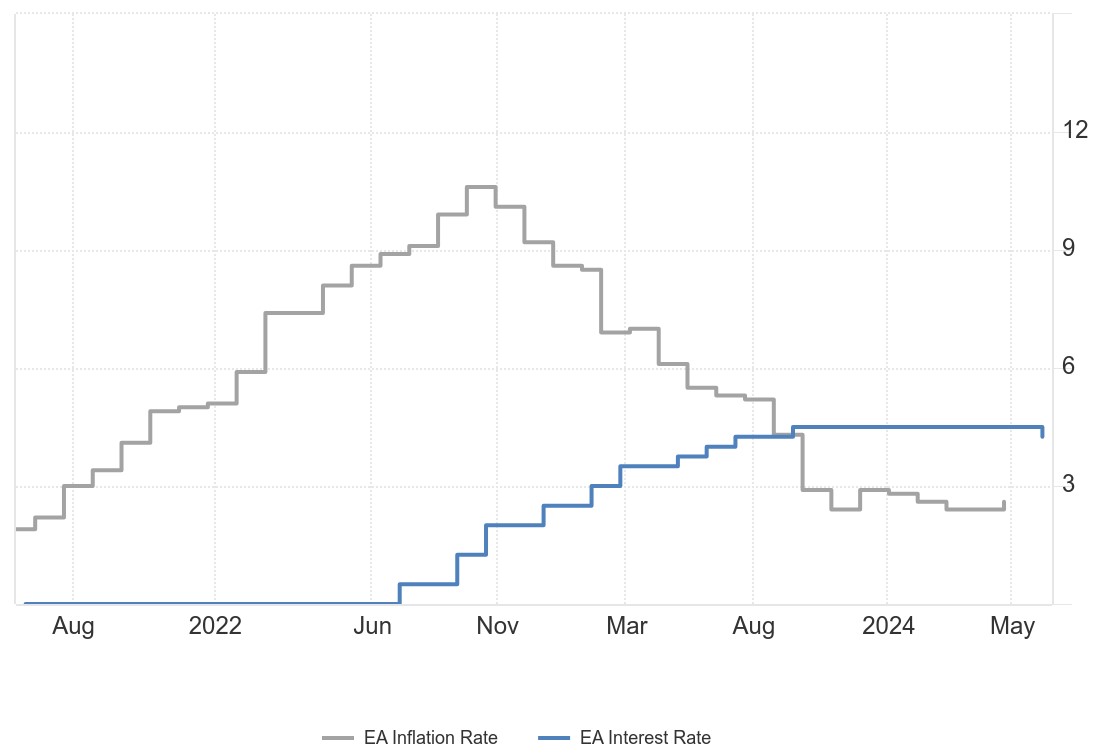

European Central Bank lowers key interest rate to 4.25 % despite high inflation

The European Central Bank (ECB) has just lowered its key interest rate from 4.5% to 4.25% - despite an inflation rate of 2.6% being reported for May in the eurozone.

