Germany has apparently been selling thousands of Bitcoin since mid-June. Of the 50,000 BTC seized by Saxon authorities in January, there are currently only less than 40,000 left in the wallet assigned to the BKA.

Reports are now circulating on the 𝕏 platform that Germany is said to have bought back stocks. Users of the short messaging service are suggesting that a change of heart has taken place. What is the truth?

Germany buys back Bitcoin?

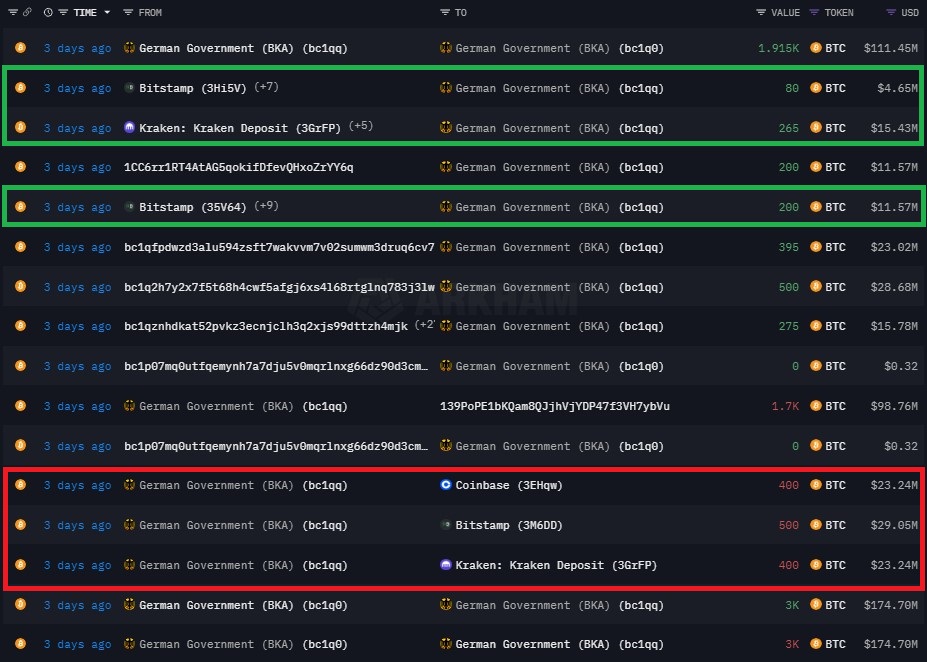

This week alone, almost 2,000 BTC have flowed from the BKA wallet to crypto exchanges. In addition, around 5,000 BTC were transferred to an unidentified wallet. According to the well-known analysis company Arkham Intelligence, these transactions are probably OTC sales, i.e. sales on the "open market".

The assumption that Germany has now bought back some of the Bitcoin is based on an article that speaks of a "surprising turnaround" in this context. The reason for this reporting is that payment flows can also be observed from exchanges to the BKA wallet. This week, for example, just under 700 of the 2,000 BTC sent to the known exchanges flowed back again.

However, this is anything but news. Blocktrainer.de has already reported that transactions from the exchanges to the authorities are also recognizable. The first transactions of this kind took place on June 20. However, as with the subsequent transactions from exchanges to the BKA, these were only part of the holdings previously sent to Coinbase, Kraken and Bitstamp. Accordingly, the assumption that these were purchases is not plausible. Nevertheless, this means that not all of the BTC that flowed to the aforementioned exchanges was sold in full by Germany.

What exactly is behind this cannot be said with certainty. The fact that the BKA, for example, sends Bitcoin to Kraken, receives a portion back from Kraken and then transfers BTC back to this very exchange is bizarre in any case. A theory is that the BKA has discovered other attractive sales opportunities over time and is increasingly reorienting itself in this direction - for example, to sell more via OTC.

Although there are voices claiming that Germany should rather keep its holdings and even implement a Bitcoin strategy, it cannot yet be assumed that a change of heart has taken place. It is not yet known what proportion of the remaining 40,000 or so Bitcoin worth more than two billion euros will be sold.

Beware of "crypto Twitter" and dubious news outlets

The currently widely shared reports show once again that misleading information can spread quickly in the Bitcoin community. In this case, however, it would have been possible for any market observer to trace the payment flows of the BKA wallet themselves with just a few clicks and come to the conclusion that these were probably not purchases, let alone a "surprising turnaround".

Nevertheless, the payment flows of the BKA wallet are not easy to understand at a glance. In addition to the transactions to and from the exchanges, there are also payment flows to "flow traders" in addition to the supposed OTC sales, which probably means that the BKA merely provides part of the BTC holdings as liquidity. On the other hand, these transactions to the trading company could also be sales.

It remains to be seen which transactions can still be observed in the coming weeks and months and how many of the 50,000 BTC will ultimately actually be sold by Germany.