The financial system is crumbling and Bitcoin is the way out

The stress in the global financial system is increasing. While a new banking crisis is looming in the USA, the Japanese yen, the fourth largest currency in the world, is collapsing. At the same time, the fiat money system seems to be increasingly struggling and fighting Bitcoin as an alternative. Is Bitcoin becoming a threat to the fiat money system as a way out? And can we expect stronger reprisals so that countries can reduce their debt?

New banking crisis on the horizon

Last Friday, Philadelphia-based Republic First Bank was closed by regulators and sold to larger lender Fulton Financial. Republic First Bank was pressured by the same factors that caused several regional US banks to collapse just over a year ago: sharp declines in the value of bonds on its balance sheet and many uninsured deposits that customers quickly withdraw at the first sign of trouble.

However, Republic First Bank, with only USD 6 billion in total assets, was significantly smaller than Silicon Valley, Signature or First Republic Bank, which were at the center of the last banking crisis. However, the banking crisis of 2023 also began with the collapse of Silvergate Bank, which was also rather small at the time with 11 billion US dollars in assets.

The balance sheet takeover by larger institutions appears to be only a temporary solution. New York Community Bancorp (NYCB), which took over Signature Bank's portfolio last year, has also staggered in recent weeks. Since the start of the year, NYCB shares have fallen in value by over 70 percent. The many long-dated bonds on the balance sheets of US banks, which have lost a lot of value as a result of the interest rate turnaround, are putting financial institutions in the US under further pressure.

In response to the banking crisis in 2023, the Federal Reserve launched the Bank Term Funding Program (BTFP). This allowed financial institutions to deposit their bonds with the Federal Reserve as collateral in the amount of the initial value of the security for loans. Although the BTFP expired on March 11 of this year, Republic First Bank could have used it until then to obtain extremely favorable credit terms. The question that market observers are asking accordingly is why they didn't do it.

Why the hell didn't they use the BTFP? [...] Just because the BTFP closed on March 11 doesn't mean you have to pay the money back immediately. No, there is a redemption period of one year. So Republic First Bank could have used the BTFP on March 10 and said to the Federal Reserve, "Hey Fed, here's all this bad collateral, or the Treasury bonds, that we would have to book at a 70% discount if we sold them in the market to get the liquidity we need because of all the deposit runoff, but you'll give us 100 cents on the dollar." Why didn't they do that? It doesn't make any sense at all.

George Gammon, renowned analyst

George Gammon concludes that the balance sheet must have looked so bad that even bridging loans would not have helped. Accordingly, the analyst assumes that the takeover by Fulton Financial has only shifted the risks and that the stress in the US banking system may be far from over.

So my point is that we need to put Fulton Financial on the watch list, and I would be very surprised if it doesn't have the same problems that New York Community Bancorp has had recently.

George Gammon, renowned analyst

Joseph Lynyak, a banking attorney with Dorsey & Whitney, shared a similar assessment of the Republic First Bank collapse and the risks in the banking sector with Fox Business.

This bank failure suggests that there will be more failures, both at smaller community banks and larger banks.

Joseph Lynyak, specialist in bank receiverships and bank insolvencies

The fact that the Federal Deposit Insurance Corporation (FDIC) emphasized several weeks ago that the number of failing financial institutions has risen from 8 to 52 and that delinquencies on credit card and commercial real estate loans are at their highest level in nearly a decade also suggests that a crisis is still imminent. NYCB, interestingly, was not even on the Federal Deposit Insurance Corporation's list.

The FDIC has indicated that banks potentially have significant unrealized losses in their investment portfolios, and many banks will eventually need additional capital to make up for these unrecorded losses.

Joseph Lynyak, specialist in bank receiverships and insolvencies

Although the leading media are trying to calm the situation, this is only understandable in view of the fact that the entire banking system would not survive a bank run. After all, only a single-digit percentage of bank deposits actually exist as cash or as deposits at the central bank. Bank deposits are ultimately only a liability to the bank.

One of the greatest dangers for the financial system would probably be a loss of confidence in the banks, which would expose all the circulating credit money as an illusion - even the deposit protection of up to 250,000 US dollars per entity by the FDIC would not be able to help here. In this case, the only option may be for the central bank to print the missing money and carry out a bailout, as it did during the 2008 financial crisis.

