Since the beginning of the week alone, Germany and the federal state of Saxony have apparently sold around 25,000 Bitcoin. Of the 50,000 Bitcoin seized by Saxon authorities in January, around 38,000 BTC were still in the wallet assigned to the Federal Criminal Police Office on Monday morning. As of today, only just over 13,000 units remain.

Although Germany is probably causing strong selling pressure at the moment, the Bitcoin price seems to be coping well with this. Since last Friday's low, Bitcoin has already recovered by around 8 percent. One factor in this is likely to be the Bitcoin spot ETFs from the USA. These have since seen inflows of several hundred million US dollars per trading day.

ETF inflows pick up speed again

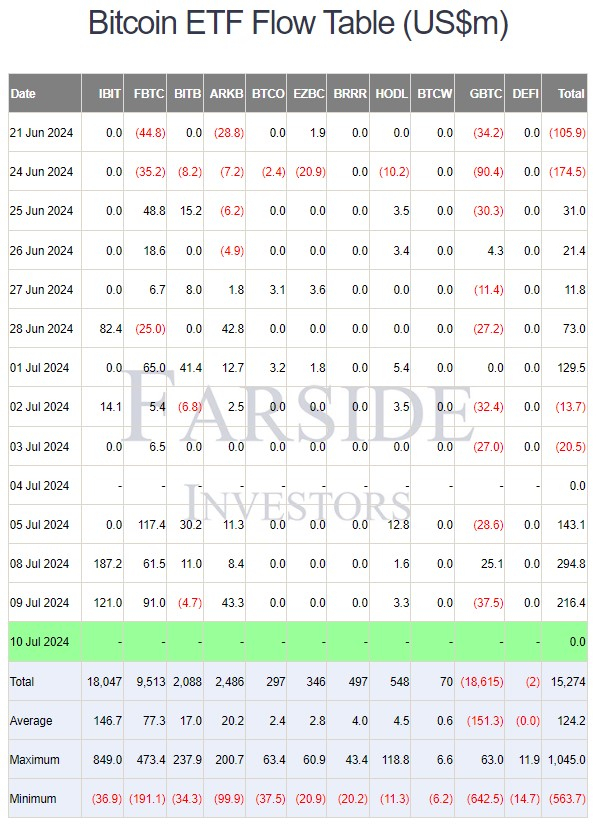

Following a brief lull in US Bitcoin spot ETFs in mid-June, demand for the investment products is currently high again. Since June 25, funds have flowed into the ETFs on eight out of ten trading days - a total of USD 886.8 million during this period.

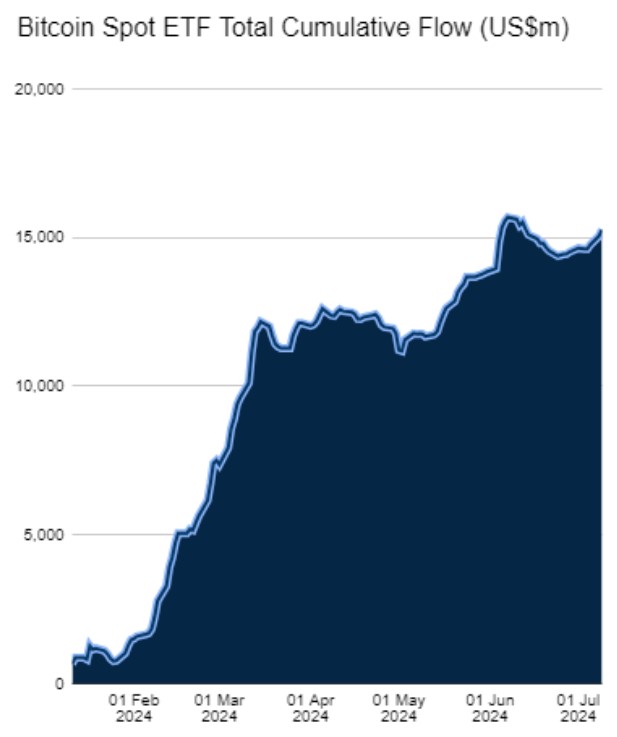

In particular since Friday last week, the day on which the Bitcoin price reached its local low of around USD 53,500, ETF inflows have once again increased significantly. In the three trading days since then alone, US investment products have absorbed USD 654.3 million or 11,610 BTC. This means that cumulative inflows since the start of trading in January have risen again to USD 15.27 billion and are thus only just below the high of USD 15.68 billion reached at the beginning of June.

This shows that US ETF investors, including institutional investors, are taking advantage of the lower Bitcoin price, which is probably due in part to the sales by Germany.

Some market observers had feared that Wall Street would panic-sell Bitcoin ETFs if the price were to plummet. However, it now turns out to be the other way around.

Bloomberg ETF experts were also surprised that ETF investors, who are jokingly referred to as "boomers", are currently acting anti-cyclically. "Boomers persevered, even harder than I had predicted, and kept net inflows above USD 15 billion since the start of the year," commented Eric Balchunas on the Bitcoin spot ETF data on the 𝕏 platform yesterday. His colleague James Seyffart already wrote on the topic at the weekend that the ETFs showed the complete opposite of strong ETF outflows during the first major correction.

Bitcoin ETFs doing the exact opposite of "dumping" in the first ~20% drawdown since launch https://t.co/bh4dyKzOft-

James Seyffart (@JSeyff) July 6, 2024

The market absorbs the German Bitcoin

The fact that the Bitcoin price is holding up so well while Saxony is apparently selling billions of Bitcoin suggests that the market has already anticipated a large part of the selling pressure. In addition, the high demand for Bitcoin, particularly via spot ETFs from the US, is counteracting this somewhat.

It remains to be seen whether the market will also be able to easily absorb the coins that were redeemed by the Bitcoin exchange Mt.Gox, which collapsed ten years ago. However, it has long been known that this could potentially bring additional tens of thousands of Bitcoin onto the market in the coming weeks.

Once the selling pressure from the Mt.Gox coins and the German state of Saxony is finally over and the Bitcoin has been distributed in the market, it is quite conceivable that the Bitcoin bull market will continue at full speed in light of the US presidential election and the forthcoming interest rate cuts by the US Federal Reserve.