China is home to the largest manufacturers of ASIC miners, which supply the entire world with their devices. It is therefore hard to imagine Bitcoin mining without China.

Reports and rumors about an alleged or planned "ban" on Bitcoin and Bitcoin mining in China have been around since 2013 and have been covered by numerous media outlets ever since. The corresponding reports often triggered price losses in the crypto market and were accordingly labeled as scaremongering (FUD - Fear, Uncertainty and Doubt).

The year 2021

The Chinese government's ambivalent stance on this issue is also reflected in 2021. On May 21, 2021, the Financial Stability Development Committee proposed at its 51st meeting to crack down on mining and trading in Bitcoin and other cryptocurrencies to prevent financial risks to the country and its people.

On June 2, 2021, Chinese state news agency Xinhua reported that cryptocurrency services are banned for payment providers and financial institutions in mainland China. This means that Bitcoin and other cryptocurrencies cannot be exchanged for the Chinese currency Renminbi and used for payments and settlements. The official justification was to protect people's interests from fraud by providers of useless cryptocurrencies that are marketed as objects of speculation with great promises of profit. According to Xinhua, however, there is no ban that prohibits citizens from buying or trading cryptocurrencies as virtual goods at their own risk - Blocktrainer.de reported.

With regard to mining, the high energy consumption and the associated emissions are problematic for China's energy supply and climate goals, but also the fact that a lot of capital flows out of the country through large mining companies. Chinese officials have therefore taken various measures in Inner Mongolia, for example, and closed 35 mining companies by the end of April 2021.

Additionally, on September 24, 2021, the National Development and Reform Commission (NDRC) put cryptocurrency mining on the list of "obsolete industries" after the authorities in Beijing cracked down on crypto miners. Although it seems that the Commission has thus taken a definitive position after several years of indecision, a referendum on the issue was initiated by the Commission in order to obtain the opinion of the population. In this context, the Commission also published a post on its website stating that the United States has replaced China as the dominant Bitcoin mining nation in the world.

Daniel Batten's criticism of Western media

While numerous mining companies left China in 2021 and exported their equipment to various countries (mainly the USA and Kazakhstan) to restart their business model there, numerous Western media reported on the "mining ban" in China.

