Bitcoin mining has long raised concerns about its environmental impact due to its high energy requirements. In recent years, however, the industry has proactively responded to these challenges and driven the transition to renewable energy sources.

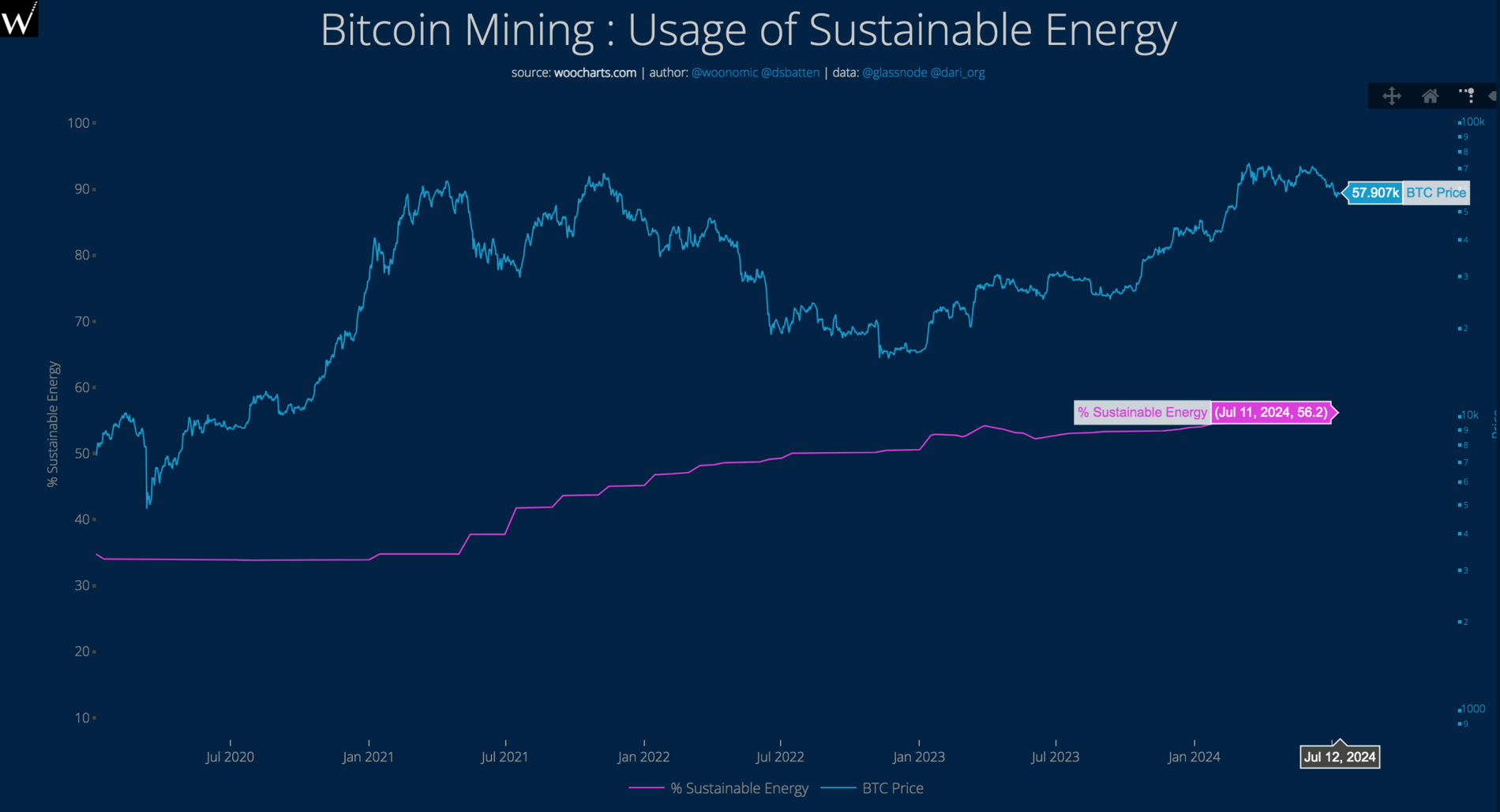

Recent data from the Digital Asset Research Institute (DARI) confirms this trend towards sustainability: the use of carbon-neutral energy sources is currently at an all-time high!

