Last night, something happened that had been looming ever since Joe Biden's disastrous performance in the TV duel against Donald Trump: the incumbent president officially renounced his candidacy for the upcoming election. Biden made the announcement on the 𝕏 platform.

As Donald Trump, the Republican presidential candidate who was officially confirmed last week, wants to support the Bitcoin and crypto sector, this turnaround in the US presidential election campaign is also relevant for the Bitcoin market.

The Bitcoin price fell yesterday evening in response to the news, but then rose to its highest level in more than a month - although this rise did not prove to be sustainable.

What does Joe Biden's resignation mean for the crypto market and for Bitcoin-friendly Donald Trump's prospects of victory?

A relevant turning point in the US election campaign?

Ever since the TV debate against Donald Trump, it has been common knowledge that Joe Biden's constitution no longer allows him to hold the office of US President. Although the 81-year-old subsequently affirmed that he would continue to stand for election, when the pressure from within his own ranks increased and he confused Ukrainian President Volodymyr Zelensky with Vladimir Putin, Biden had no choice but to give up. However, Biden will remain President of the USA until the election winner takes office.

It has not yet been finally decided who will run for the Democrats against Republican Donald Trump. This will be decided at the Democratic Party conference in August. However, Joe Biden has already pledged his support to current Vice President Kamala Harris. The 59-year-old is also the only one who can access the Biden campaign's funds - a relevant advantage over other potential candidates.

Accordingly, Harris is also currently seen as the most likely candidate for the Democrats. However, a change of candidate at such short notice before the election is likely to make it difficult for the Democrats to win back votes.

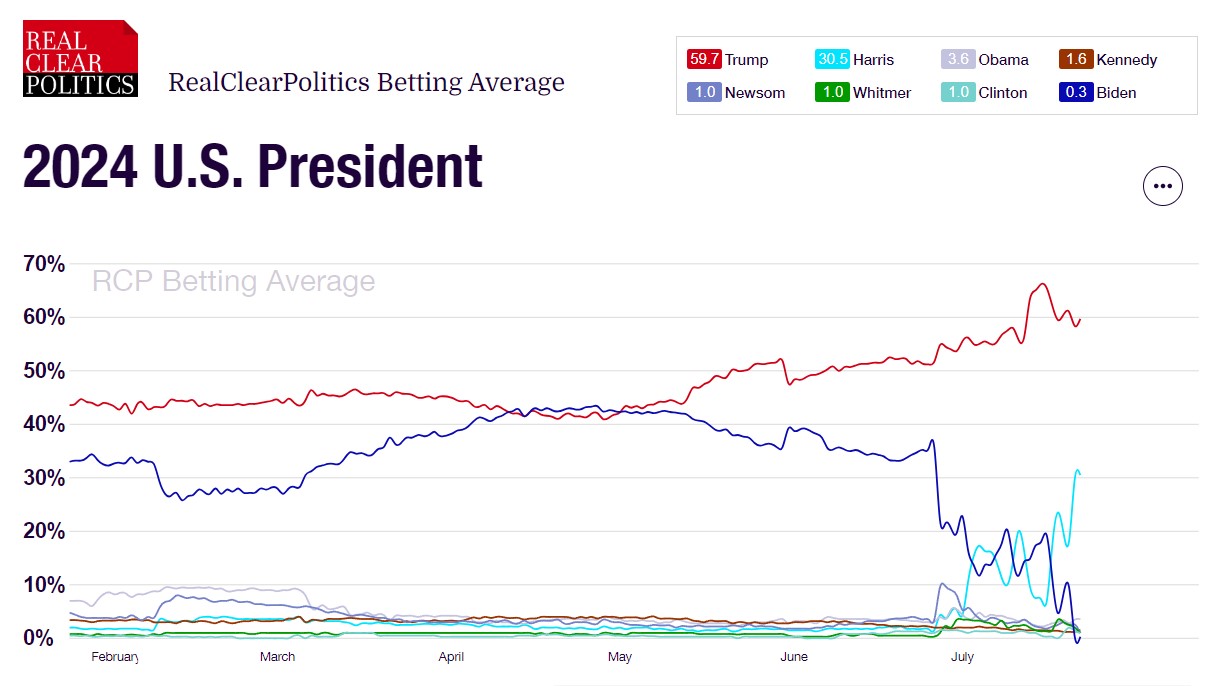

Although Donald Trump would have had an easy game against Joe Biden - especially after the TV duel and the assassination attempt on him - it is still likely that the Republican will be elected to the White House in November. According to the betting markets, the probability of his re-election has fallen slightly, but he still has a clear lead of around 60 to 30 percent over Harris.

