Kamala Harris angers Wall Street and the crypto industry

The economic plans of Democratic presidential candidate Kamala Harris include price controls and tax increases for companies - a thorn in the side of Wall Street. Meanwhile, the plan to win over the ever-growing Bitcoin and crypto community for the Democrats doesn't seem to be working.

Could this cost the Democrats the election after all?

Criticism of planned tax increases and price controls

In order to finance her costly economic plans, Kamala Harris is planning to increase corporate taxes - from 21% to 28% - as US President. Donald Trump had reduced this from 35% to 21% during his presidency.

In addition, the Democrat also wants to use the planned economy instrument of price controls in the food sector. Specifically, she wants to ban profiteering by food manufacturers and retailers.

Kamala Harris explained the need for nationwide price controls by the fact that the situation with supply chains - which some have blamed as the main driver of hyperinflation in the wake of the coronavirus pandemic - has improved again, but food prices are still well above previous levels.

The fact that the US dollar money supply (M2) has increased by more than a third since the outbreak of the pandemic does not seem to be taken into account in their explanation of the rise in the general price level.

We all know that prices went up during the pandemic when the supply chains shut down and failed. But our supply chains have now improved and prices are still to high. A loaf of bread costs 50% more today than it did before the pandemic. [...] And i will work to pass the first ever federal ban on price gouging on food. My plan will include new penalties for opportunistic companies that exploit crisies and break the rules.

Kamala Harris

🇺🇸Präsidentschaftskandidatin @KamalaHarris wants to ban companies from raising prices too high👀

Blocktrainer (@blocktrainer) August 21, 2024

A look at the many failed planned economy systems shows where #pricecontrols lead📉

She blames greedy companies for the price hikes... pic.twitter.com/O5s7P1X0H8-

Representatives of the food industry immediately expressed their anger, as the New York Post reported.

Tax increases for companies or planned economic measures such as price controls are generally not in the interests of Wall Street. As the financial industry is very influential in the USA and many citizens are also interested in growing their share portfolios, Harris seems to be making more enemies than friends with her plans.

The New York Post headlined accordingly:

Harris’ price control ‘Kamanomics’ plan risks scaring away Wall Street donors on the fence

New York Post headline

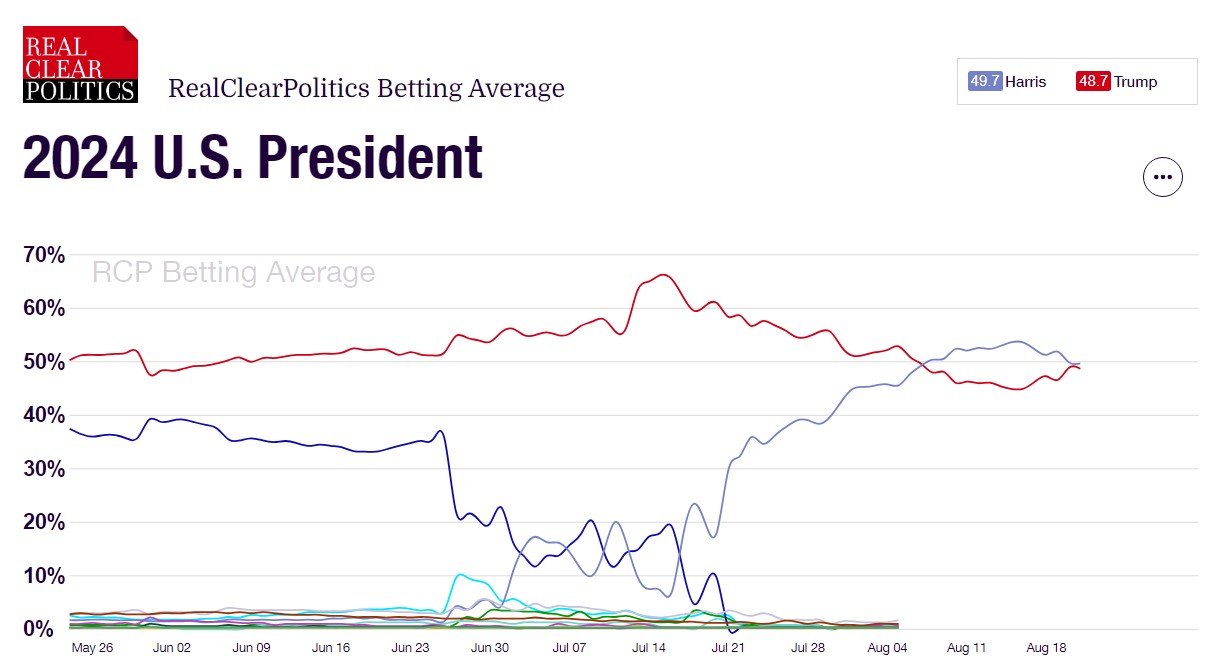

After the Democrat had been well ahead of her opponent Donald Trump for some time according to the betting markets, this gap has since melted away again.