Japanese yen under pressure

While the banking system in the USA is weakening due to the still high interest rates, the Japanese yen appears to be collapsing. The currency of the fourth-largest economy has fallen to its lowest level in 34 years. The yen has lost around half of its value against the US dollar since 2011 and more than a third since the beginning of 2021 alone.

The yen's slide accelerated at the end of last week when the Bank of Japan (BOJ) made it clear that it would not be raising interest rates despite the sharp exchange rate losses, nor was it planning to reduce its balance sheet significantly. Previously, there was some hope when the BOJ raised the key interest rate for the first time in 17 years in March - from negative territory to the 0.0 to 0.1 percent range. However, a more restrictive course does not really seem to be planned for the time being.

When the yen continued its strong downward trend at the beginning of the week, there was suddenly a clear countermovement, which many market observers explain by the BOJ stepping in to support the yen. People familiar with the subject confirmed this theory to the Wall Street Journal.

The BOJ can strengthen the exchange rate by buying its own currency with US dollar reserves. However, this is tilting at windmills if it is simultaneously keeping interest rates low and buying Japanese government bonds with newly printed yen. Robin Brooks, senior fellow at the Brookings Institution and former foreign exchange strategist at the major bank Goldman Sachs, also comes to this conclusion.

The Yen is in free-fall and markets wonder if there's a red line. There isn't. The red line that exists is on 10-year JGB yield, which can't rise as this would cause a fiscal crisis. Japan can't simultaneously stabilize Yen and cap yields. Japan's debt put it in a terrible place. pic.twitter.com/27FanuhCiF-

Robin Brooks (@robin_j_brooks) April 28, 2024

In 2022 alone, the BOJ is said to have supported the yen several times with a total of 60 billion US dollars. Despite brief counter-movements, the yen has continued to fall since then. However, such interventions on the currency markets are not possible indefinitely, as central banks may one day run out of foreign currency reserves. However, Japan is still by far the largest foreign holder of US government bonds.

Japan illustrates the problems of high national debt

Japan is the most indebted country in the world, with government debt amounting to around 260% of economic output - in the USA, government debt is only half as high. To prevent the Japanese state from collapsing under this burden, the BOJ buys 6 trillion yen (around 35 billion US dollars) worth of Japanese government bonds every month, thereby keeping interest rates low. This creates the problem that if inflation picks up or other economies appreciate their currencies, Japan has little room for maneuver.

The East Asian country therefore finds itself in a dilemma. Although inflation in Japan has been above the targeted 2 percent for two years, the BOJ is unable to raise interest rates noticeably. Meanwhile, the key interest rate in the US is in a range of 5.25 to 5.5 percent, making it more profitable for investors to flee the yen for the world's reserve currency. Accordingly, fixed-interest securities denominated in US dollars yield higher returns. As a result, the exchange rate of the yen is increasingly suffering and with it the Japanese economy. Even the Japanese government attributes the slumping economy to the weak currency.

Japan is currently in a recession and, in fact, the BOJ's loose monetary policy in recent decades has ensured anything but a flourishing economy: measured in US dollars, Japan's gross domestic product is at the level of the 1990s. The favourite country of the advocates of Modern Monetary Theory (MMT), who claim that printing money does not cause any problems, is therefore anything but a positive example, as Robin Brooks also recognizes.

Japan has always been a favorite talking point for the #MMT crowd, who claim Japan's huge debt load is totally fine. It isn't. Japan is in a currency crisis because its debt forces the BoJ to keep interest rates pinned. A huge warning sign for debt aficionados in the Euro zone... pic.twitter.com/mnO6RUQgnq-

Robin Brooks (@robin_j_brooks) April 28, 2024

Is the USA the next Japan?

