Bitcoin is good for everyone - game theory unfolds

Bitcoin is increasingly moving to the center of society. Exchange-traded Bitcoin funds from the world's largest asset managers have been available to buy on the most relevant capital markets for a few months now. At the same time, Satoshi Nakamoto's creation is taking up more and more space in political debates and Bitcoin is even currently in the spotlight in the election campaign for the next US president. Not only politicians and private investors are realizing that they can benefit from Bitcoin, but countries and a large number of companies are already actively investing in the asset.

In view of the current developments, has the threshold now finally been crossed so that Bitcoin can no longer be ignored and, in the sense of the often used game theory, it is now only a question of who discovers Bitcoin first and profits the most?

The game theory behind Bitcoin

The term game theory is often used in the context of Bitcoin adoption. This refers to the analysis of the successive decision-making processes of actors. In relation to Bitcoin, it is often said that sooner or later everyone will bet on Bitcoin because one day they will realize that Bitcoin will not disappear and it will therefore be best to get on board as quickly as possible.

This applies to Bitcoin as an investment on the one hand, but also as a political issue on the other. If the spread of Bitcoin continues to increase, then it would make sense to stock up on the asset, which is limited to 21 million units, as early as possible. At the same time, however, it is also a danger for institutions to stand in the way of an unstoppable spread. After all, people will remember who has approached the issue intellectually honestly and who has tried to make adoption more difficult - whether out of malice or ignorance.

Even for states or companies that currently benefit from the mechanisms of unbacked fiat money, the theory is that one day the time will come when it will cost them more to oppose Bitcoin than to defend the old system. As more and more entities are currently making use of Bitcoin, the question arises as to whether this threshold could be slowly being crossed in more and more areas.

Bitcoin becomes a political issue

The first time that Bitcoin became an election issue this year was when the South Korean parliamentary elections were held. The democratic Minju party promised to campaign for the approval of Bitcoin spot ETFs - Blocktrainer.de reported. Surprisingly, Minju was able to win the majority of votes and has already called on the regulators to review the matter. It remains to be seen whether ETFs will actually become tradable in the Republic, where many people have a positive attitude towards Bitcoin and cryptocurrencies.

In light of the upcoming US presidential elections, Bitcoin has now also moved to center stage. After the Biden administration announced that it would veto a resolution for more crypto-friendly banking regulation, causing displeasure among politicians and the Bitcoin community, Trump suddenly turned to Bitcoin and Co. in his election campaign - Blocktrainer.de reported.

The ex-president criticized the Biden administration for its anti-crypto stance and emphasized that with him as president, the industry would remain in the country. Shortly afterwards, Trump accepted cryptocurrencies for campaign donations and declared that he would build a "crypto army" to fight Bitcoin critics such as Senator Elizabeth Warren and Co.

Trump went even further and promised to free the founder of darknet marketplace Silk Road, Ross Ulbricht, from prison, which earned him great approval from the Bitcoin community. At Silk Road, Bitcoin was the exclusive means of payment and thus the trading center for drugs and the like represented the first major use case of Bitcoin as a money for free markets.

One of the ex-president's campaign aides is David Bailye, CEO of the Bitcoin news portal Bitcoin Magazine. On 𝕏 Bailey shared that Trump said he wanted to add several trillion US dollars in market capitalization to Bitcoin, which would mean a multiple increase in the Bitcoin price. In an audio discussion on 𝕏 last Sunday, the CEO of Bitcoin Magazine also reportedly said that Trump had asked him whether the US could solve its national debt problem with Bitcoin.

