It has been certain for some time that the Federal Reserve would initiate a turnaround in interest rates today. However, unlike at previous FOMC meetings, it was still unclear until the meeting whether the monetary authorities would reduce the federal funds rate by 25 or 50 basis points.

A week ago, the probability of a cut of just 25 basis points was just under 90 percent. However, since the start of the week, the tide has turned and the market suddenly assumed a greater interest rate cut by around 60 percent.

The overall market initially reacted positively to the official announcement and the subsequent press conference by Fed Chairman Jerome Powell. Bitcoin stood out somewhat with a price jump of 2.5%. However, the price gains were not sustained by either Bitcoin or the stock markets.

Prospect of further interest rate cuts

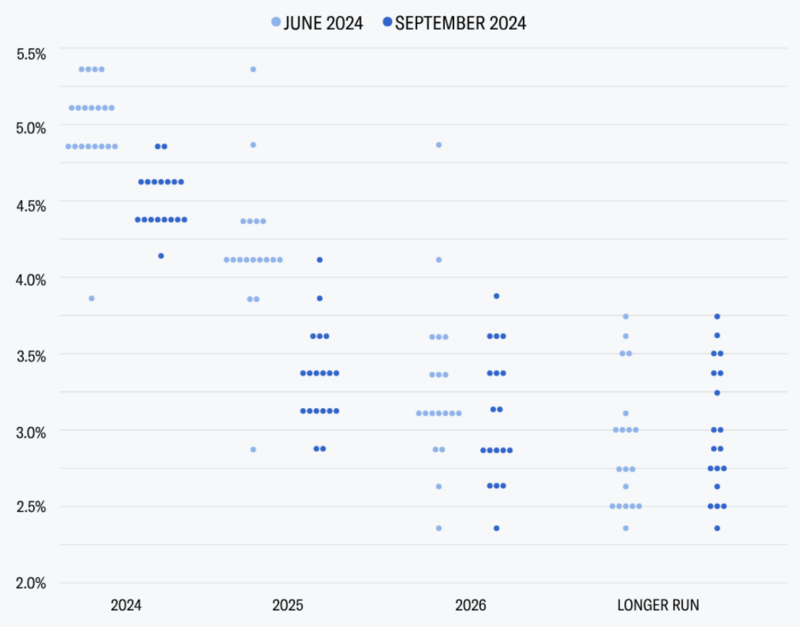

As part of the central bank meeting, the monetary authorities also announced their forecast for the key interest rate they will set in the near future. According to the so-called "dot plot", which painted a much more optimistic picture than at the last publication in June of this year, a few more interest rate cuts can be expected.

The Federal Reserve is likely to make two more interest rate cuts this year. By the end of this year, the central bankers see the key interest rate at an average of 4.4 percent and next year at 3.4 percent.

In addition to price stability, the US Federal Reserve also has the task of ensuring full employment. As US inflation has now fallen to 2.5 percent year-on-year and the US labor market is weakening at the same time, the monetary authorities now have the necessary room to ease monetary policy again somewhat.