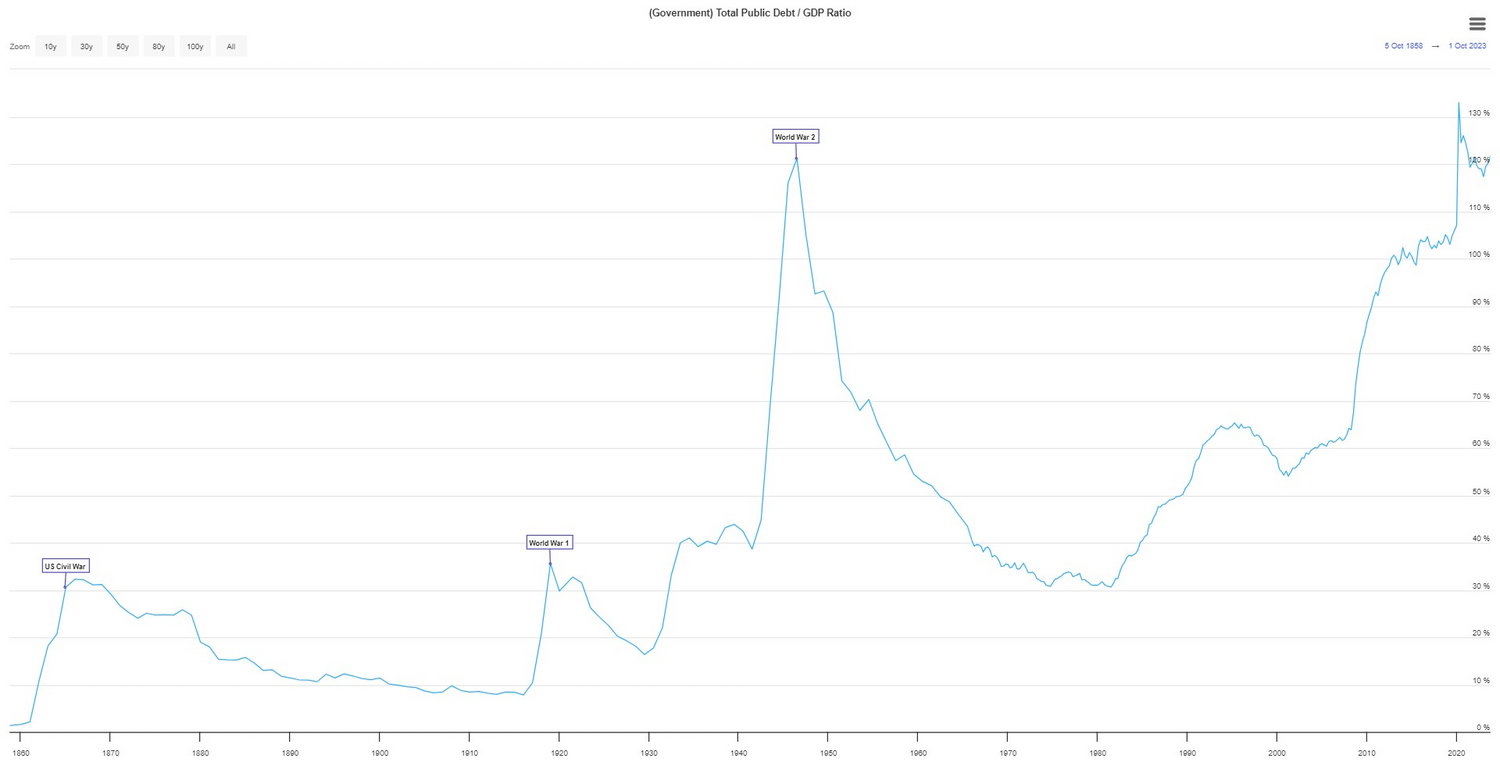

The USA appears to be well on the way to soon being confronted with the same problems as Japan. The national debt in these countries is constantly rising to new heights and there is no sign of this changing. The USA already has a national debt of around 120 percent of economic output and the annual interest costs are well on the way to soon being Uncle Sam's highest expenditure factor.

In the long term, there is probably no way around the fact that the Federal Reserve will keep interest rates on government bonds low in the USA and will once again have a proper grip on securities. The question that arises here is which currency people will then flee to in order to escape currency devaluation.

Is the age of financial repression coming?

