The largest Bitcoin ETF: BlackRock overtakes Grayscale!

A danger for BTC?

BlackRock's Bitcoin ETF IBIT now holds 288,670 BTC worth around 20 billion US dollars. This means that the investment product has gone from being the largest asset manager in the world to the largest Bitcoin ETF, which means that no other company in the industry currently holds more Bitcoin than Larry Fink's company.

IBIT overtakes GBTC

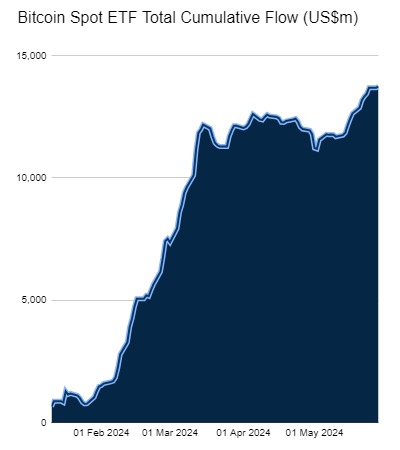

Since the US Securities and Exchange Commission (SEC) gave the green light for Bitcoin spot ETFs on January 10, 2024, BlackRock's Bitcoin ETF has experienced an unprecedented inflow streak. In the first 71 trading days, the exchange-traded fund saw an uninterrupted inflow of funds - a record for a newly launched ETF. BlackRock has also broken records with IBIT in terms of investment volume after the relaunch: Never before has a newly launched ETF had so much equivalent value in assets after just a few days and weeks. Even CEO Larry Fink proudly described IBIT as the "fastest growing ETF in ETF history".

But until yesterday, there was another ETF larger than BlackRock's, namely Grayscale's GBTC. Prior to the approval of Bitcoin spot ETFs, GBTC was a closed trust from which no Bitcoin could flow out. Holders of the investment product could sell their units, but not exchange them for the underlying asset. As a result, GBTC occasionally traded with large deviations from the actual Bitcoin price.

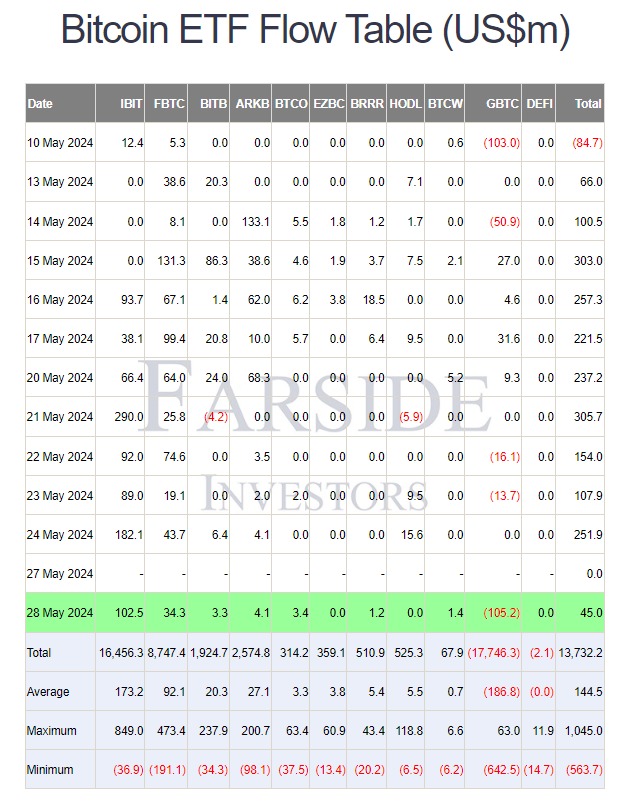

Since Grayscale, an asset manager from the crypto industry, was allowed to convert its investment product into a spot ETF at the beginning of the year, GBTC has seen an unprecedented outflow of funds from an ETF. This was partly due to GBTC's expensive management fee, which at 1.5 percent was significantly higher than that of its competitors. BlackRock, for example, only charges 0.25 percent in annual fees with IBIT.

