In recent years, more and more concepts have been presented in which Bitcoin mining has been integrated into various processes in order to reduce methane emissions and improve environmental sustainability and economic viability - Blocktrainer reported. Now, five authors have published a scientific paper on the topic, in which they examine the economic viability of Bitcoin mining on landfills.

Study on Bitcoin mining with landfill gas

The study, titled "An integrated landfill-gas-to-energy and Bitcoin mining model ", highlights the potential of Bitcoin to offer great environmental, economic and social benefits in the waste management sector as a sustainable, versatile, adaptable and scalable economic model. This concept can ultimately be applied to other sectors, such as agriculture, food processing, wastewater treatment plants or oil and gas drilling.

It should be mentioned that the study is not entirely independent. For the five authors, Bitcoin and Bitcoin mining are important aspects of their other work. They could therefore be pursuing their own interests with the study. For example, Murray A. Rudd and Dennis Porter work for the non-profit organization Satoshi Action Education to refute misinformation about Bitcoin. Matthew Jones and Daniel Sechrest both work at Nodal Power, a company that is already working on the integration of Bitcoin mining facilities in landfills - Blocktrainer reported. The fifth author is environmental activist and entrepreneur Daniel Batten, who has contributed a great deal to raising awareness of the environmental aspects of Bitcoin, particularly in the past year. Despite the possible bias of the authors, the research paper has extensive source references and evidence that substantiate the statements made in the study in a comprehensible manner.

Incentives for methane reduction

The study begins by describing the need to press ahead with methane reduction. The global warming potential of methane is up to 30 times higher than that of carbon dioxide. Methane emissions have risen continuously since the early 2000s. Natural phenomena and human activities in the areas of agriculture, waste management and energy are responsible for this. Landfill sites in particular will become one of the largest producers of methane in the future. It is estimated that annual methane emissions, especially from waste disposal (landfills and sewage treatment plants), are already in the order of 65 million tons.

Complex measures are required to reduce emissions. The importance of the necessary methane reduction has already been recognized by certain ESG funds, the US government and the International Monetary Fund (IMF). In addition, over 150 countries have signed the Global Methane Pledge. Delays in implementing the methane reduction targets would lead to extremely high costs for future measures and a significantly lower reduction in warming rates. Economic factors, such as capital-intensive infrastructure, uncertain revenue streams and the regulatory environment, influence the pace and progress of action. Carbon credits create incentives to reduce emissions.

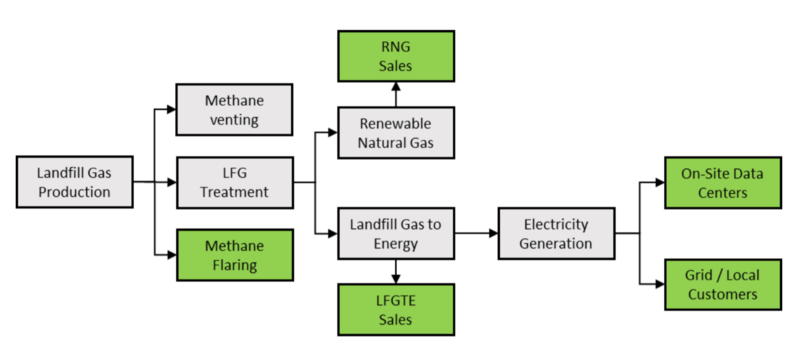

LFGTE projects

Landfill operators can convert excess methane gas into energy or various revenue streams in different ways, protecting the environment and public health by reducing emissions. Such projects are known as landfill gas-to-energy (LFGTE) projects.

The potential for energy recovery and power generation is enormous, but is often hampered by economic challenges. The study's integration of bitcoin mining facilities at LFGTE landfills powered by energy from excess methane gas could provide a novel, cost-recovery solution to accelerate the adoption of methane reduction measures that improve landfill sustainability and create new economic opportunities. Bitcoin mining offers several advantages for landfill operators, such as global market access, dynamic scalability, location and infrastructure independence, and associated cost savings (no grid connection, no transmission losses). Bitcoin's economic incentives are available worldwide and could promote climate protection even without government incentives or subsidies.

