Bitcoin: institutional adoption stronger than expected

The positive news about Bitcoin has been overwhelming this week. Alongside several other major financial service providers, the first pension fund from the US has invested in Bitcoin spot ETFs. In addition, the market's positive perception of inflation figures has made it more likely that the US Federal Reserve will cut interest rates in the near future.

In the wake of these reports, inflows into Bitcoin spot ETFs picked up again and the Bitcoin price rose to over USD 66,000. This means that Bitcoin is now only around ten percent away from the all-time high of USD 73,800 set in mid-March.

Institutional interest is surprisingly high

By May 15, financial service providers with over $100 million in securities traded in the US had to disclose what positions they held at the end of the first quarter of this year. As the Bitcoin spot ETFs celebrated their first day of trading in the United States on January 11, it was the first time the new investment products could appear in the so-called 13F filings.

The news was quite something: the State of Wisconsin Investment Board (SWIB) was the first US pension fund to invest in Bitcoin spot ETFs - Blocktrainer.de reported. The tenth-largest pension fund in the US announced in the filing that it held USD 163 million in Bitcoin ETFs as of March 31. Although these positions only accounted for 0.1 percent of the total portfolio, the signal effect should not be underestimated.

Bloomberg ETF expert Eric Balchunas emphasized that this is a good sign, as institutions are moving in herds and more can now be expected.

Who bought the ETFs?

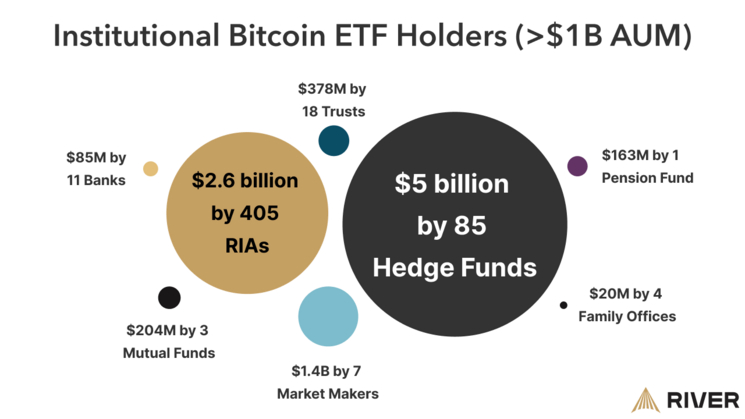

The majority of financial service providers with Bitcoin positions were investment advisors (RIAs). However, these generally invested smaller amounts in Bitcoin ETFs. The more speculative hedge funds reported significantly larger positions - although there were fewer companies overall with Bitcoin exposure on the reporting date.

However, the figures for hedge funds in particular should be treated with caution. As futures positions do not appear in the filings, it is possible that they only held the ETFs for a so-called basis trade. If hedge funds short Bitcoin futures and buy the spot ETFs at the same time, they can profit from the narrowing gap between the spot and futures price. This was very high at times in the first quarter.

A total of 405 RIAs and 85 hedge funds, each managing more than one billion US dollars in assets, held Bitcoin ETFs as at March 31. The 85 hedge funds held around USD 5 billion in Bitcoin ETFs, almost double the amount held by the RIAs.

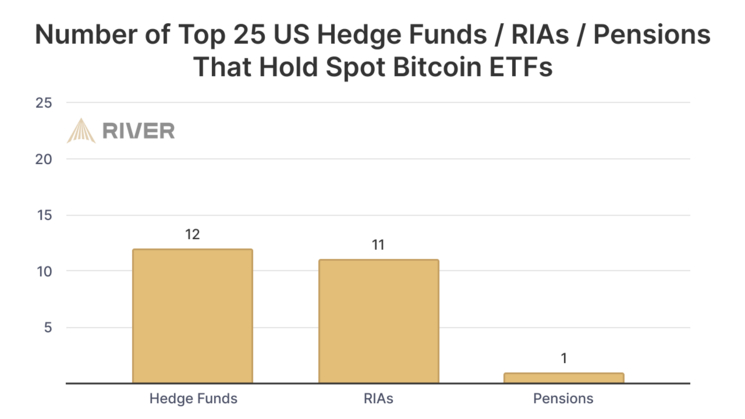

It is also interesting to note that 12 of the 25 largest hedge funds in the USA held Bitcoin ETFs. Together, these alone amounted to 2.6 billion US dollars.

