The Bitcoin price has been trading in a wide range between USD 49,000 and USD 74,000 for more than half a year now - with some ups and downs.

With a current price of around USD 65,000 per BTC, the asset is up around 50% since the start of the year - and this after a strong 2023 in which Bitcoin gained more than 150%.

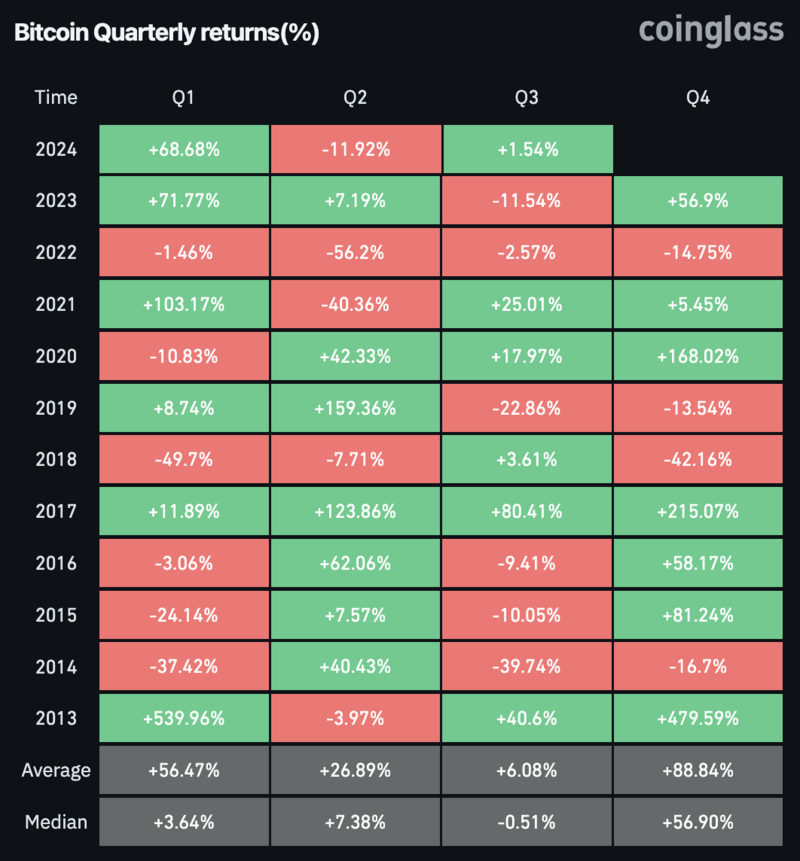

The fourth quarter, which has generally been particularly strong for Bitcoin historically, is now imminent. On average, BTC has gained over 88% from October to December over the past ten years.

The best Bitcoin months are by far October and November, which clearly stand out with an average performance of 22.9% and 46.8% respectively.

The current news situation would certainly allow the Bitcoin bull market to continue. Potentially strong price-driving catalysts are also still imminent.

