Bitcoin: Is the sell-off over?

Bitcoin did not perform well in the second quarter, which ended yesterday. The Bitcoin price fell by more than 10 percent in the period from April 1 to June 30. However, even in Bitcoin bull markets, quarters with price losses are not unusual and the signs are good that the correction may now have come to an end.

Corrections are normal for BTC

While the Bitcoin price virtually only knew one path in the first quarter of this year, and that was upwards, the asset has gone into correction mode since mid-March, when it set its previous all-time high of just under USD 73,800. After the phenomenal rise beforehand, this is unlikely to cause any uncertainty.

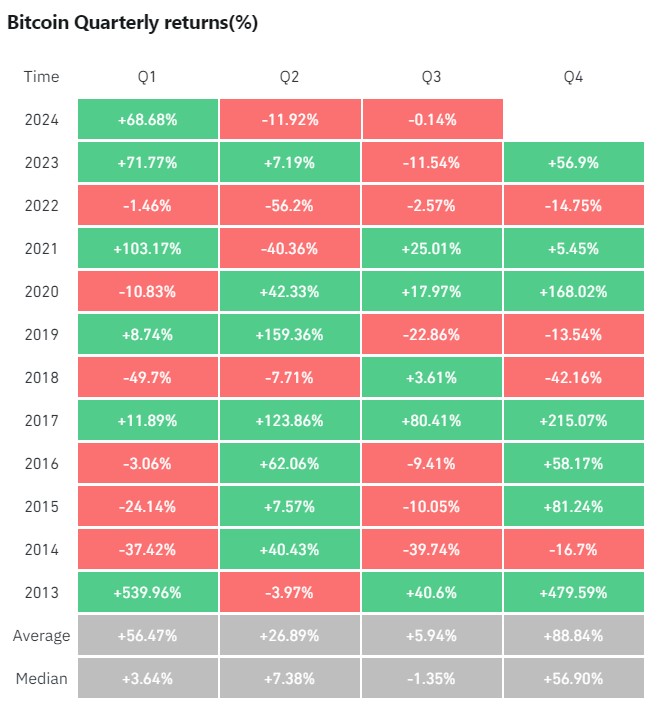

In Q1 2024, Bitcoin gained almost 70% and this price increase followed an equally strong last quarter of 2023, in which BTC rose by almost 60%. As of now, Bitcoin has still recorded an increase of around 50% since the beginning of the year.

Even in bull markets, significant setbacks in the Bitcoin price are sometimes normal. For example, when the Bitcoin price increased more than a hundredfold from summer 2015 to winter 2017, there were not only several corrections of around 30% along the way, but also quarters of negative performance. Even in the last bull market, the asset slumped by more than 55% in the summer of 2021, only to rise to new highs again afterwards.

In general, the Bitcoin price usually has a harder time in the summer months. This can be explained by the fact that people are generally less interested in investing or keeping their money together for summer vacations when the weather is good. The lower level of interest can also be seen in the current decline in Google searches for Bitcoin. In the first and last quarter of the year, however, the Bitcoin price historically records significantly better average returns.