56.2 percent sustainable energy sources

In recent years, reporting has mainly relied on independent data from the Cambridge Centre for Alternative Finance (CCAF). The proportion of sustainable energy sources in the energy mix of Bitcoin mining was estimated at less than 38 percent.

However, this has changed in the last year. Environmental activist and entrepreneur Daniel Batten, together with data analyst Willy Woo, used Batten's BEEST (Bitcoin Energy & Emissions Sustainability Tracker) calculation model to prove that the majority of energy sources used for Bitcoin mining come from non-fossil sources. The BEEST model takes into account both on-grid and off-grid Bitcoin mining facilities, providing more accurate data than the Cambridge study. This has led to major news portals such as Bloomberg now referring to the BEEST model instead of the Cambridge study. In addition, a Cambridge representative recently publicly admitted the erroneous data for the first time.

The BEEST model shows that the share of non-fossil energy sources amounted to 52.6 percent in July last year and has risen continuously since then. Currently, sustainable energy sources account for 56.2% of the energy mix of Bitcoin mining.

At this rate of increase, the sustainable share could be more than 60 percent in July 2025 and 80 percent by the end of 2030, Batten estimates.

BREAKING: New All Time High

— Daniel Batten (@DSBatten) July 12, 2024

Bitcoin mining now uses 56.2% sustainable energy

At the current rate of increase, it will cross 60% by July 2025, and be 80% sustainable by end of 2030

Source: https://t.co/q1KgEHU85Z (@dari_org), @woonomic

Live chart: https://t.co/rqemLg3Ktv pic.twitter.com/eyWdOzAkkF

Furthermore, innovative concepts - such as the conversion of methane gas into electricity for Bitcoin mining facilities (on oil fields or landfills) and the use of waste heat - could lead to an additional reduction in greenhouse gas emissions and make the industry even cleaner and more sustainable.

Will Tesla soon be accepting Bitcoin payments again?

In view of the positive trend towards sustainability in the electricity mix, the electric vehicle manufacturer Tesla should actually be accepting Bitcoin payments again, according to CEO Elon Musk.

Back in February 2021, the company announced that it had purchased USD 1.5 billion worth of Bitcoin and would accept Bitcoin as a means of payment. Just six weeks later, it was possible to purchase a Tesla vehicle with BTC. However, in June 2021, the company reversed this decision due to concerns about the environmental impact of Bitcoin mining. However, Musk noted that Tesla would allow Bitcoin payments again "once there is confirmation that miners are using a reasonable amount (~50%) of clean energy and there is a positive trend going forward."

Since this change of opinion, however, the sustainability of the Bitcoin network has clearly improved, mainly due to the reduction of mining activities in China and the increasing use of renewable energy sources. At the same time, the hashrate and the Bitcoin price have risen. However, there are still critics who doubt the mining industry's data, such as Bitcoin opponent, data analyst and employee of the Dutch central bank Alex de Vries, whose statements about Bitcoin's energy consumption have been refuted several times. De Vries is of the opinion that the mining industry lacks transparency, that its data cannot be verified and that the industry is greenwashing through data manipulation. De Vries based this on the industry's lawsuit against the US Department of Energy, which demanded the mining industry's energy consumption data but had to destroy the collected data as a result of the lawsuit.

De Vries suspects that Tesla and Elon Musk do not yet consider the mining industry's data to be solid enough and would be aware of the alleged data manipulation. De Vries sees an early rethink by Tesla as a danger for the company.

Relying on claims about Bitcoin mining and renewable energy at this point in time would cause another PR disaster for Tesla.

De Vries in an interview

Daniel Batten is aware of the fluctuations in Bitcoin mining data, but his calculation model now provides more accurate data that could lead Elon Musk to rethink the Bitcoin payment option at Tesla. Batten is certain that the proportion of sustainable energy sources is over 50 percent.

There is still a statistical possibility that mining is below 50%, but I would now put that probability at less than one in a million.

Daniel Batten in an interview

Ultimately, the final decision on when and if Tesla will accept Bitcoin payments again lies with CEO Elon Musk. His own AI model Grok has already suggested this step - at Batten's request:

Elon Musk's AI chatbot Grok has some advice for Elon:

— Daniel Batten (@DSBatten) June 14, 2024

"it seems that the time has come for Elon Musk to fulfill his promise and allow Tesla to accept Bitcoin payments once more." pic.twitter.com/WGBsXR4i0d