Federal Reserve leaves key interest rate unchanged and disappoints with interest rate outlook

The Federal Reserve (Fed) left the key interest rate in the range of 5.25% to 5.50% for the seventh time in a row today - this was already expected. The market was eagerly awaiting the prospect of future interest rate hikes by the monetary authorities as part of the dot plot and the press conference by Fed Chairman Jerome Powell.

The members of the Federal Open Market Committee (FOMC) only held out the prospect of a median interest rate cut this year, putting a slight damper on the markets.

The Bitcoin price corrected slightly in response to the central bank meeting, giving up the gains made after the better-than-expected inflation figures for May, which were also reported today.

What the markets paid attention to

Before the central bank meeting, the probability that the monetary authorities would leave the key interest rate unchanged was almost 100 percent. Accordingly, the news that this is exactly what happened came as no surprise - even if the inflation data reported today, which was better than expected across the board, was taken into account in the decision, according to Jerome Powell.

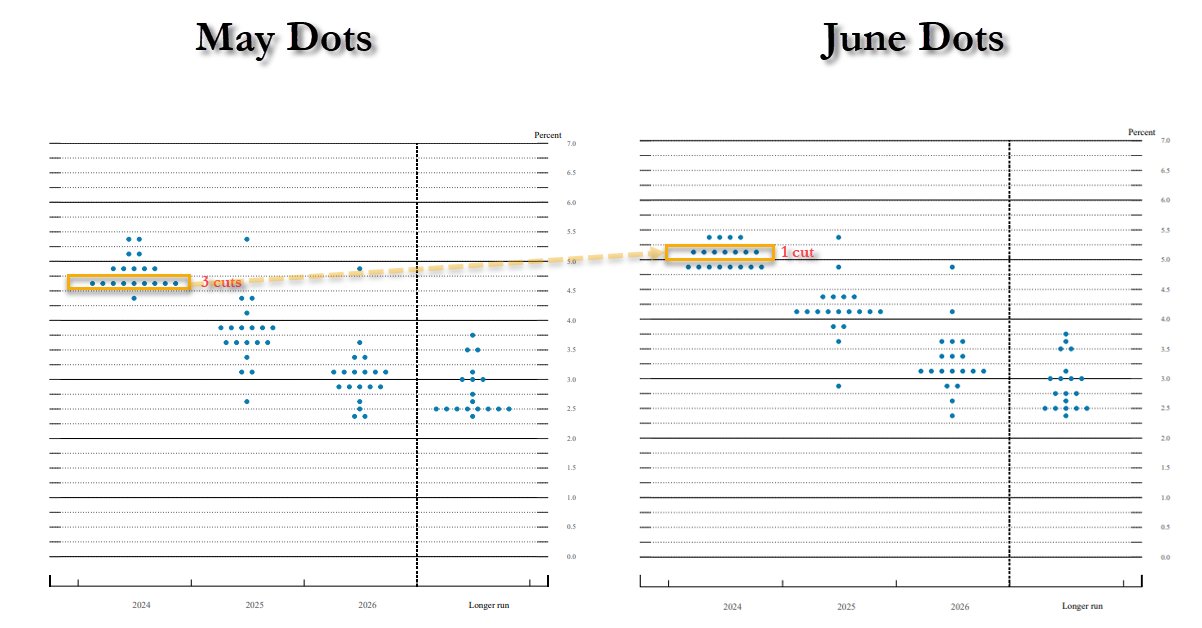

The focus of the markets at today's FOMC meeting was on the so-called dot plot, which shows the interest rates forecast by the individual FOMC members for the future. The monetary authorities publish the dot plot every three months, i.e. at the central bank meeting in September, December, March and June.

Dot plot causes slight disappointment

The dot plot published at the central bank meeting in March signaled three interest rate cuts before the end of the year. Now, however, the monetary authorities are forecasting fewer rate cuts. Four FOMC members predicted no interest rate cuts, seven predicted one and eight two. The median forecast is therefore only one rate cut this year.

However, as US inflation has already turned out to be somewhat more stubborn in recent months and the market has already priced in only one or two interest rate cuts, the negative surprise was limited.

However, the long-term outlook is also somewhat more pessimistic. While the median long-term interest rate forecast in March was still 2.6%, it is now 2.8%.

