Africa and Bitcoin have a special relationship. There is great potential for Bitcoin to remain an important part of people's lives on the continent in the long term. Blocktrainer.de has already reported on the high adoption rate in Nigeria, the social influence of Bitcoin in Malawi and the role of Bitcoin as a catalyst for the expansion of electricity grids.

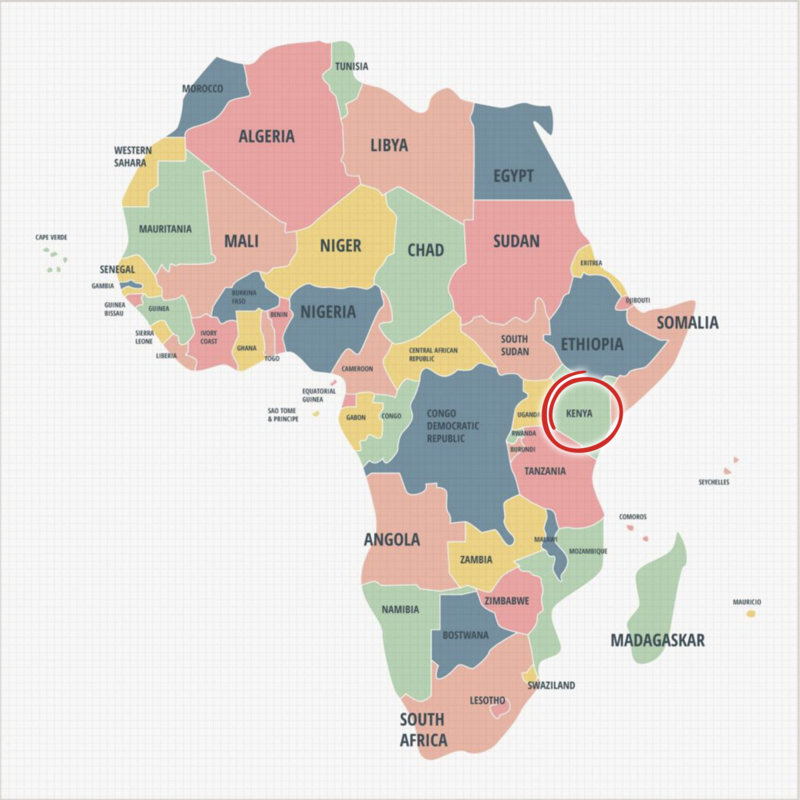

Bitcoin is also playing an increasingly important role in people's lives in Kenya. The East African country is a special region for the African Bitcoin space, as projects have emerged there that could change the entire continent for the better: Bitcoin DADA and Gridless.

What is behind these initiatives? And does their commitment promote a "symbiotic relationship" between Bitcoin and Africa?

The financial situation in Kenya

Kenya is an important economic and political player in East Africa, playing a central role in trade, peacekeeping and diplomatic conflict resolution in this region of Africa. Economic growth in the country is primarily driven by the private sector, agriculture and the service industry.

However, the country is also struggling with major financial challenges, such as national debt. Kenya has around 11.3 trillion Kenya shillings (approx. 94 billion US dollars) in debt, which was equivalent to 73 percent of gross domestic product in 2023. 55 percent of the debt is foreign debt. The high interest rates of recent years have exacerbated Kenya's debt situation. The International Monetary Fund (IMF) has already imposed certain measures on the country to make public financial management more efficient and combat corruption.

Countries such as Kenya, Malawi or the Democratic Republic of Congo need US dollars, euros or yuan to repay their debts or purchase oil, fertilizer, factories or aircraft. It is not an option to simply print the regional currency in order to buy US dollars, for example, as this would only make their own currency even more worthless. For these reasons, African countries rely on exports. They do not produce the products they need, but those that are in demand in the USA, Europe or China. Kenya is not the largest exporter of flowers in the world for nothing. The dependence on foreign countries is therefore very high.

In addition, intercontinental payment transactions are often associated with delays, bureaucracy and fees or rent-seeking from abroad. According to the author and strategy director of the Human Rights Foundation, Alex Gladstein, who has written an essay on Bitcoin in Africa, by the end of 2022, either European or US companies will have processed 80 percent of all payments within Africa and collected the corresponding fees.

