The Bitcoin price fell below the USD 60,000 mark today before the start of trading in the US. Bitcoin is thus continuing the correction of recent weeks. So far, however, it has not yet fallen below the low of Monday last week, the day on which the imminent payout of around 142,000 BTC by Mt.Gox was announced.

Where the sales pressure comes from

Although the news surrounding Bitcoin is currently rather positive, the selling volume is currently significantly higher than the buying demand, which is causing prices to fall. This is probably partly due to the Bitcoin, which has been paid out step by step to the damaged customers of Mt.Gox since the beginning of this month. The Japanese Bitcoin exchange collapsed in 2014 after several hacks, but was able to recover some Bitcoin over time to compensate the platform's users at the time - Blocktrainer.de reported.

As the price of Bitcoin has increased roughly a hundredfold since the fall of Mt.Gox, some market participants assume that those who were forced to become steel hodlers as a result of Mt.Gox's collapse will sell off most of their holdings. This is why the Bitcoin price plummeted by several percent last Monday in response to the news of the imminent redemption.

However, it appears that the impending sell-off was not yet fully priced in. Since July 1, the Bitcoin price has already fallen by more than 4%, continuing its downward trend.

At the same time, Saxon authorities are regularly transferring the Bitcoin they received as part of the arrest of the operators of the illegal streaming service Movie2k to crypto exchanges - apparently in order to sell them. There are still over 40,000 BTC in the possession of the German government, which could possibly come onto the market in addition to the coins from Mt.Gox in the coming days and weeks.

The US government also sent 3,375 Bitcoin worth almost 250 million US dollars to the Coinbase exchange a week ago. This could also have been a reason for the falling Bitcoin price. In total, the US government still holds around 213,000 BTC.

The 142,000 BTC from Mt.Gox alone account for more than half of the approximately 250,000 BTC that the Bitcoin spot ETFs have collected since their approval in January. If large quantities of Bitcoin from the USA or Germany were to be added to this, this could represent a significant headwind for the Bitcoin price.

ETFs not responsible for the recent price slide

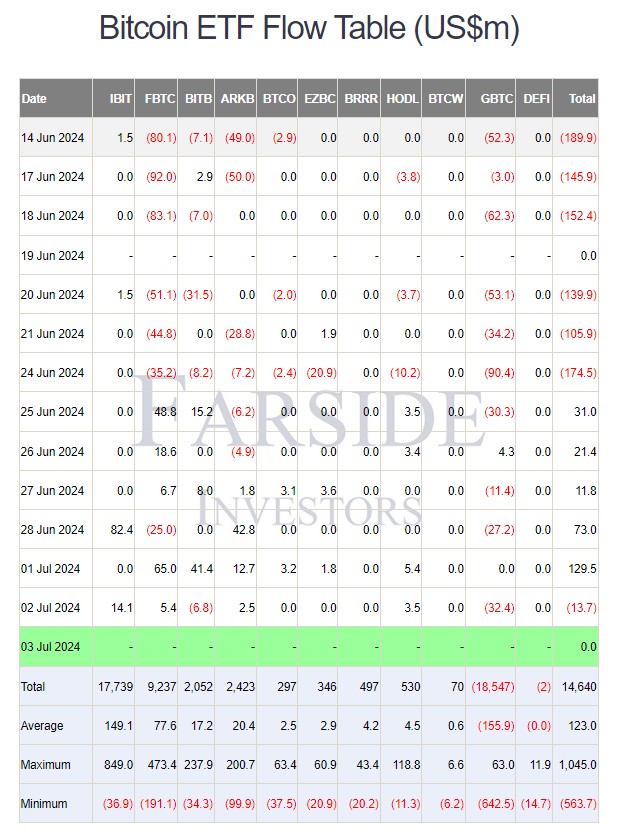

The fact that the sell-off so far is probably due to the sell-off of Mt.Gox coins as well as that of Germany and the US is also supported by the fact that the US Bitcoin spot ETFs are currently back in the black for the most part. In the weeks and months before, ETF inflows correlated strongly with the Bitcoin price. Now, however, the investment products have soaked up a total of USD 253 million in Bitcoin since June 25, while the Bitcoin price is falling. Only yesterday has there been a day with outflows since then - but only in the amount of USD 13.7 million.

In addition to the inflows into the investment products, the trading volume has also generally weakened significantly. This means that Bitcoin ETFs are currently attracting fewer active investors. The generally low level of interest in Bitcoin at the moment, which can also be observed in Google searches, is therefore also reflected in the lower trading activity in Bitcoin spot ETFs.

US #Bitcoin ETF flows have mostly stagnated. Not seeing tons of inflows, not seeing tons of outflows. Net inflows since launch sits at very healthy $14.7 billion

James Seyffart (@JSeyff) July 2, 2024

BUT the trading volume for the group is definitely on a downtrend. The group hasn't hit $3 billion since mid May pic.twitter.com/SDkoE2Lqyf-

Sell-of will come to an end

The good thing about one-off factors such as the sell-off by the Mt.Gox coins is that the Bitcoin has subsequently been distributed in the market and potential imminent selling pressure no longer hangs over the market like the sword of Damocles. This means that there could be a big sigh of relief once the Bitcoin has all hit the market.

As there are currently no fundamental reasons for the price weakness, the correction resulting from the one-off sell-off could turn out to be an attractive entry opportunity - even if prices could of course fall further.

It will be interesting to see what price level the selling pressure will drag Bitcoin down to or whether the buying demand will be high enough to largely cushion the additional coins sold. In particular, however, it remains to be seen when and to what extent the possible subsequent recovery will take place.