The question of whether the economy and humanity would fare better under hard money, which is limited in its quantity, is probably not as much of a concern to anyone as Bitcoin proponents. However, it is almost impossible to predict what a world with Bitcoin as money would actually look like. Nevertheless, it is worth taking a look into the past to get an impression by comparing the times of the gold standard with those of unbacked fiat money.

This article aims to refute the widespread assumption that unbacked paper money and the associated inflation is a necessary evil for innovation and economic growth from various perspectives. To this end, we will take a look at the period of industrialization and the Bretton Woods system, in which a gold standard went hand in hand with comparatively high economic and innovative strength.

Industrialization and the gold standard

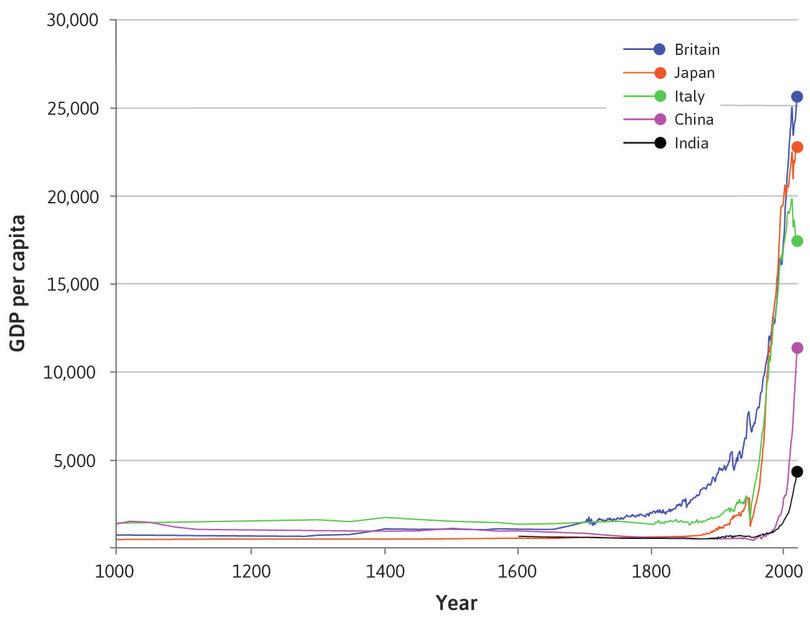

The greatest leap in productivity was probably made by mankind at the time of industrialization. In fact, humanity had stagnated for centuries before that - especially when compared to what has happened since.

The Industrial Revolution began in England around 1760. This is also well illustrated by the fact that England's per capita economic output exploded before that of other countries.

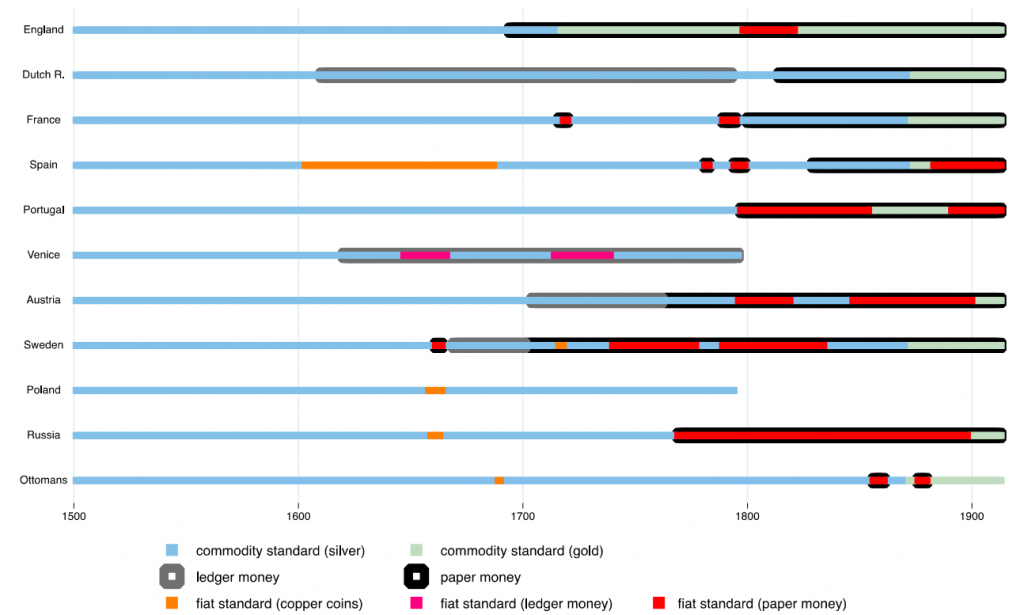

England had been operating under a de facto gold standard since 1717, while the USA, Germany and France were still increasingly relying on the less hard silver. Industrialization therefore began in the country that was the first to decide to rely exclusively on gold.

The invention of the first spinning machine, the Spinning Jenny, paved the way for the first phase of industrialization and greatly increased productivity in the textile industry. The steam engine was also improved at this time by James Watt to such an extent that it became socially acceptable. In addition, the first locomotive was built - also in England.