The Kenyan population is also struggling with a significant loss of purchasing power, which has been exacerbated by climatic and geopolitical crises. Although the Kenyan shilling is more stable than other African currencies, in 2023 it depreciated by 21% against the US dollar, which also lost value against goods and services. The loss of purchasing power and the resulting additional economic burdens led to high youth unemployment and social unrest, particularly in poor urban areas.

M-Pesa

Another negative aspect is the lack of access to the banking system. To promote financial inclusion and poverty reduction, the Kenyan mobile phone company Safaricom, together with Vodafone M-Pesa and introduced it in Kenya at the beginning of 2007. It is a system for cashless payment transactions via cell phones. Users can top up (or cash out) their electronic M-Pesa balance via special merchants and then pay other users cashlessly via SMS. It is also possible for people without an M-Pesa account to receive money from M-Pesa users via the merchants.

However, this digitalization of financial services also has its disadvantages. Critics accuse Safaricom of exploiting its monopoly-like position with excessive prices. For example, the lack of competition in Kenya has meant that the fee for transferring even the smallest amounts costs ten times as much as the same provider in neighboring countries, where there is more competition. This is also said to have hindered Kenya's economic development. Furthermore, there is no data protection law in Kenya, which means that sensitive user data is at risk and has already been passed on.

Lorraine Marcel is a Kenyan entrepreneur and activist. She initially ran the event consulting company Loryce and in 2022 decided to found the Bitcoin "DADA" (Swahili for "sister") initiative, which is also supported by the Human Rights Foundation. In the essay by Alex Gladstein, she tells the story of Bitcoin DADA.

While her savings were losing more and more value due to the government's constant tax increases, Marcel heard about cryptocurrencies for the first time at an event in 2018. She became interested in Bitcoin.

At that time, however, the topic of blockchain was very present in Kenya. Since there were still no educational initiatives in this area, many people fell victim to the scams of various token providers, which kept Marcel very busy.

After a break in events due to the COVID pandemic, Marcel helped organize a Bitcoin event in Nairobi in 2022. At the event, Marcel noticed the low female participation rate, which was even lower than at most crypto events. She told Gladstein that she noticed that women stayed away from the events because the community and the topic of finance were dominated by men.

Finance is considered a man's business, so women are financially abused. I don't want to leave women behind.

Lorraine Marcel in an interview

Marcel decided to create a safe space for women, where she teaches interested women and girls more about Bitcoin and financial freedom in a six-week course. This is how Bitcoin DADA. This educational offer was initially taken up by Marcel's friends and soon other Kenyan women. More than 300 women are said to have already taken part.

700 million potential African female Bitcoin users

Marcel gained further inspiration at the Africa Bitcoin Conference, which she was able to attend in 2022 thanks to the support of Anita Posch. Since then, Marcel has been supporting women in the Bitcoin space, optimizing a mentoring program from DADA and giving training courses at universities for anyone interested. Among other things, she also warns against the fraudulent machinations of other crypto projects (such as Worldcoin). Bitcoin DADA eventually spread to other African countries such as Uganda, Nigeria, South Africa and Tanzania. There, former graduates of Marcel's course are now teaching other African women why Bitcoin is important to them.

Marcel's goal is to improve the freedom of 700 million African women and turn them all into Bitcoiners by using an alternative currency system that cannot be controlled by the government, foreign countries or their husbands. Bitcoin also helps to ensure that foreign aid gets to where it is needed, such as a school project supported by Marcel in Kibera in Nairobi, the largest urban slum in Africa.

It's hard to be African, and even harder to be an African woman. [Bitcoin] gives us financial independence and the opportunity to work on ourselves. [...]

Bitcoin offers a way out of macro problems like currency devaluation and micro problems like domestic oppression. A lot of foreign aid doesn't reach the slums. [...]

We are eliminating waste and corruption.