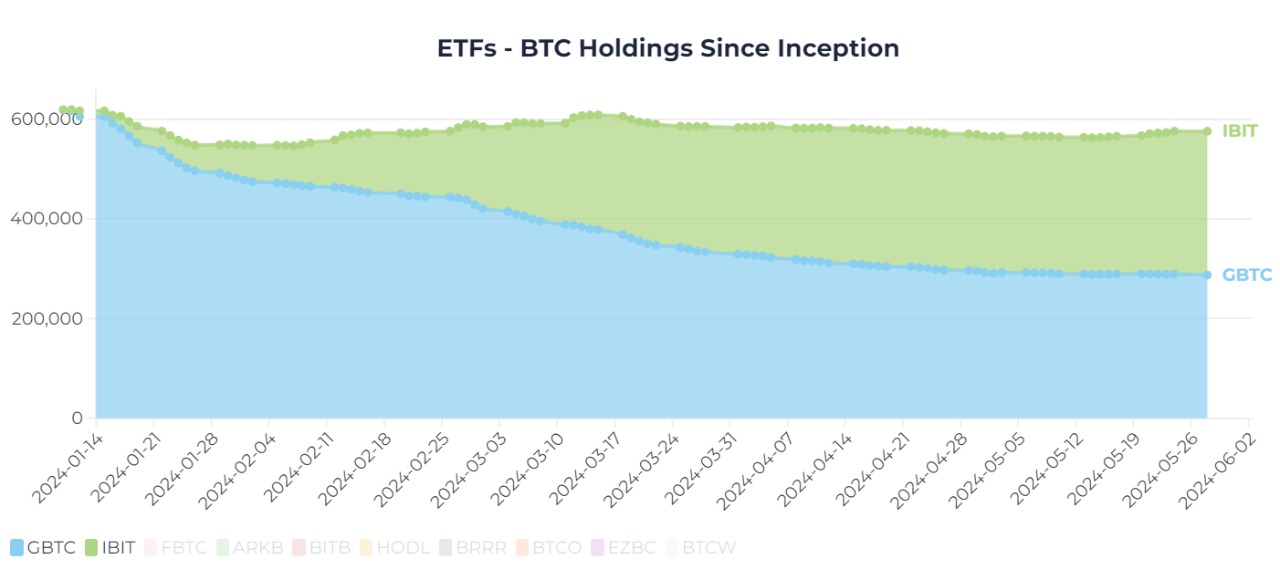

At the time of the conversion, GBTC held over 600,000 BTC. It now only holds 287,450 BTC - and the downward trend is continuing, although outflows have decreased significantly in recent weeks and GBTC has also seen a return of funds for the first time. However, the renewed increase in inflows into BlackRock's IBIT, which are presumably also largely due to a reallocation of former GBTC investors, means that the ETF from the world's largest asset manager is also the largest Bitcoin ETF with 288,670.

