted from traditional asset classes and reinvested in Bitcoin.

Excerpt from the report

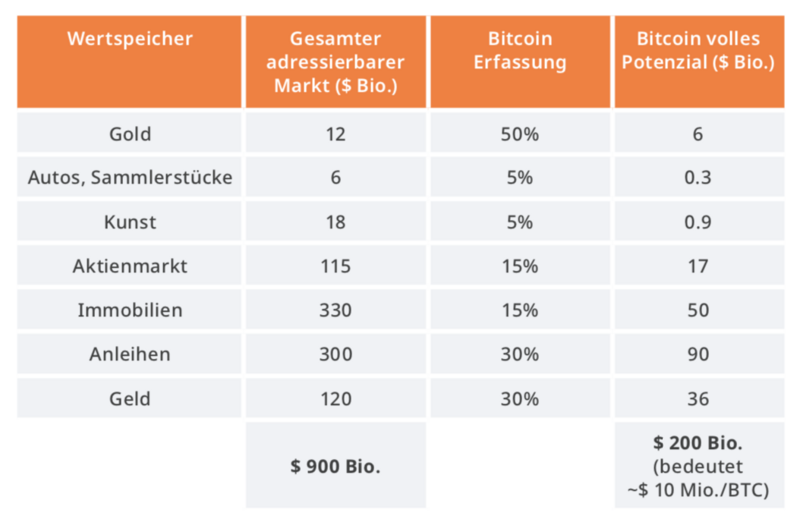

Possible transfer of assets in Bitcoin

While the inflationary fiat money system and the associated loss of purchasing power have ensured that a lot of wealth has flowed into alternative, more stable markets, the monetary revolution brought about by Bitcoin may lead to Bitcoin becoming increasingly important for investors and a further shift of wealth into the solid, secure and limited asset.

With a current market capitalization of USD 1 trillion, Bitcoin is a rather insignificant or undervalued asset, but in the past it has recorded a significantly better return than other assets. The alternative markets together are worth around 900 trillion US dollars, so shifting a few percent of these markets into Bitcoin would inevitably increase its market capitalization and thus the price of Bitcoin. According to the authors' estimate, Bitcoin could reach a market capitalization of USD 200 trillion and thus a price of around USD 10 million per Bitcoin as a result of the new asset allocation.

Even more conservative estimates would have a noticeable impact on the price of Bitcoin.

In addition, even a small addition of Bitcoin to a diversified portfolio can have a correspondingly positive effect on one's own returns without significantly increasing the volatility and risk of the portfolio.

Although the Bitcoin spot ETFs approved in the US in early 2024 have legitimized Bitcoin as an investment and made it more accessible, the authors point out the disadvantages of ETFs that Bitcoin was supposed to eliminate, such as the necessary trust in third parties, limited control over the asset or the lack of benefits of certain monetary attributes. According to them, Bitcoin is the better choice over ETFs.

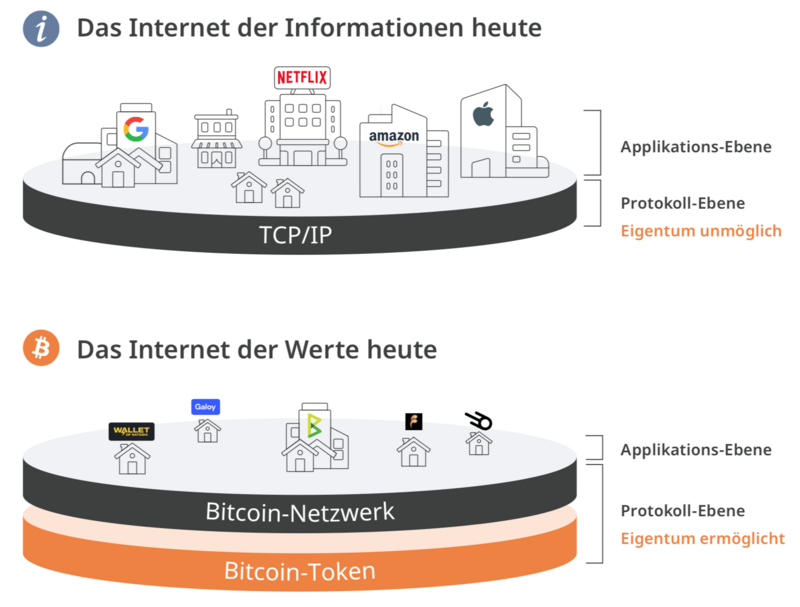

The authors also illustrate the importance and opportunity of Bitcoin by comparing it to other revolutionary inventions such as the printing press and the internet. Bitcoin is revolutionizing the global transfer of value - independent of intermediaries and restrictions - and forms the secure and decentralized basis for further scalable and user-friendly applications, such as the Lightning Network. The report suggests that the potential of the relatively young and still volatile Bitcoin as an asset, network and protocol will continue to unfold.

If Bitcoin becomes established, an increase in price is inevitable as growing demand meets limited supply.

Excerpt from the report

The number of users and long-term holders increases with the price of Bitcoin and has so far been regularly boosted by the halving events that take place every four years, during which the emission rate of new Bitcoin halves. This positive feedback loop makes the acquisition of the limited asset a promising investment opportunity - especially in the long term.