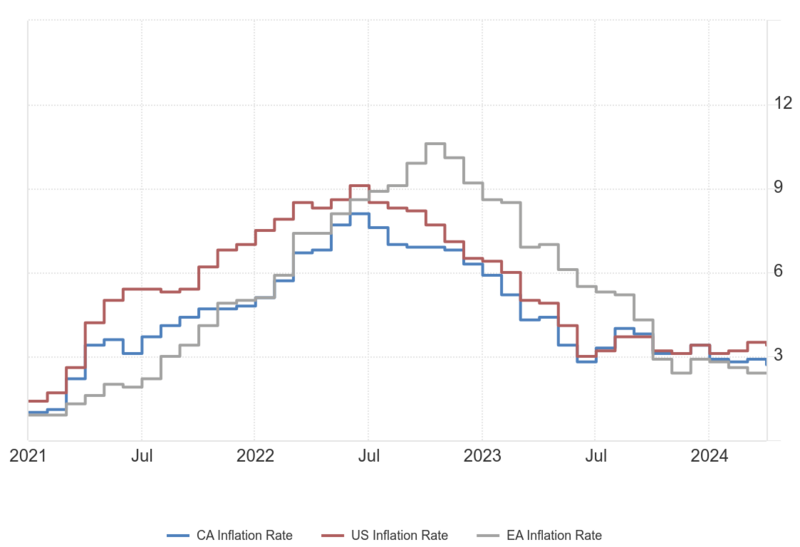

In the face of high inflation immediately after printing money in response to the coronavirus lockdowns, the ECB and other major central banks raised the key interest rate significantly in order to counter rising goods prices. Now, with inflation rates still high, central banks are beginning to ease monetary policy again. The last time consumer price inflation in the eurozone was below the target value of 2% was three years ago.

The market had expected the interest rate hike of 25 basis points, so there were no major movements on the capital markets in response to the ECB's announcement.

Interest rate cuts despite high inflation?

While the USA, the world's most relevant economy, is still keeping its key interest rate in the range of 5.25 to 5.50 percent, the ECB has now joined the Swiss National Bank and the Bank of Canada in lowering interest rates again. Central banks use the key interest rate as a monetary policy instrument in an attempt to control inflation, i.e. the rate at which consumer goods rise in price. With a low prime rate, more loans are generally taken out, which fuels general demand and increases the amount of money in circulation in a fiat money system - these are all drivers of inflation.

Normally, the US Federal Reserve sets the pace in monetary policy. If central banks set the key interest rate significantly lower than that of the US, there is a risk that their own currency will come under pressure. It may then make sense to sell euros or yen in order to invest the money in higher-yielding US government bonds denominated in US dollars.

However, inflation in the United States, which is well above 3%, still leaves the world's most relevant central bank little scope for interest rate cuts. In the eurozone, however, as in Canada, inflation of between 2% and 3% was enough to trigger interest rate cuts - although the inflation target is still 2%. In the USA, the market is currently pricing in the first interest rate cut in September. However, it is likely that inflation in the US will still be north of the 2% mark by then.

The fact that major central banks are already easing monetary policy again, even though the respective inflation rates are still a long way from the target value, suggests that the rate of inflation is unlikely to fall again any time soon. Although monetary policy is still relatively restrictive after a small interest rate cut, loosening it again - even if only slightly - when inflation rates are still high signals that the tolerance range has probably been adjusted upwards somewhat.

It remains to be seen what will happen on the interest rate front. At the moment, however, it looks as if the major central banks will cut interest rates further in the coming months in order to stimulate demand in the economy and, indirectly, the amount of money in circulation.