Millennium Management in particular was responsible for the large sums invested by hedge funds. The New York-based company reported by far the largest position in Bitcoin ETFs shortly before the deadline. The hedge fund held around two billion US dollars in the new investment products on the reporting date.

The announcement caused a stir and also confirmed many market observers in their assumption that institutional interest in Bitcoin spot ETFs is high.

"It's only retail investors who are buying the #Bitcoin ETFs."

James Seyffart

Millennium is the king among Bitcoin ETF holders, with about $2 billion in four ETFs. That's among more than 500 holders (Millennium holds about 200 times the average for the ETFs). The majority are investment advisors (60%), but there are also a large number of hedge funds (25%). You can never be quite sure what hedge funds are up to with it, but they have definitely been big buyers.

Eric Balchunas

"It's only retail traders buying the #bitcoin ETFs " https://t.co/9KpVP0Z6pT-

James Seyffart (@JSeyff) May 15, 2024

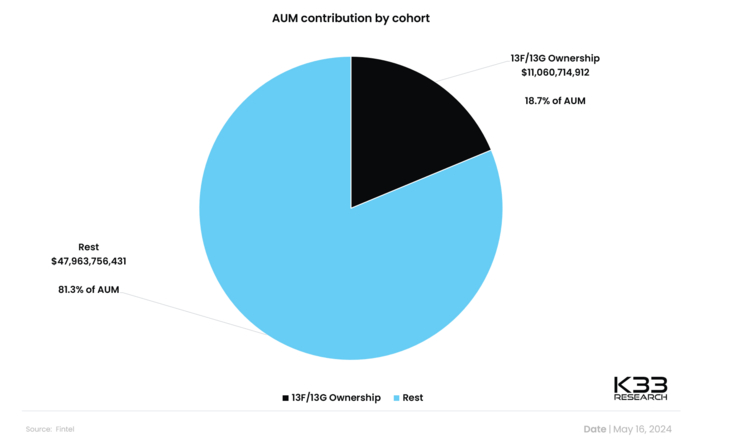

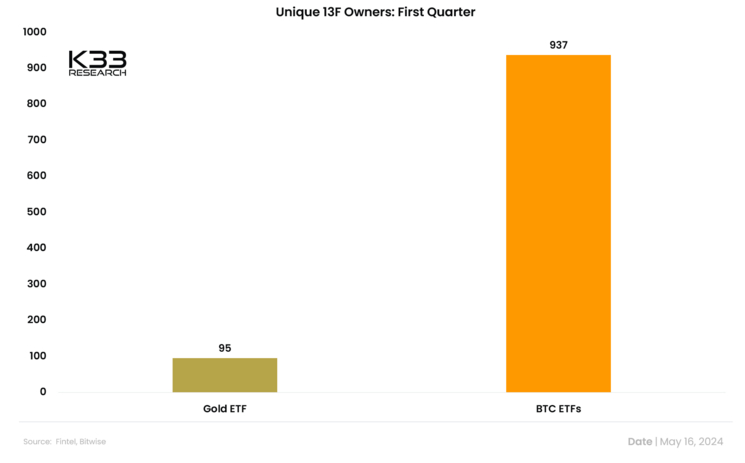

Overall, the 13F filings provided an interesting insight into the entities behind the strong inflows into the Bitcoin spot ETFs. The holdings reported in the filings account for almost 20 percent of the total investment volume of Bitcoin spot ETFs. It is also interesting to note that there were almost ten times as many financial service providers reporting Bitcoin ETF exposure than those who held gold ETFs at the end of the first quarter.

In general, many market observers were probably surprised that so many institutional investors had already invested in the investment products just a few weeks after they were launched. Other ETFs launched in January were only held by an average of around three to five financial service providers on the reporting date.