Global liquidity likely to increase significantly

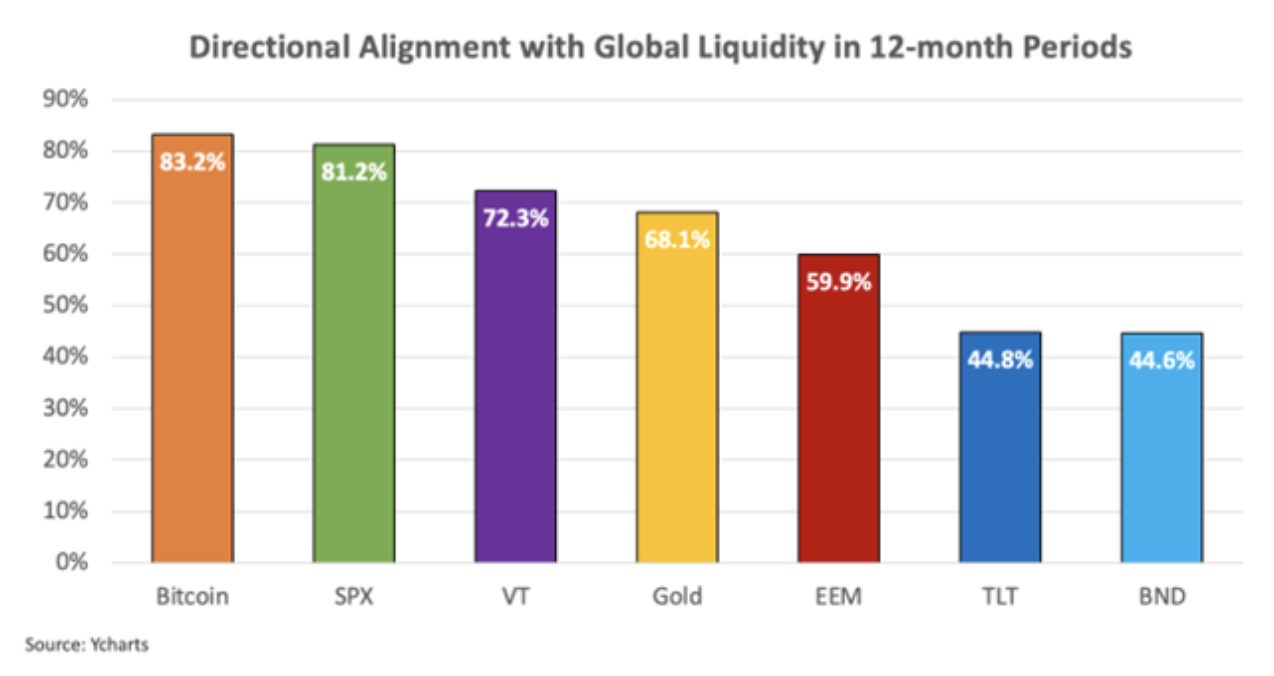

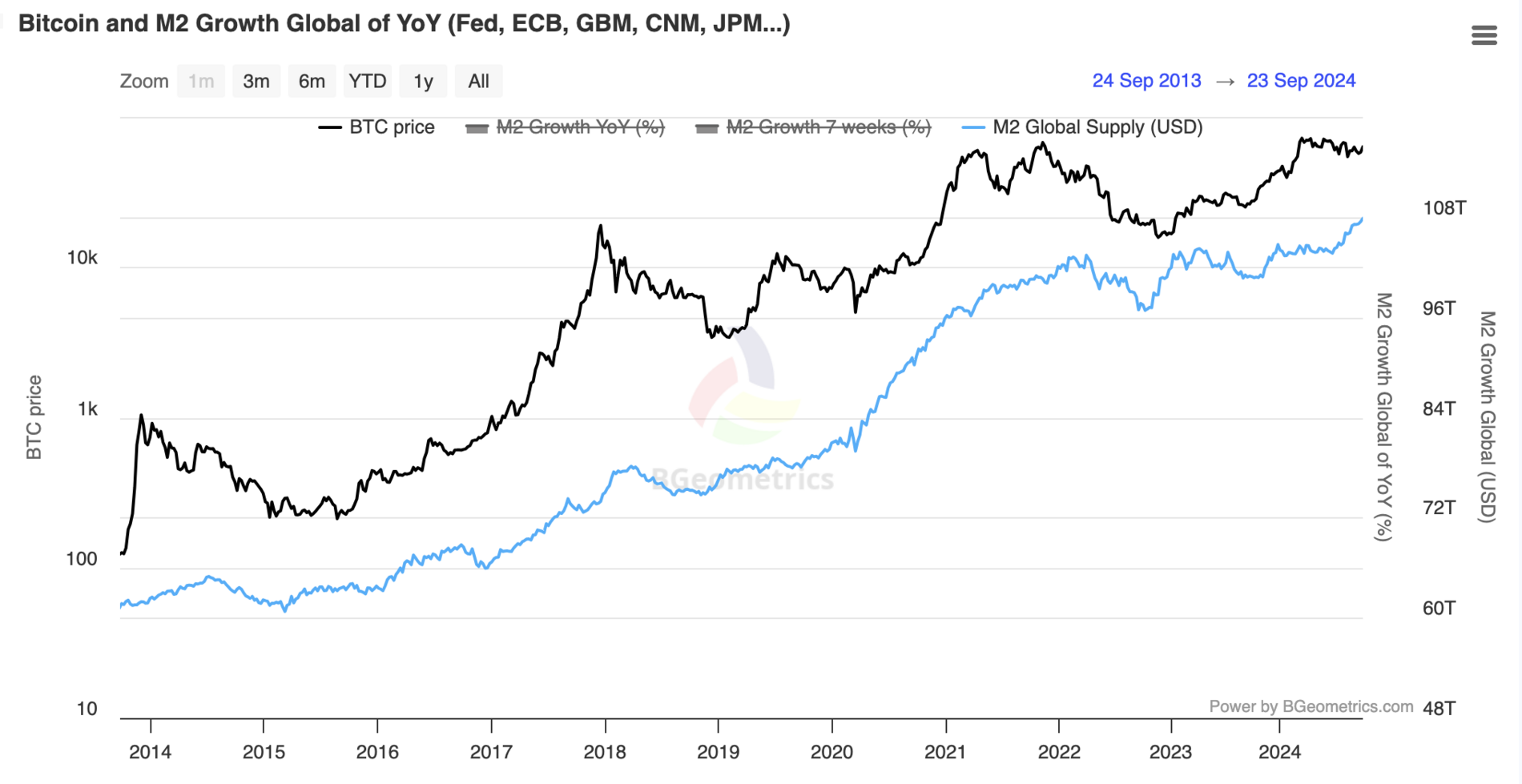

Bitcoin has a high correlation with the global money supply. This strong correlation was recently demonstrated in a study commissioned by the renowned analyst Lyn Alden. The result: Bitcoin is the asset that moves most consistently in the same direction as the global money supply.

Bitcoin moves in the direction of global liquidity 83% of the time in any given 12-month period, which is higher than any other major asset class, making it a strong barometer of liquidity conditions.

from the study

With the interest rate turnaround now initiated by the US Federal Reserve and further imminent interest rate cuts by the Federal Reserve, the signs are good that global liquidity will continue to rise. Lower interest rates encourage borrowing, which increases the amount of money in circulation in the currently prevailing fiat money system.

In addition, China, the world's second-largest economy after the USA, will now also further loosen its lending conditions. Specifically, the head of the Chinese central bank (PBOC) announced this week that the PBOC would further reduce interest rates - including interest rates on outstanding real estate loans - in order to stimulate the economy.

The minimum reserve ratio for banks is also to be reduced by 50 basis points, which should free up around an additional one trillion yuan (140 billion US dollars) for loans. The head of the PBOC has also hinted at further reductions in this area. The PBOC also announced that it would reduce the minimum down payment for real estate.

In this context, analyst Lyn Alden emphasized that the impact of China's stimulus package is somewhat overestimated by the bulls in the short term, but that the positive effect of this is likely to be more long-term than the bears currently assume.

If the money supply in the People's Republic also increases significantly, global liquidity, which is currently at an all-time high, is likely to shoot up further and fuel the Bitcoin price.