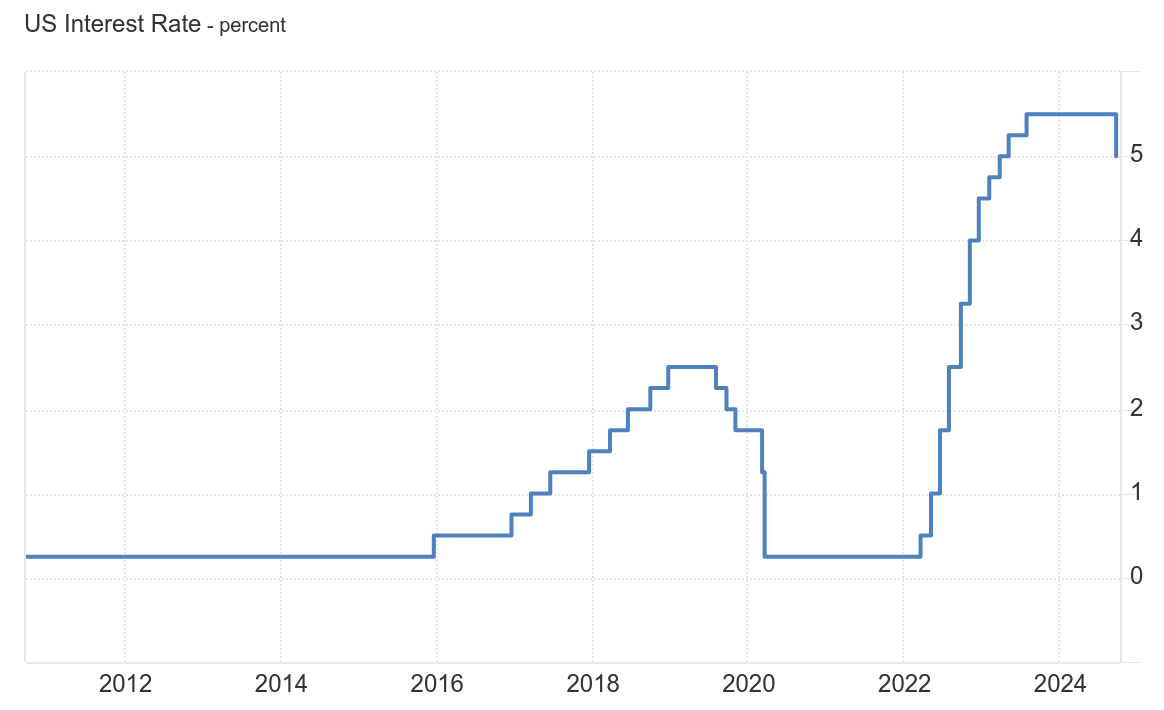

Although the turnaround in interest rates has now officially been initiated, the US key interest rate is still at a relatively high level of 4.75% to 5.00%, which is far from comparable to the monetary policy environment in response to the corona lockdowns, which led to a price explosion on the capital markets.

Interest rate turnaround as a catalyst for a rising Bitcoin price?

In general, lower interest rates have a positive effect on investors' general willingness to invest and their appetite for risk. One reason for this is that lower interest rates make fixed-interest securities such as government bonds less attractive.

