Bitcoin ETFs break new record

18 days of inflows in a row

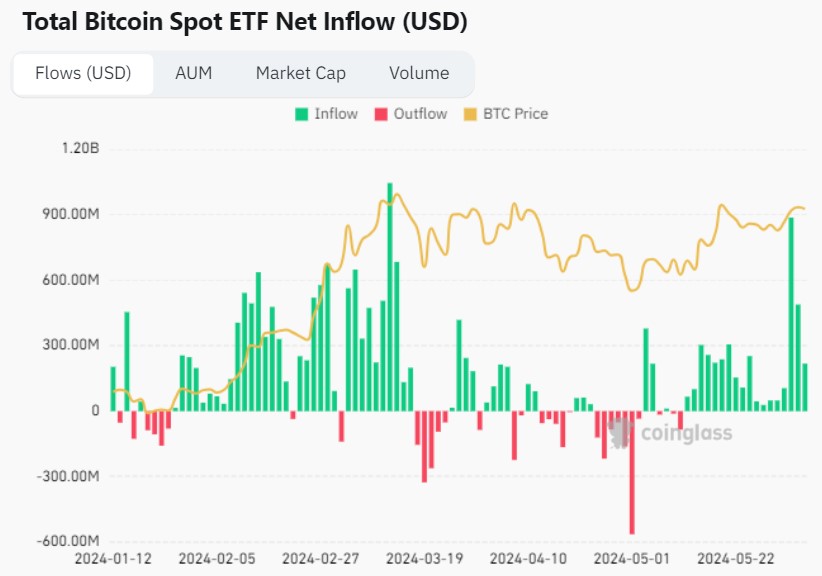

Bitcoin spot ETFs from the US set a new record of their own yesterday: For the first time, new funds flowed into the investment products for 18 trading days in a row. Demand for Bitcoin ETFs has increased significantly again in recent weeks, lifting Bitcoin to a price of over USD 71,000, which means that only an increase of just over 3% is needed to reach a new all-time high.

Record price of Bitcoin ETFs

The Bitcoin spot ETFs approved in January this year have broken several records. IBIT, BlackRock's Bitcoin ETF, is the ETF that has managed to raise $10 billion and also $20 billion in capital the fastest since its relaunch. This prompted BlackRock CEO Larry Fink to call IBIT the "fastest growing ETF in the history of ETFs". With an inflow series of 71 trading days after the start of trading, IBIT also set a new ETF record in this respect.

The best phase for the Bitcoin spot ETFs to date was from January 26 to March 15. During this period, 13 billion US dollars flowed into the eleven Bitcoin ETFs. This period also saw the longest series of inflows for all ETFs combined until yesterday, namely 17 days. However, with demand for the investment products currently picking up speed again, the ETFs were able to beat their own record yesterday.

Since May 13, there have again only been days with inflows into the ETFs, bringing the current active inflow series to 18 trading days. During this period, the Bitcoin spot ETFs soaked up almost 3.9 billion US dollars in fresh capital. Although this is slightly less than the USD 4.4 billion in the 17-day period from the end of January to mid-February, the figures are still impressive - especially as the ETFs have been tradable for almost five months.

Hand in hand with the inflows, the Bitcoin price has also risen again in recent weeks. Since admission, demand for Bitcoin spot ETFs appears to be the primary price driver for BTC.

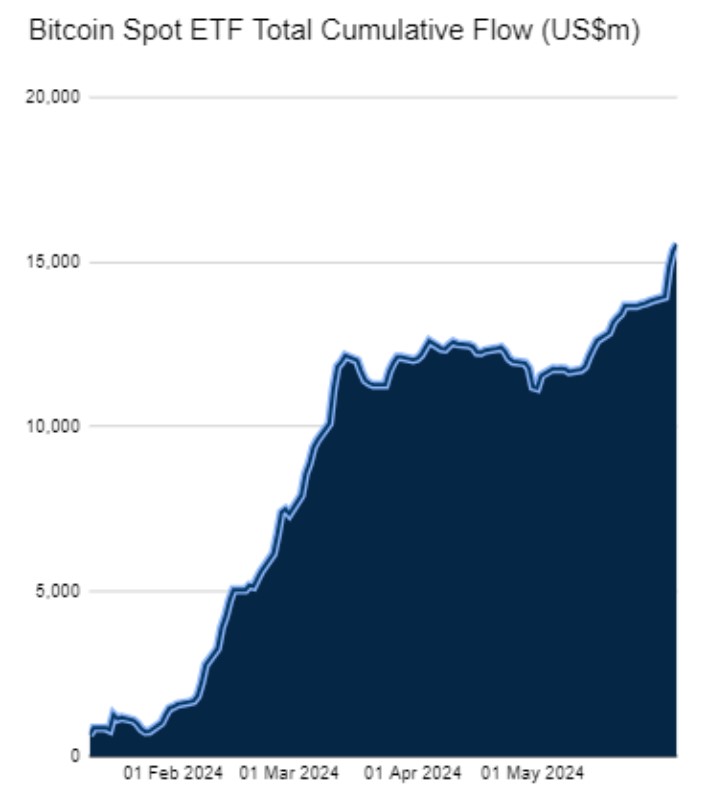

Demand does not stop

The current strong increase in inflows shows that not everyone who wanted to build up a Bitcoin position via a regulated investment product did so immediately after approval. In general, demand for Bitcoin appears to be increasing further. The cumulative inflows into the Bitcoin spot ETFs are currently rising from one new high to the next.

Since the first day of trading, more than USD 15.5 billion of new capital has flowed into Bitcoin via the ETFs. In total, the eleven US Bitcoin spot ETFs now hold over 880,000 BTC with an equivalent value of more than USD 60 billion. BlackRock and Co. hold more than 4 percent of the maximum of just under 21 million Bitcoin.