Bitcoin: the world's new reserve asset?

US dollar under increasing pressure

The US dollar continues to lose support, emerging markets are increasingly turning away from the global currency and even the US Federal Reserve is now recognizing this. Meanwhile, interest in Bitcoin is growing globally. But is Bitcoin really just a competitor to the US dollar or is Satoshi Nakamoto's creation much bigger than that?

Emerging markets divest themselves of US government bonds

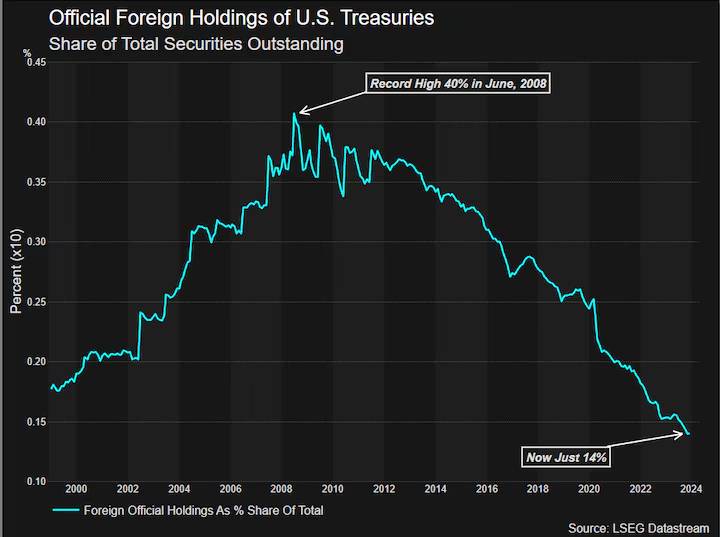

Since the global financial crisis in 2008, a new trend has set in - some emerging markets are increasingly selling their US dollar reserves in the form of US government bonds. In 2008, 40 percent of US government bonds were still held by foreign central banks, compared to just 25 percent before the pandemic. As part of the US sanctions against Russia and the money printing orgies in response to the coronavirus lockdowns, the downward trend intensified, so that at the beginning of this year only around 14% of the world power's debt securities were held by central banks of other countries.

