What Donald Trump as president would mean for Bitcoin

Trump the likely winner after TV duel

The long-awaited debate between former President Donald Trump and incumbent President Joe Biden took place last night. Following the exchange of blows, the likelihood of US citizens electing Trump to the White House in November has increased significantly. As Trump has also increasingly spoken out in favor of Bitcoin in recent weeks, the question arises as to what a presidency for the 78-year-old could mean for the asset.

Trump wins the TV duel

Few events have attracted as much attention as the duel between Biden and Trump broadcast by CNN. The focus was less on the content and more on the physical and mental condition of the incumbent president. As Biden also appeared confused in some parts of the exchange and got bogged down several times, critics were confirmed in their assumption that the 81-year-old is probably too old for the most important office in the world.

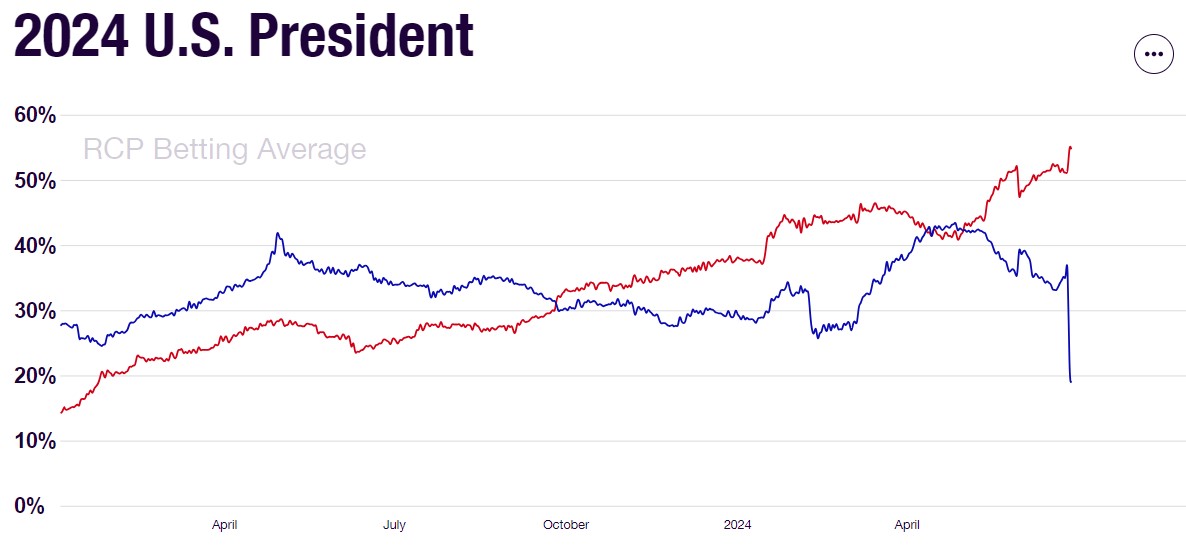

According to a CNN poll, two thirds of viewers believe that Trump was able to win the debate. The presidential candidate, who was already leading according to the betting markets, was then able to significantly increase his lead over Biden.

The likelihood of Biden's re-election plummeted from over 35% to under 20% in response to his weak performance. The incumbent president made such a poor impression that there were even calls to nominate another candidate for the Democratic Party at short notice. Whether Biden runs himself or Gavin Newsom, the governor of California, will probably not change the fact that Donald Trump is likely to become US president for a second time.

The impact of Trump as president for Bitcoin

The debate in question was never about Bitcoin. This was not to be expected, although Trump spoke out in favor of Bitcoin and the industry surrounding it several times during his election campaign.

Nevertheless, this may have caused some disappointment in the Bitcoin community. According to a survey by Michael Saylor, the founder of Bitcoin-focused company MicroStrategy, almost 70% of voting 𝕏-users assumed that Bitcoin would be discussed in the duel.