Monte Carlo simulation model

The authors used a special methodology to investigate and evaluate the economic and environmental viability of Bitcoin mining to support and improve the reduction and monetization of methane emissions at LFGTE landfills. In the study, they present the so-called Monte Carlo simulation model, developed on the Analytica platform. The model takes into account complex, uncertain parameters based on simple assumptions about landfill methane production and electricity generation costs, the scale and costs of bitcoin mining operations, and profitability and emissions reductions. The model simplifies complex phenomena and should ultimately serve as a basis for the ongoing development, which is highly dependent on unpredictable and variable factors, such as the global hashrate or the Bitcoin price. Future research should further consider technological advancement and regulatory changes to understand and assess the long-term viability and environmental impact of these integrated approaches. Accordingly, the results of the study should not be viewed as a predictive model for future financial development, but rather support the understanding of exogenous events and risk tolerance. The model is flexible and the current estimated parameters may not be directly applicable to different geographical and operational contexts.

Power generation

The base model assumes that landfills with a capacity of 1.14 megawatts (MW) could provide 10 million kilowatt-hours (kWh) of electricity annually, based on estimated methane gas generation from certain landfills in the US. The analysis includes a range of break-even power generation costs for LFGTE projects based on various national and international estimates. For the base model, the authors used plausible electricity costs of 0.01 to 0.10 USD/kWh (or 0.055 USD/kWh as a mean value).

Bitcoin mining

The scope, costs and profitability of energy-intensive Bitcoin mining, which ensures the security of the Bitcoin network and trust in pseudonymous financial transactions, are also based on variable assumptions.

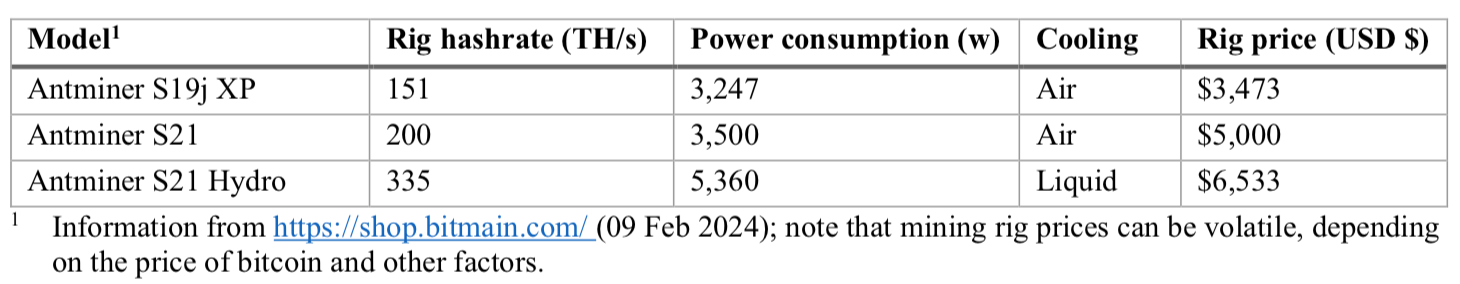

The power supply of 10 million kWh per year enables the use of 352 S19j XP, 326 S21 or 213 S21 Hydro rigs. The different ASIC model variants must be taken into account in terms of performance and costs.

Other financial aspects include the container size for the ASICs, the mining pool fees, the operating costs and the distribution of hash revenue. The income streams depend on the hash power of the system and the efficiency and number of mining rigs used. More efficient rigs (such as the S21 models) or future technological advances in mining hardware will improve potential site revenues. The advanced rigs with increased hardware efficiency not only improve the potential for higher gross profits, but also serve as a critical buffer against financial losses and mitigate risks.

Hash price

The study's base model offers an average hash price of USD 0.075 to 0.15 per terahash per day. However, given the fluctuating Bitcoin and ASIC prices, advancing energy efficiency and increased computing power of the Bitcoin network, as well as increased institutional demand (BTC ETFs) and rising transaction fees, prices are far from certain and are subject to change. Due to these exogenous factors, the business planning of mining companies is correspondingly challenging and the range of prices is very wide.

However, the total revenue shared between Bitcoin miners and dump operators can also be substantial. According to the study, the net income of mining companies alone amounts to between 0.4 and 15.5 million US dollars annually. But there are also financial risks, especially for smaller landfills with high electricity production costs or if hash prices continue to fall. This emphasizes the importance of strategic decisions in the selection of mining hardware and revenue sharing. It is not possible to capture all the nuances of financial flows and risk distribution.

Financing and profitability

The study also assumes that Bitcoin miners would bear all the risks and costs of generating electricity. Converting a landfill site that is already processing gas into a power generation plant for Bitcoin mining amounts to around USD 2.5 million per MW, mainly for the generator and ASICs.