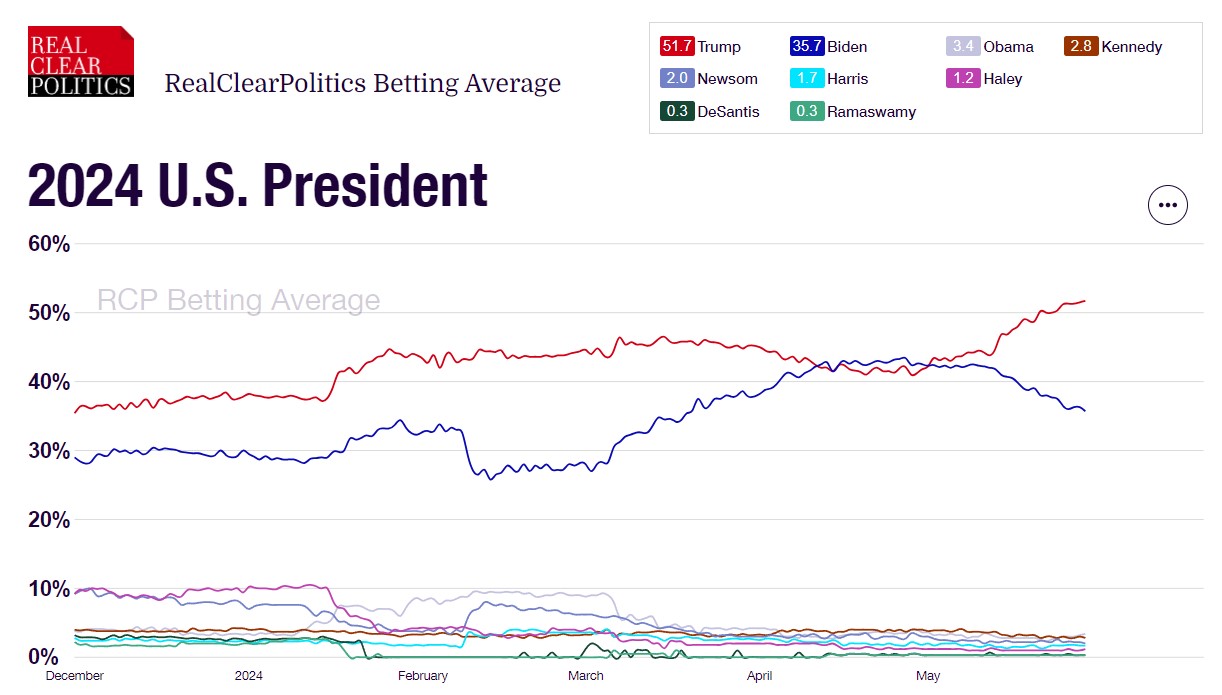

As part of Trump's "pro-Bitcoin election campaign", which has been gaining momentum since the beginning of May, the likelihood of him becoming the next US president has increased significantly. This while the 77-year-old has repeatedly attacked the current president for harming the crypto industry.

I am very positive and open-minded about cryptocurrency companies and everything to do with this new and emerging industry. Our country needs to be a leader in this area. There is no second place. Corrupt Joe Biden, on the other hand, the worst president in our country's history, wants cryptocurrencies to die a slow and painful death. It won't happen with me!

Donald Trump on the short message platform Truth Social on 25.05.2024

President Biden now also seems to be aware that Bitcoin and cryptocurrencies could be decisive in the election. Accordingly, he is approaching the sector somewhat more favorably. In response to the crypto-friendly FIT21 bill that passed the US House of Representatives last week, the Biden administration emphasized that it is open to creating an appropriate framework for the crypto sector.

The administration looks forward to continuing to work with Congress to craft digital asset legislation that includes appropriate guardrails for consumers and investors while creating the necessary conditions for innovation, and more time will be needed for this collaboration.

From the statement

According to speculation, the Biden administration has also put pressure on the US Securities and Exchange Commission (SEC) to allow Ethereum spot ETFs so that the current administration doesn't get caught in the crossfire for taking an anti-crypto stance. There has also been recent news that Biden's team is currently proactively reaching out to the crypto industry for advice on appropriate policy and community engagement - Blocktrainer.de reported.

According to a recent survey by market research institute The Harris Poll and crypto asset manager Grayscale, a third of US voters now care about a presidential candidate's position on cryptocurrencies. 37% of those surveyed also stated that they are paying more attention to positions on cryptocurrencies in the upcoming US presidential election in November than in previous elections. One in two are also more likely to vote for a candidate if they are adequately informed about cryptocurrencies.

In Germany, meanwhile, Bitcoin is still barely part of political debates. Although the AfD has submitted a minor question to the federal government on the subject, no relevant party in Germany has really championed Bitcoin to date. The fact that Germany is clearly lagging behind in this respect is also evident from the answer to the minor interpellation. It states that Bitcoin is not suitable as a means of payment or store of value due to its high volatility and that the German government is critical of energy consumption - arguments that suggest ignorance or bias with regard to the most relevant cryptocurrency.

Wave of adoption by nation states could be imminent

Meanwhile, things are looking much better in other countries. El Salvador, the country in which Bitcoin has been legal tender since September 2021, has since been making mostly positive headlines. Not only because the Central American country has made several million US dollars in profit from its investment, but also because it has become a more popular tourist destination and generally much safer.

The positive developments have probably not gone unnoticed by other countries. A few days ago, for example, representatives of the National Securities Commission of Argentina (CNV) met with representatives of the National Commission for Digital Assets of El Salvador (CNAD). The exchange focused on the use and regulation of Bitcoin - Blocktrainer.de reported.