Regulatory environment improves

With the approval of Bitcoin spot ETFs by the US Securities and Exchange Commission (SEC), it should now be a done deal that the US and other major nations will no longer put too many obstacles in the way of Bitcoin. This has contributed immensely to the legitimization of the asset - not least because large and influential asset managers such as BlackRock also have an interest in the success of Bitcoin and even state pension funds from the USA are invested in the Bitcoin spot ETFs.

However, it was only a "minimal embrasure", as Michael Saylor repeatedly emphasized. For example, the SEC has only approved the "in-cash method" for the investment products. With this method, it is not possible to exchange Bitcoin directly for ETF shares and vice versa. This would require approval of the "in-kind method", which is also more advantageous from a tax perspective.

In addition, there are currently no options based on Bitcoin spot ETFs. Last week, the SEC finally granted approval for options for BlackRock's Bitcoin ETF ($IBIT) - Blocktrainer.de reported. The OCC and CFTC have yet to give the green light for IBIT options to become tradable. However, it can be cautiously assumed that this will happen in the foreseeable future.

According to MicroStrategy founder Michael Saylor, Bitcoin ETF options will "accelerate institutional adoption". Bloomberg ETF expert Eric Balchunas explained that the options will attract additional liquidity, which in turn will make the asset class more attractive to other large investors.

Another drag is the SEC's SAB 121 regulation, which makes it extremely difficult for financial institutions to hold Bitcoin on behalf of their clients. Even though the resolution that would have overturned SAB 121 has failed for the time being due to President Joe Biden's veto, there are positive developments in this regard. The major bank BNY Mellon will be exempted from the directive in order to be able to act as a custodian of the Bitcoin spot ETFs - Blocktrainer.de reported.

