Joana Cotar, a non-attached member of the Bundestag and head of the "Bitcoin in the Bundestag" initiative, has called on the German government and the Saxon state government to stop the Bitcoin sales currently taking place.

In the letter, which the politician also shared on the platform 𝕏, she lists several reasons why Germany should keep the approximately 40,000 Bitcoin. In addition, Cotar even recommends the development of a "comprehensive Bitcoin strategy".

Background: Germany sells thousands of Bitcoin

The LKA Saxony has seized around 50,000 Bitcoin as part of the trial against the operators of the illegal streaming platform Movie2k. In mid-June, Germany began sending some of these holdings to crypto exchanges - apparently to sell them, Blocktrainer.de reported. Since then, transactions of hundreds of Bitcoin have repeatedly been observed in the direction of several exchanges.

On yesterday's trading day alone, when the US stock exchanges were closed for Independence Day, 1,300 BTC flowed to Coinbase, Bitstamp and Kraken. This probably reinforced the downward trend of the Bitcoin price, which fell to below USD 57,000 yesterday.

In total, Germany has so far transferred over 4,300 BTC to exchanges. However, around 1,500 BTC have also flowed back from the exchanges to the wallet in question, which is why the actual, official sell-off so far amounts to around 2,800 BTC.

There are still over 40,000 BTC with an equivalent value of over 2.2 billion US dollars in the possession of the German state or the federal state of Saxony, which could potentially still be sold.

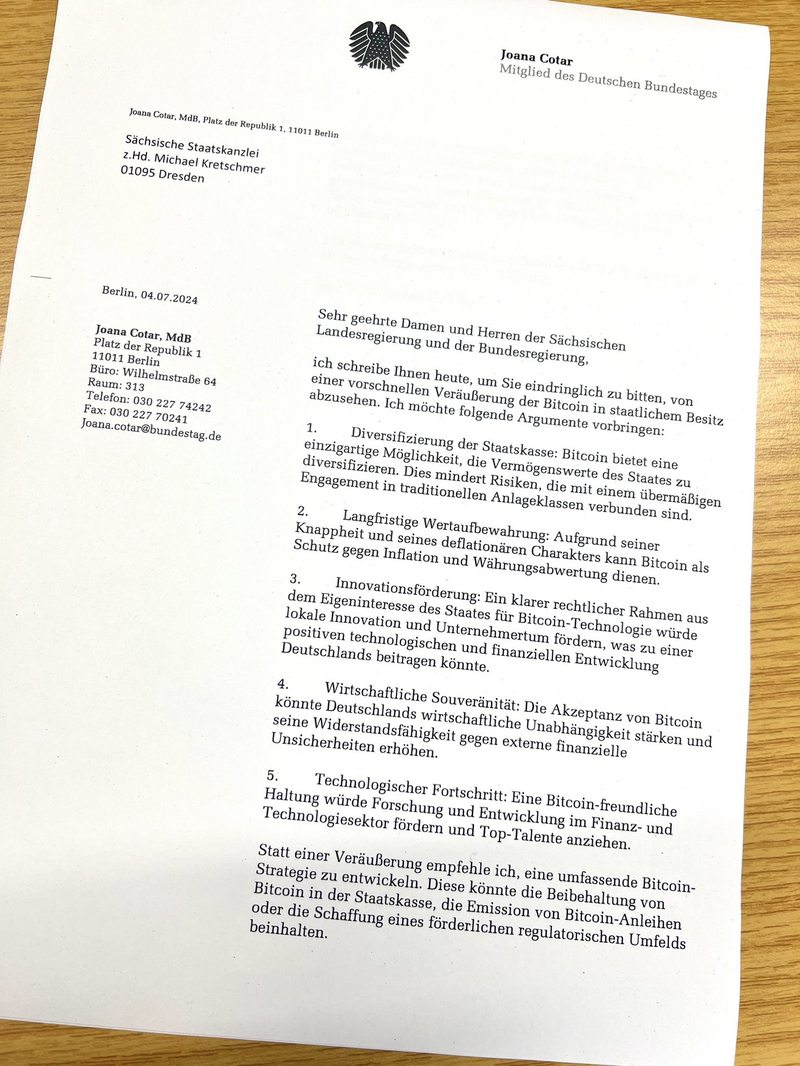

The letter to Scholz, Lindner and Kretschmer

In the letter, which is addressed to Chancellor Olaf Scholz, Finance Minister Christian Lindner and Saxony's Prime Minister Michael Kretschmer, Joana Cotar asks them to "refrain from a hasty sale of state-owned Bitcoin".

In the corresponding post on the 𝕏 platform, Cotar also refers to the increasing calls from high-ranking US politicians for the USA to strategically rely on Bitcoin. Just recently, presidential candidate Donald Trump announced that he wanted all future Bitcoin in the US to be mined. His supporter and presumed future Vice President Vivek Ramaswamy even called for the US dollar to be backed by commodities - including Bitcoin - as part of his presidential candidacy. This prompted the digital assets section of the renowned magazine Forbes to write an article on why the US could rely on Bitcoin as a reserve asset - Blocktrainer.de reported.

"Instead of holding Bitcoin as a strategic reserve currency, as is already being debated in the US, our government is selling in a big way," reads the post by Joana Cotar.

Instead of holding #Bitcoin as a strategic reserve currency, as is already being debated in the US, our government is selling on a grand scale. I've briefed @MPKretschmer, @c_lindner & @Chancellor @OlafScholz on why this not only doesn't make sense, but... pic.twitter.com/v9FpzmfLbp-

Joana Cotar (@JoanaCotar) July 4, 2024

In the publicly accessible letter, the head of the "Bitcoin im Bundestag" initiative lists several arguments as to why Germany should not sell off its holdings.

In the first two points, Cotar refers to the suitability of Bitcoin as an investment, firstly to diversify the treasury and secondly as a store of value or inflation protection. In addition, the acceptance of Bitcoin could also strengthen economic independence and make Germany more financially resilient, explains the Bundestag member.

According to Cotar, Germany's own Bitcoin holdings could also promote innovation in this country, as the state's own interest in the success of the asset class would increase regulatory security and thus promote entrepreneurship in this sector. A pro-Bitcoin stance by the government could also attract talent and drive general development in the financial and technology sector, according to Cotar.

Instead of selling Bitcoin, the non-attached member of the Bundestag recommends that Germany develops a "comprehensive Bitcoin strategy", which, in addition to its own Bitcoin holdings, could also include an open regulatory stance and even state borrowing in the asset.

For a deeper look into the matter, Cotar has enclosed an information booklet with the letter that deals with the correct handling of the asset by nation states. She also invites the politicians to attend the "Bitcoin im Bundestag" event on this topic in October.

It remains to be seen whether the letter will meet with an open ear. In view of the German government's predominant aversion to Bitcoin, which also emerged from the answer to the AfD's minor inquiry, it is unlikely that the German political elite will seriously address the issue for the time being.