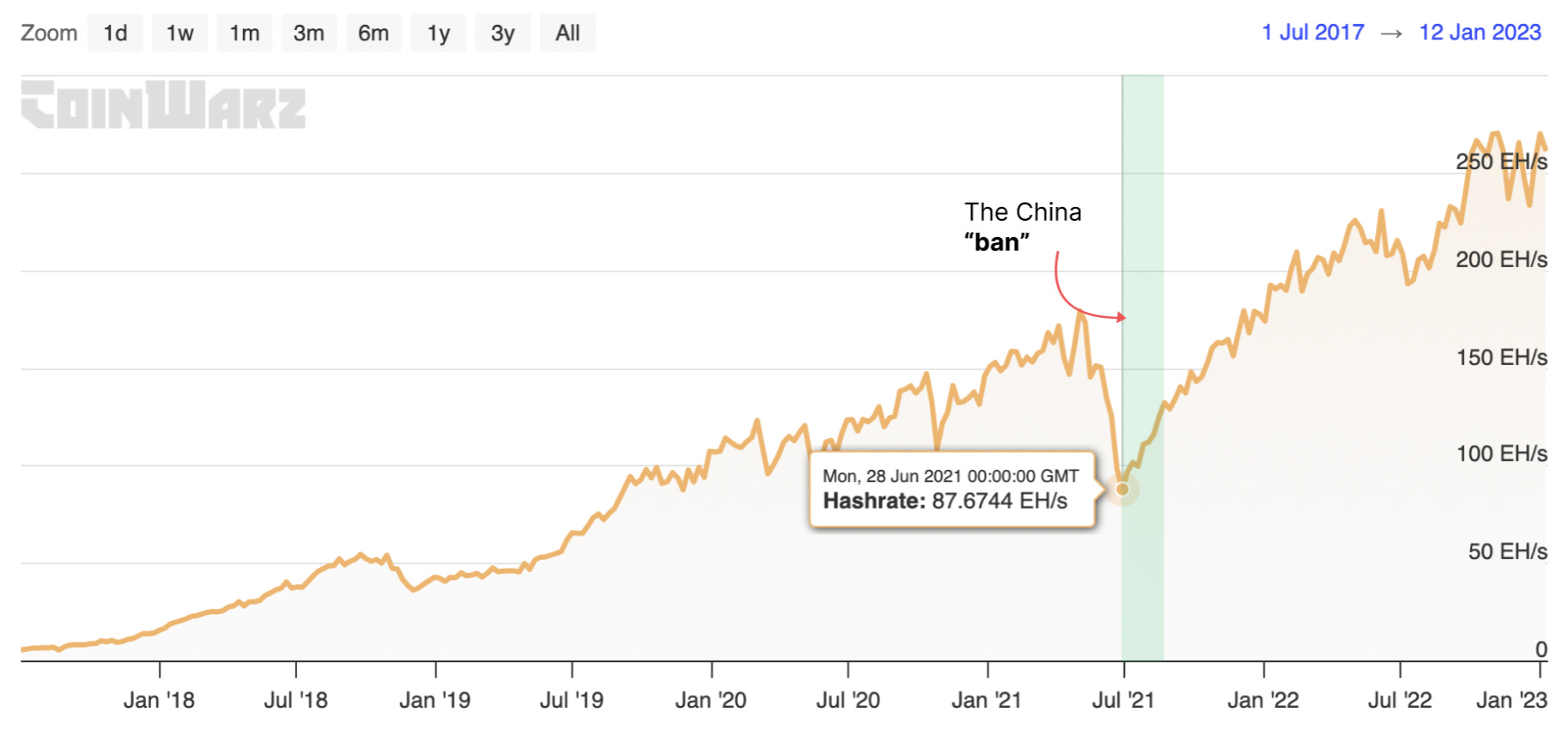

Environmental activist and entrepreneur Daniel Batten criticized this reporting in his twelfth Bitcoin Forecast and made it clear that Bitcoin mining "has never been banned in China". Batten points out the hashrate share of China before and after the alleged ban. Using data from Cambridge University, it can be seen that China was still supplying around 46% of the Bitcoin hashrate in April 2021, while the Chinese share fell to zero in July and August 2021. As a result, the total Bitcoin hashrate has fallen by more than 51% globally (from 179.2 EH/s to 87.7 EH/s). However, by September 2021, China's hashrate share was back to more than 22%, while it is currently estimated at around 15%.

In addition, Batten (behind a paywall) refers to the lack of anchoring in a Chinese legal text and the statements of four Bitcoin mining companies, but without naming specific names. According to Batten, this is more of a temporary suspension of mining rather than a complete ban.

His research has found that local government officials in China, especially in Inner Mongolia, support small, cooperative mining companies with a capacity of 100 megawatts or less (i.e. 200-500 ASIC miners), as they can help stabilize the power grids and monetize much of the unused surplus energy from hydro, wind and solar power that has become available due to the migration of large industries. Expert Jaran Mellerud from Hashlabs Mining estimates that even larger mining companies with 200-megawatt plants are currently active in China, as there would otherwise be no economic activity in some regions. In addition, the waste heat from ASIC miners is to be used for various heating systems in China, which would make the country a pioneer in the innovative use of mining equipment, Batten continues.

For these reasons, Batten criticizes the Western media for inaccurate reporting and research and suspects a deliberate dramatization through the use of the term "ban". This would give the relevant articles more attention. Batten even speaks of a "disinformation campaign" aimed at denigrating Bitcoin, which would also apply to other examples such as Paraguay, New York or Venezuela.

It would not be the first time that there has been a difference between what was reported and what actually happened in the case of a Bitcoin mining ban. News reports about "bans" in Paraguay (it was not a ban, but a measure against electricity theft) and New York (it was not a two-year moratorium on new fossil fuel-based mining) were also overstated.

Excerpt from Batten's report

Is Batten right?

The statements made by the Chinese mining companies that are currently still active in China are very interesting, as they show that the Chinese government is well aware of the benefits of Bitcoin.

However, it is debatable whether this is actually a disinformation campaign by the Western media. Given the ambivalent attitude of the Chinese government and the numerous previous "bans" on Bitcoin and Bitcoin mining in China, the Western media cannot really be blamed for their choice of words. The Chinese government's announcements regarding the handling of cryptocurrencies and mining, as well as reports of closed mining companies and confiscated ASIC miners, became more frequent, which could certainly be interpreted as a ban on mining.

However, it was also obvious to everyone and therefore no secret that China continued to deliver a significant share of hashrate despite the "mining ban". In addition, Batten himself points to the reporting of some media outlets that reported on the Bitcoin mining activities still taking place in China after the "ban". While the activities were described as illegal underground operations and presumably some wrong conclusions were drawn, there were also reports questioning the ban, which Batten did not elaborate on. Accordingly, one could doubt that it was a targeted campaign against Bitcoin or China.

Apart from the temporary losses in the hashrate and the Bitcoin price, the Bitcoin network has not suffered any long-term damage, on the contrary: the "ban" has contributed to a decentralization of the hashrate and led to a reduction of fossil energy sources in the industry. Ultimately, it could be agreed that the Chinese government will no longer allow (or ban) Bitcoin mining on a large industrial scale in China. However, this does not seem to apply to the exported facilities of Chinese mining companies that are now being operated abroad.

Regarding the missing legal text, it can be said that the legal system in China is structured differently than in Western countries. The Chinese system allows the government a certain flexibility and freedom of action, which makes it possible to apply regulations quickly and efficiently, even if they are not yet fully enshrined in law. This reflects the centralized power structure and the priority of stability and control that prevail in Chinese politics and administration. Ultimately, it remains to be seen whether the Chinese government will actually enshrine a ban on Bitcoin mining in a legal text or allow Bitcoin mining on a large industrial scale again or set up state-owned mining facilities itself.