After well-known hedge fund manager Ray Dalio announced that he would rather own Bitcoin than bonds, let's take a closer look at how Dalio sees the economy as a whole and what role Bitcoin can play in it. To start, here's Dalio's highly recommended 30-minute video on how the economic machine works.

Debts

Expenditure drives the economy. In an economy, the expenditure of one person is also the income of another. There are two ways to finance spending. Either with money that a person actually owns or with debt. This is where the first misunderstanding of many people begins: For them, the terms debt and money are the same thing.

A loan is the lender's asset. On the other hand, the borrower's debt is a liability. The borrower can now use the money he has borrowed to increase his expenditure. However, he uses his productivity from the future to do so. At some point, he will have to repay his debt. He must increase his productivity in the future in order to repay his loan. The consumer therefore draws resources from the future into the present.

Debt is not a bad thing per se. A distinction must be made as to what the debt is used for. An entrepreneur who uses debt to procure new production capacity increases his productivity in the future and thus drives the productivity growth of an economy. Bad debt, on the other hand, is expenditure that is only used for consumption. It does not generate productivity in the future. An economy that only grows by increasing productivity is the most sustainable. However, as soon as loans for consumer spending drive the productivity growth of an economy, debt cycles begin.

The cycles of debt

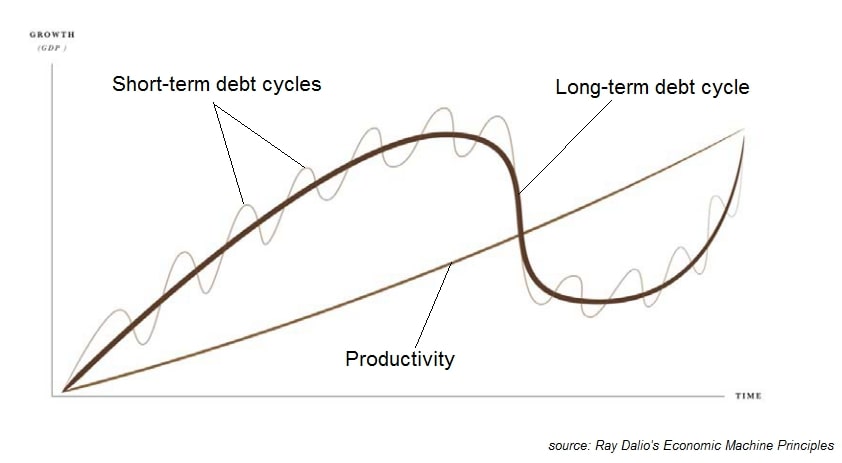

There are various cycles that currently occur in every economy in the world. If these cycles are understood, it is also possible to recognize why our economic system reacts fragile to external factors. The main difference between the cycles is their duration. Let's take a closer look at the different cycles.

Productivity growth

Productivity growth is the continuous process of economic growth. It arises in a capitalist system through the increasingly effective use of resources. Entrepreneurs are in constant competition with each other. They are forced to produce their products more efficiently. Productivity growth has a deflationary nature. Entrepreneurs can offer their goods more cheaply than before due to the more effective utilization of resources. An economy based solely on natural productivity growth would have no further debt cycles. However, as soon as credit is added that is not exclusively used to increase productivity, debt cycles arise.

Short-term debt cycle

The short-term debt cycle is the best-known cycle. It has a duration of eight to ten years and is triggered by the central banks' interest rate decisions. When people finance their consumption on credit, demand increases disproportionately to natural productivity growth. This causes prices and inflation to rise. The central banks now intervene and try to reduce consumption by raising interest rates. The cost of borrowing increases for the borrower. The current economic doctrine preaches exactly this idea. The central bank lowers the interest rate in times of crisis and the interest rate rises in phases of strong growth. But there is a problem here, which leads to the second debt cycle. The long-term debt cycle.

