US House of Representatives votes against the introduction of a CBDC

Gestern hat das US-amerikanische Repräsentantenhaus für einen Gesetzentwurf gestimmt, der es der US-Zentralbank (Federal Reserve) verbieten würde, eine eigene digitale Zentralbankwährung (Central Bank Digital Currency, CBDC) ohne die Zustimmung des Kongresses einzuführen.

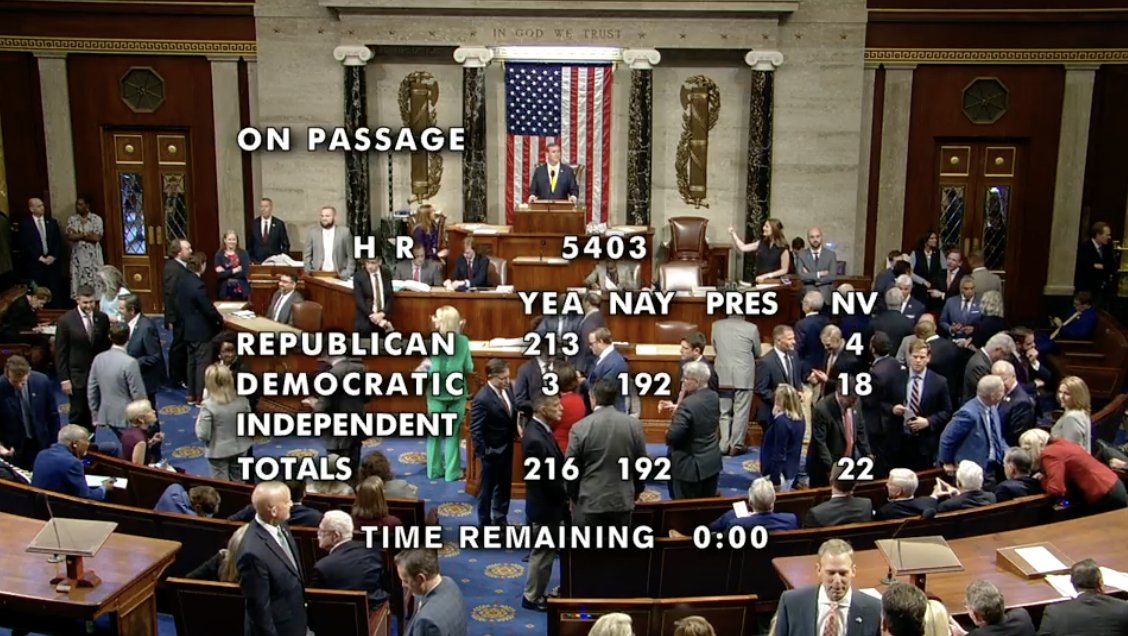

Final vote in the US Congress

In January 2022, the Republican US Congressman for Minnesota, Tom Emmer, first introduced the bill entitled "CBDC Anti-Surveillance State Act". Emmer believes that the introduction of a CBDC would create a government surveillance tool that could jeopardize and restrict the financial privacy and individual freedom of citizens.

In 2023, Emmer initially submitted the bill to Congress for debate in February and, after some amendments, resubmitted it in September - Blocktrainer reported. The Finance Committee of the House of Representatives has already approved the bill and passed it on to the full House.

The final vote took place yesterday. A total of 216 MPs voted in favor of the new potential law, while 192 were against and 22 did not vote. As the US Congress is dominated by Republicans, with all but four abstentions voting in favor of the bill, the result was not surprising. Nevertheless, the vote could have far-reaching implications for the future financial landscape in the US.

The initiator of the law, Tom Emmer, expressed his delight on the social media platform 𝕏 and emphasized the importance of his concern.

For more than two years, we have worked to educate, grow support, and pass this important legislation, which prevents unelected bureaucrats from issuing a financial surveillance tool to fundamentally undermine our American values.

- Tom Emmer (@GOPMajorityWhip) May 23, 2024

Final adoption is still uncertain

The approval of Congress is an important step towards the actual adoption of the law, but it is not yet a guarantee. There are still some hurdles in the legislative process. The Democrat-dominated US Senate must also approve the bill and the US President can still veto it.

However, it is also no secret that the current US administration under Joe Biden has a different position to that of the bill. Some members of parliament, from both the Democratic and Republican ranks, believe that progress and further development in digital finance and international competitiveness could be hindered without our own CBDC.

It remains to be seen whether the country's own central bank digital currency will also become an election issue like Bitcoin and cryptocurrencies. Donald Trump in particular has recently shown himself to be more open to such asset classes. At the same time, he has repeatedly communicated his rejection of CBDCs. So it could be very exciting. Ultimately, it is very welcome that the challenges of a CBDC in relation to the protection of civil liberties in particular are increasingly being addressed.

If the Senate and the House of Representatives are re-elected and the Republicans achieve a majority in both chambers, they could pass the law on their own. This could not only support the financial sovereignty of the American people, but also set a precedent for other countries.