MicroStrategy finds imitators - More and more companies rely on Bitcoin

When the US software company MicroStrategy began betting on Bitcoin in August 2020, some declared the then CEO Michael Saylor to be crazy. Although Bitcoin plummeted in 2022 and MicroStrategy was sitting on big book losses from its Bitcoin purchases, the stock was still trading above pre-Bitcoin levels. Now, in the face of the current bull market, the company is worth almost 30 billion US dollars - almost 30 times as much in August 2020. This success story does not seem to have passed other companies by without a trace, as MicroStrategy is now increasingly finding imitators.

The MicroStrategy success story

In 2020, the US Federal Reserve lowered interest rates in response to coronavirus lockdowns and flooded the market with liquidity through securities purchases. Michael Saylor, the CEO of MicroStrategy at the time, was faced with a problem: His company, worth around one billion US dollars, had 500 million US dollars in cash or money market funds. Saylor knew that this money would lose a lot of its purchasing power - partly due to low interest rates - and that his company would therefore harm its shareholders. In retrospect, the billionaire uses the metaphor of a melting ice cube.

We just had the terrible realization that we were sitting on a 500 million dollar ice cube.

Michael Saylor in an interview

As his company was neither growing properly nor did he see any investment opportunities, Saylor decided to invest the money in order to generate value for the shareholders. He looked around for investment opportunities and his company finally invested the first 250 million US dollars in Bitcoin on August 10, 2020. Further purchases - financed by remaining reserves, borrowing, issuing convertible bonds and recurring profits from the core business - were to follow.

When MicroStrategy became the first listed company to take this bold step, Saylor was ridiculed. However, shortly afterwards, payment service provider Block and car manufacturer Tesla bought Bitcoin and the tide turned. At the time, many expected other large companies to follow Tesla's lead. These failed to materialize for the time being, Tesla sold the majority of its holdings again in 2022 and the price of Bitcoin plummeted significantly over the course of the year.

In the Bitcoin bear market, many leading media outlets reported maliciously on MicroStrategy's Bitcoin strategy. In August 2022, with the price of Bitcoin at just over USD 20,000, Fortune Magazine ran the headline that Michael Saylor's big Bitcoin bet could sink him once and for all. The article also featured an accounting expert and founder of a research company who was certain that it would not end well for Saylor and the shareholders.

He has massively misallocated his investors' capital because the market has rewarded this behavior in the short term. This will come back to haunt him and his shareholders in a painful way.

David Trainer, accounting expert and founder of the research company New Constructs

At the bottom of the bear market, MicroStrategy held around 130,000 Bitcoin, which it had bought at an average price of just over 30,000 US dollars. When the price of Bitcoin fell to USD 15,500 during the collapse of the FTX crypto exchange, the USD 4 billion invested in Bitcoin was only worth USD 2 billion.

Although MicroStrategy had temporarily lost USD 2 billion on paper with the Bitcoin purchases, the stock was trading higher than before the Bitcoin strategy even at the worst time.

Now that Bitcoin is trading at all-time highs again, MicroStrategy is worth almost 30 billion US dollars - around 30 times as much as before the Bitcoin strategy. The company, founded by Michael Saylor, was able to raise 214,400 BTC through various financing options, which represents more than 1 percent of all Bitcoin ever in existence.

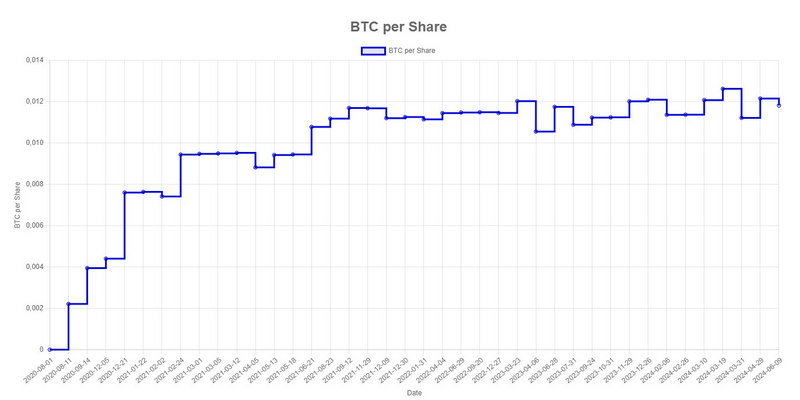

Even though MicroStrategy has financed a good portion of its recent Bitcoin purchases by issuing new shares or convertible bonds, the company was able to slightly increase the number of Bitcoin per share. Accordingly, MicroStrategy is also able to generate value for shareholders measured in Bitcoin through its financing methods.

MicroStrategy finds imitators

MicroStrategy's success story, which has catapulted a small company with hardly any future prospects to the size of DAX companies such as Deutsche Bank or Bayer, is likely to have prompted other stock corporations to consider a Bitcoin strategy.

The majority of listed companies are struggling with the same problems as MicroStrategy before the Bitcoin strategy. Only a few stock corporations actually manage to report high sales and profit growth rates and thus represent an attractive investment for potential shareholders. As a rule, only a few high-flyer companies such as technology groups are responsible for the relatively high stock market returns.

