Lightning savings plan made easy!

Submarine swaps explained with Boltz Exchange

Regularly buying Bitcoin according to the dollar-cost-average (DCA) principle is a popular way to save in Bitcoin without emotion and with little effort. The process of classic savings plans with providers such as Coinfinity, Pocket Bitcoin or Relai is very simple: after a transfer (e.g. also as a standing order), Bitcoin is automatically purchased, followed by a direct payout to your own wallet.

The big advantage is obvious: you don't relinquish control of your Bitcoin for a second longer than absolutely necessary, as there is no option to store it directly with the provider with this type of savings plan. However, this "self-custody luxury" also comes at a price, namely in the form of immediate and future transaction fees. Due to Bitcoin's UTXO model, many small withdrawals to your own wallet result in even higher fees if you want to spend your Bitcoin in the future when the network is potentially very busy.

The simple compromise

For savings plan users who invest several thousand euros a month in Bitcoin anyway, managing their own UTXO may not be a major problem, but the smaller the amounts become, the more difficult it will be sooner or later to justify an on-chain transaction in the Bitcoin network.

A common and above all convenient compromise is therefore temporary storage with an exchange or broker. In other words, you deliberately refrain from self-custody until a payout to your own wallet is worthwhile so that you don't have to wait too long for the next Bitcoin purchase.

Both approaches are valid, but not always ideal, which brings us to a third interim solution...

Lightning

The Lightning Network is perfect for many small Bitcoin payments at a negligible cost. With Lightning wallets such as the popular Phoenix Wallet or Breez, even less technically experienced users or those who simply don't have the time to manage their own Lightning node can enjoy lightning-fast and virtually free payments - without giving up control of their Bitcoin.

Conveniently, all of the above-mentioned savings plan providers, i.e. Pocket Bitcoin, Coinfinity and Relai, offer the option of paying out Bitcoin directly via the Lightning Network. The advantage of self-custody therefore remains without the disadvantage of UTXO management.

Liquidity problems

Receiving payments via the Lightning Network is not always free of charge: The requirement that a dedicated Lightning channel has sufficient liquidity available is unavoidable and must of course be taken into account in a Lightning savings plan.

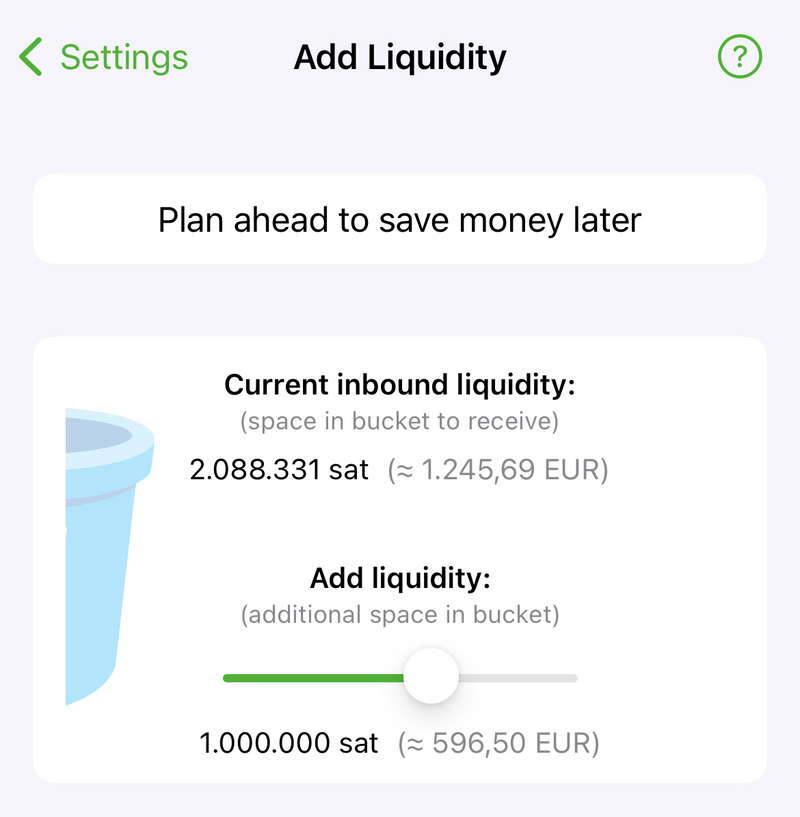

Let's take the example of a user who wants to save around 0.01 BTC or 1 million Satoshi per month. Corresponding liquidity can either be reserved in advance using functions such as the Phoenix Wallet for a small surcharge, or of course by receiving a correspondingly high payment directly.