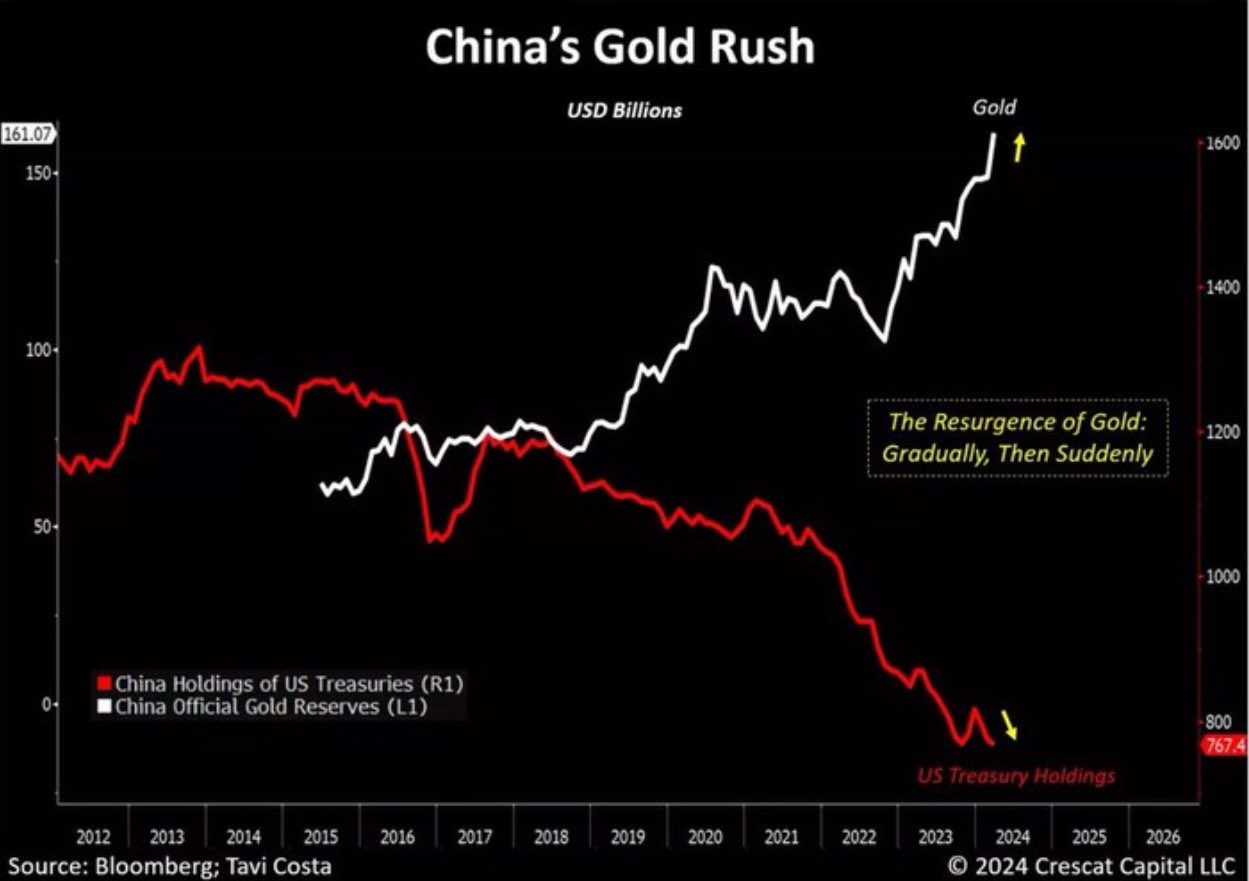

China is at the forefront of this trend. While the People's Republic is selling US government bonds at a record pace, the Bank of China is acting as a major buyer of the precious metal gold. According to the renowned analysts at Crescat Capital, this is just the beginning of a trend that is set to continue.

While the European Central Bank, the Bank of Japan and other close allies of the US still hold substantial holdings of government bonds, China, which was once the US's most important lender, has clearly shifted its focus to gold as its most important asset. In our view, this transition is just the beginning.

Crescat Capital

China was once the largest holder of US government bonds. Today, this is Japan, but the East Asian country is increasingly confronted with a devaluation of its national currency against the US dollar, which is why the Bank of Japan is intervening more and more frequently on the currency markets and buying back the yen with its US dollar reserves.

In the years before the start of the Ukraine war, Russia, like China at present, had sold US government bonds and bought gold - presumably in anticipation of the sanctions.

In 2022, rumors emerged that the BRICS nations - Brazil, Russia, India, China and South Africa - would introduce their own gold-backed currency for trade among themselves. This was announced by high-ranking leaders of the countries in the grouping.

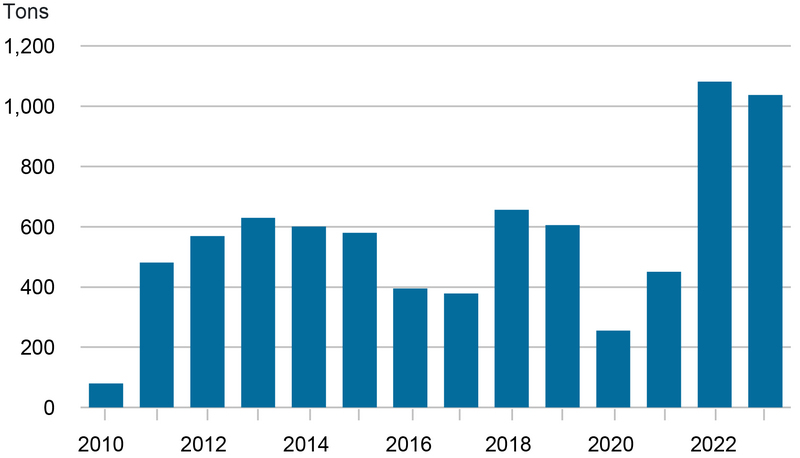

In view of the Western sanctions against Russia, under which around 300 billion US dollars in US dollar reserves were frozen, the emerging markets appear to be increasingly seeking to position themselves independently. In general, a significant increase in gold purchases by central banks can also be seen since then. In the past two years alone, central banks have bought over 1,000 tons of the precious metal.