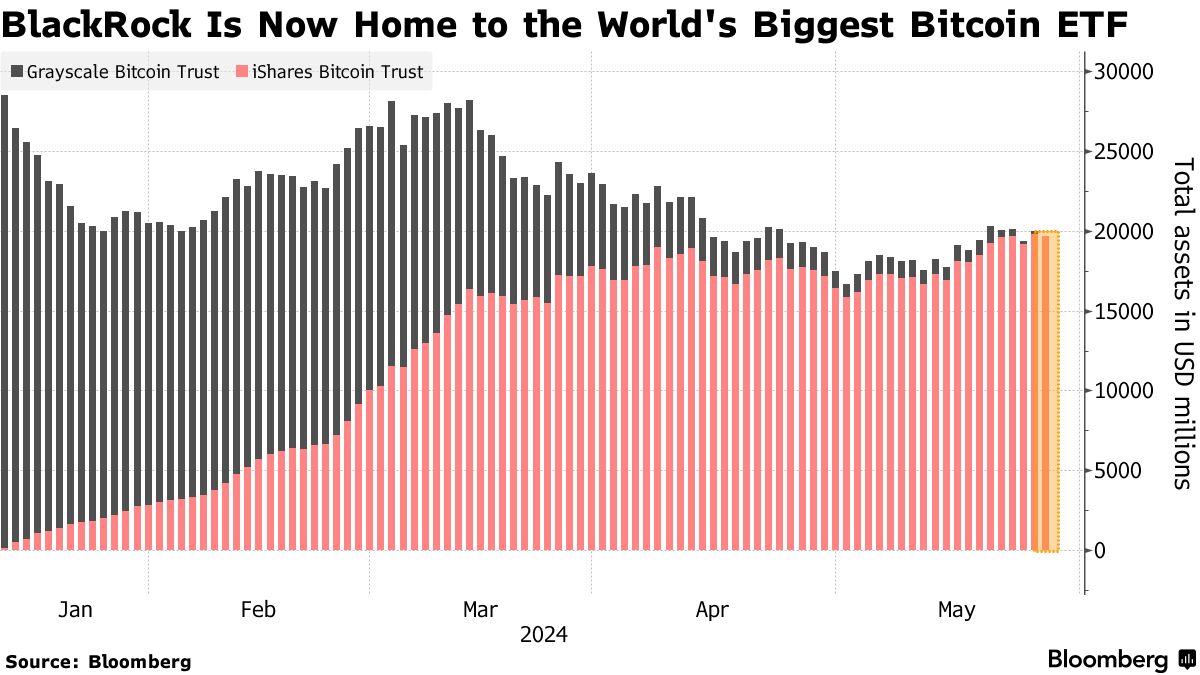

Although so many BTC have flowed out of GBTC, there has only been a relatively small decline in the assets managed by the product - measured in US dollars. This is due to the sharp rise in the price of Bitcoin since the ETF was approved, from just over 40,000 to more than 70,000 US dollars at times.

This can be clearly seen by comparing the assets under management of the two ETFs, IBIT and GBTC, since the first day of trading for the new investment products.

ETF inflows pick up speed again

Since the beginning of May, demand for Bitcoin ETFs has risen significantly again - hand in hand with the Bitcoin price. In the past eleven trading days alone, the investment products have seen combined inflows of over two billion US dollars, i.e. just under 200 million US dollars per day. The cumulative net inflows since the start of trading are currently at a new high of over USD 13.7 billion.

BlackRock becomes the largest Bitcoin player

BlackRock is now the asset manager that holds the most BTC. However, the financial giant only holds the BTC in custody as a service provider for clients who have purchased the Bitcoin ETF. From this perspective, BlackRock does not own the Bitcoin itself and could not become active on the market with it without breaking the law. Owning or holding many Bitcoin per se does not give an entity any power over the network - unlike with proof-of-stake cryptocurrencies such as Ethereum. The only "power" that many Bitcoin give a market participant is the purchasing power when they use the BTC on the market.

Nevertheless, it is interesting to see that the biggest player from the traditional financial world is now also number one in the Bitcoin market. And purely for security reasons, it is also to be welcomed if there is not just one trust with GBTC that holds many BTC, but if these are spread across several funds - even if most ETF issuers currently still rely on the crypto company Coinbase as their custodian.

The largest Bitcoin holders

MicroStrategy tops the list of entities that own Bitcoin. The company founded by Michael Saylor, which has been pursuing a Bitcoin strategy since August 2020, owns 214,400 BTC. Meanwhile, the USA is the largest holder at state level. They are said to own around 213,000 BTC.

Around 1.1 million Bitcoin can be traced back to the unknown and disappeared Bitcoin inventor Satoshi Nakamoto, but as he will probably never touch his holdings, let alone be able to, Satoshi can be safely excluded. Many assume that if Satoshi is still alive at all, he would probably not be able to access them as he would have destroyed the access. Nor would the Bitcoin inventor really be able to use his BTC without revealing his identity, which he has so far concealed so well that hardly anyone could imitate him.