High industrialization

The second phase of industrialization, also known as high industrialization, took place not only in England but also in the USA and especially in Germany. In Germany, high industrialization began in 1871. Interestingly, 1871 was also the year in which Germany switched to a gold standard.

In general, the phase of high industrialization coincides with the period in which the monetary regime of the gold standard finally prevailed in the industrial nations. The period from 1870 to 1914 is therefore the time of the classical gold standard, of high industrialization, and in retrospect this period is also referred to as the Belle Époque.

This beautiful era ended with 1914, the beginning of the First World War, when most countries introduced unbacked paper money to finance the war.

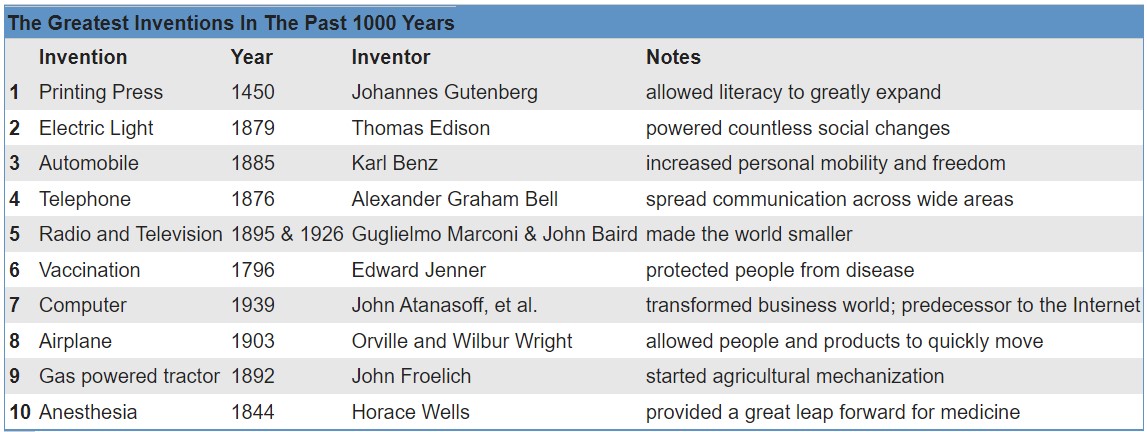

The car, airplane, radio, telephone, electric light and much more were invented during the period of high industrialization.

Innovation thanks to the gold standard and deflation?

The entire period of industrialization was a time of tremendous economic growth - even though it was a time of deflation. The standard of living rose rapidly and some of the most important inventions of mankind originated from this period.

In 2000, Ohio State University published a list of the ten greatest inventions of the last 1,000 years. Five or six of the ten inventions originated directly from the time of the classical gold standard (1870 - 1914). In addition, vaccination and anesthesia were also invented where a gold standard prevailed at the same time: vaccination in England in 1796 and anesthesia in the USA in 1844, which had been on a gold standard for ten years at the time.

This means that seven and eight of the ten most important inventions of the second millennium were made during the gold standard era.

The economic miracle and the Bretton Woods system

After the states expanded the money supply throughout the world wars, the Bretton Woods system (1944 - 1973) reintroduced a kind of gold standard. The period of the Bretton Woods systemwas ultimately also a time of strong economic growth. In the USA, this period is also known as Post-World War II prosperity (1945 - 1973). The period is generally regarded as a golden era of economic growth and prosperity.

In Germany and Austria, the period of the Bretton Woods systemis also referred to as the economic miracle (1948 - 1973). In the GDR, on the other hand, which relied on uncovered paper money at the same time, there was no economic boom after the Second World War.

The era of economic growth and prosperity ended not only in the USA, but also in Germany with the abolition of the last gold standard in 1971.

With the end of the Bretton Woods system [...] the era of consistently high economic growth, public debt of 20 percent and full employment with an unemployment rate of less than two percent came to an end in West Germany.

Wikipedia: "German economy"

The Bretton Woods system also saw the invention of the Internet, which laid the foundations for the leaps in productivity of recent decades.

Gold standard vs. fiat standard

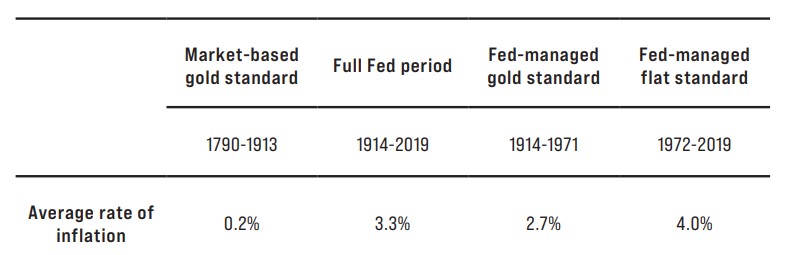

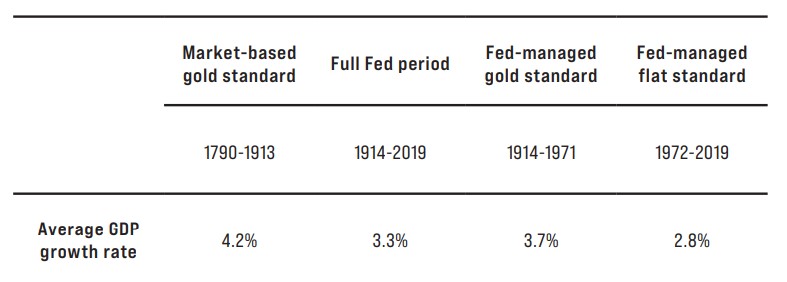

A clear picture emerges when comparing various economic indicators of the respective periods. Thomas L. Hogan, former Chief Economist of the US Senate, divides the US monetary system into the following periods:

- Market-based gold standard (1790 - 1913)

- Central bank-managed gold standard (1914 - 1971)

- Central bank-managed fiat standard (1972 - today)

During the market-based gold standard, the prices of goods were roughly constant. Only in times of war, when the USA temporarily issued uncovered paper money, did the prices of goods rise temporarily. During the period of the managed gold standard, i.e. in the period after the founding of the US central bank, the price level also rose in times of war, but did not fall back to previous levels afterwards. Since 1971, when US President Richard Nixon effectively abolished the last gold standard, goods prices have risen continuously.

The average inflation rate during the market-based gold standard was 0.2 percent. Since the fiat standard has prevailed, the average inflation rate has increased twenty-fold to 4 percent - and this does not even take into account the hyperinflation since the start of the coronavirus pandemic.

Economic growth

Many people think that higher inflation and central bank intervention are necessary for economic growth. In fact, however, the opposite seems to be the case. In the USA, the lower the inflation in the respective period, the higher the real, i.e. inflation-adjusted, economic growth. Real economic growth, or the rate of change in real gross domestic product, is the most widely recognized metric for quantifying a country's economic strength.

During the market-based gold standard, the US economy grew by a whopping 4.2 percent per year on average. From the founding of the US central bank until the last gold standard was abolished, it was 3.7 percent and after 1971 only 2.8 percent.

Even the US stock market performed better during the gold standard era: the inflation-adjusted return on the US S&P 500 share index averaged 7. 2% during the classical gold standard and even exceeded 9% during the Bretton Woods system. In the era of fiat money, the US stock market yielded an inflation-adjusted average of just 6.4 percent.

Given the facts, it is almost frightening that the gold standard has such a bad image and that John Maynard Keynes, one of the most influential economists of the 20th century, for example, described it as a "barbarous relic" relic".

The reason for the widespread aversion to the gold standard is the Great Depression (1929 - 1939), which, according to mainstream economists, was primarily due to the gold standard.

Even the former chief economist of the US Senate, Thomas L. Hogan, considers it a misconception that the gold standard caused the Great Depression.

Many economists wrongly blame the gold standard for the Great Depression.

Thomas L. Hogan

Summary

Leaving aside the Great Depression, there is a clear link between economic growth, inventiveness and the gold standard. However, mainstream economists seem to ignore the obvious connection.

The period from 1890 to 1910 was characterized by rapid economic growth of over 7% [...]. Between 1910 and 1929, however, there was a sharp drop in the growth rate to around 2.8%. Economists are not sure what combination of supply and demand factors caused this slump [...].

Wikipedia: "Economic History of the United States"

However, the facts paint a clear picture: real economic growth was better in the days of the gold standard. And in general, the US economy grew significantly better in the 123 years before the Federal Reserve was founded than in the 106 years after.

In addition, what was probably the greatest productivity leap in human history, industrialization, began in the country that was the first to rely exclusively on gold. Industrialization finally accelerated when the gold standard became the accepted currency regime in the industrial nations - the majority of the most important inventions in the young history of mankind originated in this period. And when a kind of gold standard was reintroduced after the world wars, the economy in the industrialized nations picked up speed again until US President Nixon effectively abolished the gold standard in 1971.

Fiat currency-

Elon Musk (@elonmusk) October 1, 2023

Conclusion

If we compare the times of the gold standard with those of the fiat standard, the conclusion is obvious that hard money generally seems to be better for the economy and therefore for humanity. However, only the good old crystal ball can answer the question of whether Bitcoin as the world's money will lead to an increase in prosperity and productivity comparable to or even greater than that of high industrialization.

At this point, it must be mentioned that even during the classical gold standard,"fractional reserve banking" was practiced, i.e. banks created more paper money than there was underlying gold. Nevertheless, US banks were disciplined by the fact that they would not have been rescued in the event of a bank run. If, with Bitcoin as the world's money,"fractional-reserve banking" also prevails - as some Bitcoin proponents expect - then one could possibly imagine a Bitcoin standard like the time of the classical gold standard. If, on the other hand, people were to trade exclusively with Bitcoin in its basic form, it would be all the more difficult to predict, as mankind has never used a money with a truly fixed money supply.

The observation that less inflation has gone hand in hand with more economic growth in recent centuries - at least when long-term periods are considered - ultimately suggests that a world with Bitcoin as money would be clearly superior to a world with fiat money and central bank intervention or monetary socialism.