Long-term debt cycle

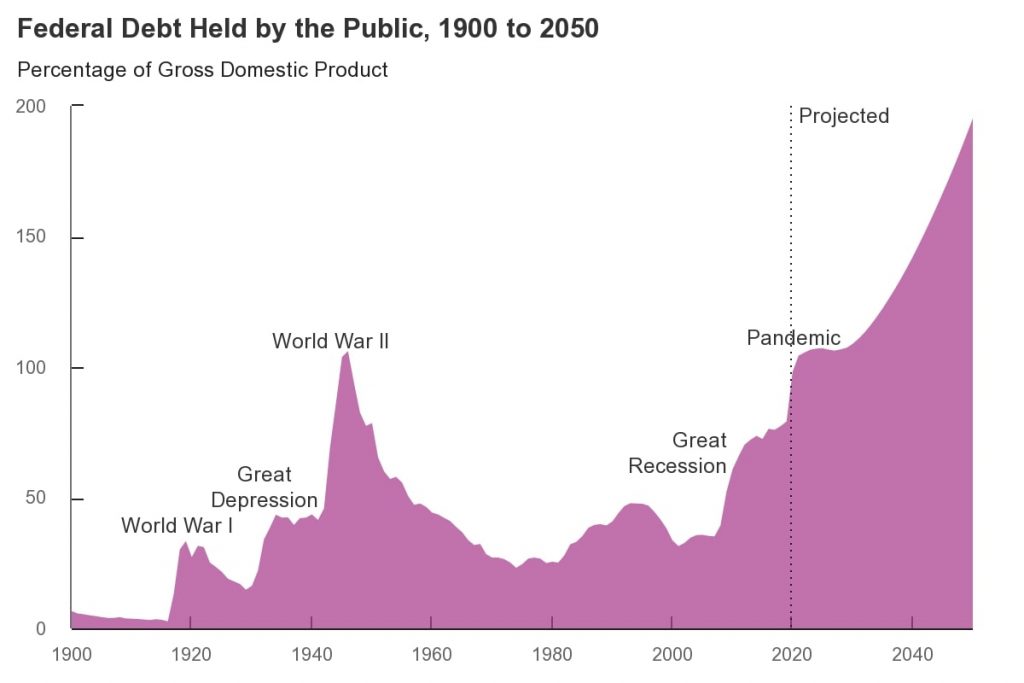

The duration of the long-term debt cycle is ~75 - 100 years. Many people do not live through an entire long-term debt cycle. This is the reason why many do not recognize the impact. The last long-term debt cycle ended with the Great Depression of 1929. The end of a long-term debt cycle occurs when interest rates approach zero.

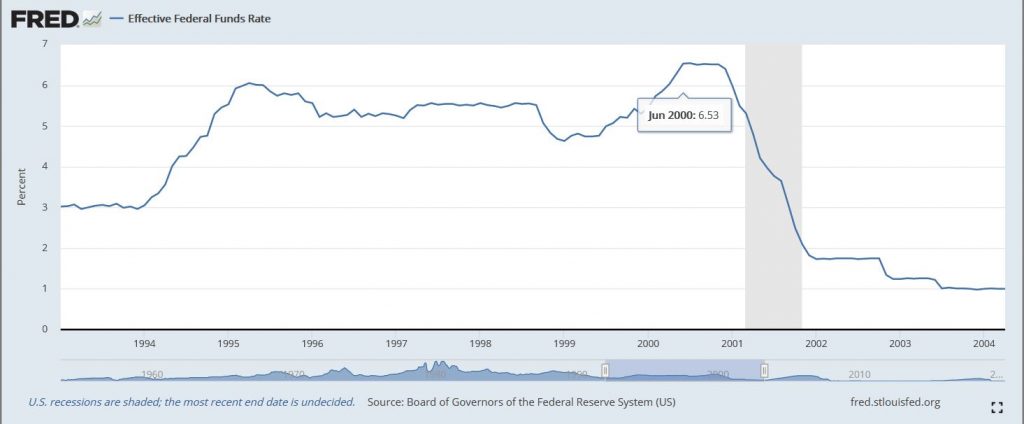

As described above, central banks control the short-term debt cycle through the key interest rate. However, interest rates continue to fall on average with each cycle. What exactly does this mean? Let's take a closer look at the USA. After the Second World War, interest rates rose continuously until they peaked at 19% in 1981.

The short-term cycles can be seen very clearly in this chart. Since the recession triggered by the oil crisis in 1981, average interest rates have fallen continuously. Since then, we have seen assets such as shares and real estate shoot through the roof, while interest rates on bonds have continued to fall. If interest rates only keep rising in the short term, but fall steadily in the long term, it makes more and more sense to take on debt over a long period of time and invest your capital in assets.

