German government answers Bitcoin inquiry from the AfD

Around a month ago, members of the Alternative for Germany (AfD) parliamentary group submitted a minor interpellation on the subject of Bitcoin. The parliamentary group of the opposition party wanted to find out from the federal government what its stance on Bitcoin is and whether there are plans for government restrictions - Blocktrainer.de reported.

The answer is now available, which shows that a deeper understanding of the advantages of Bitcoin at government level is still a long way off, but that there are no bans or greater restrictions on the use of Bitcoin.

Bitcoin in German politics

While Bitcoin is moving to the center of the upcoming presidential election in the US and Donald Trump is courting voters with his openness towards the asset class, the political discourse in Germany is still hardly focused on the asset.

Accordingly, the fact that the AfD questioned the German government on the topic at all caused quite a stir. On a positive note, the question revealed that the AfD had apparently looked into the work of non-attached MP Joana Cotar and her Bitcoin initiative in the Bundestag. The AfD parliamentary group adopted the following passage almost word for word from Cotar's draft motion.

Independent of digital central bank money, Bitcoin has established itself as the most relevant and technically sound digital currency standard over the past 14 years or so. Of all existing cryptocurrencies, Bitcoin has best solved the so-called blockchain trilemma (decentralization, scalability and security), according to the questioners.

From the AfD's minor interpellation

German government critical of Bitcoin

Even though no one would have expected the German government to have a positive attitude towards Bitcoin, the answers to the ten questions posed by AfD MPs are nevertheless sobering.

When asked whether the government sees opportunities or risks in the use of Bitcoin as a means of payment or currency reserve, the answer states:

In the view of the German government, the high volatility of the crypto asset Bitcoin already speaks against its wider use as a means of payment or stable-value currency reserve.

German government

The argument of the sometimes strong price fluctuations of Bitcoin is also cited by the German government in response to the question regarding the framework conditions of Bitcoin as a supplementary legal tender.

Here, the reply points out that the euro alone is legal tender and that Bitcoin allegedly does not fulfill the essential monetary functions, as its high volatility is "an obstacle to its widespread use as a means of payment, store of value or measure of value". The reply nevertheless states that Bitcoin can generally be used as a medium of exchange in transactions.

The German government is also critical of Bitcoin mining, which is already helping to stabilize power grids in the USA. "With regard to sustainability, the German government takes a critical view of Bitcoin mining", reads a bundled answer to question 10, among others, with which the AfD parliamentary group wanted to find out whether the government recognizes opportunities or risks in private Bitcoin mining. In this context, the AfD MPs also asked about the need for political action resulting from the attitude towards mining, but no answer was given.

When asked about the regulation of Bitcoin and Co., the German government primarily referred to the MiCA Regulation, which sets out the regulatory framework at EU level and will come into full force in the coming months. However, it also stated that it would continuously review the regulatory framework for crypto assets for appropriateness.

No Bitcoin ban planned

Despite the general rejection of Bitcoin at government level, there are currently no plans to introduce stricter restrictions.

The federal government is not currently working on a blanket ban on the possession or trading of crypto assets such as Bitcoin, nor on regulating the operation of self-operated Bitcoin network infrastructures.

Federal government

The situation is also not set to change for the time being with regard to the tax situation for Bitcoin and the like, although efforts have already been made by the Green parliamentary group in the Bundestag to abolish the tax exemption for Bitcoin after one year of holding. In its reply, the German government emphasizes that it is not currently working on any legislative procedures that would provide for changes to the taxation of profits from trading Bitcoin and Co.

Ignorance towards Bitcoin?

Through the minor interpellation, the AfD parliamentary group has made it clear that not much has changed in the understanding of Bitcoin at government level in recent years. The argument that Bitcoin is not suitable as a means of payment due to its high volatility is as old as Bitcoin itself. A few months ago, for example, the European Central Bank (ECB) denied that Bitcoin was money in a post that has since been deleted.

However, in order for free money to establish itself from the ground up, strong upward price fluctuations and the associated sharp corrections due to the many speculators who attract rising prices are inevitable. Bitcoin itself has firmly predefined monetary rules such as a maximum total quantity of just under 21 million units. From this perspective, Bitcoin is stable as a benchmark, even if the exchange rate against the euro and US dollar, and therefore also the value of Bitcoin measured in goods, still fluctuates considerably. However, this should continue to decrease as it becomes more widespread - something that can already be observed at present.

