Every 210,000 Bitcoin blocks, the block subsidy, i.e. the number of newly issued Bitcoin per block, halves. The fourth halving took place on April 20, 2024 with block 840,000, in which the block subsidy halved from 6.25 BTC to 3.125 BTC and the annual inflation rate from 1.7% to 0.85%.

For Bitcoin mining companies, the halving meant an immediate drop in revenue and an increase in production costs per Bitcoin. While daily revenues fell from USD 79 million to USD 29 million after the halving, average production costs rose from around USD 46,000 to more than USD 94,000 at times.

If the Bitcoin price does not rise accordingly and operating costs and efficiency remain the same, the mining process will no longer be profitable for some companies, forcing them to cease their activities and/or sell their Bitcoin holdings to compensate for the loss of profitability. This is known as "miner capitulation", which in turn affects the Bitcoin price and the Bitcoin hashrate. Increasing efficiency by investing in advanced mining equipment with a higher hashrate and lower energy consumption is essential for the profitability of companies.

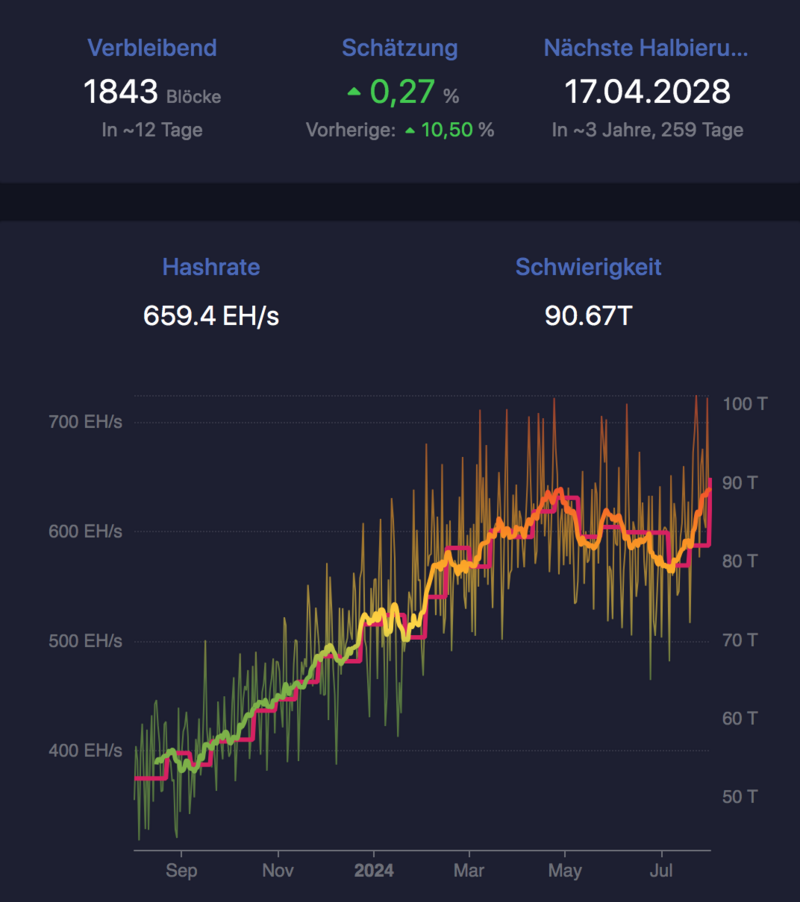

New all-time high after hashrate decline

The Bitcoin price has been in a sideways trend since the halving. In addition to the selling pressure from miners, who have been selling their BTC holdings at an increasing rate since October 2023, this has also been influenced by other factors such as the US Bitcoin ETFs approved since January, the US presidential election campaign and Germany's BTC sell-off.

At the same time, some miners stopped their activities, causing the hash rate to fall from an average of 639 exahash per second (EH/s) - the last all-time high on April 28, 2024 - to 564 EH/s on July 8. Since then, the hashrate has risen steadily again and has now reached a new all-time high of 640 EH/s on average - with spikes to over 700 EH/s.

At the same time, the miners' daily income has risen to 35 million US dollars and their average Bitcoin production costs, which now almost correspond to the BTC market price, have fallen.

The latest difficulty adjustment of 10.5% was the largest adjustment since October 2022, which could indicate that miner capitulation has ended and miners are turning their devices back on. Historically, this is a positive signal for the market. It remains to be seen whether this trend will now also have an impact on the Bitcoin price.