Yesterday evening, the time had finally come. Of the 50,000 Bitcoin seized by Saxon authorities in January, none is still in the possession of Germany or the federal state of Saxony. The Bitcoin position, which at times amounted to over three billion euros, has now flowed in full from the BKA wallet to other entities such as crypto exchanges - almost certainly in order to sell it.

50,000 Bitcoin in four weeks

The first test transactions to other entities took place on June 18. One day later, hundreds of Bitcoin were already flowing out of the wallet to crypto exchanges, among others.

At the beginning of this week, after several detectable transfers of this kind, there were still almost 40,000 BTC on the wallet, which is assigned to the Federal Criminal Police Office (BKA). These more than two billion euros in Bitcoin ultimately left the BKA wallet this week alone.

Germany, or rather Saxony, has therefore apparently sold 50,000 Bitcoin in less than four weeks. Although the price of Bitcoin has fallen slightly in the course of the sales, it must have amounted to around three billion euros. According to the Saxony State Criminal Police Office (LKA), the proceeds are to go to the Saxon state treasury.

An official statement as to what the proceeds will be used for is still awaited. The sales and the strategy behind them have also not been openly communicated. It will be interesting to see how much the 50,000 BTC will be worth in the future and whether the decision to sell will one day turn out to be a big mistake.

However, the BKA wallet is no longer completely empty. Someone seems to have taken the liberty of donating 0.0000321 BTC worth 1.70 euros to Germany last night so that the world's third-largest economy is not left completely empty-handed. The transaction was received shortly after the wallet was completely emptied.

Criticism of Bitcoin sales

Over the past few days, there has been widespread outrage in the Bitcoin community that the seized Bitcoin is being sold. There has even been criticism from politicians. For example, Joana Cotar, a non-attached member of the Bundestag, wrote a letter to the federal government and the Saxon state government asking them to refrain from a hasty sale of the assets - Blocktrainer.de reported.

Joana Cotar, among others, demanded that Germany should consider diversifying its treasury with Bitcoin and develop a strategy for the asset, which is worth over one trillion US dollars.

German sales also took center stage internationally. Even Michael Saylor, the founder of the US company MicroStrategy, which focuses on Bitcoin, posted on 𝕏 about the issue. This is evident from the fact that he did not write the tweets in his native language, but in German.

Everyone gets #Bitcoin at the price they deserve

- Michael Saylor⚡️ (@saylor) July 8, 2024

You're not selling your #Bitcoin

- Michael Saylor⚡️ (@saylor) July 12, 2024

The USA welcomes Bitcoin with open arms

While almost all German politicians have probably not yet looked at Bitcoin in depth, the situation in the USA is currently different. Not only presidential candidate Donald Trump is campaigning for Bitcoin, but also other high-ranking politicians from the United States.

On the other side of the Atlantic, more and more voices are now being raised in favor of Bitcoin as a reserve asset for the world's most relevant economy. This prompted the digital assets section of the renowned business magazine Forbes to speculate on whether the US will strategically buy Bitcoin in the future - Blocktrainer.de reported.

Recently, Republican Senator Cynthia Lummis also spoke about this on the television channel FOX Business. The 69-year-old emphasized that a Bitcoin reserve could be beneficial for the strength of the US dollar.

Republican Senator @SenLummis told @FoxBusiness

thata #Bitcoin reserve can help the U.S. dollar to strengthen bleiben🇺🇸👀

Blocktrainer (@blocktrainer) July 12, 2024

Meanwhile, today the #BTC holdings of Germany and Saxony are below 4,000 units gefallen🇩🇪😬 pic.twitter.com/pX2maqkFp6-

The USA currently holds over 213,000 BTC worth around USD 12.5 billion, which it has also confiscated but, unlike Germany, has not yet disposed of.

High demand via the US Bitcoin spot ETFs

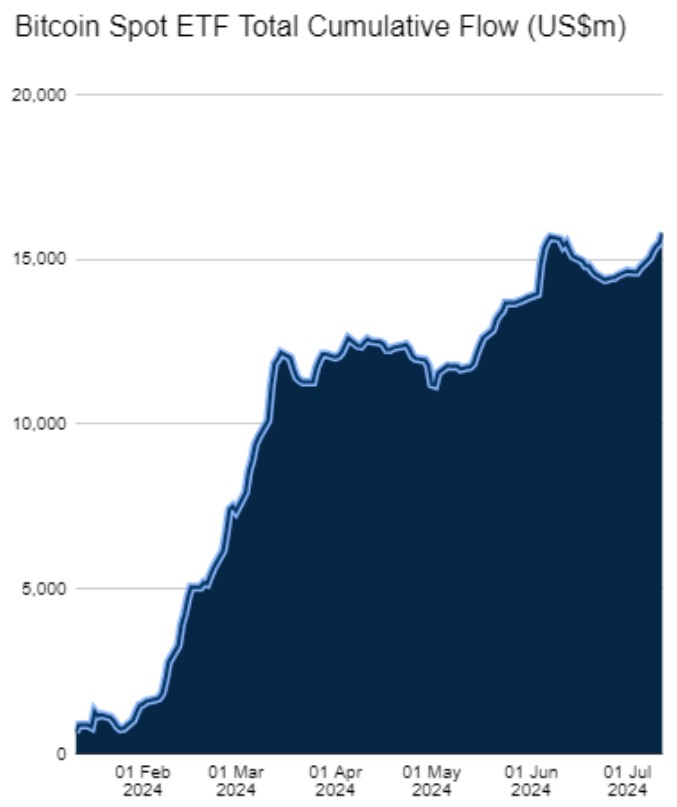

Meanwhile, Wall Street is using the Bitcoin spot ETFs approved in January to take advantage of the Bitcoin correction presumably triggered by Germany. This week alone, the investment products have soaked up almost 20,000 BTC. Measured in US dollars, this amounted to 1.047 billion - i.e. more than 200 million US dollars per trading day.

This means that the cumulative inflows into the investment products are once again at an all-time high. Over USD 15.8 billion has flowed into the US Bitcoin spot ETFs since the start of trading. The previous high of USD 15.682 billion from June 7 was exceeded on yesterday's trading day.

It remains to be seen whether the open attitude of Wall Street and US politics towards Bitcoin will prove beneficial for the economic strength of the United States and whether Germany will once again miss out on benefiting from a disruptive technology as a pioneer with Bitcoin.