Lorraine Marcel in an interview

Machankura - Bitcoin without the internet

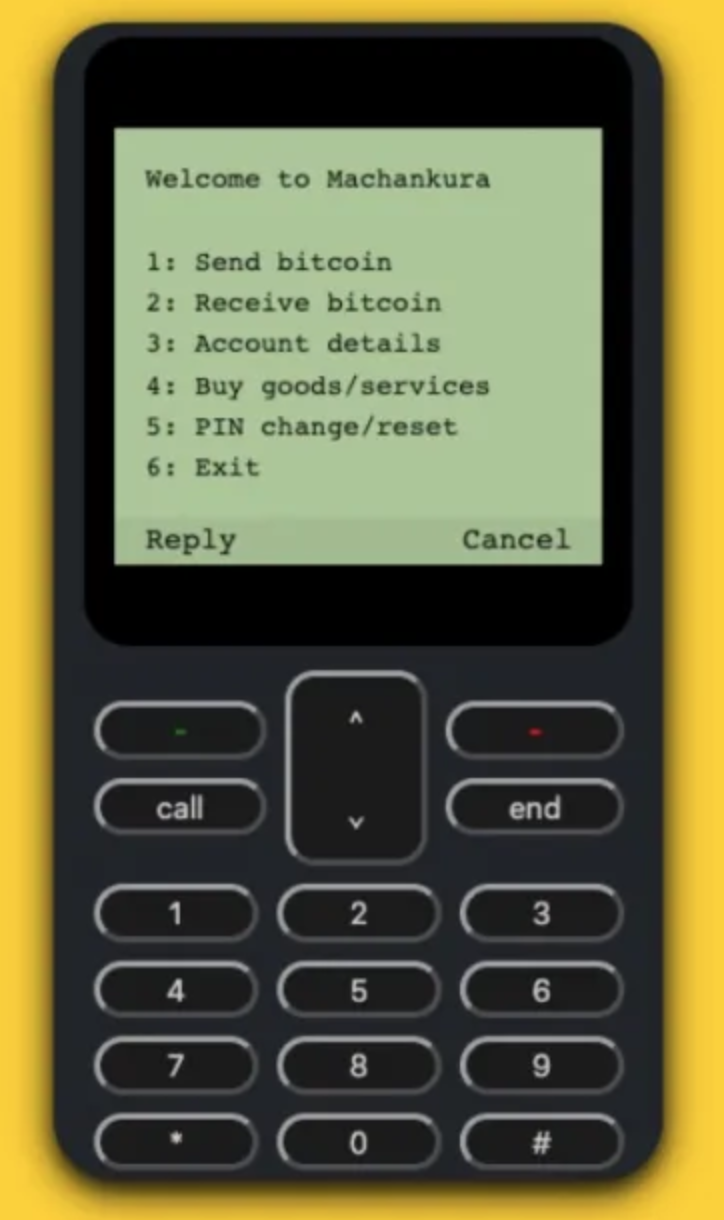

In the Bitcoin DADA courses, Marcel uses the textbook developed in El Salvador by Mi Primer Bitcoin developed in El Salvador, Marcel provides a solid understanding of Bitcoin and teaches participants how self-custody works and how to purchase KYC-free Bitcoin. To buy, receive and send Bitcoin using the Kenyan mobile payment processing system, M-Pesa, without a regular bank account, without consistent cell phone data and possibly without an internet connection, Marcel recommends online wallets such as Muun, Phoenix or Wallet of Satoshi, apps such as Bitnob or Tando and the Machankura service.

Machankura is a service developed by Kgothatso Ngako in South Africa that enables cell phone users to send, receive and store Bitcoin without an internet connection, copy&paste function or QR code scanner. Users can transfer Bitcoin via telephone numbers or "Lightning usernames" or use normal on-chain addresses or Lightning Invoices if the device allows it. The link to a voucher service such as Azteco also enables the Machankura user account to be topped up using a voucher code.

While Bitcoin, with its decentralized nature in regions with no or unreliable banking infrastructure, is an alternative currency system that can be used independently of the state (and husband) as a tool for financial self-sufficiency, Machankara additionally enables the use of Bitcoin without the internet and with almost any type of cell phone.

Gridless - energy utilization and independence through Bitcoin

In addition to a lack of access to banks, the internet and suitable hardware, many people in Africa also lack access to electricity - one of the most important aspects for a better outlook on life. 400 million people in Africa live without electricity.

Kenya has a lot of cheap geothermal energy, but it is often not used or developed because the government is already spending the money on other projects, such as the payments for expensive wind energy from the large Turkana wind farm in north-western Kenya. Without the government support, there would have been no income stream needed to build the wind farm, even though it had no paying customers for years.

As the founders of Gridlessfounders Erik Hersman, Philip Walton and Janet Maingi told Alex Gladstein in an interview, they started thinking about a solution to this waste ten years ago. They were looking for a large customer that was location-independent and didn't require much connectivity. The idea of an aluminum processing plant was quickly discarded as it was too much of a logistical challenge. Eventually, they found the solution in Bitcoin, but only realized this idea in 2022 with the founding of their company Gridless.

