Four years ago today, the US software company MicroStrategy began strategically investing in Bitcoin. The company, founded by visionary Michael Saylor in 1989, was the first publicly listed company to take this bold step.

The first Bitcoin purchase

MicroStrategy had already announced its Bitcoin strategy at the end of June 2020. As part of this, the Virginia-based company gave shareholders the option to have their shares bought back at a premium - for a total of 250 million US dollars.

On August 11, 2020, MicroStrategy finally bought 21,454 Bitcoin at a price of around 11,600 US dollars per BTC. The company spent 250 US dollars million in cash reserves on its first acquisition.

MicroStrategy® Incorporated (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company, today announced that it has purchased 21,454 bitcoins at an aggregate purchase price of $250 million, inclusive of fees and expenses.

From the press release dated August 11, 2020

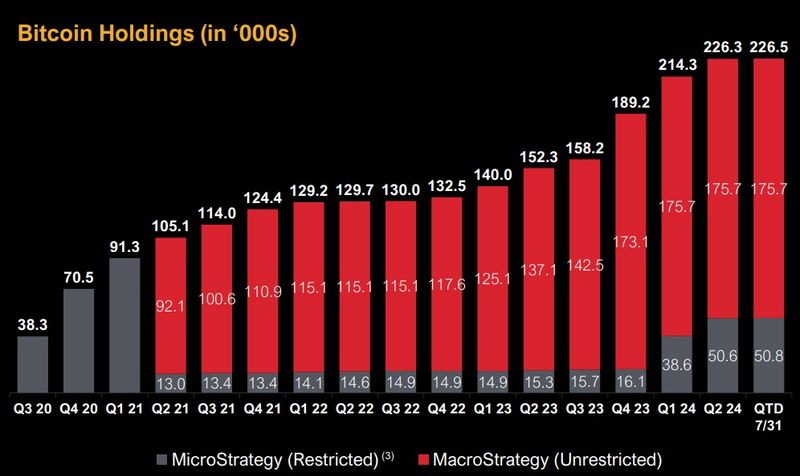

Shortly afterwards, also in the third quarter of 2020, the public company followed up.

205,046 Bitcoin later

Today, four years later, MicroStrategy holds a whopping 226,500 Bitcoin worth around 14 billion US dollars. That is more than one percent of all units that will ever exist. The company financed the additional Bitcoin purchases by issuing convertible bonds, loans, additional cash reserves, stock offerings and recurring corporate profits, among other things.

In addition to the Bitcoin holdings, the share price has also increased about tenfold since then. On August 10, 2020, a MicroStrategy share still cost around 12 US dollars - adjusted for the stock split. Today, investors have to pay 135 US dollars for a share in the company. This means that CEO Michael Saylor has achieved exactly what he wanted to with the Bitcoin strategy.

Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders.

Michael Saylor in the press release dated August 11, 2020

With this phenomenal performance, $MSTR has not only outperformed Bitcoin itself, but even Nvidia's stock, which recently went through the roof due to the AI hype, has to admit defeat.

MicroStrategy now also describes itself as the first Bitcoin Development company. With MicroStrategy Orange, the company is working on digital identities based on Bitcoin.

The visionary Michael Saylor

Michael Saylor stepped down from his role as CEO of MicroStrategy in August 2022. However, as Executive Chairman and a major shareholder of the company with more than 50 percent of the voting power, he is currently still heavily involved in its strategic direction.

Over the years, the 59-year-old billionaire has become one of the most respected voices in the Bitcoin space. He regularly speaks at Bitcoin conferences and is a welcome guest in interview formats on the subject of Bitcoin and finance.

One factor that lends additional weight to his bullish statements and forecasts is that he published a book called "The Mobile Wave" in the summer of 2012. In it, he accurately predicted the potential of large technology companies such as Apple and the trend towards more mobile technologization.

In addition to holding around ten percent of MicroStrategy shares, Saylor also has a large personal Bitcoin position. A few days ago, the billionaire told Bloomberg that he still holds the 17,732 BTC he publicly communicated his purchase of in 2020 and that he has continued to add to it and has not sold any coins. His personal Bitcoin position is therefore currently worth at least one billion US dollars.