Now that MicroStrategy has shown that the Bitcoin strategy has outperformed the company at all times despite a brutal bear market and sometimes suboptimal buying times, the first public companies are starting to copy the company founded by Michael Saylor - and not like Block, Tesla, Reddit or the Central American e-commerce company Mercado Libre, which have so far only built up negligible Bitcoin positions in view of the company's size.

Nilam Resources

The first time a company attracted attention in this regard this year was at the end of March. There, a tiny Peruvian precious metal producer called Nilam Resources announced its intention to buy Bitcoin for 1.76 billion US dollars - Blocktrainer.de reported. However, the company was only worth around one million US dollars and was therefore a genuine penny stock, which is why this Bitcoin purchase, which was to be carried out by taking over another company, looked like a fraudulent marketing stunt. The skeptics turned out to be right.

The share price of Nilam Resources multiplied in response to the news, but subsequently fell below its previous level when the former CEO exposed the action as a classic "pump and dump". The idea, which was probably never meant seriously, has been officially abandoned since the end of April and resulted in the issue of a separate token. Nilam Resources is now worth far less than one million US dollars.

Metaplanet

It was also bizarre, but nevertheless more serious, when a Japanese public limited company called Metaplanet announced at the beginning of April that it would introduce Bitcoin as its primary reserve asset - Blocktrainer.de reported. The company was worth just under 13 million US dollars at the time and invested an initial 6.5 million US dollars in Bitcoin shortly afterwards. On May 10, Metaplanet announced that it had purchased a further 1.3 million US dollars worth of Bitcoin.

In total, Metaplanet holds almost 118 BTC worth around 7.4 million US dollars. But that's not all. At the end of May, the directors authorized a Bitcoin purchase for a further 250 million yen, the equivalent of around 1.6 million US dollars. As yet, however, this does not appear to have been completed.

As a Japanese public company, Metaplanet emphasized that this step was "a direct response to the ongoing economic pressure in Japan, in particular the high national debt, the negative real interest rates for a long time and the resulting weak yen". The company also emphasized its intention to potentially invest in the asset through debt financing and to focus exclusively on Bitcoin.

Metaplanet believes that Bitcoin is fundamentally superior to all other forms of political currency, traditional stores of value and investments, and all other crypto assets/securities. Bitcoin is an absolutely scarce, digital, synthetic monetary commodity that has no central issuer. Bitcoin's monetary policy is fixed beyond the year 2140, distinguishing it from both monetary metals and competing crypto projects that operate at the whims of centralized development teams. There will only ever be 21,000,000 Bitcoin.

From the Bitcoin strategy statement

Since the announcement of the Bitcoin Strategy, Metaplanet's shares have gained 4.5x, although the Bitcoin price is now trading at the same level as in early April.

Metaplanet receives support from well-known people from the Bitcoin scene. For example, Dylan LeClair, an esteemed analyst, has joined the corporation as Director of Bitcoin Strategy. But a look at the company's past leaves a bland aftertaste.

When Metaplanet announced the Bitcoin strategy, the website still stated that the company was active in the hotel business and in the Web 3 sector - a buzzword for an internet based on cryptocurrencies. The previous website also stated that Metaplanet offered services related to the metaverse and NFTs.

In addition, Metaplanet has mostly posted losses in recent quarters and its shares have lost more than 99% of their value since 2004 - measured in the weak Japanese yen and despite the recent sharp rise in the share price. However, it cannot be ruled out that Metaplanet will develop into a success story with the help of Bitcoin and competent support.

The share is set to become an attractive investment vehicle for Japanese investors to invest indirectly in Bitcoin. In Japan, profits from trading Bitcoin are taxed significantly higher than profits from securities such as shares. Meanwhile, Bitcoin ETFs are not yet tradable in the East Asian country. As with MicroStrategy, Metaplanet's shares could be an attractive way to invest indirectly in Bitcoin. This could further boost the share price and thus enable Metaplanet to issue new shares at good conditions in order to buy more Bitcoin with the proceeds.

Semler Scientific

At the end of May, a much larger US public company followed suit, announcing its intention to use Bitcoin as a reserve asset - Semler Scientific, a Nasdaq-listed healthcare company that develops technologies and services to combat chronic diseases.

The then USD 200 million company also announced on May 28 that it had purchased 581 Bitcoin for USD 40 million. In the accompanying press release, Eric Semler stated that Semler Scientific is convinced of Bitcoin as a store of value and that BTC is the best use for the company's cash reserves.

Our Bitcoin treasury strategy and purchase of Bitcoin underscores our belief that Bitcoin is a reliable store of value and an attractive investment.

Bitcoin is now a major asset class with a market value in excess of $1 trillion. We believe it has unique characteristics as a scarce and finite asset that can serve as an appropriate inflation hedge and safe haven in times of global instability. We also believe its digital, architectural resilience makes it preferable to gold, whose market value is roughly ten times that of Bitcoin. Given the difference in value between gold and Bitcoin, we believe Bitcoin has the potential to generate above average returns as it gains increasing acceptance as digital gold.