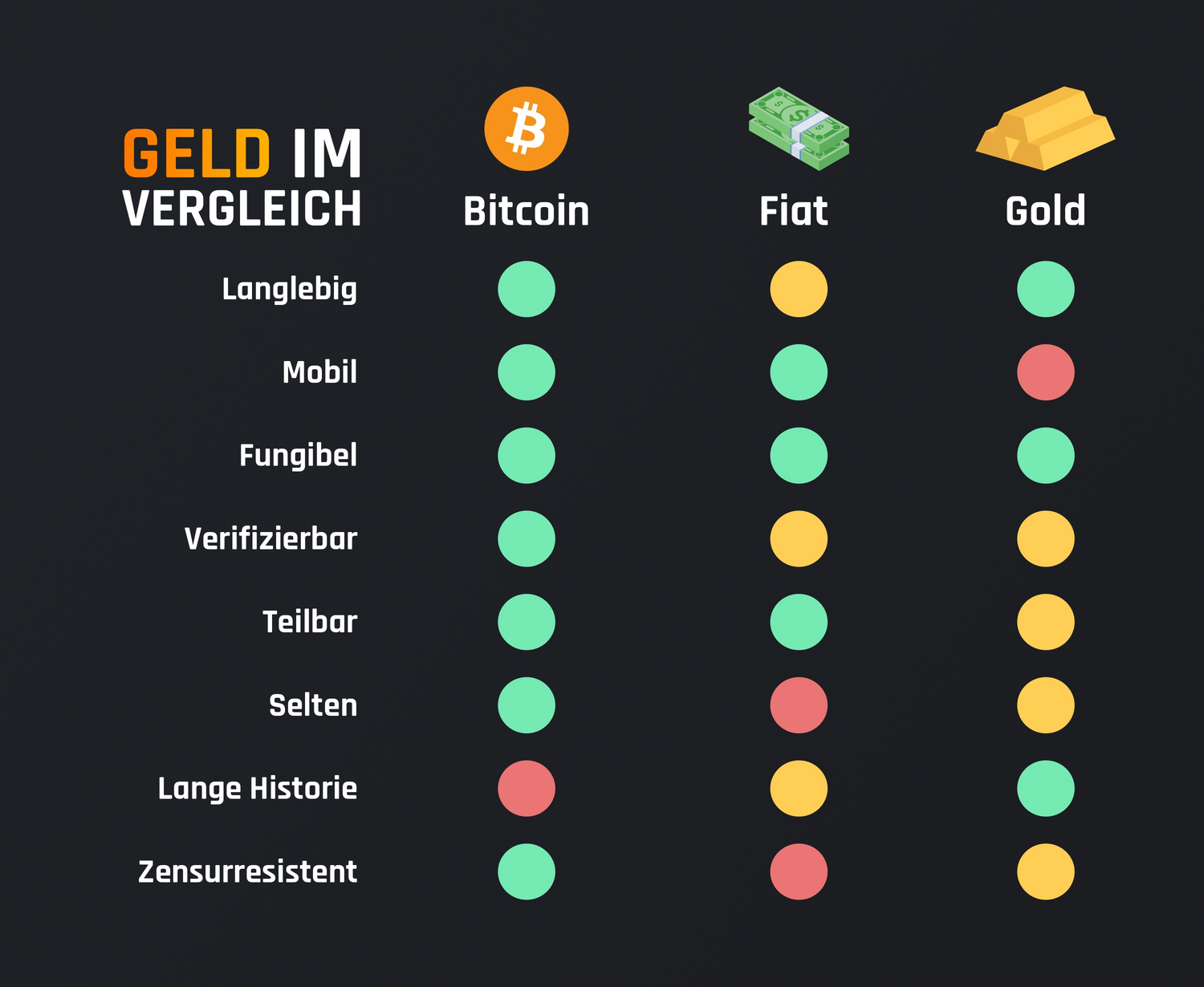

In fact, Bitcoin even fulfills the general characteristics of good money much better than state currencies or the precious metal gold. Particularly over longer periods of time, Bitcoin has also been one of the best stores of value the world has ever seen.

It is only understandable that governments and central banks are rather critical of a competitor for their own currency, which gives them the greatest possible room for maneuver. However, the example of the Central American country of El Salvador, which introduced Bitcoin as a legal tender, shows that states can also benefit from Bitcoin themselves. The country led by Nayib Bukele has now made several million US dollars in profits on its Bitcoin investment and has established itself as a popular tourist destination due to the sharp drop in crime and openness towards Bitcoin.

Dirk Brandes, AfD member of parliament and initiator of the minor interpellation, emphasized that Germany could also benefit from Bitcoin. In an interview with Kolja Barghoorn from the YouTube channel "Aktien mit Kopf", Brandes explained that Bitcoin could lend stability to a national currency, as the asset would have a disciplining effect on the currently escalating government spending. It remains to be seen whether the opposition party AfD, which in the past has tended to advocate a return to the Deutsche Mark, will now, like Donald Trump, also discover Bitcoin as an election issue for itself.

In any case, it is positive that Bitcoin is also becoming part of political debates in this country - even if only to a limited extent. Every discussion about Bitcoin draws attention to the topic, which could lead to people increasingly considering the question of what money actually is and whether it is really the best idea for a few entities to have control over something as fundamental as money, as is the case with the euro and the ECB. In Switzerland, Bitcoin took center stage last month when an initiative tried to get the Swiss National Bank to buy Bitcoin as a currency reserve alongside gold - Blocktrainer.de reported.

Although Germany probably has the most Bitcoin nodes per capita, the topic is still a long way from reaching the heart of society, let alone politics. And when institutions do comment on Satoshi Nakamoto's creation, it tends to be in a critical tone, as was the case with the German government's response. Nevertheless, despite the government's generally apparent aversion to Bitcoin, it is encouraging that it is not currently planning to enforce bans or tighter restrictions.