However, such financing plans can also be arranged differently, especially if the landfills take over a large part of the know-how. Through innovative, adaptable and flexible business models and revenue sharing agreements, the partnership should be satisfactory and beneficial to both parties and be able to survive in the volatile world of Bitcoin.

The profitability of mining ultimately depends on local electricity prices and market conditions for Bitcoin. Higher hash prices and lower electricity costs are not only attractive for Bitcoin companies, they also significantly increase profitability. These results are also relevant for decision makers considering whether to use LFGTE projects to generate energy for Bitcoin mining.

Methane reduction and social costs

In addition to the economic analysis, the model also indicates the potential reduction in emissions. The results depend on various characteristics of the landfill (age, waste type, etc.). The parameters of the study's base model indicate a reduction in methane emissions of 2,187 tons (equivalent to more than 61,200 tons of CO₂ emissions) from a single, relatively small landfill.

Depending on current assessments of the social costs of methane and carbon dioxide, recently revised and published by the U.S. Environmental Protection Agency (EPA), this reduction has a huge value of $4,200 per ton - meaning in this case $9.18 million worth of environmental credits - which is higher than typical market prices for carbon credits. Operation with electricity from the grid (i.e. without LFGTE) would yield "only" one sixth of this value. This insight could be crucial in evaluating the environmental and economic benefits of such projects. With this financial incentive (especially for landfills that have not yet monetized emission reductions), an environmental challenge becomes a pursuit of carbon credits.

It re-emphasizes the importance of integrating Bitcoin mining into LFGTE processes, as well as the complexity of revenue sharing - between landfill operator and mining company (and lenders for refinancing, if applicable) - and financial performance, which affects the scalability and speed of development. When monetizing the effort to reduce methane, the independence of the specialists who measure, verify and publish the corresponding values is of great importance.

Global initiatives for methane reduction

Increasing financial returns in the waste industry could be a game changer for facilities around the world. The use of low-cost, underutilized energy sources by flexible energy consumers such as Bitcoin mining companies could offer significant benefits, such as the electrification of local communities through the distribution of surplus energy, which can already be seen in Africa, for example.

In addition, the emissions conversion model in the study can also be applied to other sectors. There is great potential for "recycling" methane emissions in areas such as agriculture, wastewater management, food processing or oil and gas production, where Bitcoin mining can play a transformative role. The economic incentives of Bitcoin mining could lead to improved methane capture and utilization of mostly unused resources.

For example, manure from livestock could provide about one percent of the U.S.'s annual energy consumption. Also in the food sector, the electricity production costs from methane emissions are attractive to bitcoin mining companies, so this energy could be monetized rather than lost to emissions. The same applies to wastewater treatment plants, many of which already have mechanisms in place to capture and utilize biogas (mainly for heating or power generation). Bitcoin mining can significantly reduce operating costs or fees for the population or increase profitability even more. All of these sectors could benefit greatly from methane reduction.

Adapting this model to the unique operational and economic contexts of these sectors could help reconcile environmental sustainability and financial viability.

Excerpt from the study

Conclusion

The study highlights the transformative potential of Bitcoin mining in global efforts to curb methane emissions. The use of methane from landfill gas offers a financially incentivized alternative to traditional, regulation-driven environmental protection strategies. The model proposes a method to utilize the economic incentives of Bitcoin mining to drive methane reduction, increase the attractiveness of such projects and reduce regulatory costs. This new, scalable method could also reduce dependence on government subsidies. However, innovations in mining hardware, changes in energy policy and new incentives for renewable energy could significantly affect the assumptions and results of the model.

It is emphasized that no single strategy is sufficient to effectively reduce methane emissions and the success of global climate goals requires both the use of existing technologies and the promotion of innovation and strategic partnerships and business models. Key factors such as energy generation potential, technical feasibility and risk tolerance are critical to the viability of Bitcoin mining as a methane reduction strategy.

The study suggests that projects combining renewable energy and Bitcoin mining could accelerate infrastructure development and simplify regulatory requirements, with a focus on exploring further potential of Bitcoin mining to promote environmental sustainability. Ultimately, the study has shown that the market-based, incentive-driven strategy to effectively scale methane reduction efforts through Bitcoin mining is a correct and effective approach that could be applied in other sectors struggling with similar challenges.

Future research should also further explore the interaction of digital financial technologies with renewable energy projects to develop additional effective strategies for the use of Bitcoin mining in methane mitigation. With this study and the model used, the authors have created a scientific basis for this.