After considering various alternatives, we decided that owning Bitcoin would be the best use for our excess cash.

Eric Semler, Chairman of Semler Scientific

The following week, on June 6, Semler Scientific announced that it had purchased an additional 247 Bitcoin for $17 million, and the CEO emphasized in the announcement that this was just the beginning.

Semler continues to focus on our two strategies of growing our healthcare business and acquiring and owning Bitcoin. The company now owns 828 Bitcoin, which underscores our view that Bitcoin is a compelling investment and can serve as a reliable store of value. We will continue to pursue our strategy of buying Bitcoin with cash.

Dr. Doug Murphy-Chutorian, CEO of Semler Scientific

The company plans to further expand its current holdings of 828 Bitcoin worth around 60 million US dollars. On the day of the announcement of the second Bitcoin purchase, Semler Scientific also filed a form with the SEC stating that the company intends to raise additional funds of 150 million US dollars. This is to be achieved through the sale of new shares, bonds and other securities. Semler Scientific plans to use the proceeds for "general corporate purposes, including the acquisition of Bitcoin".

As part of the filing, Semler Scientific reiterated that the company will focus exclusively on Bitcoin and not other cryptocurrencies.

We believe that Bitcoin [...] is distinct not only from fiat money, but also from other crypto assets, and for that reason we have no plans to purchase crypto assets other than Bitcoin.

From the S-3 form

In less than two weeks after launching the Bitcoin strategy, Semler Scientific's stock has already gained more than a third.

Semler Scientific has generated profits in the millions in recent years and the share price has increased fivefold since the IPO in 2014. Accordingly, the company was already on course for success before the Bitcoin strategy, which is set to gain further momentum with the adoption of Bitcoin.

The ball starts rolling

Although many would certainly have expected greater adoption by companies up to this point, the status quo is quite remarkable. Although Tesla has sold the majority of its holdings, the car manufacturer still holds around 700 million US dollars in Bitcoin. In addition, Amazon's counterpart from South and Central America, Mercado Libre, also has around 30 million US dollars in Bitcoin on its balance sheet. Even the social media platform Reddit holds a small Bitcoin position.

Until 2024, Bitcoin holdings had to be included in the business figures in accordance with the general accounting guidelines. This may have acted as a deterrent for many stock corporations, as it would have significantly distorted the key accounting figures with a Bitcoin position. Since this year, however, it has been optional to report Bitcoin holdings separately as an investment and to recognize them at fair value. Fair value accounting will also be mandatory from 2025. This will finally remove a hurdle that, according to Michael Saylor, has prevented many listed companies from investing even the smallest amounts in Bitcoin.

Even though no large companies have built up significant Bitcoin holdings since 2021, adoption among public limited companies seems to be picking up speed again at the moment. The payment service provider Block announced last month that it has been investing corporate profits in Bitcoin on a recurring basis since April, thus further expanding the approximately 550 million BTC currently on its balance sheet - Blocktrainer.de reported. And with Metaplanet and Semler Scientific, two - albeit small - listed companies are already copying MicroStrategy.

Semler Scientific in particular is a profitable company to watch. Semler Scientific is not a big player in the world of public companies, but with a market capitalization that is a fifth of MicroStrategy's market capitalization before the Bitcoin strategy, it too could become a major Bitcoin buyer that also takes advantage of the capital markets to expand its holdings.

Michael Saylor believes it makes the most sense for the many small companies sitting on "dead capital" to copy MicroStrategy's strategy - especially the many Japanese public companies struggling with the weak Japanese yen and low-yielding bonds denominated in that currency. According to MicroStrategy's founder, adoption at the corporate level remains a much more realistic next step than Bitcoin purchases by large nations.

We're being far to ambitous to be calling for a nation state to do this. A much more prosaic, a much more practical next step is, how about the thousand Russel 2000 companies, there all dead money and zombie companies, how about they start doing it. and japan is settled with a lot of those zombie companies as well. So the issue really is, thousands and thousands of corporations that have dead treasuries, because their capital assets on their treasury has a negative real yield. [...] I think that people that are the obvious beneficiaries that hopefully are listening this podcast would be shareholders officers and directors of the ten thousands small midsize companies, espacially publicly traded companies, which in essence can't outperform the magnificent seven. If you don't think, you can outperform Google and Meta and Microsoft and Nvidia and you have some money you either take the cash and buy bitcoin, you issue equity and buy bitcoin or you issue debt either senior debt or even better, you issue convertible debt convertible to your equity and buy bitcoin, because that allows you to recapitalize with an appreciating asset as opposed to decapitalize and have nothing or to hold capital in a depreciating asset that has a negative real yield and is burning shareholder value.

Michael Saylor in an interview

It remains to be seen whether more small public companies will follow MicroStrategy's example in the future, sparking a Bitcoin movement in the corporate landscape. As the success of Bitcoin continues to grow, and therefore the companies that have discovered the asset for themselves, more and more public companies should consider a Bitcoin strategy.