Will #Bitcoin be a topic in tonight's Presidential Debate?

- Michael Saylor⚡️ (@saylor) June 27, 2024

Even if the Bitcoin price has not reacted positively to the debate, which ended favorably for Trump, his presidency could have far-reaching consequences for Bitcoin. Since the beginning of May, the former president has repeatedly spoken out in favor of Bitcoin and Co. and emphasized that he would be the president to support the sector. He has repeatedly criticized his opponent and the Democrats per se for the "anti-crypto course" and described it as a "war on crypto".

In the summer of 2021, the former president told FOX Business that Bitcoin looked like a scam to him. However, when his pro-Bitcoin stance recently met with great approval, he went one better. Trump then accepted Bitcoin and Co. for campaign donations and emphasized that he wants all future Bitcoin to be mined in the USA.

Trump also promised that he would release Ross Ulbricht from prison on the first day of his inauguration. Ulbricht is the founder of the darknet marketplace Silk Road, where goods could be purchased with Bitcoin more than ten years ago - one of the first uses of Bitcoin as a means of payment.

Furthermore, serious rumors are circulating that Trump will appear at the Bitcoin conference in Nashville at the end of July. Meanwhile, phrases like the following are a recurring feature in his campaign rallies.

BREAKING🚨@realDonaldTrump just reiterated his support for #Bitcoin at a campaign event in Wisconsin, emphasizing that the U.S. must not fall behind other countries in this regard😳

Blocktrainer (@blocktrainer) June 18, 2024

"To further secure America's future... pic.twitter.com/QTRLi827Mk-

At the beginning of June, multinational bank Standard Chartered predicted that the price of Bitcoin could rise to USD 150,000 by the end of the year if Trump wins the presidential election. Geoff Kendrick, head of digital asset research, cited the crypto-friendly stance of the likely next US president as the reason for this.

As we approach the US election, I expect $100,000 to be reached and then $150,000 by the end of the year in the event of a Trump victory.

Geoff Kendrick

Trump as president a price driver for Bitcoin?

There is a capital market saying that political stock markets have short legs. But in the case of Bitcoin, this is not necessarily the case. For example, the approval of Bitcoin spot ETFs in the US turned out to be a strong price driver. And should a national leader advocate for the country itself to buy Bitcoin - as is the case in El Salvador - then this could catapult the Bitcoin price to unimagined heights, at least in the case of the USA.

In general, positive regulation that ensures that the Bitcoin industry can develop more freely in the US would certainly be positive for Bitcoin adoption and indirectly also for the price. Support for the Bitcoin mining industry, which Trump has already announced, could also contribute to this.

However, there are also indications that the Republican could actively cause the price of Bitcoin to rise. David Bailey, the CEO of Bitcoin Magazine and a direct supporter of Trump's election campaign, told 𝕏 that Trump had told him he wanted to add several trillion US dollars to Bitcoin's market capitalization. For an asset that is only worth around 1.2 trillion US dollars, this would mean a multiplication of the price.

In an audio discussion on 𝕏, the CEO of Bitcoin Magazine also reportedly said that Trump had asked him whether the US could solve its national debt problem with Bitcoin. If Trump really does use Bitcoin as a strategic tool to improve the US's financial situation, then Bitcoin is likely to experience an upswing that is second to none.