The big problem that drives us every day is the number of people who don't have electricity on this continent. It's impossible to comprehend. [...] It's so outrageous and incomprehensible. And without electricity, there is no freedom. But now we can solve this problem and make money at the same time.

Erik Hersman in an interview

New perspectives through sustainable electrification

Gridless has launched numerous projects to solve rural energy problems in Africa using Bitcoin mining. Blocktrainer.de has already reported on a site in Malawi, which is also the subject of Alana Mediavilla's documentaries "Stranded" and "Dirty Coin".

Some locations with power plants (mostly small hydroelectric power plants from the company HydroBox) were also built in Kenya, which only became financially viable and profitable thanks to Bitcoin mining. At the same time, electricity offered people new opportunities and life prospects as well as time savings in various areas. Refrigerators could not only store medicine, but also promote economic activities. Electric light replaced candles or kerosene lamps, making it easier for children to study at school, for example. An excerpt from the documentary "No more inflation" by BitcoinShooter.com gives a small impression of such projects in Kenya.

How #Bitcoin mining is helping to change lives in 🇰🇪 Kenya 🙌

Bitcoin News (@BitcoinNewsCom) July 10, 2024

pic.twitter.com/dajg6s01zN-

The founders of Gridless are certain that Bitcoin mining will help to increase access to electricity in some African countries to almost 100 percent and bring per capita electricity consumption in Africa to the level of Northern Europe by the end of the century.

Geothermal energy

In order to assess the potential of Bitcoin mining, Alex Gladstein and Erik Hersman visited a Gridless site on Lake Naivasha in south-western Kenya. The special thing about this location is the use of geothermal energy.

Geothermal energy is absolutely stable and clean, making it one of the most attractive sources of electricity available. Unlike solar and wind power, geothermal energy is not intermittent. Even hydropower can slow down in dry months and therefore does not offer a constant energy supply.

The geothermal plant at Lake Naivasha generates electricity by feeding hot steam from a 2,000-metre-deep hole into a turbine. The power plant has a capacity of 1.4 megawatts and could run for 40 years without interruption or change in power generation. The capacity has not yet reached its limits. The foreman of the plant noted that the geothermal energy in the immediate vicinity could supply up to 10 gigawatts of electricity.

The electricity generated drives a water pump about 1000 meters away on the lake, which pumps the lake water to nearby flower farms to irrigate the fields. However, as the pumps do not consume electricity all the time, but the geothermal energy supplies energy all the time, a large amount of electricity remains unused. Storing the energy in batteries is currently neither economically nor technically feasible.

Instead of leaving the surplus energy unused, Gridless uses it to operate 144 Bitcoin mining devices from Whatsminer in a container with Starlink satellite internet near the pump. According to the operator, these ASICs consume an average of 375 kilowatt hours per day. The revenue that can be generated from Bitcoin mining depends on the Bitcoin price, which also influences the hashrate and therefore the difficulty of the network. The operator has carried out a study in which the income over the next five years is estimated at between 7 and 9 cents per kilowatt hour. This means that the plant earns a few hundred US dollars per day, of which Gridless pays 30 percent to the operator of the geothermal power plant as a flat fee for the use of the otherwise wasted energy.

The costs for the plant, including the mining equipment and infrastructure, are in the low six-figure range. This means that Gridless can usually refinance the plant within a few years. The geothermal energy provides the necessary energy for agriculture and the Bitcoin mining plant monetizes the surplus energy, thus eliminating wasted electricity.

If you know that you are building a power plant with variable demand in the future, you will include bitcoin mining right from the start. Otherwise, you're wasting energy.

Erik Hersman in an interview

Biomass

Due to its reliability, Gridless focuses primarily on small hydropower plants and geothermal energy, but the company is also considering other forms of energy. However, solar and wind power are not consistently available due to their intermittent nature. Solar power plants in particular could require additional investment in expensive battery technology in order to be profitable. This would also increase the overall costs of operating the power plant, making this option less attractive.

Energy from biomass appears much more attractive for Gridless. This year, the company built two new biomass-powered Bitcoin mining plants in East Africa to supplement two industrial operations (sugar and sisal fiber processing plants). In both plants, excess plant material is burned at high capacity to boil water and drive a turbine that generates electricity. Despite the combustion process, this process is generally considered clean and renewable, as plants absorb carbon dioxide from the air and release it again when burned.