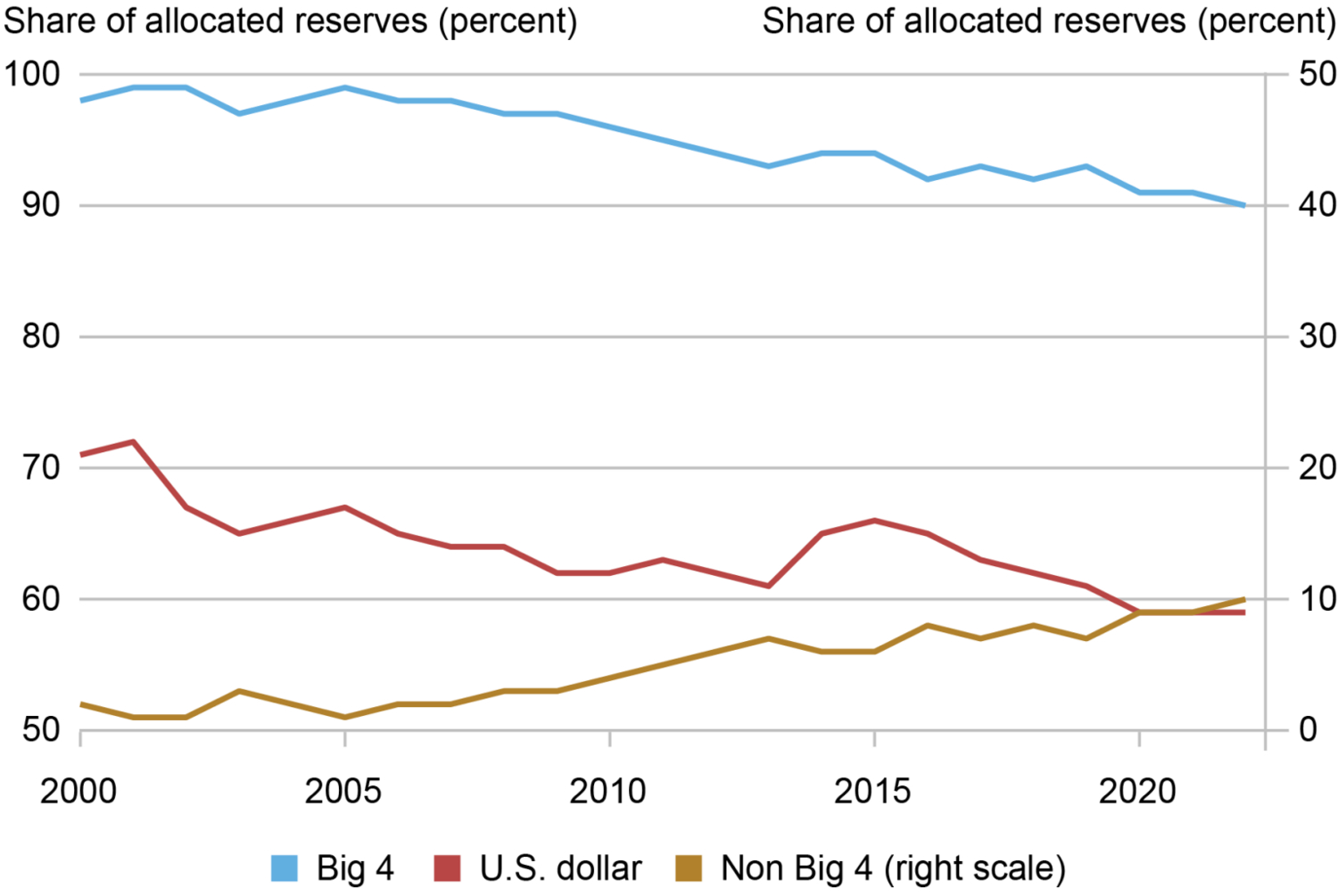

Even if the idea of a gold-backed trading currency for the BRICS nations seems to have been discarded for the time being, a paradigm shift in the global monetary system is on the horizon: Over the past 20 years, the US dollar's share of global currency reserves has steadily declined - from over 70 percent to under 60 percent. Meanwhile, the share of the smaller currencies - i.e. all currencies apart from the US dollar, euro, yen and pound sterling - has risen from almost zero to 10 percent.

The US central bank itself now recognizes this development. The Federal Reserve Bank of New York published an article a few days ago in which it attempts to appease the situation. Among other things, the authors of the New York Fed explain that the declining demand for US dollars is only attributable to "a small group of countries".

This statement caused a smile in the Bitcoin community. Balaji Srinivasan, the former CTO of the major crypto exchange Coinbase, commented on the article on the 𝕏 platform that the monetary authorities wanted to portray China, India, Russia and Turkey as insignificant.