It is therefore hardly surprising that the Bitcoin price has not really reacted negatively to this news. Kamala Harris is rather unpopular among the American population - according to a poll from last year, she is the most unpopular vice president in US history. So far, she has hardly made any public statements about Bitcoin or cryptocurrencies.

Trump should therefore - unless he makes a fundamental mistake or an assassination attempt on him is successful - almost certainly become the next US president. The Republican candidate's sudden pro-Bitcoin stance as well as the market's anticipation that his presidency will lead to lower interest rates and higher inflation is probably one of the main drivers of the Bitcoin price at the moment. Biden's withdrawal during the election campaign is apparently not enough to put a major damper on this.

Democrats will also be pro-Bitcoin?

However, Joe Biden's resignation could provide an opportunity for the Democrats to credibly campaign for Bitcoin and cryptocurrencies and thus win back votes.

🚨NEW: #Crypto policy group @CIFonX says President Biden's decision to step aside is a new opportunity for the top of the Democratic Party ticket to embrace crypto and blockchain technologies:

Eleanor Terrett (@EleanorTerrett) July 21, 2024

"While Secretary Gensler and Senator Warren may have misguided White House policy in...-

The incumbent president was an avowed opponent who said four years ago that he did not have any Bitcoin and would never ask for any to be sent to him or for donations to be made to him.

Even if there were indications that the Biden administration wanted to take a more sympathetic approach to the issue, the ship had apparently already sailed. Public pro-Bitcoin statements were still a long time coming from Joe Biden before he withdrew from the election.

In addition to Joe Biden, other high-ranking Democrats who fall into the camp of Bitcoin critics are also likely to lose influence. Elizabeth Warren, for example, will find it difficult to remain a senator in future. The Winklevoss twins have each donated 500,000 US dollars to the Commonwealth Unity Fund to replace the Massachusetts senator with crypto-friendly Republican John Deaton.

I just donated $500k in bitcoin (8 BTC) to @DeatonforSenate to help him unseat @SenWarren as a U.S. Senator. Here’s why:

Elizabeth Warren is one of the single greatest threats to American prosperity. When it comes to crypto, she is public enemy number one. She’s the chief architect and driver of the Biden Administration’s war on crypto. She wages this unlawful war by weaponizing government agencies to attack our industry through a combination of debanking, bad faith enforcement actions, and other abuses of power.

Tyler Winklevoss on 𝕏

The head of the US Securities and Exchange Commission (SEC), Gary Gensler, who is classified as hostile to cryptocurrencies, is also expected to resign shortly after Trump's election, according to Markus Thielen, founder of 10X Research. His prediction is based on historical trends, according to which the head of the SEC usually resigns when a new government comes to power. Under Trump, the pressure on Gensler is likely to increase significantly. Not only because the leading presidential candidate is in favor of Bitcoin and cryptocurrencies, but also because his running mate, J. D. Vance, seems to see the SEC chief as the "worst person ever".

No setback for Bitcoin

Despite the upcoming change in the Democratic presidential candidate, Donald Trump should still have an easy time becoming the first pro-Bitcoin president of the US in November - even if the probability of his election success has decreased slightly.

It will be interesting to see whether a realignment of the Democrats' election campaign will lead to a more Bitcoin-friendly stance on the campaign trail or whether everything will remain the same. In general, Bitcoin critics within the Democratic Party are likely to continue to have an increasingly difficult time in light of current developments, which is ultimately positive for the asset class.