$IBIT had 414 reported holders in its first 13F season, which is insane and shatters the record. Even with 20 holders as a newly launched ETF, that would be a huge thing, very rare is such a thing. Here's a look at how the BTC ETFs compared to other ETFs from January (aka the class of 2024) in this metric.

Eric Balchunas

$IBIT ended up with 414 reported holders in its first 13F season, which is mind boggling, blows away record. Even having 20 holders as a newborn is bfd, highly rare. Here's a look at how the btc ETFs compare to other ETFs launched in Jan (aka the Class of 2024) in this metric. pic.twitter.com/ngicEdbaTq-

Eric Balchunas (@EricBalchunas) May 16, 2024

The CIO of Bitwise, an asset manager that has also launched a Bitcoin ETF, also categorized the results from the 13F filings as a positive surprise.

The 13Fs are filed for Q1 2024! The short version? Buy the institutions. Summary data:

* 944 firms with more than $100 million report ownership of Bitcoin ETFs.

* Collectively, they own $10.7 billion.

That's already a big hit and just a taste of what's to come.

Matt Hougan, CIO of Bitwise

US inflation data raises hopes of falling interest rates soon

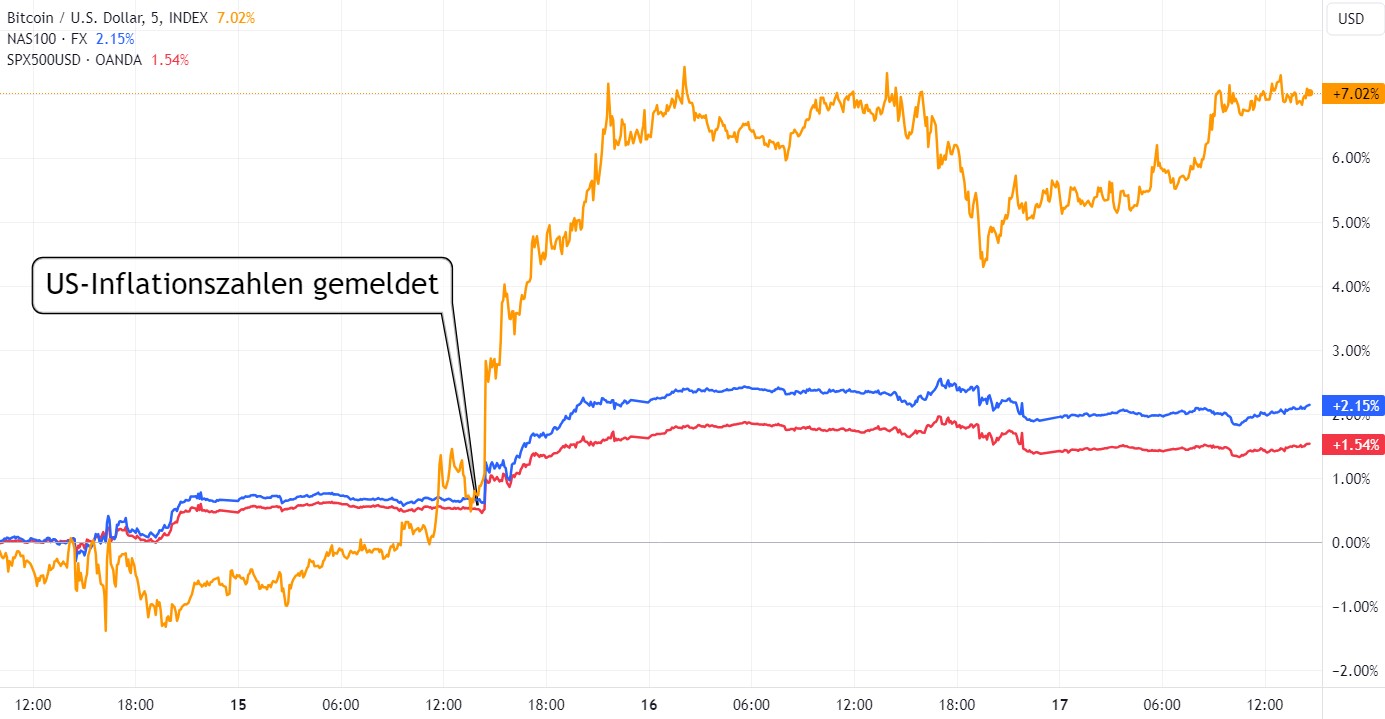

However, the 13F filings did not turn out to be the primary price driver this week. These were the inflation figures reported in the USA for April. At 3.4% year-on-year, consumer price inflation was in line with expectations, but at 0.3% the month-on-month rate of change was slightly below the expected 0.4% - Blocktrainer.de reported.

