MicroStrategy plans to pay off debt and buy more Bitcoin

The software company MicroStrategy, which is strategically focusing on Bitcoin, announced yesterday that it intends to issue further convertible notes, so-called "senior convertible notes", in the amount of 700 million US dollars - with a call option of an additional 105 million US dollars.

The company plans to use the proceeds to repay debt and increase its Bitcoin holdings.

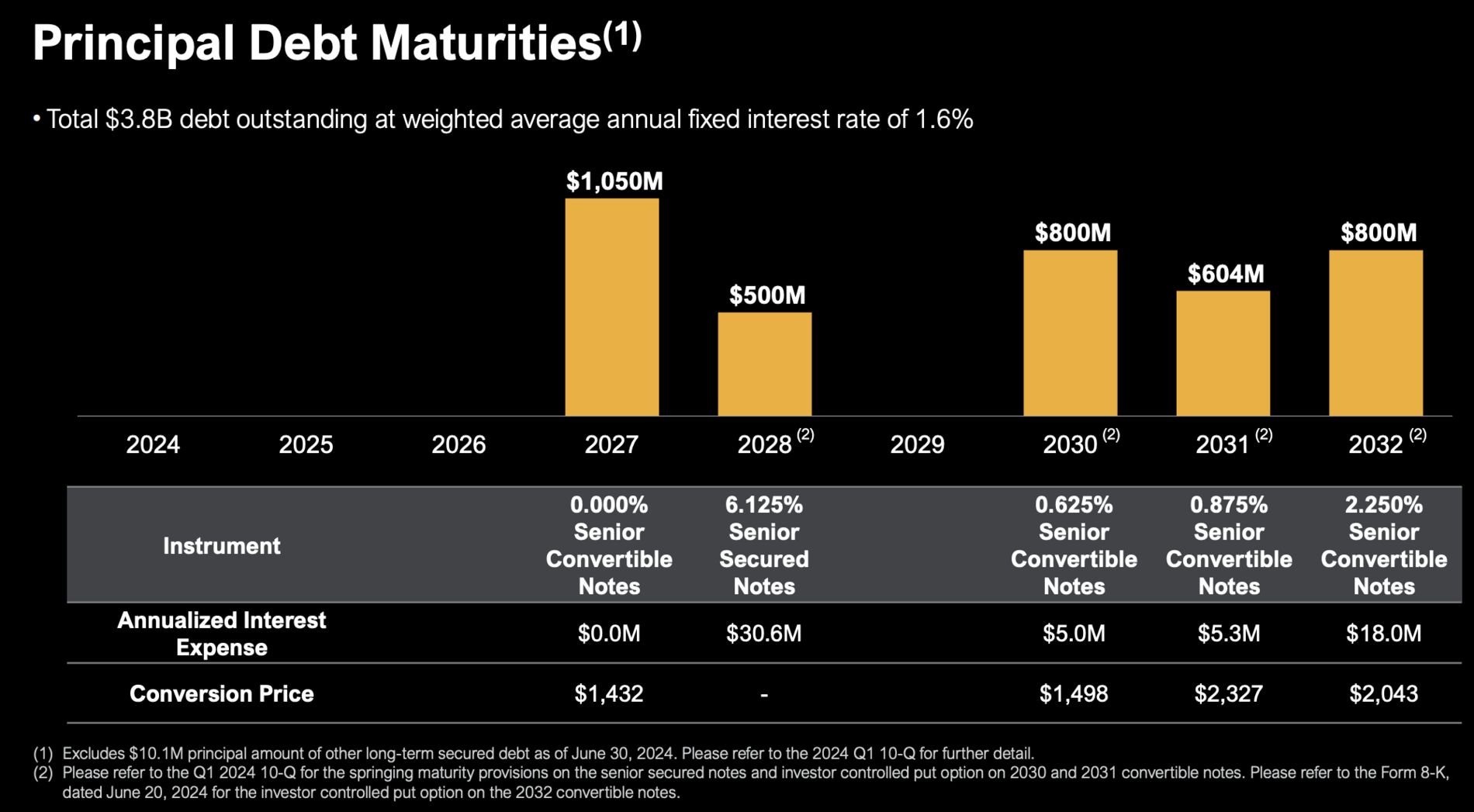

MicroStrategy intends to use the net proceeds from this offering to redeem all $500.0 million outstanding aggregate principal amount of MicroStrategy’s 6.125% Senior Secured Notes due 2028 (the “Senior Secured Notes”) and to use any balance of the net proceeds to acquire additional bitcoin and for general corporate purposes.

