This week, the Bitcoin exchange Mt.Gox, which collapsed in 2014 due to hacks, began repaying BTC to its damaged customers. It has been known since Monday last week that this will happen from the beginning of July - Blocktrainer.de reported. Now there are further developments regarding the potential pressure to sell the almost 142,000 Bitcoin worth around 8 billion US dollars.

The Bitcoin price has dropped significantly in response to the start of redemptions this week, falling to USD 53,500 at times. With a price drop of around 12%, it is already the weakest week for the Bitcoin price since the collapse of the FTX crypto exchange in November 2022. Bitcoin fell by over 20% over the course of the week.

The repayments from Mt.Gox begin

The customers of Mt.Gox, the largest Bitcoin exchange at the time, have been waiting over ten years for a refund of the coins they left on the exchange. The Japanese exchange lost almost one million Bitcoin after several hacks. Mt.Gox was able to recover around 200,000 BTC, of which just under 142,000 are now available to compensate customers at the time. In addition, there is almost the same number of units of the hard fork Bitcoin Cash, a spin-off from the Bitcoin network in 2017, and over 400 million US dollars in Japanese yen.

Even if only some of the Bitcoin lost at the time can be repaid by Mt.Gox, those who suffered losses at the time are likely to be pleased. Only a few of them would probably have held on to their holdings to this day without this circumstance. Since then, the price of Bitcoin has increased roughly a hundredfold and the return measured in US dollars for customers who were forced to become steel "hodlers" is gigantic. Moreover, when an exchange goes bust, there is always the risk of ending up completely empty-handed.

The Bitcoin on the exchange, which was managed by Frenchman Mark Karpelès at the time, is now gradually finding its way back to its rightful owners.

MtGox customers have finally started receiving Bitcoins! After over 10 years I wasn't sure anymore if it'd finally happen, but here we are finally!!! This has been a long journey and I'm happy to see we're finally getting there, only a bit more...

- Mark Karpelès (@MagicalTux) July 5, 2024

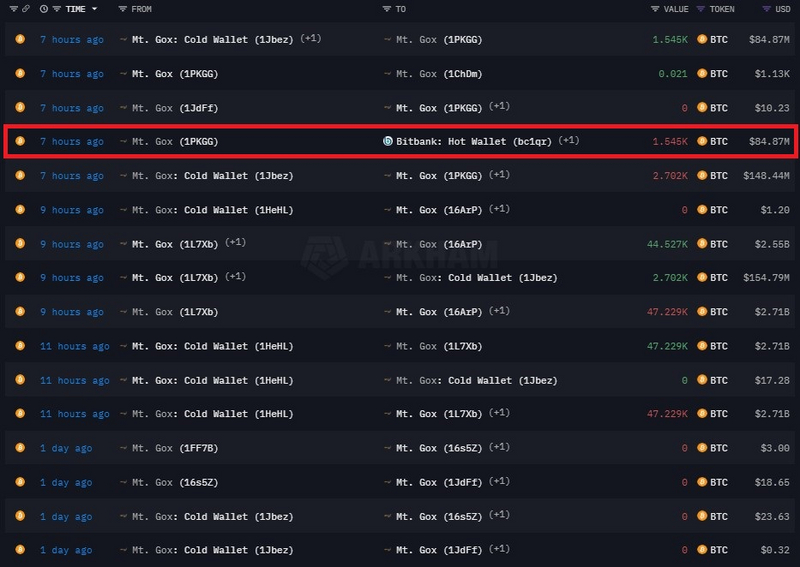

Tonight, 1,545 BTC worth the equivalent of over 80 million US dollars have already been paid to the Japanese crypto exchange Bitbank. Today, the rehabilitation trustee also issued a statement indicating that the repayments have now been initiated and can be completed swiftly, provided that certain conditions are met - including that the discussions with the settling crypto exchanges have been concluded or that the aggrieved parties have a registered account with the exchanges in question.

However, the creditors of Mt.Gox - as the former CEO has also made clear - will have to wait a little longer. This probably also applies to those hoping for a quick end to the pressure to sell.

It was communicated from the outset that the repayments would extend until October 31. Depending on the exchange handling the payout of the aggrieved Mt.Gox customers, it can take up to 90 days for the coins to actually end up with their rightful owners. This is the case with the exchange Kraken, which has not yet received any Mt.Gox coins. Bitbank, on the other hand, the first exchange that has already received Bitcoin, will process the repayments within two weeks according to the rehabilitation plan itself.

Bitcoin price collapses in anticipation of the sell-off

It is almost certain that the repayment of around 142,000 BTC is the main reason for the current significant decline in the Bitcoin price. Although Germany and the federal state of Saxony also regularly sell hundreds of Bitcoin, the potential selling pressure from the Mt.Gox coins is likely to significantly outweigh this.

So far, however, market participants still seem to be selling their BTC primarily in anticipation of the Mt.Gox selling pressure, as the redemptions have only just begun and only a fraction of them so far. However, it is surprising that the Bitcoin price has plummeted so sharply, even though it has been clear for years that one day many of the BTC recovered by Mt.Gox will end up back on the market. It has also been known for almost two weeks that the repayments are now imminent. Accordingly, it would have been more logical if the market participants who wanted to "frontrun" this selling pressure had already done so on Monday last week.

As is usual for the crypto market, liquidations by traders are currently reinforcing this price movement. In the past three trading days alone, liquidations of positions betting on a rising Bitcoin price have already amounted to around USD 265 million.

It remains to be seen how large the actual sell-off by Mt.Gox coins will ultimately be. Only time will tell whether the Bitcoin price will come under further pressure as a result of the repayments or whether the market has already completely anticipated the potential selling pressure.

On today's trading day, the Bitcoin price was at times more than 27% below its all-time high in mid-March. So far, this price decline has been a normal correction in Bitcoin bull markets, in which BTC has frequently recorded setbacks of around 30% or even more in the past.