IMF paper recognizes benefits of Bitcoin:

To circumvent capital controls and in the event of economic instability

In the Bitcoin scene, the International Monetary Fund (IMF) is known for its critical stance towards Bitcoin. At the beginning of 2022, for example, the IMF called on El Salvador to abolish Bitcoin as a means of payment. The reason for this was that Bitcoin posed major risks to financial stability.

It is therefore all the more exciting that in a recent academic paper, the IMF found increased activity in the Bitcoin market during precisely this financial instability. Another finding of the paper is that Bitcoin can apparently help to circumvent capital controls.

Cross-border off-chain Bitcoin capital flows appear to be related to incentives to avoid capital movement restrictions.

From the paper

A few months ago, a paper by economists from the European Central Bank, which normally does not have a good opinion of Bitcoin either, also came to similar partially positive conclusions - Blocktrainer reported.

The relevance of the paper

The IMF paper published earlier this month is entitled "A Primer on Bitcoin Cross-Border Flows", which means "A Primer on Cross-Border Payments with Bitcoin". The paper was written by three IMF employees and authorized for publication by Kenneth Kang, Deputy Director in the Strategy, Policy and Review Department and "Agenda Contributor" of the World Economic Forum (WEF).

The authors attempt to quantify cross-border capital flows via Bitcoin using very extensive methodologies, distinguishing between on-chain and off-chain transactions. The former are those that are processed directly via the Bitcoin blockchain and off-chain transactions that run via an intermediary, such as an exchange. Using this data, economists are also trying to establish a link between cross-border Bitcoin capital flows and macroeconomic conditions such as financial uncertainty.

Matt Hougan, CIO of asset manager Bitwise, which has launched a Bitcoin spot ETF in the US, interprets the scope and depth of the 43-page paper alone, as well as the sophisticated mechanisms for measuring capital flows, as a positive sign of the asset's increased relevance.

Insight #3: The IMF is paying attention to Bitcoin.

This is a serious paper. It was written by three IMF researchers, reviews the relevant academic literature, and takes a sophisticated approach to using on-chain and off-chain techniques to determine Bitcoin capital flows.

The IMF is conducting this research because Bitcoin "has grown rapidly over the past decade" and policymakers increasingly need to understand the implications of this for the global economy.

Matt Hougan on 𝕏

Relatively high Bitcoin capital flows in developing countries

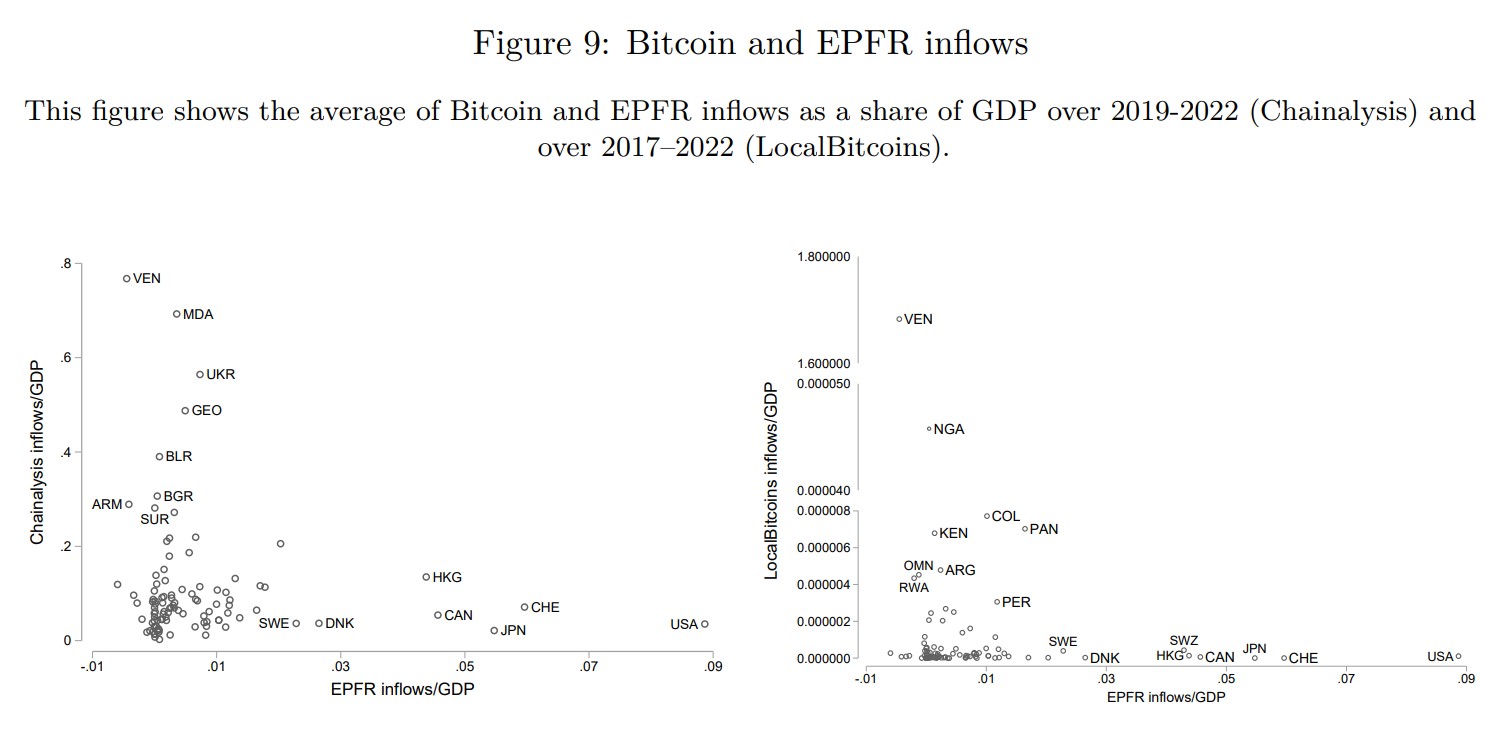

One of the main findings of the paper is that, in relative terms, higher Bitcoin capital flows can be observed in developing countries where there are less developed financial markets and more frequent capital controls. To this end, the authors put both on-chain and off-chain Bitcoin inflows in relation to the local economic output. They compare this share with the relative inflows into traditional investment funds (EPFR flows) of the respective countries.

