The Bitcoin price has been able to make significant gains in recent days. Since the interim low of around USD 52,500 on September 6, BTC has risen by over 25% to USD 66,000 at times within just a few weeks. The asset is thus trading at its highest level since the end of July.

This price increase was accompanied by strong inflows into the US Bitcoin spot ETFs. The investment products even broke a previous record yesterday - that of cumulative inflows.

All-time high for Bitcoin ETF inflows

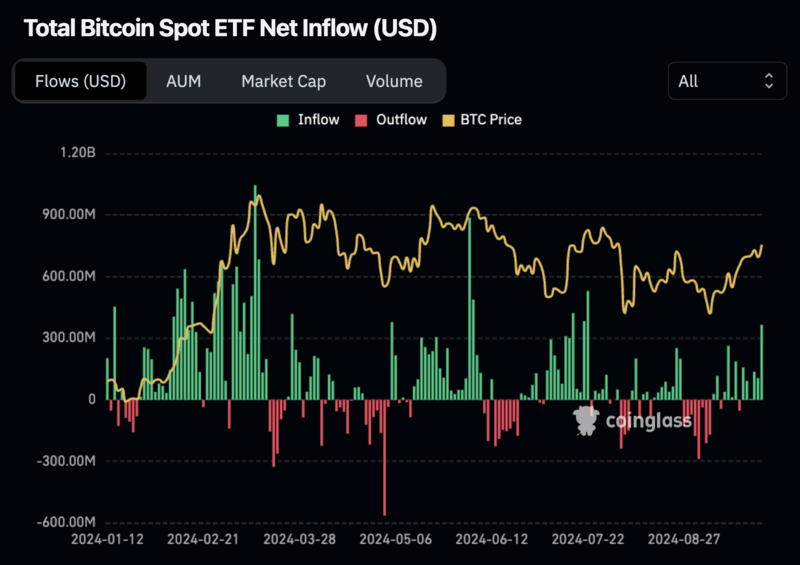

Yesterday, the US Bitcoin spot ETFs recorded combined inflows of around USD 365 million. This was their best day since the end of July.

In the past 14 trading days, fresh capital has flowed into the investment products in 12 cases - a total of just over USD 1.4 billion.

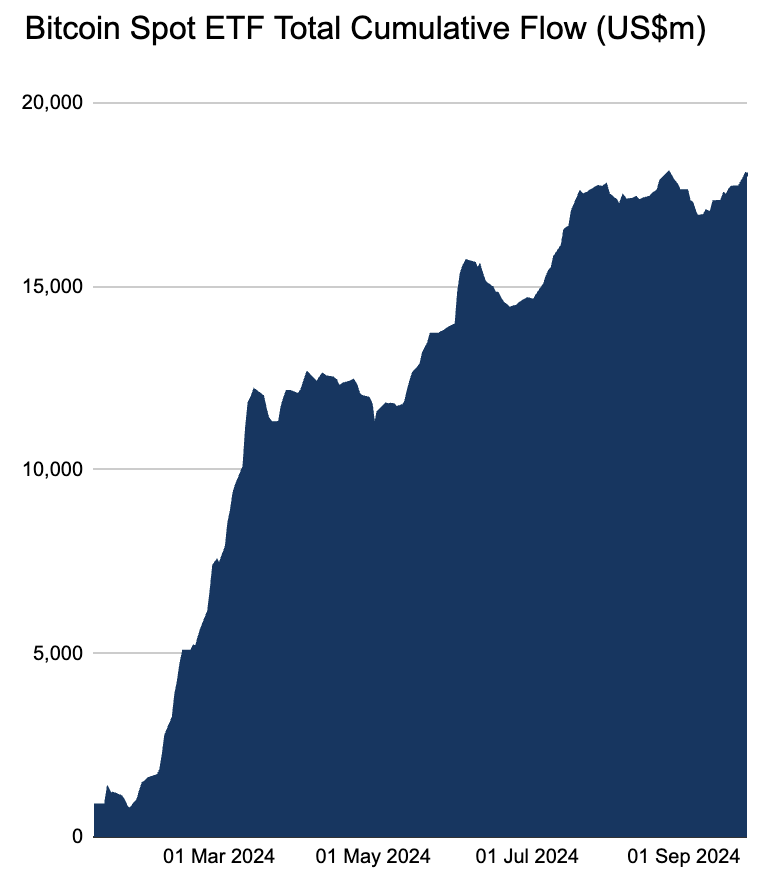

The strong trading days of the past few days have enabled Bitcoin ETFs to set a new all-time high in what is probably the most important metric. These are the cumulative net inflows since admission. Here, the daily inflows and outflows across all Bitcoin ETFs are added up - at the US dollar value on the respective day.

With yesterday's inflows of USD 365 million, this metric has risen above USD 18.3 billion for the first time. The previous high was slightly less than USD 18.1 billion, which the investment products reached exactly one month earlier.

In total, the Bitcoin spot ETFs from the US collectively hold more than 920,000 BTC worth around USD 60 billion. The largest ETF is that of BlackRock, the world's largest asset manager. $IBIT alone holds more than 360,000 BTC on behalf of clients.

Investors who invested in one of the new investment products at the start of trading on January 11 can look forward to a price increase of more than 30 percent as of today.

Demand from Wall Street remains high

The fact that Bitcoin spot ETFs are still regularly recording inflows in the triple-digit millions more than eight months after approval shows that traditional investors continue to view Bitcoin as an attractive investment - even at a price close to its all-time high.

The investment managers' 13F filings for the third quarter, which are due to arrive shortly, should provide some information as to which market participants could be behind this strong ETF data. Among other things, these showed for Q1 and Q2 that not only hedge funds and RIAs, but also state pension funds have built up a Bitcoin position via ETFs.

Meanwhile, institutional adoption could only really pick up speed in the coming months, as the CIO of asset manager Bitwise, which has also launched a Bitcoin spot ETF, explains. According to Matt Hougen, the majority of influential people in the financial sector are already privately invested in Bitcoin and the like, which in his experience should now lead to clients following suit.

It remains exciting to see which major investors are behind the strong inflows of recent days and weeks and whether the institutional adoption of Bitcoin will actually increase significantly in the coming months. In any case, the signs are currently good that the Bitcoin price could also reach a new all-time high in the near future.