The Fed now admits some countries are moving to gold. But says it's a small group.

Balaji (@balajis) May 30, 2024

🇨🇳 China: 1.4B

🇮🇳 India: 1.4B

🇷🇺 Russia: 144M

🇹🇷 Turkey: 85M

That "small group" represents 3B people. So 37.5% of the world is moving away from dollars towards gold. https://t.co/mx7QFjESCs pic.twitter.com/cDbl1KqZgR-

Bitcoin: the better reserve asset?

Meanwhile, the major central banks do not yet seem to have Bitcoin on their radar, although there are good reasons to rely on the digital alternative instead of the precious metal. Although there are already nations such as El Salvador and the Kingdom of Bhutan that accumulate Bitcoin for themselves, these countries still hardly play a role on the global stage.

Michael Saylor, the founder of MicroStrategy, the first listed company to back Bitcoin, believes that gold is a waste of time in the context of central banks as a reserve asset and that the money guardians are more concerned with the signal effect of their purchases. Saylor explains in a recent interview that gold failed as a reserve currency more than a century ago.

Gold collapsed as a reserve currency before the First World War. On the eve of the First World War, when all these nations declared war, every single one of them went off the gold standard.

Michael Saylor in an interview

He adds that for an effective reserve asset, it is essential that transactions can be settled from entity to entity in real time and gold is clearly inferior to Bitcoin in this respect.

The MicroStrategy founder also cites the higher inflation rate of gold as an argument against gold and in favor of Bitcoin. With an average inflation rate or annual increase in quantity of 2 percent, gold holdings double approximately every 30 years. Bitcoin, on the other hand, is limited to a maximum quantity, which means that the half-life is ultimately infinite and not 30 years, as is the case with the precious metal, explains Saylor.

Bitcoin is the fix for gold. Gold itself is just a flawed reserve asset because it is too slow and too inflationary.

Michael Saylor in an interview

Due to Bitcoin's independence and resistance to censorship, a scientific paper by Matthew Ferranti from Harvard University also came to the conclusion a few months ago that it would make sense for central banks to include Bitcoin as a reserve asset - especially if they see countries facing the threat of sanctions. Ferranti is the economic advisor to Ken Rogoff, former economist at the International Monetary Fund (IMF) and the Federal Reserve.

Can Bitcoin solve the currency problems?

Asked by the interviewer about Japan's precarious situation, Michael Saylor makes it clear that Bitcoin can also be a way out for countries with collapsing currencies.

The first country to print money to buy Bitcoin wins.

Michael Saylor in an interview

With a national debt of around 260 percent, Japan is the most indebted country in the world. At the same time, the Japanese yen is in free fall against the US dollar, but the Bank of Japan is finding it difficult to raise interest rates to harden the yen, as this would only further escalate the national debt.

If they are smart, they spend 20 billion US dollars worth of yen and buy 20 billion US dollars worth of Bitcoin. When they publish the press release, the Bitcoin price triples and they would have 60 billion US dollars in the reserve asset, which increases in value by 30 percent per year.

Michael Saylor in an interview

Saylor recognizes, however, that Japan is probably too big an economy at the moment to take this bold step. For him, it would make most sense for countries like Turkey, which are somewhat smaller but also have a currency that they issue themselves.

With El Salvador, there is already a country that actively uses Bitcoin, but since the country led by Nayib Bukele does not have its own currency, it is inferior to other countries in this respect, according to Saylor.

El Salvador does not have its own currency. That's why I said the first country that can print its own currency and buy Bitcoin wins. You have to be able to spend ten billion dollars of your own currency and exchange it for ten billion dollars in Bitcoin and have the Bitcoin gain 30 percent a year in value. And that's exactly how a reserve asset should work because then everybody gets in there.

Michael Saylor in an interview

Isn't Bitcoin more than just a reserve asset?

As Bitcoin is also often referred to as a cryptocurrency and for many represents an alternative to the euro, US dollar and yen per se, the question arises as to whether Bitcoin itself can simply become the world's money and thus prevent the continued existence of state currencies that keep collapsing and causing endless suffering among the population. Whether and when Bitcoin will establish itself as global money is a frequently debated topic in the community.

However, Michael Saylor believes that governments - especially the strong ones - will always issue their own currencies and declare them as legal tender. But that does not mean that Bitcoin is not or cannot be money.