This was reason enough for the entire financial market to rise significantly on the day of the announcement. These figures catapulted the major US stock indices to new all-time highs. However, Bitcoin stood out with a gain of more than 7% on the trading day - even though the asset was still a good 10% away from new highs.

The reason for the positive market reaction to the inflation figures is that this has made interest rate cuts by the US Federal Reserve somewhat more likely in the near future. The vast majority of market participants currently expect the first interest rate cut at the US Federal Reserve meeting in September.

Bitcoin ETF inflows pick up speed again

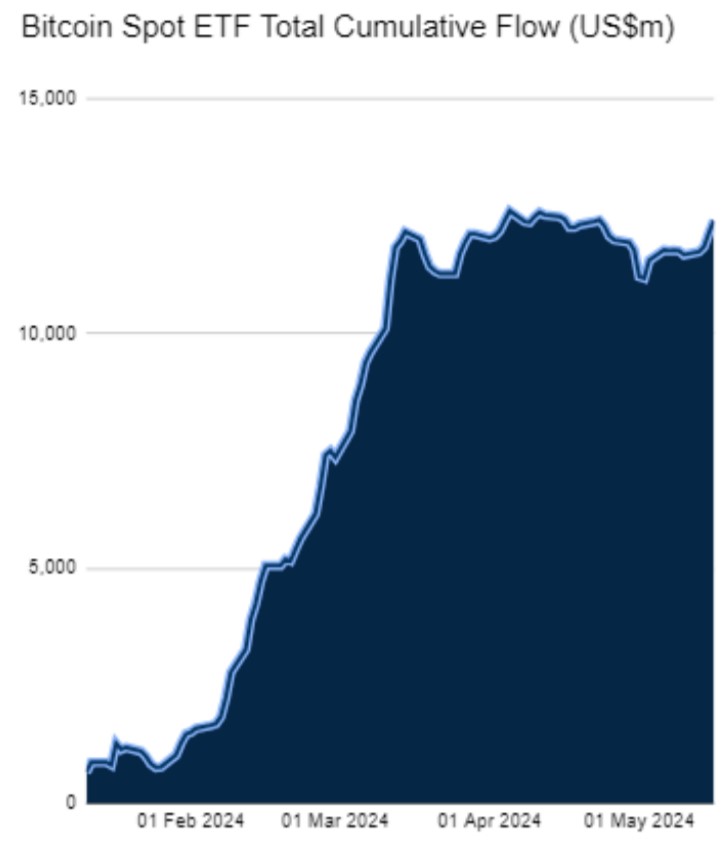

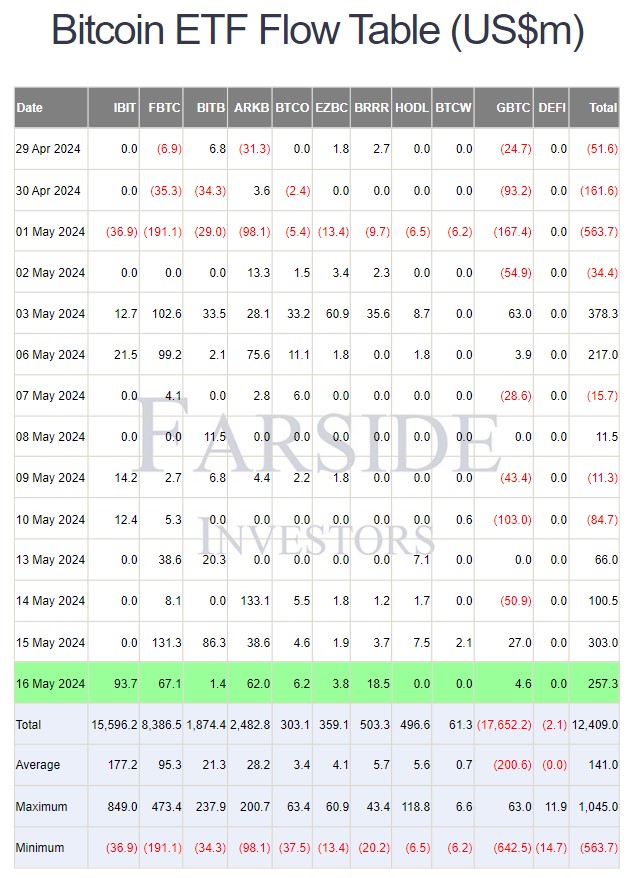

As part of the positive news, the wind also shifted for Bitcoin spot ETFs. In the first four trading days of the week alone, more than USD 725 million flowed into the investment products. The data thus paints a much more positive picture than the previous weeks, in which inflows stagnated and ETFs even saw a large outflow of BTC at times.

This week and last week, Bitcoin spot ETFs were able to fully compensate for the sometimes strong outflows in April and early May.

The Bitcoin ETFs have had two solid weeks with inflows of USD 1.3 billion, offsetting all the negative inflows in April and bringing them back near the peak of +USD 12.3 billion net since inception. This key number is important in my opinion as it balances inflows and outflows (which are normal).

Eric Balchunas

The bitcoin ETFs have put together a solid two weeks with $1.3b in inflows, which offsets the entirety of the negative flows in April- putting them back around high water mark of +$12.3b net since launch. This key number IMO bc it nets out inflows and outflows (which are normal) pic.twitter.com/tdnZOKEocM-

Eric Balchunas (@EricBalchunas) May 17, 2024

Big players meet limited supply

While institutional interest is picking up again and, according to some market observers, the big inflows are still to come, there is less and less Bitcoin available for quick sale on the exchanges. The long-lasting downward trend currently appears to be continuing - despite prices close to their all-time high.

In addition, since the fourth Bitcoin halving, which took place on April 20 this year, fewer new Bitcoin per block have been coming into circulation to meet the high demand. Sooner or later, this could - as was the case with the first three halvings - be reflected in a rising Bitcoin price.