Bitcoin as protection against monetary expansion and inflation

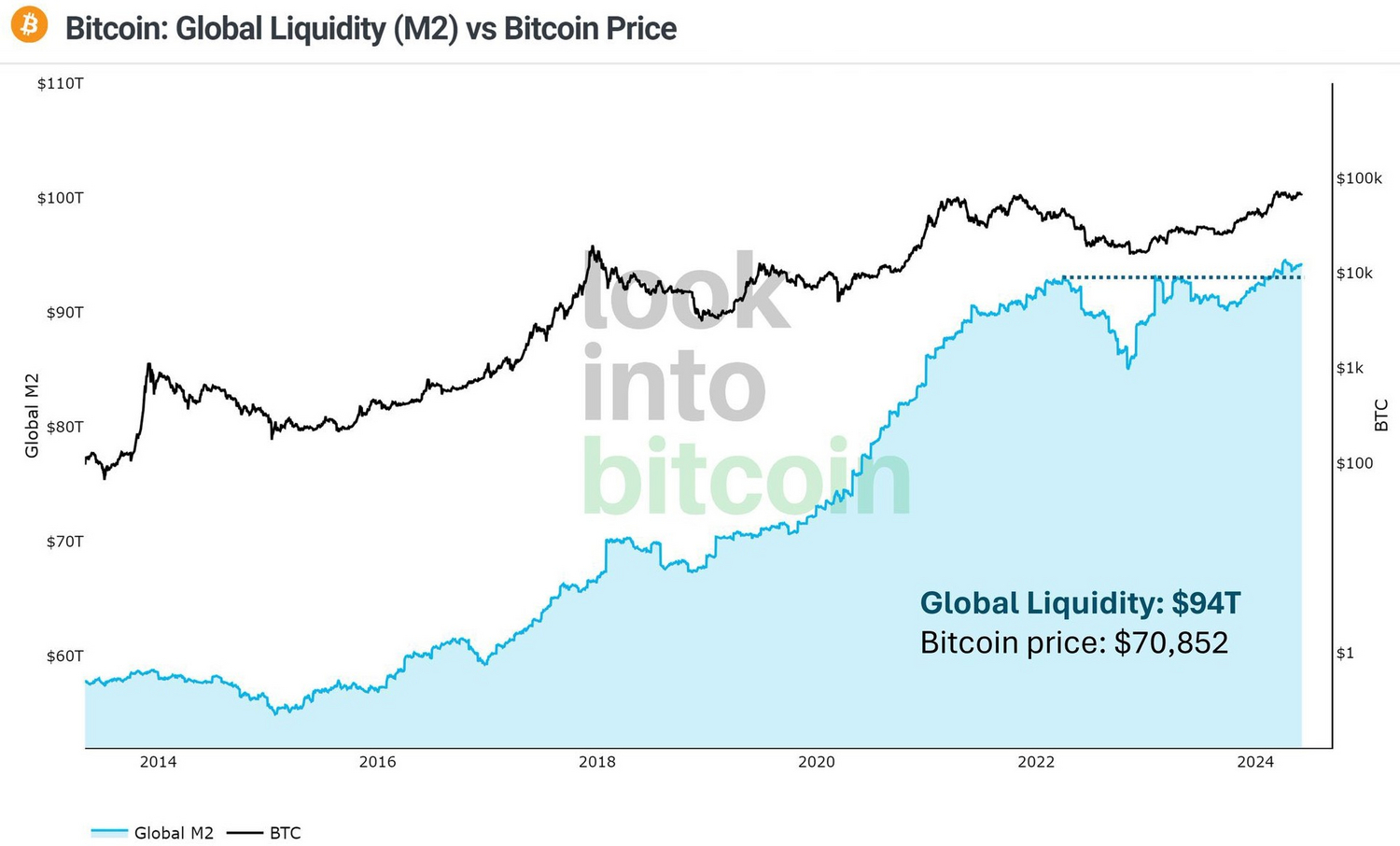

Bitcoin is the asset that reacts most sensitively to changes in the global money supply. And in view of the high levels of debt worldwide, this will in all likelihood only continue to rise in the coming years. This is because high interest rates and a declining money supply would cause the debt-based fiat money system to falter. In particular, this would lead to an ever-increasing mountain of national debt.

Despite the still rather restrictive monetary policy worldwide, the global money supply - i.e. the money supply from China, the eurozone, the UK, Japan, Canada, Russia and Australia combined - is currently at a new all-time high. With the interest rate cuts that have just taken place and those still pending in the USA, the largest currency area, the big upswing in global liquidity is probably still to come.

Meanwhile, Bitcoin is already trading at an all-time high. And if the amount of money in circulation in the major currency areas continues to rise, nothing stands in the way of significantly higher Bitcoin prices.

Bitcoin is a money with a limited supply, where the rules of money are firmly anchored in the code and not determined by a group of supposed experts. A hard money like Bitcoin could be a solution to the problem of inflation and all the negative effects it has on the economy and society.

At the current eurozone inflation rate of 2.6%, the value of the euro will halve in just 26 years. This steady loss of purchasing power of the official currency forces people to enter into new salary negotiations year after year in order to avoid earning less and less over time, adjusted for inflation. Inflation also encourages speculation, as savings must be used as profitably as possible, otherwise they will become worth less and less. And since most workers are not experts in the financial markets, let alone have the time to deal with them alongside their job, this usually ends in speculation that is unlikely to benefit society as a whole - and often results in total losses.