The problem: at some point, the incoming liquidity of the payment channel is exhausted and it is time for an on-chain transaction to your own wallet. If we take the Phoenix wallet as an example, you could now use splicing to "split off" the desired amount directly from the payment channel and send it to your own Bitcoin address - with the obvious disadvantage that the payment channel loses liquidity again.

This approach is not really sustainable or an advantage over the status quo, as you would have to regularly spend money to reserve or increase liquidity in the payment channel.

Boltz Exchange

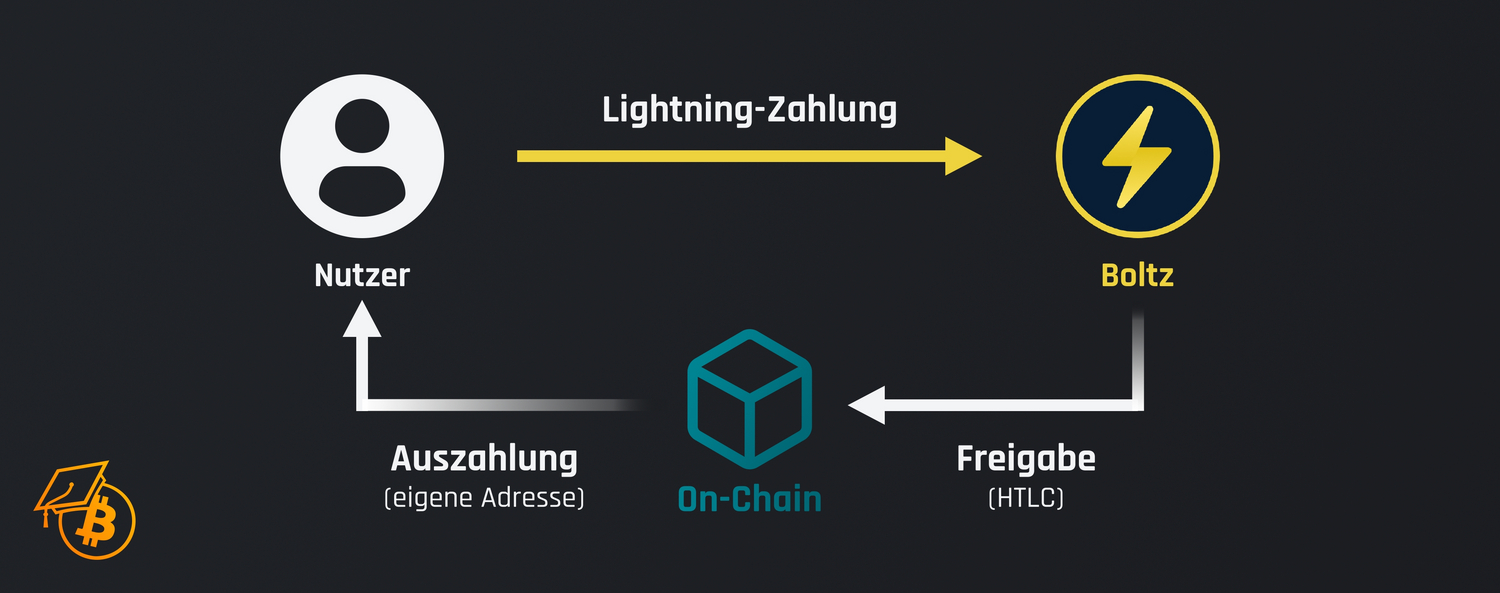

This is exactly where swap service providers such as Boltz Exchange come into play: instead of taking liquidity away from the payment channel, it is used for an outgoing lightning payment instead. When the payment is received, the service provider releases the corresponding amount of Bitcoin in an on-chain transaction, which can then be paid out automatically to your own address.

Not only is this procedure quite user-friendly, as all the complexity naturally runs in the background, it also resets the "savings plan status" of the payment channel to the beginning: the exemplary 0.01 BTC of outgoing liquidity is now available again for incoming payments, i.e. further Bitcoin purchases, at no additional cost.