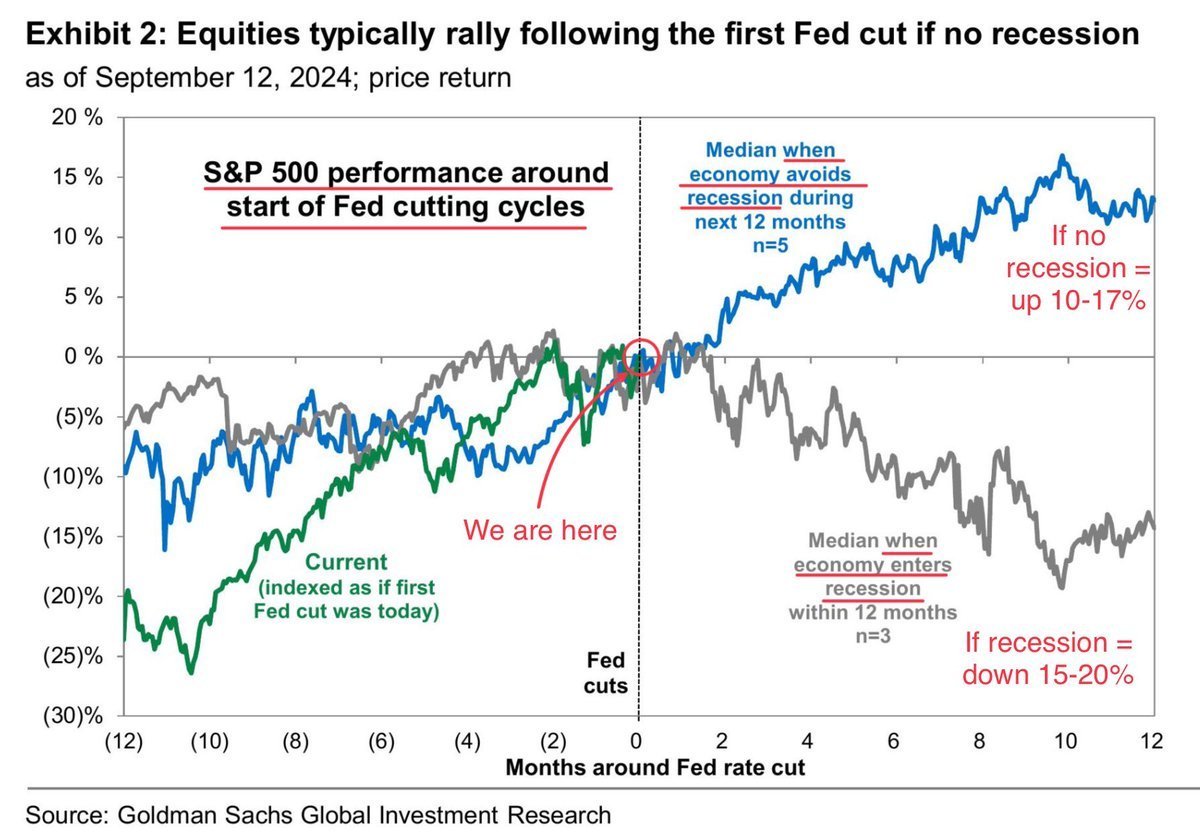

However, whether the capital markets - and therefore in all likelihood Bitcoin - will be able to benefit from monetary easing in the medium term currently depends primarily on the state of the US economy.

In general, it is clear that the performance of the US stock market - with which BTC currently appears to correlate strongly - following a turnaround in interest rates is primarily linked to whether the US slips into recession.

Accordingly, market participants will be focusing primarily on US economic data in the coming months.

In addition to an economic crisis, another potential risk would be that US inflation picks up again, thereby thwarting the Federal Reserve's plans to cut interest rates.

Outlook for Bitcoin is positive

If there is no economic crisis in the US and no second wave of inflation, which currently looks likely, the right environment for a continuation of the Bitcoin bull market should certainly be in place.