The result: the countries that record the largest capital inflows via Bitcoin in relation to their economic output - both on-chain and off-chain - also tend to be those in which traditional investment products hardly play a role, and vice versa.

The scale of cross-border Bitcoin capital flows is significant in some countries, particularly those with low capital flows. Conversely, countries that tend to have relatively large capital flows generally have lower Bitcoin capital flows. This can also be seen in Figure 9, which compares Bitcoin inflows with EPFR inflows. The latter are largest in advanced economies with highly developed financial markets, while Bitcoin inflows tend to be larger in emerging and developing economies.

From the paper

It is striking that the high-inflation country Venezuela (VEN) is far ahead in terms of on-chain and off-chain Bitcoin capital flows in relation to economic output. Countries with high inflation rates and/or strict capital controls, such as Argentina (ARG), Nigeria (NGA) and Colombia (COL), are also represented in off-chain Bitcoin capital flows via the now closed LocalBitcoins exchange.

The economists also found that higher capital outflows via Bitcoin can be observed in countries where there is a greater deviation from the official to the actual exchange rate of the national currency (parallel exchange rate premium), which they determined using the Bitcoin exchange rate in the respective currencies on LocalBitcoins. From this, the IMF staff conclude that Bitcoin is being used to circumvent capital controls.

Off-chain data also suggests that an increase in a Bitcoin-based measure of the parallel currency premium is associated with higher outflows. These findings are consistent with a body of recent work suggesting that Bitcoin facilitates the evasion of capital controls.

From the paper

The authors also add that there is evidence that remittances, i.e. migrants' transfers back to their home country, are also behind cross-border off-chain Bitcoin capital flows.

Bitcoin use in times of financial uncertainty

Furthermore, the authors recognize an increase in on-chain Bitcoin capital flows measured by the crypto analysis company Chainalysis in the event of economic uncertainty. When the volatility index VIX, which quantifies the expected fluctuation of the most relevant stock index S&P 500, rises, activity in the Bitcoin market increases. This means that Bitcoin capital flows behave in the opposite way to those in traditional investment products (EPFR and IIF flows).

Overall, our analysis suggests that cross-border Bitcoin inflows react differently to traditional factors than capital flows. The response of EPFR and IIF flows is in line with our expectations. That is, we find that an increase in risk aversion and a strengthening of the dollar lead to lower inflows. In contrast to capital flows, chainalysis flows respond positively to changes in the VIX.

Our cross-border results suggest that on-chain bitcoin capital flows are positively related to the VIX (the opposite response of capital flows).

From the paper

This result seems to suggest that Bitcoin is a haven for some people in the face of higher volatility in the traditional market. More generally, the authors conclude that increased use of Bitcoin may also be a sign of cracks in the local financial system.

From a more structural perspective, it is certainly also important to address the underlying imbalances that manifest themselves in pressures on the exchange rate, as the use of crypto-assets are only symptoms of the imbalances.

From the paper

Conclusion

The fact that IMF economists are looking so closely at cross-border Bitcoin capital flows and the connection to macroeconomic variables is certainly a positive development. In general, more and more scientific papers on Bitcoin seem to be written by large institutions, which also use evidence to establish that Bitcoin has a benefit for people in developing countries in particular - even if the paper is, as usual, accompanied by the note that the statements only reflect the opinion of the authors and not that of the IMF.

The authors of the IMF paper also repeatedly emphasize that the adoption of Bitcoin has risen sharply and that the asset is already widely used for cross-border capital flows.

The adoption of Bitcoin has increased rapidly over the past decade.

Based on these data sets on cross-border Bitcoin transactions, we show that the use of Bitcoin for cross-border transactions is geographically very widespread, with a relatively high intensity in different regions for both off-chain and on-chain Bitcoin capital flows [...].

From the paper

While the finding that Bitcoin is arguably being used to circumvent capital controls may please some in the Bitcoin community who oppose financial censorship, IMF economists may see this as more of a threat. They seem to want to draw the attention of policymakers with what they have found out so that they take Bitcoin into account in their legislation.

As the IMF (2023a) points out, policymakers seeking to manage capital flows should ensure that regulations governing capital flows cover crypto-assets.

From the paper

The increase in Bitcoin activity as financial uncertainty increases - as measured by its correlation to the VIX - is interesting, but probably not reason enough to assume that the asset is already seen by many people as a safe haven in crisis environments. Another paper from the IMF, for example, found that Bitcoin acts as a risk asset when volatility in the traditional financial market is higher. This is also supported by the recent slump in the price of Bitcoin in response to the dispute between Iran and Israel.

It remains to be seen whether and when Bitcoin will be perceived by the majority of market participants as the safe haven par excellence due to the non-existent counterparty risk and the limited volume.