From the press release

Specifically, the aim is to use the capital from the issue of the convertible bonds to repay the outstanding normal senior secured notes in the amount of USD 500 million in full. The software company took out this loan in June 2021 to buy Bitcoin - at a significantly lower price than at present.

Repaying the senior secured notes early makes sense insofar as these securities represent a relevant corporate expense with annual interest costs of more than 30 million US dollars - especially in comparison to the low-interest convertible bonds.

The remaining funds, which will ideally amount to around 300 million US dollars, are likely to be used to a large extent for the purchase of additional Bitcoin, as suggested by MicroStrategy's usual phrase "for the purchase of additional Bitcoin and for general corporate purposes".

Refinancing

In the corporate world, it is common practice to borrow capital at better conditions in order to repay outstanding loans. For MicroStrategy, issuing convertible bonds has proven to be a very suitable method of raising capital. Market participants literally snatched the securities out of the company's hands. For example, in June of this year, when the software company used senior convertible notes to raise 800 million US dollars to buy more Bitcoin - Blocktrainer.de reported.

With convertible notes, investors can be paid out in cash or shares in the company at the end of the term. This means that investors with limited risk - provided the company remains solvent - can benefit from the success of Bitcoin and therefore MicroStrategy. If Bitcoin and thus the company value of the stock corporation continue to rise, the investors will exchange the securities for new shares and thus make a good deal.

In this case, MicroStrategy does not have to sell any Bitcoin to repay the loans, but only dilute the company shares. To the extent that the stock corporation succeeds in increasing shareholder value in this way, this is a win-win situation for all parties involved. In recent months, MicroStrategy has succeeded in significantly increasing the BTC per share ratio, the so-called "BTC yield", by a whopping 17% since the start of the year.

244,800 BTC is not enough

Just a few days ago, MicroStrategy announced that it had purchased an additional 18,300 BTC for just over one billion US dollars, increasing its holdings to 244,800 - Blocktrainer.de reported. The Virginia-based company financed this investment through the sale of new company shares.

The bitcoin purchases were made using proceeds from the issuance and sale of Shares under the Sales Agreement. […] On September 13, 2024, the Company announced that, as of September 12, 2024, the Company had sold an aggregate of 8,048,449 Shares under the Sales Agreement for aggregate net proceeds to the Company (less sales commissions) of approximately $1.11 billion.

From the SEC filing

The issue of new convertible bonds announced yesterday is the third of its kind this year. Accordingly, well-known personalities from the Bitcoin community came forward to comment humorously.

- Adam Back (@adam3us) September 16, 2024

- Dylan LeClair 🟠 (@DylanLeClair_) September 16, 2024

Fred Thiel, CEO of the listed mining company Marathon Digital Holding, which recently increased its Bitcoin holdings to 26,200 units, also commented on the upcoming Bitcoin purchase from MicroStrategy. Thiel congratulated Michael Saylor under his post and noted that he should leave some for him.

He also shared Saylor's announcement himself, drawing attention to the competition between the two US public companies for the Bitcoin still up for sale.

Well, that's another 12,500 BTC less for the rest of us to acquire....@saylor https://t.co/keBpOHBR2h-

Fred Thiel (@fgthiel) September 16, 2024

Even if the almost 300 million US dollars that are likely to remain after fees and other expenses are only enough for around 5,000 Bitcoin, the latest press release shows that MicroStrategy is sticking to its unconventional, aggressive Bitcoin strategy. Accordingly, the company founded by Michael Saylor could soon reach the 250,000 BTC mark.

So far, it has more than paid off for the software company: since MicroStrategy first invested in the asset in August 2020, its shares have outperformed all 500 companies in the US stock index S&P 500. Although the Bitcoin price has stagnated since March this year, $MSTR has gained almost 100 percent since the beginning of the year.