What is money? A classical economist says money is a medium of exchange, a unit of account, a store of value - and then he stops to think. So, it turns out that in Argentina the medium of exchange is the peso, the unit of account is the US dollar, the store of value is neither. No intelligent person in the US thinks that the US dollar is a store of value.

Michael Saylor in an interview

According to Saylor, people will continue to use local currency as a means of payment, the global currency as a unit of account and hard assets such as Bitcoin as a store of value. Bitcoin is therefore more likely to take on the role of an effective store of value or reserve asset - especially at an individual level.

Chamath Palihapitiya, a well-known venture capitalist in the US, also recently commented on this topic. Palihapitiya also predicts that Bitcoin will be used as an asset or money alongside local currencies and he recognizes that this is already increasingly the case.

There are more and more countries that will introduce a dual currency system. They will look at their local currency and they will look at Bitcoin. And they will say that both things are needed. The former, if they're buying goods and services on a daily basis, and the latter, if they want to buy a durable asset that has to have a durable value, they'll buy Bitcoin for that. I think that's a very powerful concept. [...] If [Bitcoin] gains so much traction, it will completely replace gold and become a hard asset with transaction capability.

Chamath Palihapitiya in a podcast

Is Bitcoin not the world's money after all?

With Michael Saylor, it often shines through that he does not believe in Bitcoin as the world's money. But this could just be for tactical reasons. At the beginning of the interview, Saylor also explains that it is not useful to call Bitcoin a digital currency, as this could cause influential people to perceive Bitcoin as a threat.

So if you think it's a digital currency [...] then the implication is that we're going to replace a nation's currency, be it the US dollar, the euro, the yen or the yuan, with Bitcoin. Then every establishment politician, most bankers and most economists will fight it. The politicians will oppose it because no one wants to see the US dollar collapse as it is a source of US strength and probably earns the US trillions of dollars a year.

Michael Saylor in an interview

So it could be a strategy not to promote Bitcoin as a competitor to the major currencies, but simply as a digital store of value that benefits everyone. But once Bitcoin has established itself as an asset, enjoys sufficient trust and is therefore no longer subject to such strong fluctuations, then it won't be long before people simply switch directly to Bitcoin as money. Bitcoin is superior to traditional currencies in many respects, such as its resistance to censorship. By the time this happens, the infrastructure around Bitcoin could also have developed to the point where it works perfectly for everyone - for example via second-layer technologies such as the Lightning Network - to use Bitcoin for even the smallest payments.

Currencies currently only account for around 120 trillion US dollars worldwide. The markets for real estate and bonds are each around three times the size of the currency market. Accordingly, from an investment perspective, it is not at all negative if Bitcoin is not classified as digital money, but as a digital store of value. According to Saylor, the potential market for digital property or digital capital, which in his opinion most accurately describes Bitcoin, is around 100 to 400 trillion US dollars. Accordingly, the MicroStrategy founder considers a market capitalization of 100 to 400 times the current value to be appropriate.

What is Bitcoin? It is digital capital. How big is the addressable market for digital capital? Somewhere between 100 and 400 trillion US dollars. So, what is Bitcoin? It's a hundred to four hundred fold increase from here, once you understand what it is.

