Joe Biden blocks Bitcoin-friendly banking regulation

Will this cost the Democrats the presidency?

US President Biden officially vetoed the resolution last night, which would have led to more Bitcoin-friendly banking regulation in the US. H.J.Res. 109 previously passed the House of Representatives and the Senate with bipartisan support. Joe Biden announced on May 8 that he would not sign the resolution and therefore not allow it to become legally effective.

The debate about SAB 121

In March 2022, Staff Accounting Bulletin No. 121 (SAB 121), a directive from the US Securities and Exchange Commission (SEC) came into force, which requires US banks to recognize Bitcoin and other cryptocurrencies held in custody as a liability on their balance sheets. Accordingly, banks must hold equity equivalent to the value of their customers' Bitcoin and crypto positions, which makes the custody business much more difficult for financial institutions. This is also an obstacle to banks accepting Bitcoin as collateral for loans.

Back in February of this year, the US banking lobby, which has been rather hostile to Bitcoin in the past, spoke out and called for a revision of SAB 121 in light of the success of Bitcoin ETFs - Blocktrainer.de reported. The reason given was primarily the general risk they see in the fact that only crypto companies like Coinbase can offer custody services. But rather, it seemed that financial institutions were suddenly keen to cash in on the asset class's rise as custodians themselves, realizing that a lucrative business was at risk of slipping through their hands due to SAB 121.

[Bitcoin spot ETFs] have already seen billions of dollars in inflows, but it is virtually impossible for banks to act as custodians for these ETFs on a large scale due to the Tier 1 capital ratio and other reserve and capital requirements resulting from SAB 121. This raises important questions about the security and stability of this ecosystem. We believe this outcome could increase concentration risk as a non-bank entity now serves as custodian for the majority of these ETFs. This risk may be mitigated if prudentially regulated banking entities have the same ability to provide custody services to Commission-regulated ETFs as qualified non-bank custodians. SAB 121 does not appear to contemplate this type of concentration risk, perhaps in part because spot bitcoin ETFs or similar products were not an authorized product at the time SAB 121 was published.

From the lobbying organizations' letter to SEC Chairman Gary Gensler

H.J.Res. 109 would ultimately overturn SAB 121. The resolution passed the House of Representatives and the Senate, leaving only President Joe Biden standing in the way of more Bitcoin-friendly banking regulation.

SAB 121 moves to the center of the election campaign

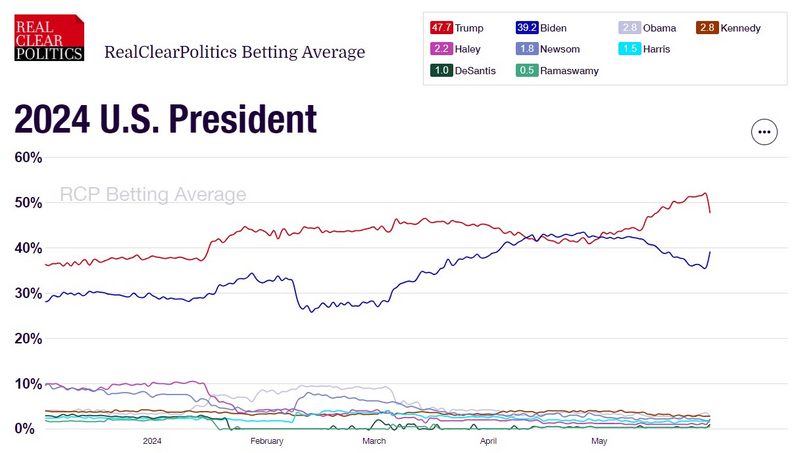

Before the House of Representatives voted in favor of H.J.Res. 109, Biden had already announced his veto. As a result, his opponent for the upcoming presidential election in November, Donald Trump, suddenly showed himself to be open to Bitcoin and Co. and criticized the incumbent president and SEC chief Gensler for driving the industry out of the country - Blocktrainer.de reported. In light of this development, the likelihood of Donald Trump being elected increased significantly.

When the US Senate voted overwhelmingly in favor of the resolution and the political pressure on the Biden administration increased accordingly, it seemed as if Biden was now making a U-turn after all. On the one hand, some suspected that the government was pressuring the SEC to approve the Ethereum spot ETFs. On the other hand, there were reports that the team around the incumbent president was meeting with the crypto industry in the background to seek advice on legislation and how to deal with the Bitcoin and crypto community - Blocktrainer.de reported.

Biden vetoes the resolution

But last night, President Biden officially vetoed it. The letter states that H.J.Res. 109 would "unduly restrict the SEC's ability to set appropriate guardrails and address future problems". Biden sees risks to investor and consumer protections in overturning SAB 121.

This reversal of the SEC staff's considered judgment risks undermining the SEC's broader authority over accounting practices. My administration will not support any action that jeopardizes the welfare of consumers and investors. Appropriate guardrails to protect consumers and investors are necessary to realize the potential benefits and opportunities of crypto innovation. [...] Therefore, I am vetoing this resolution.

