53 years since the end of the gold standard - time for a new monetary system

53 years ago today, on August 15, 1971, Richard Nixon abolished the convertibility of the US dollar into gold. The then US president announced this in a well-known televised speech in which he blamed speculators for this drastic measure, which he described as "temporary".

In recent weeks, the speculators have been waging an all-out war on the American dollar. The strength of a nation’s currency is based on the strength of that nation’s economy – and the American economy is by far the strongest in the world. Accordingly, I have directed the Secretary of the Treasury to take the action necessary to defend the dollar against the speculators. I have directed Secretary Connally to suspend temporarily the convertibility of the American dollar [...].

Richard Nixon

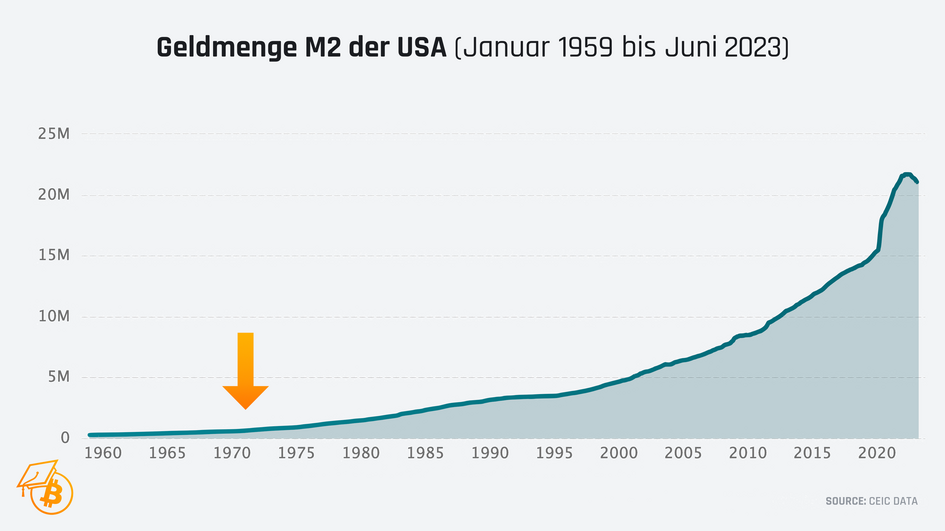

However, this was more likely due to the USA's declining gold reserves and the simultaneously expanding US dollar money supply. Since the 1960s, US government spending has continued to accelerate, partly due to the costly Vietnam War.

With this so-called "Nixon Shock", the last gold standard finally came to an end not only in the USA, but also in many other countries that were part of the Bretton Woods system. The countries participating in the monetary system - including Germany - had pegged their currencies to the US dollar at a fixed exchange rate and had previously also operated on a kind of gold standard.

Until this historic event, 35 US dollars could be exchanged for one troy ounce of gold, which today costs more than 2,400 US dollars. However, this promise only applied to central banks in other countries - private possession of the precious metal worth more than 100 US dollars was still prohibited for US citizens at the time. It was not until 1974 that the American people were allowed to hold substantial amounts of gold again.

In Switzerland, which did not participate in the Bretton Woods system, the currency was still backed by gold for several years afterwards. The Swiss National Bank was obliged to cover at least 40 percent of outstanding banknotes with gold reserves. In 1999, as part of a comprehensive constitutional amendment, the Swiss franc finally became a genuine fiat currency.

The problems of the fiat money system

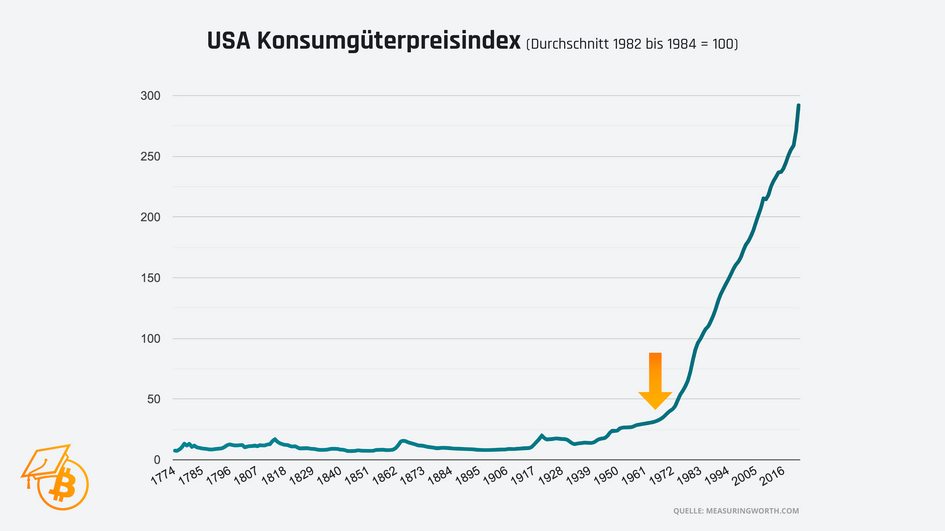

Since the US dollar is no longer exchangeable for anything, the price level of consumer goods has exploded alongside the US dollar money supply. The disciplining power of precious metals as the basis of the monetary system finally disappeared on August 15, 1971.