Trump and monetary policy

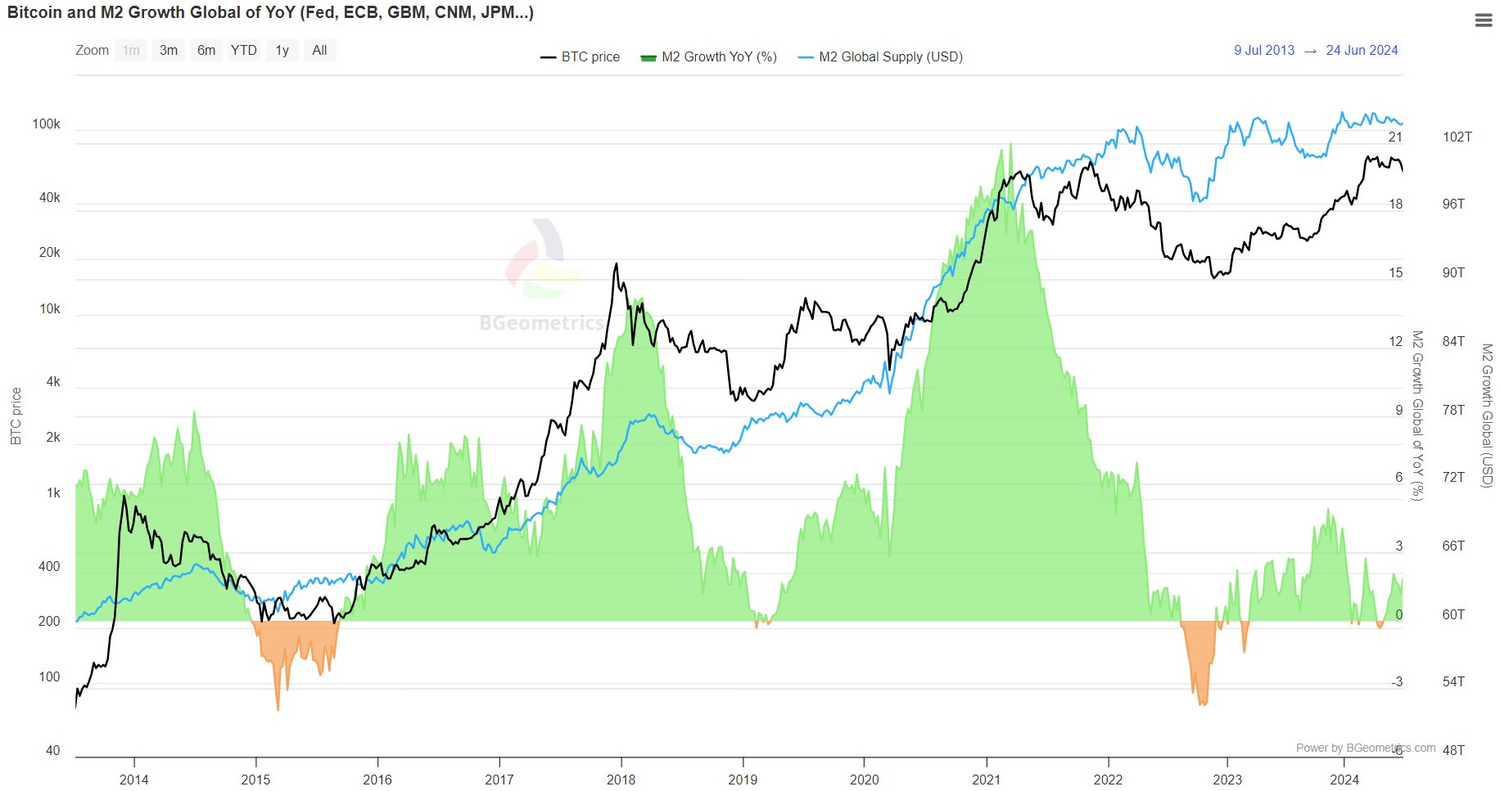

However, political concessions before elections should always be treated with caution and the biggest price driver for the Bitcoin price is and remains global liquidity, on which US monetary policy has the greatest influence. Bitcoin is the asset that reacts most sensitively to the money supply in the major currency areas. And it is the central bank of the leading currency and the world's most relevant economy that sets the tone.

Donald Trump is a proponent of a looser monetary policy. During his last term in office, he increasingly spoke out in favor of lower interest rates. In addition, the presidential candidate and his allies are said to already have plans to overhaul the US central bank. Moreover, the Republican is not on good terms with current Federal Reserve Chairman Jerome Powell - he does not want to reappoint him as Fed Chairman if he is elected to the White House in November.