From the letter

However, as with his response to the crypto-friendly FIT21 bill that passed the House of Representatives last week, Biden is committed to developing an appropriate regulatory framework.

My Administration is committed to working with Congress to ensure a comprehensive and balanced regulatory framework for digital assets that builds on existing authorities, promotes the responsible development of digital assets and payment innovation, and helps strengthen U.S. leadership in the global financial system.

From the letter

Pressure on the president increases

H.J.Res. 109 has met with approval even among leading Democrats. In the Senate, there were 60 votes in favor, 21 of them from Democrats, and only 38 against. This shows that Biden is currently making himself unpopular across party lines with his anti-Bitcoin stance. The day before Biden officially vetoed the resolution, eight members of Congress and Republican Senator Cynthia Lummis sent an open letter to Biden urging him to sign the resolution.

In light of the overwhelming bipartisan support for H.J.Res.109 [...] we urge you to sign H.J.Res. 109 or work with the SEC to reverse the agency's guidance. [...] Congress has spoken: The vote on SAB 121 CRA sent a clear, bipartisan message to the SEC that this misguided policy harms consumers and that the SEC's guidance was inadequate to enforce policy changes and must be rescinded.

From the open letter

Two Democratic members of Congress, Ritchie Torres and Wiley Nickel, also signed this request to the President.

In addition, the banking lobby also spoke out again yesterday with an open letter. As with the letter in February, the American Bankers Association, the Bank Policy Institute, the Financial Services Forum and the Securities Industry and Financial Markets Association opposed SAB 121 in favor of H.J.Res. 109.

The associations respectfully urge you to sign on to H.J. Res. 109.

From the open letter

When Biden vetoed the bill yesterday, it drew criticism from politicians and market observers.

The Biden administration is doing everything they can to stop Bitcoin's success.

Cynthia Lummis 🦬 (@CynthiaMLummis) June 1, 2024

It's time for a president that understands how important #Bitcoin is for America's future. https://t.co/buPkXk7dY7-

"Crypto is the Wild West. It's completely unregulated."

Nate Geraci (@NateGeraci) May 31, 2024

Ok, so let's provide trusted, *regulated* financial institutions with the ability to custody crypto.

White House... pic.twitter.com/LsBjwR34xS-

Nate Geraci is also now certain that the Biden administration's influence theory regarding Ethereum spot ETFs can now be safely discarded due to the veto.

I remember the narrative from last week that the White House basically called Gensler and told him that he had to approve ETH spot ETFs...

That's ridiculous now.

NateGeraci on 𝕏

According to him, the SEC's unexpected change of heart was more likely due to concerns about losing in court again over the crypto ETF issue.

Bloomberg ETF expert James Seyffart, who was certain that the approval of ETH ETFs was due to political pressure, interprets the veto as not as strong a U-turn by the Biden administration as previously assumed.

The veto is in. I guess the 180 degree turn in dem circles was more like a 90 degree turn https://t.co/gAimeobwZw-

James Seyffart (@JSeyff) May 31, 2024

Other market observers, such as Jeff Roberts, a journalist for Fortune magazine, believe that this veto has not earned Biden any new votes, but has cost him a lot.

Biden risks presidency over Bitcoin?

After presidential candidate Trump was unanimously found guilty by the jury yesterday on all 34 counts in the "hush money case", the likelihood of his election has diminished. Trump has been found guilty of falsifying business records to cover up hush money payments as part of an affair with porn actress Stormy Daniels. A prison sentence of up to four years is possible, the sentence will be announced on July 11. Despite all this, Trump will be able to continue his election campaign and experts are assuming a fine and probation.

Immediately after the verdict, however, Trump's election campaign is said to have received record donations. Supporters are said to have sent him almost 35 million US dollars in just a few hours after the guilty verdict. The fact that Biden vetoed the Bitcoin-friendly banking regulation at almost the same time led to speculation that Biden no longer considers it necessary to position himself more openly towards Bitcoin and the like. However, as already mentioned, Biden announced the veto weeks earlier.

However, the resolution could still come into force if the House of Representatives and the Senate override the president's veto with a two-thirds majority. In the first round, however, the House of Representatives only voted in favor by 228 to 182, which would not be enough for an override. It therefore remains to be seen whether other Democrats in the House of Representatives will oppose the President and vote in favor of H.J.Res. 109, so that the required 290 votes are obtained. In the Senate, which voted 60 to 38 in favor of the resolution, a two-thirds majority would be more likely, but the 60 votes of the total 100 senators would still not have been enough to overrule the president.

Bitcoin has arrived in the middle of the US election campaign and Biden currently risks losing votes with his anti-crypto stance. According to a recent survey by crypto asset manager Grayscale and market research institute The Harris Poll, a third of US voters now care about a presidential candidate's position on cryptocurrencies. It remains to be seen how the US election will turn out in November and whether Biden will still go out to win over voters in the crypto community, as reports in recent days have suggested. In any case, Bitcoin should remain one of the big issues in this election campaign.