There were also reports that Kamala Harris would significantly increase taxes on investment income and even want to tax unrealized gains. Some large 𝕏-accounts had published this without citing any sources.

According to the Wall Street Journal, Harris supports Joe Biden's proposed wealth tax of at least 25 percent. However, this should only apply to citizens with more than 100 million US dollars in assets.

Further details on the presidential candidate's tax plans remain to be seen. Even if she is elected to the White House in November, these legislative changes still have to pass through the chambers of Congress, in which the Republicans are likely to dominate.

In the meantime, Trump is in favor of tax breaks for companies and the Republican could therefore increasingly win over Wall Street to his side.

No successful rapprochement with the crypto industry

Ever since it became clear that Vice President Kamala Harris would enter the race for President Joe Biden, there have been several reports that her team has been reaching out to people from the crypto industry in the background - Blocktrainer.de reported. However, unlike Trump, the politician herself has not yet spoken out in favor of the industry.

Meanwhile, efforts have been underway for months to bring the Biden administration into a clarifying exchange with the crypto industry through meetings organized by Democratic Congressman Ro Khanna - Blocktrainer.de reported.

The second meeting in early August, which was attended by top officials from the Biden administration, a senior advisor to Harris and representatives of the crypto industry, did not succeed in smoothing the waters.

Instead of finding common ground, industry executives lashed out at White House officials largely over the regulatory assault from agencies like the Securities and Exchange Commission and the Federal Reserve.

From the FOX Business article on the meeting

Things finally got a little more concrete when industry representatives and political decision-makers launched "Crypto for Harris", a kind of lobby group to win over the many US holders of Bitcoin and Co. for the Democrats.

However, as FOX Business reported, the first meeting of "Crypto for Harris", which took place in mid-August and was open to the public, was more of a flop. Participants were reportedly disappointed because neither the presidential candidate nor her campaign team were present. In general, according to Eleanor Terrett of FOX Business, the event also failed to convince viewers that Harris would be good for the crypto industry.

It should come as no surprise that Bitcoin or cryptocurrencies are not included in the official Democratic Party Platform. The Republicans, on the other hand, are said in their platform that they would defend the right to Bitcoin mining and self-custody - Blocktrainer.de reported.

A few days ago, there were also reports that Kamala Harris might appoint the current head of the SEC, Gary Gensler, as Secretary of the Treasury. The Washington Reporter published this report, referring to several members of the US Senate. This was followed by a hail of denials. For example, Caitlin Long, CEO of Custodia Bank, wrote on the 𝕏 platform that several Democrats had contacted her to tell her that this rumor was false.

US election remains relevant for the capital markets and Bitcoin

One thing should be clear: regardless of whether Harris or Trump wins the election, the US national debt, which already amounts to more than USD 35 trillion, is likely to continue to balloon.

The many promises made by Harris - for example to help first-time home buyers with 25,000 US dollars - are only likely to drive up government spending even further. The Committee for a Responsible Federal Budget (CRFB) predicts that her economic plans will increase the national debt by a further 1.7 trillion US dollars.

But even under Trump, who is generally in favor of tax cuts, revenue and expenditure are unlikely to balance out. This is also supported by the fact that during his last term in office, the national debt increased significantly more than under President Joe Biden - although this was also due to the coronavirus. Even if the Republican is toying with the idea of paying off the national debt with Bitcoin, this is unlikely to be feasible in the short term.

Bitcoin is a protection against the escalating national debt and the associated currency devaluation, which could benefit significantly from these developments over the coming months and years.

However, as Trump is generally very open to the crypto industry and has even promised to establish a Bitcoin reserve, Bitcoin and co. are likely to have an easier time under his presidency. Meanwhile, the support of the Bitcoin community, which should not be underestimated, could be decisive in the election. So could the prospect of lower taxes for companies compared to a Kamala Harris presidency. Harris' economic plans could cost her valuable support from the financial industry and the many US private investors.

It remains to be seen who wins the election in November and to what extent the announced plans can actually be implemented. Bitcoin is likely to benefit in the short and medium term from the increasing probability of a Donald Trump victory.