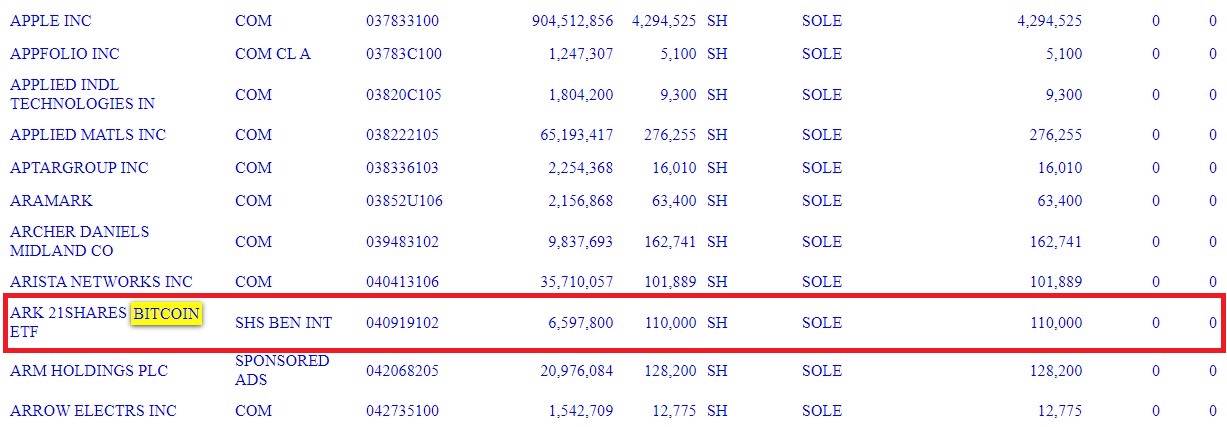

The pension fund of the US state of Michigan bought Bitcoin in the second quarter. This is according to the mandatory 13-F filing with the US Securities and Exchange Commission (SEC). As of June 30, the fund, which provides pensions for state employees, held 110,000 units of ARK Invest's Bitcoin Spot ETF worth almost USD 6.6 million.

The pension funds are coming

The State of Michigan Retirement System's Bitcoin holdings built up in the second quarter are another sign that institutional adoption of Bitcoin is in full swing. While the bitcoin position represents only a fraction of the fund's billion-dollar asset base, a trend is now evident.

As part of the 13-F filing for the first quarter, it was already revealed that the Wisconsin pension fund, State of Wisconsin Investment Board (SWIB), held around USD 163 million in Bitcoin ETFs as of March 31, 2024. This made SWIB the first US state pension fund to take this step.

When SWIB's Bitcoin position became known, ETF experts such as Eric Balchunas from Bloomberg already assumed that more would follow. They were proved right: This week, the Democratic mayor of Jersey City finally announced that the city's pension fund will invest around two percent of its portfolio in Bitcoin via ETFs - Blocktrainer.de reported.

Even if the individual pension funds do not necessarily buy market-moving amounts of Bitcoin, the signaling effect should not be underestimated. In particular, if the asset continues to perform so well over the coming years, the funds' Bitcoin positions are likely to make up an increasingly large proportion of the portfolio on their own. The 110,000 shares in the State of Michigan Retirement System's ARK 21Shares Bitcoin ETF ($ARKB) were already worth almost USD 7.5 million at the close of trading on Friday - an increase of almost 15 percent since the reporting date.

In total, state pension funds in the USA manage around six trillion US dollars in assets. If more and more funds were to build up even a small Bitcoin position in the future, this would create overwhelming demand for the asset, which together could well be a catalyst for sharply rising prices.

It will be interesting to see whether the 13-F filings for the second quarter, which must be submitted by mid-August, will reveal that other state pension funds have taken up positions in the Bitcoin spot ETFs.