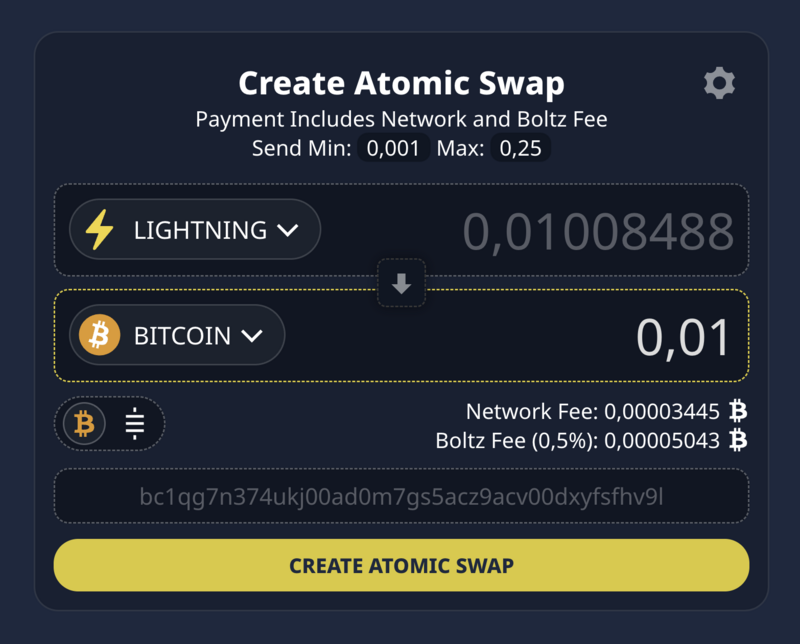

Using Boltz is relatively self-explanatory: you can select a swap between the Bitcoin network, Lightning network and Blockstream's Liquid sidechain - in any direction, of course. In our savings plan example, a common swap would be a switch from the Lightning to the Bitcoin network, for which only the desired Bitcoin address needs to be specified. In the next step, you are shown a Lightning Invoice for the desired amount plus the Boltz service fee (0.5%) and the currently required transaction fee in the Bitcoin network. The 0.5% service fee at Boltz is comparatively fair, and in our example would amount to just 5000 Satoshi or currently just under 3 euros. The service is also completely open source, which means that the specific functionality can be traced in the publicly accessible code.

If you ignore the one-off costs for creating the payment channel, you can effectively save Bitcoin for free in any number of versions - without any custodial service provider and without having to worry about managing lots of small UTXO.

An added bonus: Even if the privacy of payments on the Lightning Network is not "perfect" across the board and you are of course identified at least with the aforementioned brokers, swaps via Boltz enjoy a comparatively high level of privacy, especially as you can use the service without logging in and optionally even via the Tor network.

Does Boltz work without trust?

The technology behind swaps with Boltz does not actually require trust in the service provider - and the service provider in turn does not have to trust the user. If one of the parties does not cooperate, the other can claim the money for itself, similar to a regular Lightning payment. Such submarine swaps can be simplified to look like regular lightning payments, except that part of the payment process takes place directly on-chain and not just off-chain.

In our example above, i.e. a swap from Bitcoin in the Lightning Network to on-chain Bitcoin, a submarine swap takes place in the opposite direction: The user creates a secret and sends a fingerprint of this secret to Boltz. The service provider can now create a Lightning Invoice, which is paid by the user. However, this Lightning payment is not yet complete at this point. Only when the service provider releases the corresponding amount of Bitcoin and the user claims it with a transaction is the secret released and Boltz can in turn complete the Lightning payment. Both parties receive their Bitcoin and Boltz receives a small fee for providing the liquidity.

In short: you don't have to be afraid to send your own Bitcoin to Boltz. The payment is only actually executed when the Bitcoin is already on its way to your own wallet. Otherwise, the payment will fail and your Bitcoin will automatically end up back in your Lightning wallet. In the case of a reverse swap, i.e. from on-chain Bitcoin to the Lightning network, you receive a recovery file that you can use to recover in the event of a problem.

A certain amount of trust must be placed in the locally running Boltz client, which performs the processes described above in the background. However, as this is an open source project and it is even possible to host Boltz yourself, this trust can also be reduced to a minimum.

Conclusion

At the end of the day, the specific implementation of your own Bitcoin savings plan is a very individual question.

If you attach great importance to the most favorable conditions possible and have no problem storing Bitcoin on a custodial wallet in the short term, you are probably already in good hands with a classic crypto exchange with low trading fees.

If you want to retain maximum control over your own Bitcoin but are not interested in high transaction fees and UTXO management, you could find an elegant interim solution via the Lightning Network in combination with swap services such as Boltz. This method can offer more flexibility, especially for savers with a comparatively low savings rate or those who want to spread their purchases across as many smaller versions as possible.