If you were to ask Bitcoiners how much Bitcoin they own, they would probably all say "not enough". At best, someone would not disclose how much he or she holds. This would only unnecessarily expose Bitcoiners to the risk of robbery, even if they don't have the private keys at home. On the one hand, the potential robber may assume that he or she will find them and on the other hand, there is still the possibility of blackmail. Who knows what value your own Bitcoin holdings, which you have communicated to the outside world, will have one day.

When are you rich?

Defining "being rich" is always difficult. We often put wealth or income in relation to other people in a certain population group. A common definition is "the richest 10%".

Wealth can be defined per se on the basis of assets or income. For calculations relating to Bitcoin, the wealth in Bitcoin is of course a suitable measure. Furthermore, a person is not really rich if they earn well above average but consume all the money directly or even have debts.

How much Bitcoin is there per person?

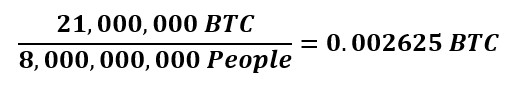

Let's assume the total number of Bitcoin that has ever been and will ever be movable is just under 21,000,000 BTC - or 20,999,999.97690000 BTC to be precise. We therefore assume that all Bitcoin has been mined and that no one has really lost access to their Bitcoin, but that the coins that have not been moved for years simply belong to steel "hodlers". If we divide the entire Bitcoin supply evenly among the world's current population of around eight billion people, each person would have 0.002625.

If a person owns this amount of Bitcoin, they can ensure that they will never hold less than the average person - and for just a few dollars today.

Rich in Bitcoin

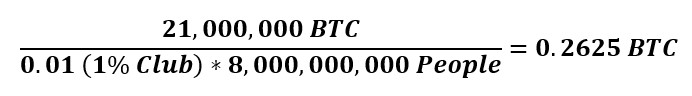

To ensure that we belong to the club of the richest 1%, we stick to the most conservative calculation. This is the scenario in which all Bitcoin is divided equally among 80 million people - around 1% of the world's current population - and the rest have nothing.

Accordingly, it would need 0.2625. This amount would mathematically guarantee that no more than 1% of the world's population could have more Bitcoin than you.

Accordingly, 0.02625 is needed for the club of the richest 10%.

However, the assumptions made are highly unrealistic. Hopefully, one day everyone will have Bitcoin and not just a small proportion of the world's population, as is the case today. In addition, there are many people or even companies that have already accumulated a lot of Bitcoin.

Both factors would greatly reduce the amount of Bitcoin actually required to be in the 1% or 10% club. In addition, it is estimated that around 3.7 million Bitcoin are "lost".

Furthermore, according to forecasts, the world population will probably be over 10 billion when all Bitcoin is in circulation. The calculation is therefore as conservative as possible.

The richest 1% among Bitcoiners

It is almost impossible to determine how much Bitcoin it would take to be one of the 1% of the richest Bitcoiners. Bitcoin addresses cannot really be assigned to people and one person alone can manage many addresses. Furthermore, exchanges themselves also have addresses where they store Bitcoin for thousands of people. A large number of assumptions must therefore be made for the calculation.

In 2017, Blocklink came to the conclusion that it takes 15 Bitcoin to make up the 1% richest club. InvestAnswers calculated in 2021 that this would be around 3.33 Bitcoin. However, as Bitcoin has become more widely distributed over time and will presumably continue to do so as the number of Bitcoin holders continues to grow, it can be assumed that the amount required should become smaller and smaller.

If Bitcoin was the money of the world

There is the equivalent of around 100 trillion US dollars worth of money or currencies in the world. This includes all cash, bank deposits and money substitutes, such as savings deposits and money market funds. If this amount were divided equally among the world's population, each person would have around 12,500 US dollars. If you like, under a Bitcoin standard, 0.002625 Bitcoin would have the purchasing power of today's 12,500 dollars. A whole Bitcoin would be worth around 4.75 million dollars in this scenario.

However, the 100 trillion US dollars do not include the many assets, which in total are worth much more than all the currencies and forms of money on this planet. Of course, even under a Bitcoin standard, real assets would make up a good proportion of global wealth, but probably not as much as at present. Nowadays, savers are virtually forced to save in assets such as real estate and shares, as holding government currencies is not an alternative in the medium and long term due to the high loss of purchasing power.

Bitcoin as an asset

In total, there are assets worth around 900 trillion US dollars in the world. This includes shares, precious metals, real estate, bonds, collectibles and currencies. Bitcoin currently accounts for far less than 1 percent of this.

Probably the most important question regarding the order of magnitude in which Bitcoin could one day settle is what percentage of this could be taken up by digital, non-confiscable and demonstrably scarce property.

According to Michael Saylor, the founder of the first public company to strategically buy Bitcoin, a market capitalization of several hundred trillion US dollars would be at least appropriate for Bitcoin in the long term. This would effectively mean a price of around 10 million dollars per BTC or even more.

Bitcoin is digital property. What is digital property worth? Several hundred trillion US dollars. Is Bitcoin overvalued? Not yet, Bitcoin is at one trillion US dollars. If Bitcoin is worth a hundred times as much as it is now, is it overvalued? Probably not. It will probably still perform better than anything else you can buy. Why? Because it's better than anything else you can buy.

Michael Saylor

We are still early in the process

It currently doesn't take much fiat money to secure a far above-average share of the total Bitcoin supply. With just a fraction of the average monthly net income, anyone can ensure that they are not left empty-handed in the event of "hyperbitcoinization".

That should be reason enough for even the critics and doubters to hedge against this scenario - even if they consider it highly unlikely.

I thought I was late to Bitcoin, but apparently I'm not.

Michael Saylor