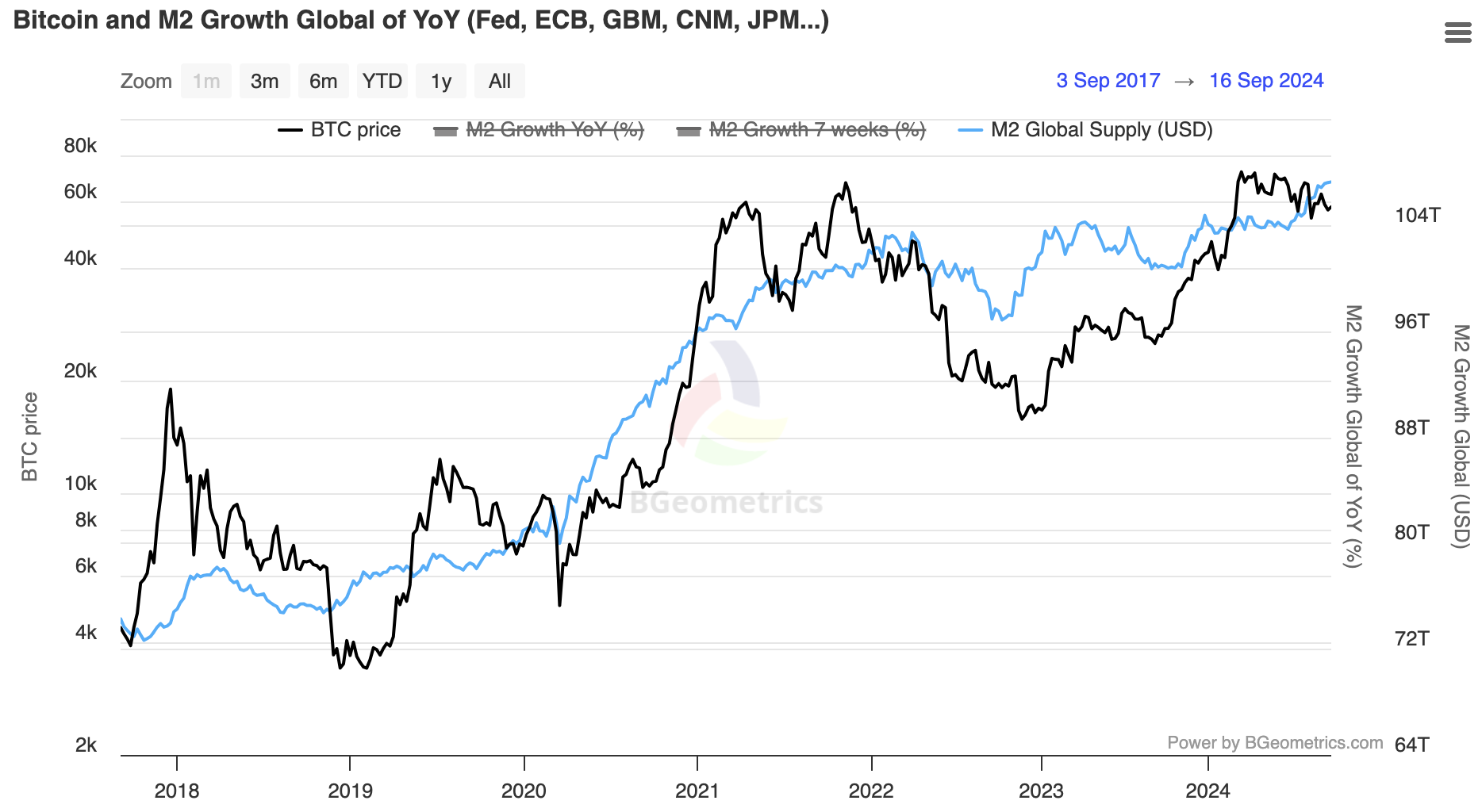

With interest rates likely to fall further, global liquidity, with which Bitcoin has a strong correlation, should pick up speed.

In addition, the US presidential election in November is another potential price driver on the horizon - and not just because Donald Trump, a Bitcoin-friendly president, could be elected to the White House.

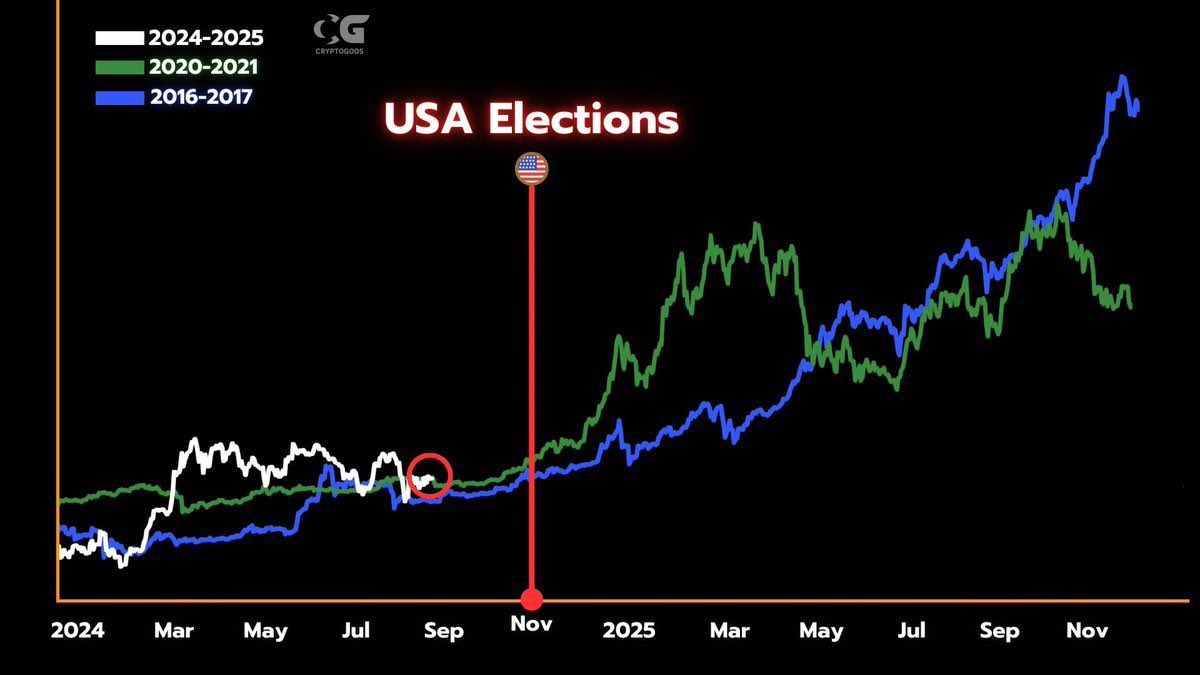

In general, the capital markets perform well in the months following the US elections. In its still recent history, Bitcoin also shows a clearly positive performance after the presidential election.

Another price-driving factor could be the Bitcoin halving, which occurred for the fourth time in April this year. After the first three halvings, the Bitcoin price always multiplied in the months that followed.

It remains to be seen whether Bitcoin will also follow the typical patterns for the asset in this cycle. In any case, the biggest risk factor is likely to be a weak US economy.