Are big price gains still to come?

Meanwhile, retail investors do not yet appear to have returned to the market, as suggested by the low level of Google search interest and the trading volume of private individuals on the major crypto exchange Coinbase, which is still far below its highs - Blocktrainer.de reported.

It will be interesting to see whether institutional investors will rush into the limited asset even more in future, thereby driving up the price. And since high prices usually attract retail investors, this could further reinforce the price-driving effects.

The fact that retail investors are currently more willing to invest again was demonstrated by the renewed hype surrounding the GameStop share when Keith Gill returned to 𝕏 at the beginning of the week. Gill, known as "Roaring Kitty", is considered the main driver of the stock's short squeeze in early 2021.

And since after the first GameStop hype, during which the share could only be sold but not bought at its peak on the stock exchanges, some private investors apparently moved to the decentralized Bitcoin market out of displeasure with the financial system, market observers expect that this could happen again this year.

One indication of this would be the controversial influencer Andrew Tate. At the beginning of the week, he told his millions of followers that he was now also using GameStop to wipe out the financial system. When trading in the security was suspended several times by the exchanges, the former kickboxer announced that he was now going "all in" on Bitcoin and turning his back on the financial system.

I know I'm not supposed to do this in chaotic times but I'm about to leave fiat completely and ape over 100M into btc.

" - Andrew Tate (@Cobratate) May 15, 2024

And I'll even prove I did it.

I'm done with the banks.

I'm done with their money.

Done with the scams.

Then I'm going boating.

It remains to be seen whether the past will repeat itself and private investors will rush back into Bitcoin in the near future.

In general, however, the investment environment is only likely to get better in the coming months. Meanwhile, with the upcoming US presidential election, it is unlikely that the US central bank will stifle the capital markets with a restrictive monetary policy. And since Bitcoin as an asset has benefited greatly from low interest rates in the past, this could give the Bitcoin price an additional boost.