As inflation has become increasingly rampant since 1971, a number of other aspects have deteriorated. These include the distribution of wealth and the relative compensation of the working population.

In our article "WTF Happened In 1971?", we use a number of charts to show the negative developments that have taken place since the Nixon shock. To mark the 53rd anniversary, we have expanded the article to include several illustrations.

During the Bretton Woods system, however, everything was far from perfect. Despite the gold standard, the US dollar money supply in circulation increased continuously - albeit at a slower rate than in the current fiat money system. The big problem, however, was that people were not trading in gold per se, but in US dollars, which represented a claim on central bank money, which in turn represented a claim on gold.

Gold in its basic form was not suitable as global money in a globalized world, which is why paper money systems were established on the basis of it. And insofar as hardly anyone wants to exchange their banknotes for the precious metal, the amount of money in circulation, for example through bank lending, can easily become increasingly decoupled from the amount of gold.

Nevertheless, despite the partial reserve system, the gold standards of past centuries had a disciplining force that basically kept inflation in check. It is generally observable that harder monetary systems have led to higher inflation-adjusted economic growth. For example, the real growth rate of the US economy during the market-based gold standard, which lasted until the founding of the US central bank in 1913, was 4.2 percent, 50 percent higher than during the entire fiat money episode that began with the Nixon shock.

Time for a new monetary system

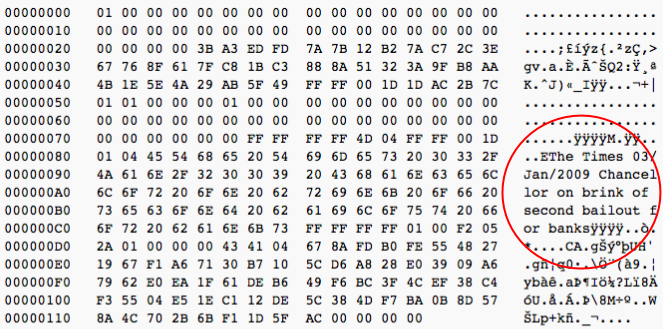

With Bitcoin, Satoshi Nakamoto created an alternative monetary system at the beginning of 2009. In the "Genesis Block", the Bitcoin inventor also drew attention to the negative aspects of the centrally controlled fiat money system. He immortalized the news of another "bailout" for the banks as part of the global financial crisis. These bailouts are a direct symptom of the currently prevailing "monetary socialism", in which central actors - without the consent of the population - can redistribute money or purchasing power in order to support related industries, which are often major political donors.

Bitcoin is a money that is verifiably limited in its total quantity. In fact, Satoshi Nakamoto's great innovation was to create digital scarcity in the first place. The unknown person (group) has brought the world an uncensorable, hard money with which humanity can trade in its basic form in a globalized world. In doing so, Satoshi has not only created the better gold, but has opened up the possibility of sustainably switching to a monetary system that no entity is able to control and in which there is no need for middle men.

El Salvador is one country that has already declared Bitcoin as its official means of payment. In the US, too, voices are currently growing louder - including from high-ranking politicians - calling for the US dollar to be backed by Bitcoin or for the world's most relevant economy to have a Bitcoin reserve. Meanwhile, the BRICS nations are toying with the idea of implementing a gold-backed trading currency.

53 years after the beginning of the "fiat era", a global rethink seems to be taking place, which has its origins not least in the escalating national debt worldwide and the sharp rise in prices for everyday goods. Most people now realize that Bitcoin is here to stay. If adoption continues at this rate and the asset, which is only 15 years old, increasingly establishes itself as a stable store of value, it will probably only be a matter of time before Bitcoin establishes itself as the global money due to its superiority - also with the help of second-layer technologies such as the Lightning network, which is based on Bitcoin.

Whether and when the fiat money system will come to an end remains to be seen. In view of current developments, however, it is more likely to be in its final stages. Nevertheless, it cannot be ruled out that unbacked paper money and the many problems that an arbitrarily centrally controlled monetary system entails will be with us for a few more years or even decades.