Bitcoin ETFs with a weaker 2nd quarter

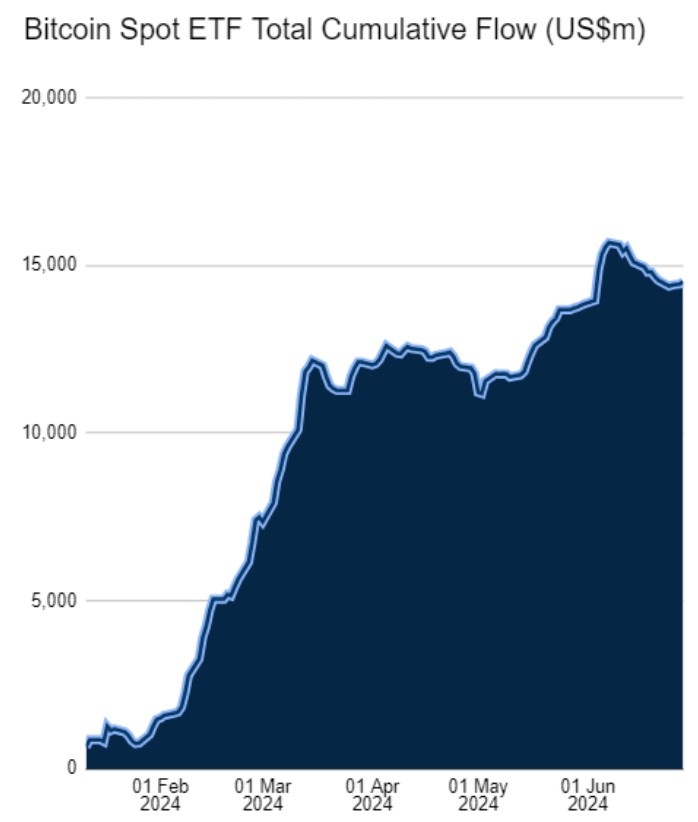

In the first quarter, inflows into the Bitcoin spot ETFs, which started trading on the US stock exchanges on January 11, fueled the price. The new investment products recorded slightly more than USD 12 billion in cumulative net inflows up to March 31 alone. Since then, demand for the exchange-traded funds has declined noticeably, which was also reflected in the weaker Bitcoin price. There were even some days on which exchange-traded funds lost hundreds of millions of euros.

Nevertheless, spot ETFs still recorded cumulative net inflows of more than USD 2.5 billion in the second quarter - a considerable sum even for Wall Street.

After the brilliant start of the investment products, some market participants probably assumed that demand would remain at this high level forever. However, it was foreseeable that sooner or later there would be a breather - as Bloomberg's ETF analysts repeatedly emphasized when the hype seemed never-ending.

It remains to be seen whether inflows will pick up again in the third quarter. This is supported by the fact that institutional investors often rebalance their portfolios at the half-year mark. If one of their investments significantly outperforms the others, they usually sell it proportionately in order to regain the desired portfolio weighting. As Bitcoin performed significantly better than the stock markets or gold in the first half of the year, it can be assumed that some investors reduced their BTC position to the originally planned proportion as part of the rebalancing process. The selling pressure presumably triggered by this should therefore have come to an end for the time being.

One indication of this is that the Bitcoin price was already able to recover well from the low of the last trading day of the first half of the year on the weekend, when Wall Street is not trading. Since then, Bitcoin has recorded an increase of over 5 percent.

Upcoming selling pressure priced in?

In addition to the alleged reallocation measures by institutional investors, the looming selling pressure from the insolvent crypto exchange Mt.Gox, Germany and the US is also likely to have had a negative impact on the price in recent days.

When it became official on Monday last week that the repayment of around 140,000 BTC recovered by Mt.Gox would begin in July, the Bitcoin price fell by more than 5% over the course of the day. The fact that Germany and the USA repeatedly transferred shares of their confiscated Bitcoin holdings to exchanges also caused additional panic.

As the price reaction to the potentially imminent sales by the compensated Mt.Gox customers shows, the market is quickly pricing in upcoming selling pressure. Conversely, this also means that the actual sales are unlikely to cause prices to fall. It may even be that once the sales have been completed, the market will breathe a sigh of relief, as the worst is over and no further events are imminent that could cause prices to fall.

At the moment, Bitcoin miners are also continuing to sell off their holdings. If this selling pressure also comes to an end soon, then demand is likely to significantly exceed supply, leading to a rising price.

Exciting months ahead

Insofar as the coming selling pressure has already been fully priced in, there is hardly anything standing in the way of rising prices - at least if the buying demand does not unexpectedly come to an end. However, with the first interest rate cuts by the US Federal Reserve expected to take place in September and further progress in Bitcoin adoption - including among stock corporations - the buying volume is likely to pick up even more momentum in the coming months.

A significant rise in the Bitcoin price towards the end of the year at the latest, which continues the rally well into 2025, would also fit perfectly into the pattern of previous cycles. It remains to be seen how Bitcoin will develop in the coming months and which catalysts will prove to be the primary price drivers in retrospect.