It remains to be seen whether another country, Argentina, will soon follow El Salvador. However, the country led by Nayib Bukele is demonstrating to the whole world that introducing Bitcoin as a means of payment can have advantages in terms of self-determination and make a country a more popular tourist destination. For emerging markets in particular, relying on Bitcoin could currently be an interesting strategy.

Industrialized nations, meanwhile, generally seem to be hardly considering the option of Bitcoin as an official means of payment. Countries such as El Salvador could therefore benefit all the more from Bitcoin adoption, provided the asset continues to gain acceptance. The White House announced a delegation trip to El Salvador yesterday. It remains to be seen whether the Biden administration will learn something from El Salvador's Bitcoin strategy at national level. So far, the debates in the USA have mainly revolved around Bitcoin as an investment and not its function as a means of payment.

Companies are increasingly relying on Bitcoin

When the US software company MicroStrategy was the first public company to start using the Bitcoin strategy in August 2020, some thought that things would really take off now and others would follow. In fact, the well-known payment service provider Block and then car manufacturer Testa followed in the footsteps of the company founded by Michael Saylor. However, the really big wave of company adoption has yet to materialize.

However, with the sharp rise in the price of Bitcoin in recent months, something seems to be happening again on this front. At the beginning of May, Block announced that it had been running a monthly Bitcoin savings plan with a portion of the company's profits since April. At the same time, smaller companies are realizing that they can benefit from Bitcoin. For example, the Japanese public limited company Metaplanet, which announced around two months ago that it was now focusing on a Bitcoin strategy. Metaplanet's share price has tripled since then and the company has continued to buy. However, with a market capitalization of just over 50 million US dollars, Metaplanet is still an insignificant company.

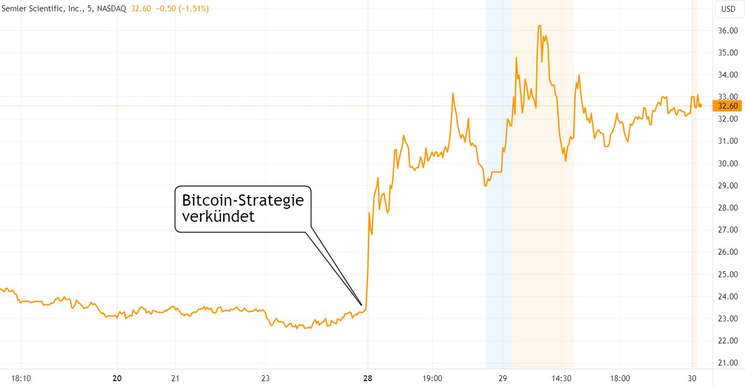

However, Semler Scientific, a US listed company, has now done the same. On Tuesday, the public company announced that it had purchased Bitcoin for USD 40 million and is now strategically focusing on the asset.

Our Bitcoin treasury strategy and the purchase of Bitcoin underscore our belief that Bitcoin is a reliable store of value and a compelling investment.

Eric Semler, Chairman of Semler Scientific

The market value of the company, which is only worth around 200 million US dollars, has increased by more than a third since then.

$SMLR announces corporate #bitcoin standard:

-$160m market cap, $40m $BTC purchased

-

In two days of trading:+39%, +$64m market cap

-Volume 17.5x above 1-year average

- Dylan LeClair 🟠 (@DylanLeClair_) May 29, 2024

Probably nothing.

Even though only very small companies besides MicroStrategy, Block and Tesla have currently invested in Bitcoin, a small trend can be seen again at the moment. The fact that not only MicroStrategy, but also Semler Scientific and Metaplanet have already been able to significantly increase in value through the Bitcoin strategy could prompt other companies to also consider buying Bitcoin.

Bitcoin adoption picks up speed

Even if Bitcoin is still a long way from being the world's money, there is a clear trend towards broader adoption. It is also positive that Bitcoin is not only perceived as an investment by more and more companies or even asset managers such as a US pension fund, but also that Bitcoin is being used in developing countries as a tool for self-empowerment - for example in remote regions in Peru.

With more and more entities relying on Bitcoin or positioning themselves positively towards Satoshi Nakamoto's creation, the pressure on their competitors is increasing. And it is all the more credible to stand up for Bitcoin at an early stage and not just when the pressure from society becomes too great. Because then, too many people will justifiably suspect that the driving force is not genuine conviction, but merely opportunism.

It remains to be seen whether Bitcoin adoption will increase even more than it already has now that the asset is becoming more mainstream. At the moment, however, it looks as if the Bitcoin community's well-known motto "gradually, then suddenly" actually describes the reality.