4 years - a meaningful period

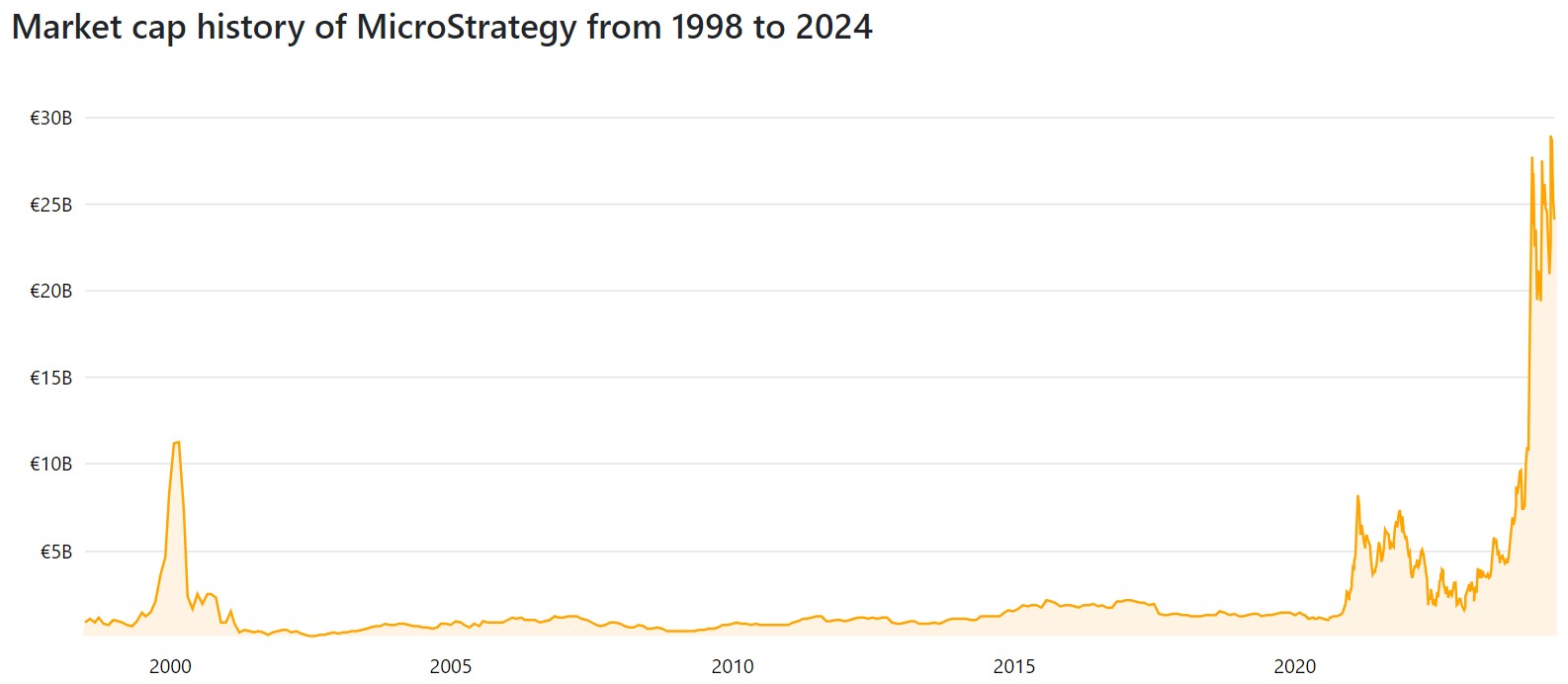

Since MicroStrategy started using Bitcoin, the company has become a success story. The company's market capitalization has risen by a factor of about 23 after almost two decades of more or less stagnation - with a relatively slight upward trend after the dotcom bubble burst at the turn of the millennium.

Although Bitcoin came under significant pressure in 2022, and the company was temporarily $2 billion, or 50 percent, in the red with its Bitcoin purchases, the stock itself traded higher than before the first Bitcoin acquisition, even at its lowest point.

In the midst of the Bitcoin bear market, the media reported rather derisively on the software company's unconventional strategy. In August 2022, for example, when one Bitcoin cost just over 20,000 US dollars, Fortune Magazine ran the headline that Michael Saylor's "big bet on Bitcoin might sink him once and for all". The article also featured an accounting expert and founder of a research company, who was certain that none of this would end well for Saylor and the shareholders.

He’s massively misallocating his investors’ capital because the market rewarded that behavior in the short-term. It will reconcile in a painful way for himself and his shareholders.

David Trainer, accounting expert and founder of the research company New Constructs

MicroStrategy, however, managed to survive the bear market. A rule in the Bitcoin community is that you have to hold the asset for at least four years to be safely in the black. While Bitcoin traded below its high of exactly five years earlier at times in December 2022, having a time horizon of just over a halving cycle has continued to prove its worth - especially when regular recurring purchases are part of the investment strategy.

Having successfully weathered the challenging Bitcoin year of 2022, MicroStrategy is slowly but surely finding the first imitators. With the Japanese company Metaplanet and the American healthcare company Semler Scientific, there are now other publicly traded companies that have made large Bitcoin bets relative to their size and are, in the end, copying the "playbook" of the "first mover."

The journey continues

However, MicroStrategy's story is only just beginning. As Saylor communicates, the company will continue to find ways and means to expand its Bitcoin holdings. The latest quarterly report, for example, shows that MicroStrategy is currently in the process of issuing new shares worth two billion US dollars - it should be clear at this point what the proceeds will be used for.

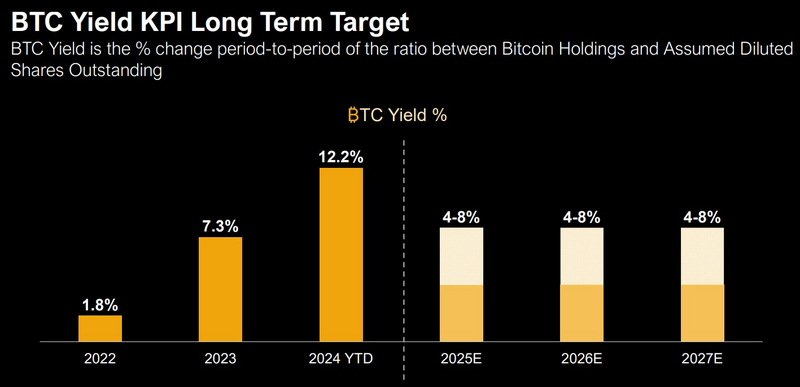

The software company also forecasts that it will continue to increase the Bitcoin per share ratio. The company has managed to do this in the past, and the so-called "BTC yield" is expected to remain between four and eight percent over the next three years.

Although the ETF approval led to voices claiming that MicroStrategy's shares are now less attractive as an indirect Bitcoin investment due to the new investment products, $MSTR is still in high demand. Due to its special strategy, the share is likely to remain an interesting instrument in the future, allowing investors to benefit disproportionately from the success of Bitcoin - despite the entrepreneurial risks.

It will be interesting to see whether and how MicroStrategy succeeds in accumulating further Bitcoin in the future and thus creating additional value for its shareholders. If Bitcoin continues to develop so well over the coming years, it will probably only be a matter of time before the company founded by Michael Saylor joins the ranks of the world's largest stock corporations.