Press conference not bullish enough

In the press conference, Jerome Powell said of the inflation data reported today that while it was "a step in the right direction", a single data point should not be over-interpreted. The Fed Chairman thus emphasized that this is not quite enough to be confident enough that inflation will return to the 2% target in the near future. This interpretation may have slightly disappointed the markets.

Interest rate cuts become a political issue

Although the current inflation rate in the US is well above the 2% target at 3.3%, pressure for interest rate cuts is growing. On Monday this week, Elizabeth Warren and two other Democratic senators tried to urge the Fed chairman to cut interest rates.

They have kept interest rates too high for too long: It's time to lower them.

From the open letter

The reasoning behind this was that working people were suffering from the still relatively high interest rates and that this was provoking a recession. The senators also pointed out that high interest rates would increase the cost of housing and insurance and thus fuel inflation.

Due to the US presidential election in November, the Democrats are keen to ensure that the economy performs well and a recession is avoided. The dilemma, however, is that high inflation figures are also unpopular with the population.

The European Central Bank (ECB) and the Bank of Canada (BoC) have already cut interest rates by 25 basis points each, although inflation in the eurozone and in Canada is also above the target value - at 2.6 and 2.7 percent respectively.

Interest rate cuts will come

As the market currently assumes and the Fed is also signaling, the key interest rate of the world's most relevant currency should be lowered in the foreseeable future. Presumably as early as the central bank meeting in September, the last before the presidential election in November.

With a rate cut in September, which the market is currently still pricing in with a probability of over 60%, the Fed would be giving the Democrats a helping hand. After all, it is also in the Fed's own interests to prevent Republican Donald Trump from becoming president, as he has already announced his intention to replace the central bank.

However, the former president has also often called for lower interest rates in the past, which is why a very loose monetary policy can be expected under his presidency. This is one of the reasons why some economists are predicting that inflation could pick up significantly under Trump - there is even talk of hyperinflation in this context.

There has never been a presidential program that has been as obviously inflationary as President Trump's. I have little doubt that we will see a significant acceleration in inflation with the Trump program, unless we get a major recession first.

Larry Summers, renowned economist in an interview with The Atlantic

How inflation and the monetary policy of the most relevant economy will develop in the coming months remains exciting to watch. At the moment, the question is not if, but when the US Federal Reserve will cut interest rates again.

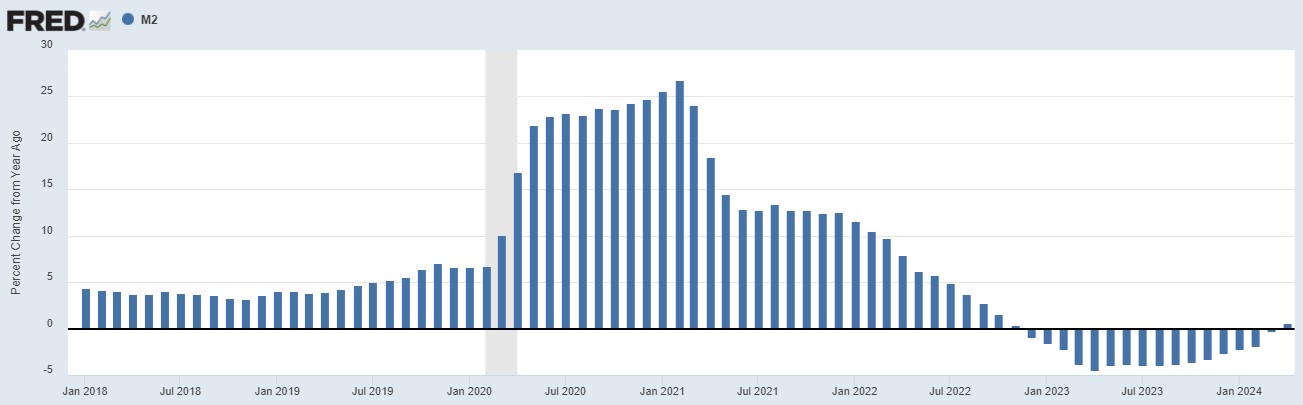

Although the Fed has not yet lowered the key interest rate and is continuing to reduce its balance sheet, the amount of US dollars in circulation is already rising again. Since lower interest rates increase the incentive to borrow and new money is created through loans in a fiat money system, it seems that the big increase in the M2 money supply is still to come.

Bitcoin should benefit significantly from a looser US monetary policy in the medium and long term, as hardly any other asset has such a high correlation with the US dollar money supply as Bitcoin.