A softening or even permanent repeal of SAB 121 could further integrate the asset into the traditional financial system, giving it additional legitimacy and making it more accessible to institutional investors. Saylor sees this as a major catalyst for the wider use of Bitcoin as capital.

When SAB 121 gets repealed or when there's support for banking bitcoin in the traditional banking system, i think that accelerates the monetization of bitcoin and it accelerates the demonetization of equity and debt.

Michael Saylor in an interview

Institutional adoption continues to gain momentum

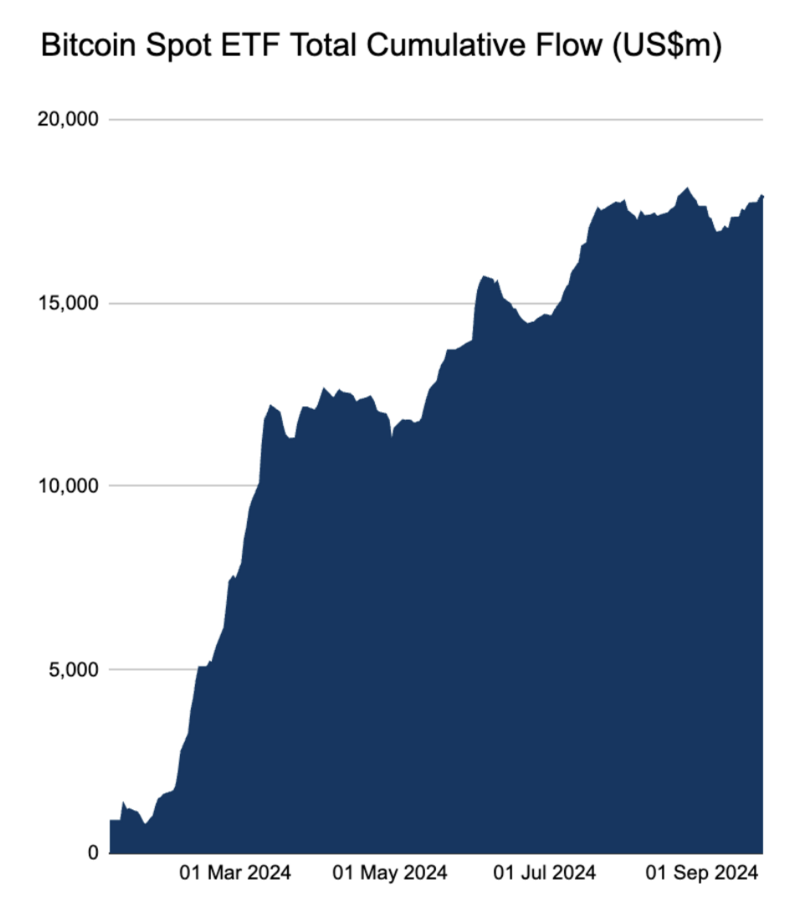

With the Bitcoin spot ETFs approved in the US in January, major investors now have a regulated investment product with which they can invest in the asset via the established structures of Wall Street. The ETFs are still very popular and have seen cumulative inflows of around USD 18 billion since trading began.

However, institutional adoption takes time. Before asset managers, pension funds or insurers invest in Bitcoin, they generally carry out thorough due diligence processes and take a closer look at the asset class. Given that this is a lengthy process, it is astonishing that even state pension funds such as those of Michigan or Wisconsin have already invested in Bitcoin via ETFs.

However, the next surge in demand could be imminent. Matt Hougan, CIO of asset manager Bitwise, explained this in a recent interview. According to him, 70 to 80 percent of influential figures in the financial industry already have an allocation to cryptocurrencies. In his experience, their clients are now slowly but surely following suit.

I speak each year at the Barron's Top 100 conference to the 100 largest financial advisors and wealth managers in the world [...]. I always ask the audience, "how many people here own crypto?". [...] I asked this year, and it was 70 or 80 percent of the hands. The whole room owns crypto in their personal accounts. [...] I think the catalyst is bitcoin ETFs. They made it easy for these people to allocate. And the important thing that I know from having been at bitwise for six yeas, is, the step before they allocate in mass for clients is doing it themselves. [...] That tells me, when I go back next year, all the clients of these people will have allocation to crypto and that does tell me, that the bull market is near.