At the same time, we are seeing an enormous increase in debt. More and more credit is in circulation. Although the interest burden is being reduced by lowering the interest rate, the debt burden still remains. The USA now has a debt to GDP ratio of 127%, which is higher than at the time of the Second World War. At that time, the USA was able to greatly reduce its debt burden within 30 years. Debt used to be used to finance particular crises. Today, the enormous debts create the feeling that we are living in a permanent crisis. This debt burden is crushing the population. Everyone knows that debt cannot last forever. Sooner or later it will have to be repaid.

Although central banks repeatedly try to raise interest rates during economic booms, they never reach pre-crisis levels. Here is the development of interest rates in the last short-term debt cycles.

If you now superimpose productivity growth, the short-term debt cycle and the long-term debt cycle, you get the cycle of any economy.

What now?

History does not repeat itself, but it does rhyme. As in the past, the interest rate on the world reserve currency will not reach the pre-crisis level. Once the long-term interest rate has fallen to 0% and the end of the long-term debt cycle has been reached, the central bank will need new monetary strategies to stimulate the economy. In Japan, we have been seeing these mechanisms for 40 years and can therefore pretty much predict what will happen. First, the central banks will buy government bonds from governments (=QE). To make the debt burden bearable, the debt is monetized. Every citizen of a country no longer guarantees only their own debt, but also the debt of their government.

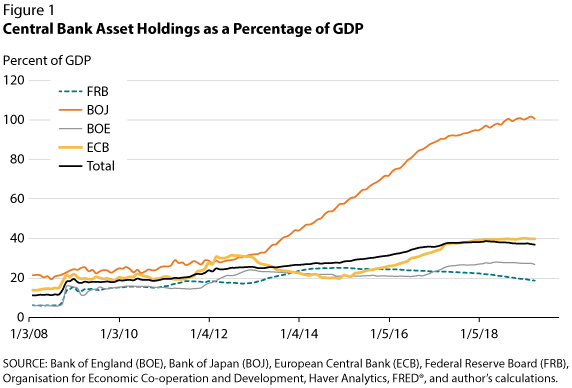

As soon as the central banks start to monetize the debt, they will also buy up other financial products on the capital market. The central bank will become a lender of last resort. Now not only government bonds are being bought up, but also corporate bonds and listed indices. The Bank of Japan holds shares worth 434 billion US dollars. In total, the Bank of Japan holds asset classes equivalent to Japan's gross domestic product.

This entire process is referred to as the nationalization of the economy. But all this still does not solve the problems of the debt burden. Paying off the debt is not a long-term solution.

The logical way would be to reduce spending and get the debt under control again with the help of a tough austerity policy. However, as mentioned above, one person's expenditure is another person's income. The economic situation would therefore continue to worsen. In the 1930s, Roosevelt tried exactly that to overcome the Great Depression. However, he ended up in a deflationary spiral. If less is produced by reducing spending, productivity growth slips into negative territory. This would ultimately lead to an increase in the debt burden.

The only solution is to inflate the debt. If the person has more money, they can reduce their debt burden with the fresh money. Central banks are looking for a mechanism to make this possible. The introduction of CBDC (Central Bank Digital Currency) would be a potential solution. Citizens could then have a direct account with the central bank. This means that the central bank is no longer dependent on the commercial banks and can implement monetary decisions directly. The disadvantaged party is the creditor. The debtor can pay him, but only with the devalued monetary unit. However, this option is still better for him than a debt cut, in which part of the claim against the debtor is canceled.

As soon as the nation's debt burden has been reduced, the long-term debt cycle starts all over again. Consumption is once again financed more with own funds and not with loans, the economy starts to grow again and the central bank can raise interest rates again in the long term.

Social unrest

At first glance, that doesn't sound too bad. The devaluation of money can be justified by the fact that at least the economy is now starting to grow again. Devaluation is also better for creditors than a debt haircut. However, if we look at the social upheavals that occur at the end of a long-term debt cycle, we get a different picture.

