Recent developments around Bitcoin and the crypto sector highlight the complex relationship between regulatory frameworks and the efforts of major financial institutions to offer crypto custody services. At the center of this debate is the US Securities and Exchange Commission's (SEC) Staff Accounting Bulletin 121 (SAB 121), which has a significant impact on the accounting of digital assets. This regulatory measure has a significant impact on the way financial institutions hold and report digital assets and has been met with both political and industry-specific criticism. Meanwhile, the world's largest custodian bank, BNY Mellon, is preparing to provide custody services for Bitcoin and Bitcoin ETFs, according to reports and a public hearing.

BNY Mellon's plans & regulatory context

BNY Mellon appears to be on the verge of entering the crypto custody sector. Bloomberg, among others, reports that the bank is planning to provide custody services for spot Bitcoin ETFs. This move is particularly notable as BNY Mellon has received an exemption from the provisions of SEC rule SAB 121. This exemption has in turn sparked widespread discussion about the different regulatory requirements for financial institutions in the crypto space.

SAB 121, introduced in March 2022, requires custodians to recognize a liability and a corresponding offsetting position on their balance sheets for the fair value of their clients' digital assets. As a result, banks must hold enormous amounts of capital, which makes offering such services unprofitable for most institutions. However, the SEC sees SAB 121 as a necessary measure to ensure investor protection and a fair presentation of the financial institutions' financial position.

Political pressure on the SEC to repeal SAB 121

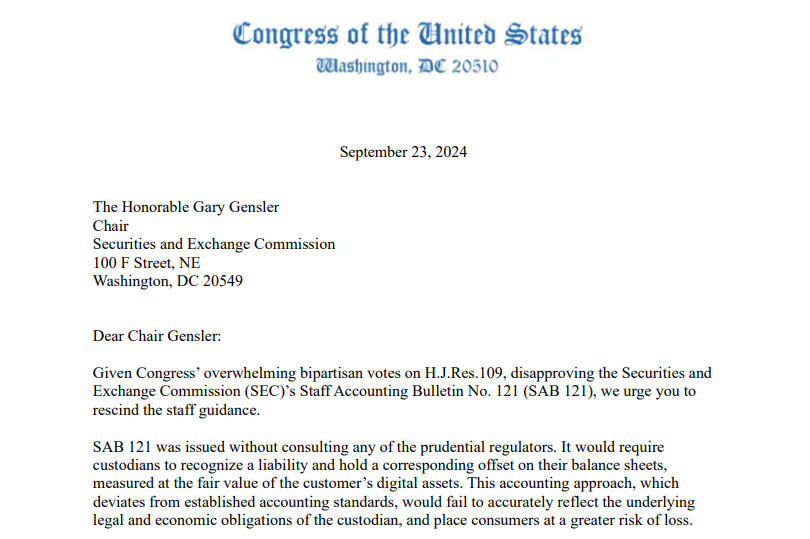

The implementation of SAB 121 has generated significant opposition not only within the industry, but also at the political level. In an open letter to SEC Chairman Gary Gensler, leading politicians, including House Financial Services Committee Chairman Patrick McHenry and Senator Cynthia Lummis, called for the repeal of SAB 121, arguing that the rule was introduced without the necessary consultation with other regulators and that it could lead to crypto custody services being incorrectly reported on balance sheets.

In particular, the Republicans criticize the SEC for effectively issuing regulations without going through the proper public consultation process required by the Administrative Procedure Act (APA). In their view, SAB 121 does not contribute to transparency or asset security, but rather creates uncertainty and ambiguity regarding regulatory requirements for financial institutions. The call for its repeal therefore reflects a desire to ensure a fairer and more transparent approach to digital assets in the US.

SAB 121 was enacted without consultation with the relevant regulators. It would require depository institutions to recognize a liability and record a corresponding asset on their balance sheets, measured at the fair value of clients' digital assets. This accounting approach, which deviates from established accounting standards, would not accurately reflect the underlying legal and economic obligations of depository institutions and would expose consumers to a higher risk of loss.

Excerpt from the letter to Gary Gensler

Back in May of this year, the US Senate voted 60 to 38 in favor of repealing SAB 121 - Blocktrainer.com reported. However, current President Joe Biden vetoed the resolution, which is why it went back to the House of Representatives for a vote.

Exclusivity and lack of transparency

The fact that the SEC has worked behind closed doors with selected institutions, such as the aforementioned BNY Mellon, to grant exemptions from the requirements of SAB 121 has caused additional displeasure. These unofficial arrangements raise questions about the extent to which the SEC is being transparent and fair in its regulation of the crypto sector. Critics see this as an attempt to determine certain "winners and losers" in the crypto custody sector without respecting the formal rulemaking process.

Instead of recognizing this failure and rescinding the guidance, the SEC's Office of Chief Accountant (OCA) has only created further confusion by working with certain custodians to circumvent the accounting rules. These consultations, which are conducted on a case-by-case and confidential basis, do not provide the transparency or predictability necessary to ensure fair and consistent application of SAB 121 to different institutions. This approach creates a patchwork - the SEC's own, albeit disguised - and thus argues against itself by failing to provide enhanced disclosure to investors.

Excerpt from the letter to Gary Gensler

On its website, the SEC emphasizes that SAB 121 is merely an interpretation of its staff and is not an official rule of the Commission. However, concerns about inconsistent application and enforcement of these guidelines remain, adding to the uncertainty for crypto sector players.

Conclusion: the debate continues

The debate around SAB 121 and the SEC's reactions highlight the challenges facing cryptocurrency regulation. While political actors and market participants continue to put pressure on the SEC to create a clearer and fairer regulatory basis, large financial institutions such as BlackRock and BNY Mellon are implementing their plans to establish themselves in the crypto custody sector.

The coming months will be crucial in determining how the regulatory environment in the US develops and what impact this will have on the further integration of digital assets into the financial system. It remains to be seen whether the political efforts to repeal SAB 121 will be successful and how this will affect the long-term acceptance and use of cryptocurrencies by institutional investors. The outcome of the US elections could also play a decisive role in this respect.