Michael Saylor in an interview

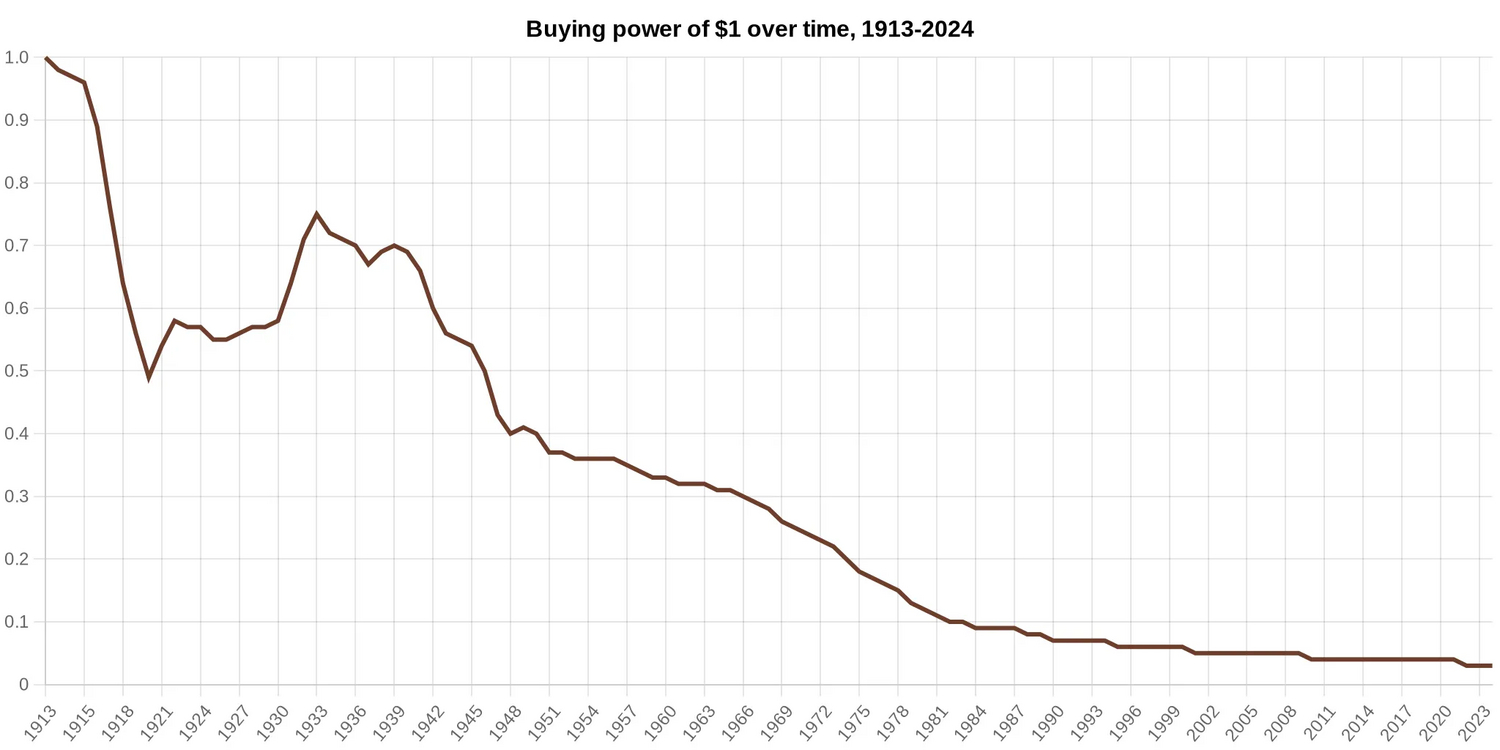

According to Saylor, it is also not necessarily likely that the US dollar will collapse. Rather, he sees a further steady decline in the purchasing power of the global currency, as has been the case over the past 100 years. Since the founding of the US central bank in 1913, the US dollar has lost around 97 percent of its value, whether you call that a collapse is in the eye of the beholder.

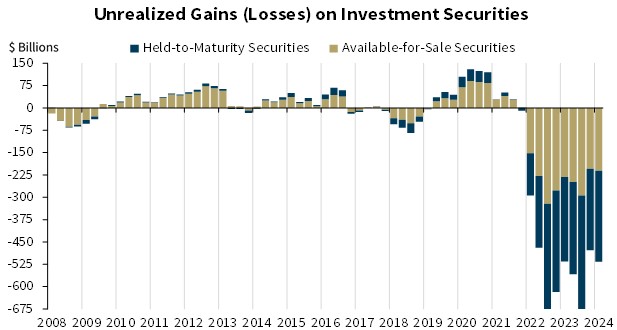

However, in view of the escalating national debt in the USA, which now accounts for around 120% of economic output, and the increasing loss of confidence in the global currency, an even greater fall in the value of the global currency is becoming more likely. The US banking sector is also under pressure at the moment. Financial institutions are still sitting on high unrealized losses due to the fall in prices of the supposedly safe bonds on their balance sheets. Just over a year ago, this problem led to some of the biggest bank failures in US history.

According to the FDIC, the Federal Deposit Insurance Corporation, the number of US banks at risk of collapse rose further in the first quarter, from 52 to 63. If the US banking system collapses and the Federal Reserve has to bail out the system again with freshly printed money - as in the 2008 financial crisis - this could further undermine the strength of the US dollar. Even if the US dollar is likely to remain an instrument of power for the USA for decades to come, it will be interesting to see whether the global currency continues to lose relevance and whether Bitcoin can establish itself as a better reserve asset or even as a global currency in the long term. Satoshi Nakamoto's creation certainly has the prerequisites for this.