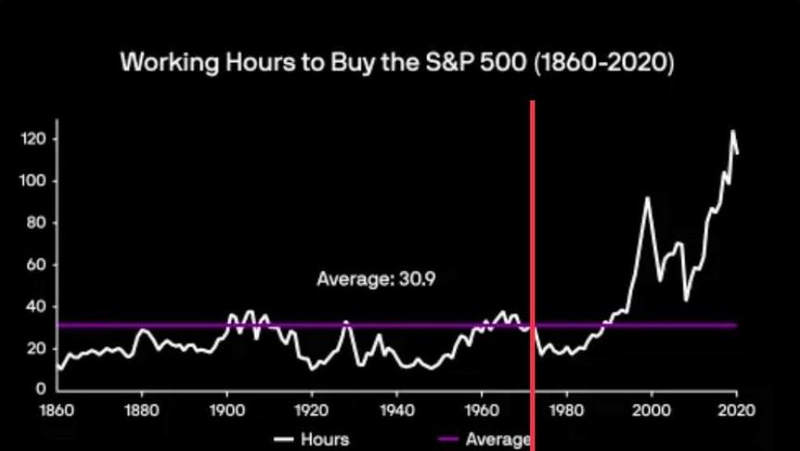

A country that surrenders to the nationalization of the economy by central banks allows one group of people to benefit while the rest suffer the negative consequences. As previously described, asset values in the US have experienced an incredible boom over the last 40 years. Unfortunately, however, it is not the ordinary worker in the capital markets, but already wealthy people. They benefit all the more from the rise in asset prices. New market entrants have no option but to buy overpriced assets if they want to protect their savings from inflation. This is best illustrated by the American S&P500. On average, an American had to work just under 31 hours to be able to buy the S&P500 index fund. Now it is 120 hours.

Inflation in the asset class leads to a redistribution of wealth from the bottom to the top. Capital is increasingly being accumulated by people who are already invested in the capital market. The gap between rich and poor is widening. The calls to redistribute wealth with the help of the state are getting louder and louder. If the state does not heed this call, there may be riots and political unrest. It is no coincidence that populist parties are finding broad support among the population at this time. They offer simple solutions to an extremely complex problem. Ray Dalio sums it up:

"Wealth gaps increase during bubbles and become particularly vexing for the less privileged during difficult times. In such times, populism emerges on both the left and the right. How well people and the political system can cope with this situation depends on the extent of the economic and social damage. Currently, inequality and populism are on the rise in the US to the same extent as in the 1930s. In both cases, the net worth of the top 0.1 percent of the population was roughly equal to that of the bottom 90 percent combined."

Ray Dalio, The Debt Crises

Situation in Europe

Let us now take a closer look at the situation in Europe and what phase of the long-term debt cycle we are in. The European project with a common currency is still very young. Nevertheless, we also see typical signs here that point to the end of the long-term debt cycle. Normally, the duration of the long-term debt cycle is 75 - 100 years. Unfortunately, there have been developments in Europe that have accelerated the process.

Over the last 20 years, Europe has experienced two short-term debt cycles. This can be observed in the development of interest rates. Just as in the USA, the maximum interest rate in the second interest rate cycle was lower than in the first, before approaching 0% as a result of the euro debt crisis. While the USA managed to raise interest rates again in 2018, the key interest rate in the eurozone has been at 0% since 2016. The reason for this is the enormous debt burden of some EU countries such as Greece, Italy and Spain. The debt burden of many southern European countries has grown faster than in the USA and these countries cannot keep up with the economic growth of the USA. The USA has more debt in absolute terms, but in relation to its economic strength, the USA is still better off than Europe.