The term financial repression refers to a set of measures that enable a state to manage its debt burden. The key here is to keep interest rates on government bonds below inflation in order to devalue government debt. However, in order for this to succeed and for the state to be able to reduce its debt at the expense of the money holders or prevent the debt from escalating further, it is important that the general public also holds the currency.

During the reduction of government debt after the Second World War, the USA sometimes obliged pension funds and insurance companies to hold a certain proportion in government bonds. At that time, private ownership of gold with an equivalent value of more than 100 US dollars was also prohibited in the United States. The gold ban was introduced with Executive Order 6102 before the Second World War in 1933 and was only lifted again in 1974. Criminalizing the flight from the US dollar into gold certainly helped to reduce the national debt from over 120 percent at the end of the Second World War to around 30 percent in the 1970s.

Is a Bitcoin ban on the horizon?

In the US, there have been several measures in recent days directed against the private or anonymous possession of Bitcoin. First, the judicial authorities arrested the founders of the privacy wallet Samourai. Then the FBI warned against using crypto transfer services that do not verify their users, shortly after which the popular Bitcoin lightning wallet Phoenix announced that it would soon cease operations in the US.

Due to these measures, some Bitcoin enthusiasts fear that the US is now targeting Bitcoin and wants to restrict access to the alternative. Although the approval of Bitcoin spot ETFs in the USA at the beginning of the year speaks against this, some see the intention to be able to confiscate Bitcoin more easily with a new edition of Executive Order 6102, as it is then in financial products and not in private ownership.

They're going to go after self-custody because they need capital controls to properly execute financial repression.

Dylan LeClair 🟠 (@DylanLeClair_) April 25, 2024

Capital is sufficiently captured in walled-garden ETFs.

Widely adopted self-custodial #bitcoin used as a MoE w/ privacy tools present an existential threat. pic.twitter.com/OLefHBKnHH-

1. approve ETFs to create honeypot

*all

2. criminalize privacy tools by labeling it ML

3. go after self-custody btc by labeling it black market

4. Execute 6102 on ETF honeypotswhile the price of real btc pumps really hard and game theory plays out on the global stage-

Frank (@FrankAFetter) April 25, 2024

It remains to be seen whether the plan behind the increasing crackdown on the anonymous use of Bitcoin is actually to force citizens into ETFs in order to confiscate as much Bitcoin as possible one day. The pro-government and lobby-strong companies such as BlackRock and Fidelity, which have launched exchange-traded Bitcoin funds in the US, would certainly not like this.

Bitcoin is the way out

There are more and more cracks in the global fiat money system and the future does not look rosy due to the ever-increasing national debt and currency devaluation. Bitcoin is the ideal alternative. Not only as a store of value that cannot be inflated, but also as an asset without counterparty risk. However, to enjoy the full benefits of Satoshi Nakamoto's creation, investment products such as ETFs are not the best choice. Especially if the small but unavoidable risk of a ban were to strike in the major economies.

It is still permitted to hold Bitcoin in custody in most jurisdictions. Even if there are increasing obstacles to anonymity, Bitcoin cannot be confiscated. With just 12 or 24 words in their head, people can secure their assets and thus protect themselves against bank failures or the collapse of their national currency. Even when fleeing a totalitarian regime, it is a good idea to carry the money with you as information in your head.

Bitcoin can even be a suitable asset for a central bank's defense of its own fiat currency. This was recently emphasized again by Luzius Meisser, co-founder of Bitcoin Suisse, at the Annual General Meeting of the Swiss National Bank (SNB). Back in 2022, he suggested that the SNB should divest itself of devaluing European bonds and use them to buy Bitcoin. If the SNB had followed this advice back then, it would now have around CHF 30 billion more in its reserves, as Meisser calculated last Friday.

The example of Japan also shows that even today it can make sense for central banks to have plenty of reserves with which they can buy back their own currency and thus strengthen it.

It also remains to be seen whether the fiat money system will lash out even more in the context of the impending decline and attack alternatives or whether Bitcoin itself will take advantage of this. With Bitcoin, however, the non-confiscable lifeboat is already available and the genie cannot be put back in the bottle. Or to put it in other words:

Freedom has already won.

Roman Reher, founder of Blocktrainer.de