As there are no other electricity consumers in the surrounding area, either the electricity generation function is dispensed with altogether or the electricity is fed back into the ground and thus wasted. Thanks to Gridless, these plants are now running at full speed and turning the previously orphaned electricity into capital.

ASICs will be an integral part of any energy site. A turbine, a transformer and a mining container.

Philip Walton in an interview

Stabilization of the electricity grids

In conversation with Gridless co-founder Janet Maingi, Gladstein also learns about the numerous power outages in Kenya and Gridless' strategy to prevent such outages in their small off-grid energy projects. Similar to the demand response programs in Texas during heat waves or extreme cold, Gridless uses the flexible properties of Bitcoin mining equipment to stabilize the power grid. The operator switches the machines off when demand is high and on again when demand is low. This allows excess energy to be absorbed and power outages to be prevented without affecting the ASICs.

As the example of Texas shows, this concept can easily be transferred from small off-grid power grids to national grids and counteract the power problems of the African continent.

Less dependence on foreign countries

The Gridless concept has shown that the integration of Bitcoin mining facilities into various energy projects offers the African population the opportunity to use and monetize lost surplus energy and stabilize power grids. It is also very profitable and could be a model for other projects.

Significantly larger facilities would also bring in significantly more gross revenue, in a sound form of money, without the loss of purchasing power, bureaucratic obstacles, fees and foreign exchange costs of the established monetary system. Bitcoin gives the population access to an economic system that is not based on foreign loans with strict conditions and fees and thus on dependence on foreign countries.

As Bitcoin becomes a larger and larger part of the global economy, African nations will be able to convert their energy into a global reserve currency without asking permission from or doing business with an empire or distant power.

Alex Gladstein

With Bitcoin, business within Africa would be possible on a peer-to-peer basis without having to pay some sort of tribute tax to foreign companies.

It remains to be seen how these aspects will develop and whether Bitcoin can eventually eliminate the injustices of today's global financial system, where the privileged minority of the world's population uses a freely tradable and widely accepted reserve currency while the rest of the world has to make do with inferior monetary technologies.

Until then, it remains a bitter reality that the place of birth determines the quality of the currency and that various governments can realize their corrupt machinations by deliberately devaluing the currency.

If African governments were to integrate Bitcoin into their financial and energy policies instead of cutting spending, raising taxes or continuing to finance themselves from abroad (through loans or share sales) and thus maintaining dependency, they could generate capital with surplus energy that might eventually be enough to pay off the debt.

The symbiotic relationship between Bitcoin and Africa

The low-cost to free electricity makes Africa an attractive location for mining companies. Not only do older ASIC models remain profitable there, there is also a certain independence from crises and wars, which could lead to higher energy prices in Western countries and thus to a restriction of Western mining operations.

Gladstein sees a symbiotic relationship between Bitcoin and Africa. Bitcoin could not only do a lot for the African population, but Africa could also do a lot for Bitcoin.

If companies, and one day nation states and corporations, begin to convert the continent's thousands of gigawatts of wasted and unused energy from water, geothermal and biomass into capital and feed all that electricity into the Bitcoin network via a decentralized and unconnected grid system, then we will have a much more unstoppable global currency.

Alex Gladstein

In addition, the profitable gridless concept of off-grid mining and the bank-independent use of Bitcoin through services like Machankura continue to drive decentralization and the strengthening of the Bitcoin network.

Conclusion

In Kenya with Gridless and Bitcoin DADA two projects that benefit not only the people of Africa, but also the entire Bitcoin network.

The energy concept of Gridless uses Bitcoin mining to supply numerous people with electricity, monetize surplus energy and thus eliminate energy waste. This is how Gridless has shown that Bitcoin mining directly helps people and is essential for energy companies to prevent energy waste. To ensure that the Bitcoin proceeds can be used by all African citizens, the Bitcoin DADA faces the challenge of increasing the proportion of women in the male-dominated community and creating educational opportunities that teach people how to use Bitcoin without a bank account or internet access, thus enabling financial independence.

As soon as African governments recognize the added value of the energy concept and financial independence for themselves and perceive Bitcoin as a tool with which they are able to convert Africa's valuable energy sources into hard cash and become more financially sovereign, then perhaps dependence on foreign countries can also be broken.

At the same time, the Bitcoin network would become even stronger through the increasing decentralization of mining activities and thus the hashrate and further adoption. The activities surrounding Bitcoin in Kenya therefore show that Bitcoin and Africa can benefit from each other. This win-win situation should also be an inspiration for other countries.