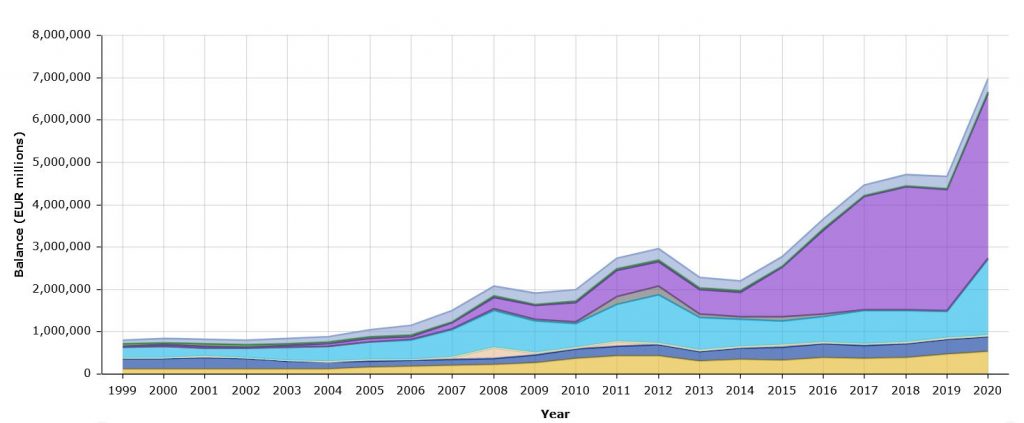

The second point has also already been fulfilled. The monetization of debt. Following the abolition of interest rates as a way of stimulating the economy, the European Central Bank now has to act on the capital market itself. Like most central banks, it does this by buying government bonds from European member states. The volume of bonds purchased now amounts to more than seven trillion euros.

With the Pandemic Emergency Purchase Program (PEPP), the ECB has now also started buying corporate bonds. In November 2020, the ECB held corporate bonds worth 640 billion euros. Unlike the US, the ECB has not yet used the concept of helicopter money during the pandemic. However, it should be noted that the US stimulus package was more of a political decision in the wake of the presidential election and not a monetary decision on the part of the Fed. Although the period of the cycles differs from country to country, there are very strong parallels with the monetary measures taken by central banks.

The social upheavals in Europe cannot be overlooked. European countries with the highest debt burden, such as Spain, Italy and Greece, also have the highest youth unemployment. In Spain, 37% of young people have no job. The frustration is particularly noticeable in the elections. In Italy, the populist Five Star Movement won the 2018 general election. The result was a coalition of five parties from very different spectrums. It was no wonder that Italy has been plunged into political chaos in recent years. Populists are the result of a failed monetary experiment. It is to be hoped that the damage caused will remain minimal, as Dalio described above.

Bitcoin

Now let's bring Bitcoin into play. As described earlier, the only solution to the long-term debt cycle is to reduce the debt burden by debasing money. Is it? Although Japan has now had interest rates at zero for more than 40 years and the Bank of Japan is the largest shareholder, they still can't get out of the cycle. The problem is finding the right balance between monetary stimulus and the threat of hyperinflation.

But even if the cycle can be broken, the problems have not been solved. Central banks will continue to set interest rates and short-term debt cycles, which inevitably lead to a long-term debt cycle, will re-emerge. The only option would be to find a monetary asset that can function independently of a decision by a central authority.

Bitcoin is exactly that. In a decentralized system like Bitcoin, there can be no one to set an interest rate. The only monetary property of Bitcoin is the hard limit of 21 million coins. Monetary measures that central banks use to cushion the inevitable long-term debt cycle are not possible with Bitcoin. A bond-buying program cannot be implemented with a scarce commodity like Bitcoin. The devaluation of money is also not possible. Only the elimination of interest rate manipulation by central banks will make many of the problems that our current financial system has disappear.

Bitcoin offers everyone the opportunity to leave the system peacefully. It seems naïve to assume that states can solve the problem with their monetary policy. The only option would be to devalue the money and reduce the debt burden. History has shown that a devaluation of money always has one loser: the ordinary citizen. They have no choice but to bear the fiscal and monetary consequences of governments. Today, they have an alternative: Bitcoin. The Bitcoin community is often ridiculed for its simple view of things. Many cannot imagine the positive consequences of a money that cannot be manipulated. However, it is well known that the best solutions are the simplest.

Summary

Ray Dalio's theory of different debt cycles is an excellent description of the current system. Central banks can only lower interest rates over a longer period of time. However, as soon as interest rates fall towards 0%, central banks have to resort to alternative methods. However, this leads to many negative consequences. In Germany, the end of the long-term debt cycle almost 100 years ago and the resulting hyperinflation contributed significantly to the rise of Hitler. History is full of social upheavals that set in when people realize that the monetary system is not in order. We are currently seeing the old voices of wealth redistribution becoming louder again. Movements like "Eat the Rich" in America should not be underestimated. With the invention of Bitcoin, however, we do not have to resign ourselves to such gloomy scenarios. We have the opportunity to get out of the old system ourselves at any time and help to create a better system.