Matt Hougan in an interview

The fact that more and more institutional investors are interested in Bitcoin is also reflected in the fact that banks and financial service providers are expanding their offerings in this area. Commerzbank, for example, recently started offering its business customers the opportunity to trade and store Bitcoin. The payment service provider PayPal is now also offering US corporate customers the opportunity to trade, accept and even transfer Bitcoin and Co. to their own wallet - Blocktrainer.de reported.

The first "Bitcoin election campaign"

On November 5 of this year, Americans will elect their president. Bitcoin has already become a relevant topic in this election campaign. Presidential candidate Donald Trump, for example, has promised to establish a Bitcoin reserve for the US and to protect the right to Bitcoin mining and self-custody.

The ex-president is also toying with the idea of solving the US national debt problem, which is worth more than 35 trillion US dollars, with Bitcoin - Blocktrainer.de reported. A few days ago, the 79-year-old returned to the subject - although in this case he only spoke of "crypto".

If Donald Trump wins the election, this could significantly boost the Bitcoin price. On the one hand, because an even more favorable regulatory environment can then be expected. On the other hand, however, active Bitcoin purchases by the US could possibly follow in order to improve the nation's financial situation. Trump's party colleague, Senator Cynthia Lummis, has already presented the appropriate bill for this, which provides for the accumulation of one million Bitcoin - Blocktrainer.de reported.

Renowned analysts such as Bernstein assume that Trump's election victory could lead to a sharp rise in the price of Bitcoin due to the Republicans' pro-Bitcoin stance. By the end of the year, the well-known analyst firm sees the Bitcoin price at USD 80,000 to 90,000 if Donald Trump wins the election.

However, the regulatory landscape could also improve a little with Kamala Harris - although disappointment on the Bitcoin market could prevail for the time being. The presidential candidate recently emphasized that she would promote "digital assets" - Blocktrainer.de reported. This is also stated in her 80-page economic agenda. In addition, the current vice president promised that the USA will remain dominant in the "blockchain sector" with her.

Ultimately, however, Bitcoin may not care who moves into the White House. Bitcoin will no longer be banned - even if this were not possible - and the asset will continue on its path regardless of who leads the USA. One thing also remains certain: with both Trump and Harris, the US national debt will almost certainly continue to escalate for the time being and have a negative impact on the purchasing power of the US dollar - arguably Bitcoin's biggest competitor.

Selling pressure over?

In recent weeks and months, one-off effects in particular have led to headwinds for the Bitcoin price. For example, the already completed emergency sale by the German state of Saxony or the repayments of the Bitcoin exchange Mt.Gox, which was closed in 2014. The remaining 45,000 or so Bitcoin are likely to leave the Mt.Gox wallet by October 31, possibly leading to selling pressure. However, sellers should then gradually run out of Bitcoin.

Meanwhile, the repayments of the crypto exchange FTX, which collapsed in 2022, could be a potential price-driving factor. The exchange, whose founder Sam Bankman-Fried has since been jailed, will pay out around USD 16 billion in cash to its former customers - and is expected to do so from the fourth quarter. As FTX customers are probably Bitcoin or crypto enthusiasts, a good portion of the money is likely to find its way back into the market.

Is a continuation of the bull market inevitable?

In addition to all the positive catalysts, the Bitcoin price has always gone through the roof several months after the halving in the past, which took place for the fourth time this year in April. The explanation for this is that halving the number of new Bitcoin added per block has a significant impact on supply and demand dynamics in the market in the medium term.

Even if there are good signs that prices will rise sharply in the coming months, it is of course not a foregone conclusion that this will actually happen. Past patterns such as the well-known Bitcoin cycles are no guarantee for future developments.

One risk is and remains that the US economy slips into a severe recession, which could put pressure on the capital markets as a whole. The geopolitical situation could also come to a head and a major war could break out. Even if the asset manager BlackRock has stated in a recent report that Bitcoin will rise in the medium term in response to crisis situations, this could - at least in the short term - cause BTC prices to fall sharply.

Even if rising money supply is good for the Bitcoin price per se, it harbors the risk of consumer goods becoming more expensive. A further wave of inflation could throw a spanner in the works for the central bankers' planned monetary easing and thus cause major disappointment on the capital markets, where this is already partly priced in.

If there are no major crises and the central banks are able to stimulate the markets without triggering a sharp rise in consumer goods prices, the environment should be perfect for a sharp rise in the price of Bitcoin, which should receive a further boost from rising institutional demand and developments in the US election.