MicroStrategy, the first public company to buy Bitcoin, published its figures for the second quarter yesterday. As part of this, it was announced that the Virginia-based "Bitcoin company" had acquired a further 169 units. But that's not all: the press release on the quarterly figures reveals that MicroStrategy is currently in the process of raising further capital on the market - namely two billion US dollars.

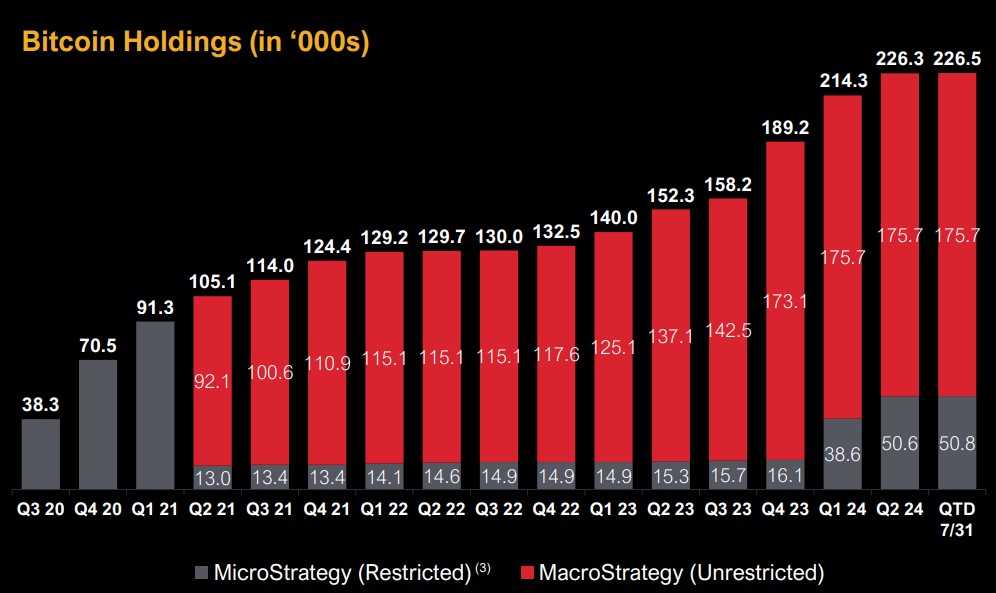

Bitcoin holdings grow to 226,500 BTC

In mid-June, the software company founded by Michael Saylor first issued further convertible bonds to buy Bitcoin. The proceeds amounted to 786 million US dollars and were enough to buy 11,931 BTC - Blocktrainer.de reported.

In addition to its strategy of raising money on the capital markets to replenish its Bitcoin holdings, MicroStrategy also has an operational business in business intelligence software. This is normally profitable and allows the company to invest additional equity in Bitcoin - albeit relatively small amounts.

In the past quarter, however, the software company had to report a loss from its operating business of just over USD 100 million. In this case, the company financed the purchase of an additional 169 BTC, which MicroStrategy announced yesterday, with surplus cash reserves. This investment was made in the current quarter.

As a result, the public company now holds 226,500 BTC with an equivalent value of just under 15 billion US dollars. The average entry price has risen to 36,821 US dollars per Bitcoin as a result of the latest purchases, which in turn means that the Bitcoin company has had to put a total of 8.3 billion US dollars on the table for the Bitcoin to date - a tidy book profit.

The holdings continue to grow. MicroStrategy currently not only holds more Bitcoin than the USA or China, but also more than almost all Bitcoin spot ETFs - only BlackRock and Grayscale hold more units.

Subsequent purchase planned for 2 billion US dollars?

MicroStrategy is also already preparing the next capital raising measure. The company is currently submitting the necessary documents for an "at-the-market equity offering program", according to the press release. This means that the stock corporation will issue new company shares - to the tune of no less than two billion US dollars. It should be clear what the money will be used for.

We continue to closely manage our equity capital, and are filing a registration statement for a new $2 billion at-the-market equity offering program.