As the amount of money in circulation generally rises when interest rates are lower due to the increased creation of credit money by the banks, an increase in liquidity could be expected if Trump becomes president. As already mentioned, this would certainly fuel the price of Bitcoin.

At the same time, Trump also wants to push through a series of tax cuts, which could further stimulate the economy and thus the capital markets. However, due to this combination, some economists assume that inflation could also pick up significantly under Trump.

In this context, some economists are even talking about high waves of inflation like in the 1970s or even hyperinflation, which Trump could trigger. Due to its limited total volume of just under 21 million units, Bitcoin is suitable as a protection against rampant inflation, which benefits in particular if there is a stronger devaluation of money - as was the case in 2020 and 2021.

However, high inflation, insofar as the central bank combats it with a restrictive monetary policy, i.e. with high interest rates, could also have a negative impact on the price of assets such as Bitcoin. This was observed in 2022. However, some economists fear that the Federal Reserve could completely lose its supposed independence under Trump and keep interest rates low despite high inflation rates.

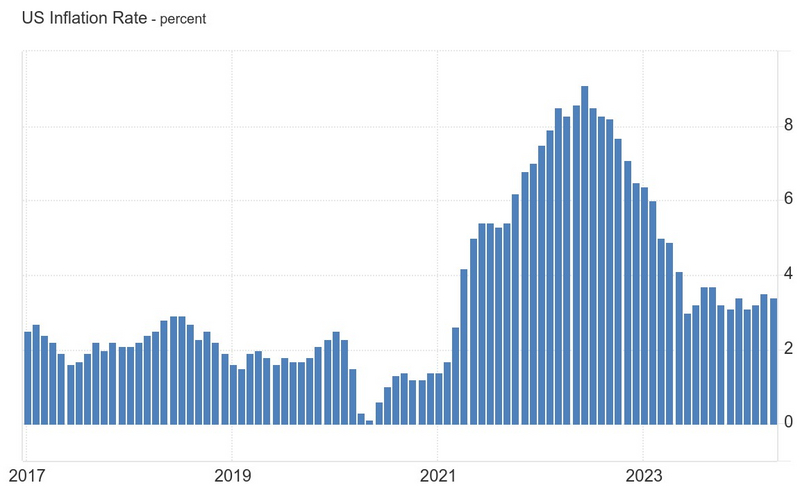

Even though the USA under Trump in 2020 probably laid the foundation for the high inflation of the coming years, which Americans are still struggling with today, average inflation was significantly lower with the Republican as president than under Biden. Although the incumbent president recently claimed that inflation was 9 percent when he took office in January 2021, it only rose from 1.4 percent to just under 10 percent at times with him in the White House.

No presidency has had as much success in creating jobs and lowering inflation as we have. It was 9 percent when I came into office, 9 percent.

Joe Biden

However, if the oft-quoted economists are correct that Donald Trump as president would result in at least very high inflation with a Federal Reserve that doesn't fight it, then this would likely put Bitcoin front and center as the most attractive hedge against the accompanying demonetization and general loss of confidence in the Federal Reserve. As positive as this could be for Bitcoin, it would be negative for savers who do not protect themselves from rising consumer goods prices by investing in tangible assets.

Exciting times ahead

Although it currently looks very much as if Donald Trump will be elected president for the second time in November, a lot can still happen in the almost four months until then. It also remains to be seen whether the Republican will continue to campaign for Bitcoin even after an election that goes in his favor.

In any case, a Bitcoin-friendly US president could significantly boost the adoption of Satoshi Nakamoto's creation in the medium term. But even if Trump's presidency could possibly lead to a sharp rise in the price of Bitcoin for a variety of reasons, it is less relevant for the long-term development of the asset which person holds which office.