US inflation lower than expected - Bitcoin rises

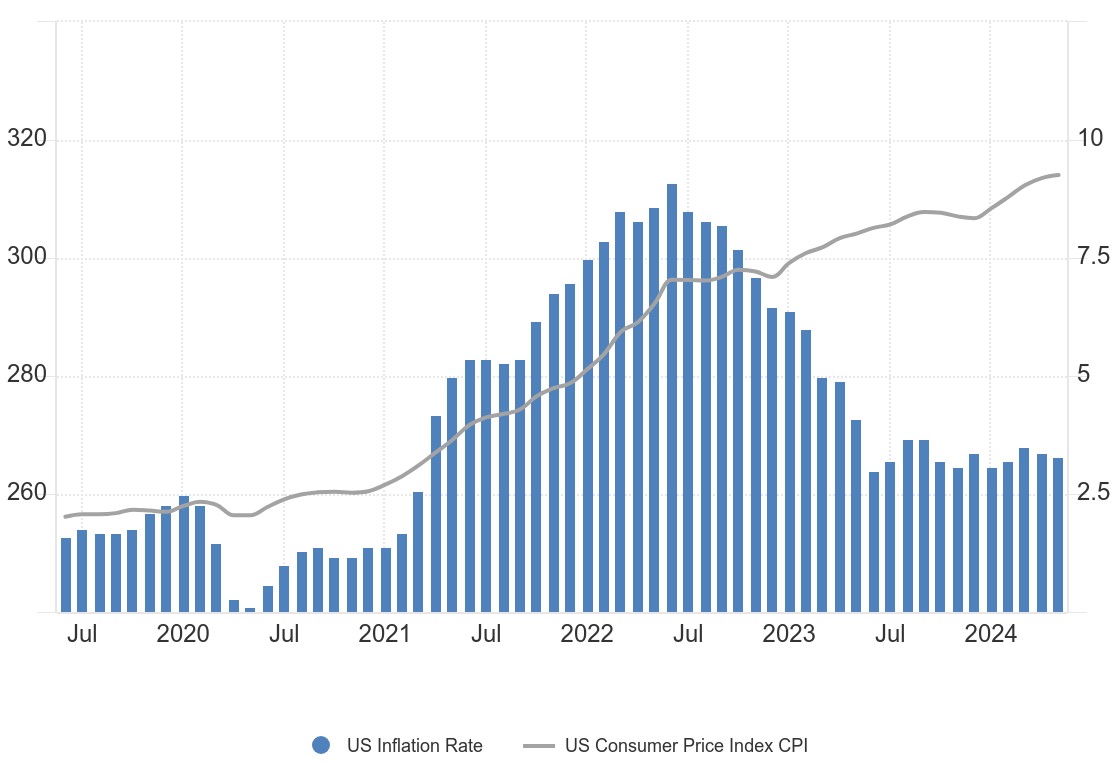

US inflation for May was lower than expected across the board. Consumer goods prices rose by 3.3% compared to the previous year - 3.4% was expected. Compared to the previous month, there were no price increases for the first time since June 2022 - the market was expecting an increase of 0.1%.

Core inflation - i.e. the inflation rate excluding the more volatile energy and food prices - was also 10 basis points below expectations in each case. It rose by 0.2% compared to the previous month and by 3.4% compared to the previous year.

Even though the inflation rate is trending downwards, this does not mean that prices are falling again. As the current inflation rate of 3.3% shows, prices have risen further compared to the previous year. And even compared to the previous month, the price level continues to rise. The sharp rise in the price of everyday goods and services in recent years is thus neither being cushioned nor coming to an end, even if, for once, no increase in prices was reported compared to the previous month.

Inflation target still a long way off

However, with a current inflation rate of 3.3%, the inflation target of 2% is still a long way off. Nevertheless, the markets are still pricing in one or two interest rate cuts by the US Federal Reserve this year. This evening, the Federal Reserve will decide on the key interest rate for the USA, but there is a probability of over 99% that it will remain in the range of 5.25% to 5.50% today.

Meanwhile, the European Central Bank (ECB) and the Bank of Canada (BoC) have already cut interest rates for the first time - despite inflation rates of 2.6% and 2.7% respectively in the respective currency areas. Although the key interest rate in the eurozone and Canada was only lowered slightly, meaning that the monetary policy environment is still relatively restrictive, this indicates that the tolerance range for inflation has been adjusted slightly upwards.

Political pressure for interest rate cuts

Elizabeth Warren and two other Democratic senators recently took the fact that other central banks are already cutting interest rates again as an opportunity to urge the head of the Federal Reserve to lower interest rates. In the open letter to Jerome Powell, they write that high interest rates are driving up housing and insurance costs, further burdening working Americans and risking a recession including unemployment.

They have kept interest rates too high for too long: It's time to lower them.

From the open letter

The political pressure to cut interest rates is increasing. Especially with the presidential election coming up in November, the current Democratic administration is likely to be keen to ensure that the economy performs well. A restrictive monetary policy is undesirable, even if excessively high inflation figures are also fueling discontent among the population.

But former President Trump is also a supporter of low interest rates. If the Republican is elected to the White House, this could also lead to a looser monetary policy.

The slightly lower inflation data for May should give the Federal Reserve the necessary room to make its first interest rate cut soon - at least that is what the markets are assuming. Immediately after the inflation data, the probability of the first interest rate cut in September rose from 47% to over 60%. The basic assumption is now that the central bank will cut the key interest rate twice more this year.

It remains to be seen how the inflation data and monetary policy of the most relevant economy will develop in the coming months and what the US monetary authorities will signal in this regard this evening. This is all highly relevant for the Bitcoin price, as the asset reacts very sensitively to US monetary policy.