From the press release

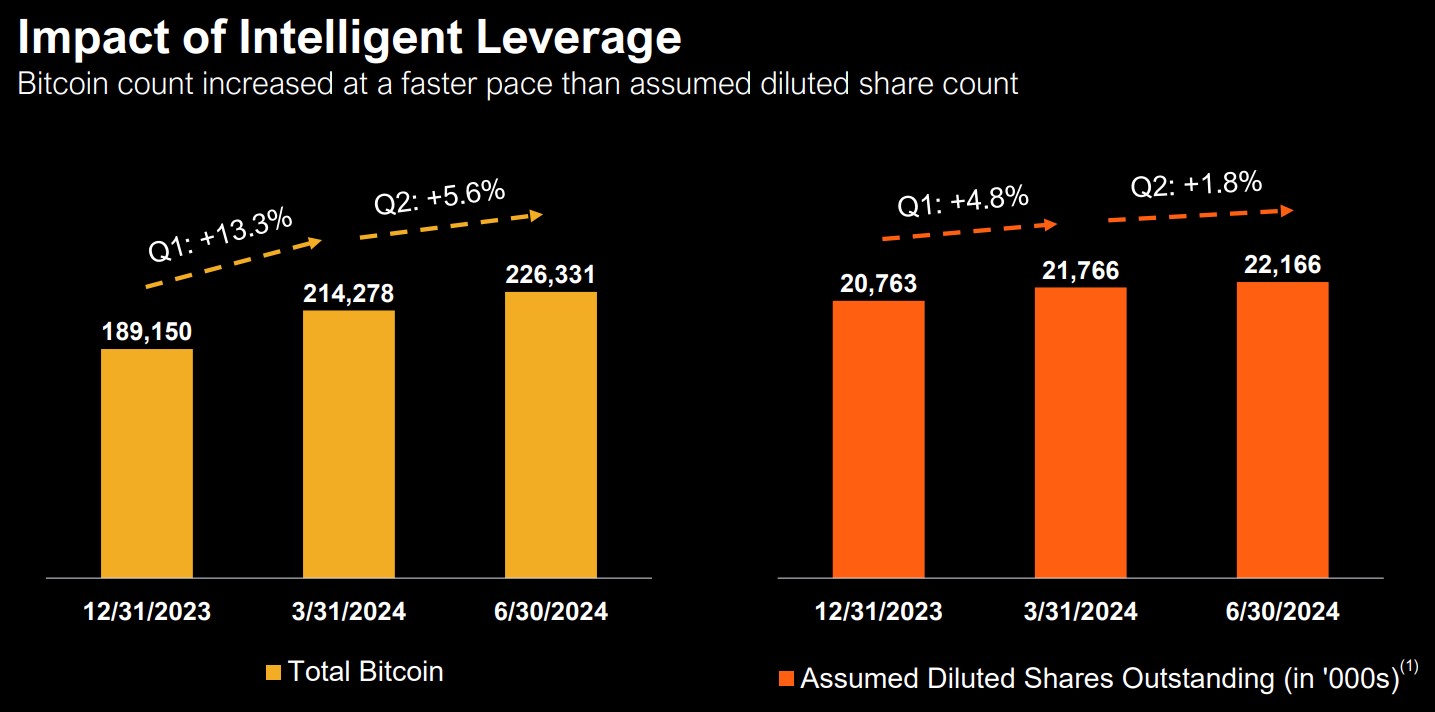

Issuing new shares, in addition to issuing convertible notes or simply borrowing, is another fundraising method MicroStrategy is utilizing to raise money in the capital markets for Bitcoin purchases. By issuing convertible bonds or simply issuing new company shares, the company dilutes the shares, but the strategy not only allows it to acquire more Bitcoin overall, but also to increase the ratio of BTC per share.

In other words, MicoStrategy manages to increase its Bitcoin holdings relatively more than the shares in circulation. According to the investor presentation, this should continue to work in the future.

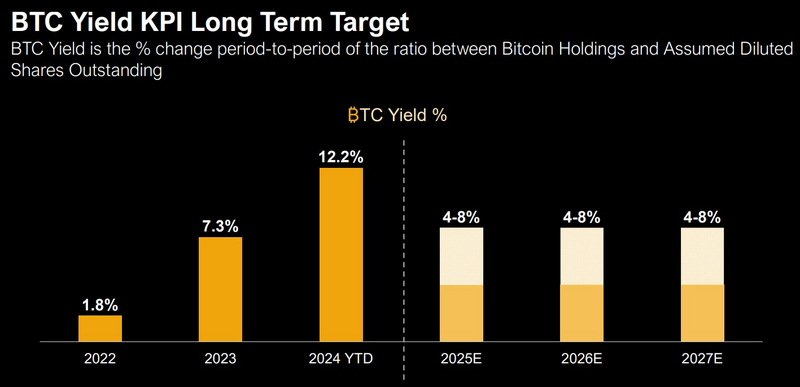

"BTC Yield"

MicroStrategy quantifies this outperformance of Bitcoin holdings compared to the outstanding shares with the so-called "BTC Yield". This has amounted to 12.2% so far this year and is expected to remain positive in the future. The company forecasts a "BTC Yield" of between four and eight percent for the next three years.

MicroStrategy is not only a major regular buyer of Bitcoin, but the public company is also demonstrating how the capital markets can be used for strategic acquisitions of the asset - with an approach that makes it possible to acquire more Bitcoin per share.

The previously announced share split is also due to take place next week. One company share will then become ten. Although this has no fundamental impact, it makes a share - which currently costs around 1,500 US dollars - significantly more affordable. This can boost the share price, as private investors can more easily add a single share to their portfolio. The share split could therefore help to raise as much capital as possible through the planned issue of new company shares.

A success story

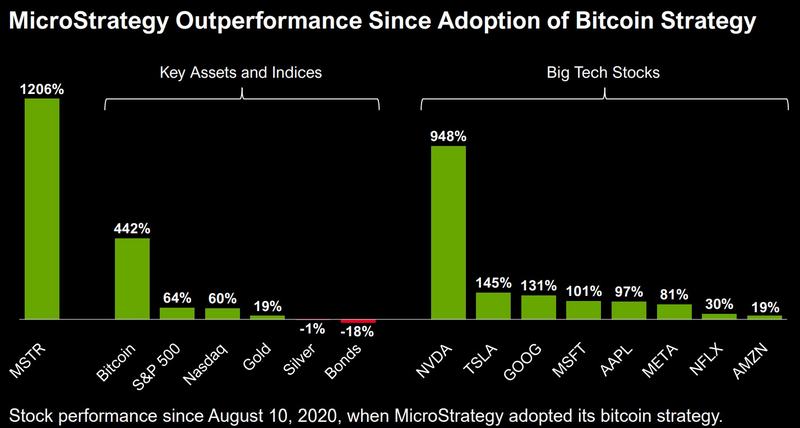

The company, founded by Michael Saylor, has managed to outperform even high-flyers such as Nvidia or Bitcoin itself over the past few years - and only with a partly leveraged all-in Bitcoin strategy. Since MicroStrategy started investing in Bitcoin, the share price has increased roughly thirteenfold - an incredible return for such a short period of time.

It is therefore not surprising that the first stock corporations, such as Metaplanet and Semler Scientific, are already copying this strategy - and others are likely to follow, provided the software company continues to develop so phenomenally in the future.